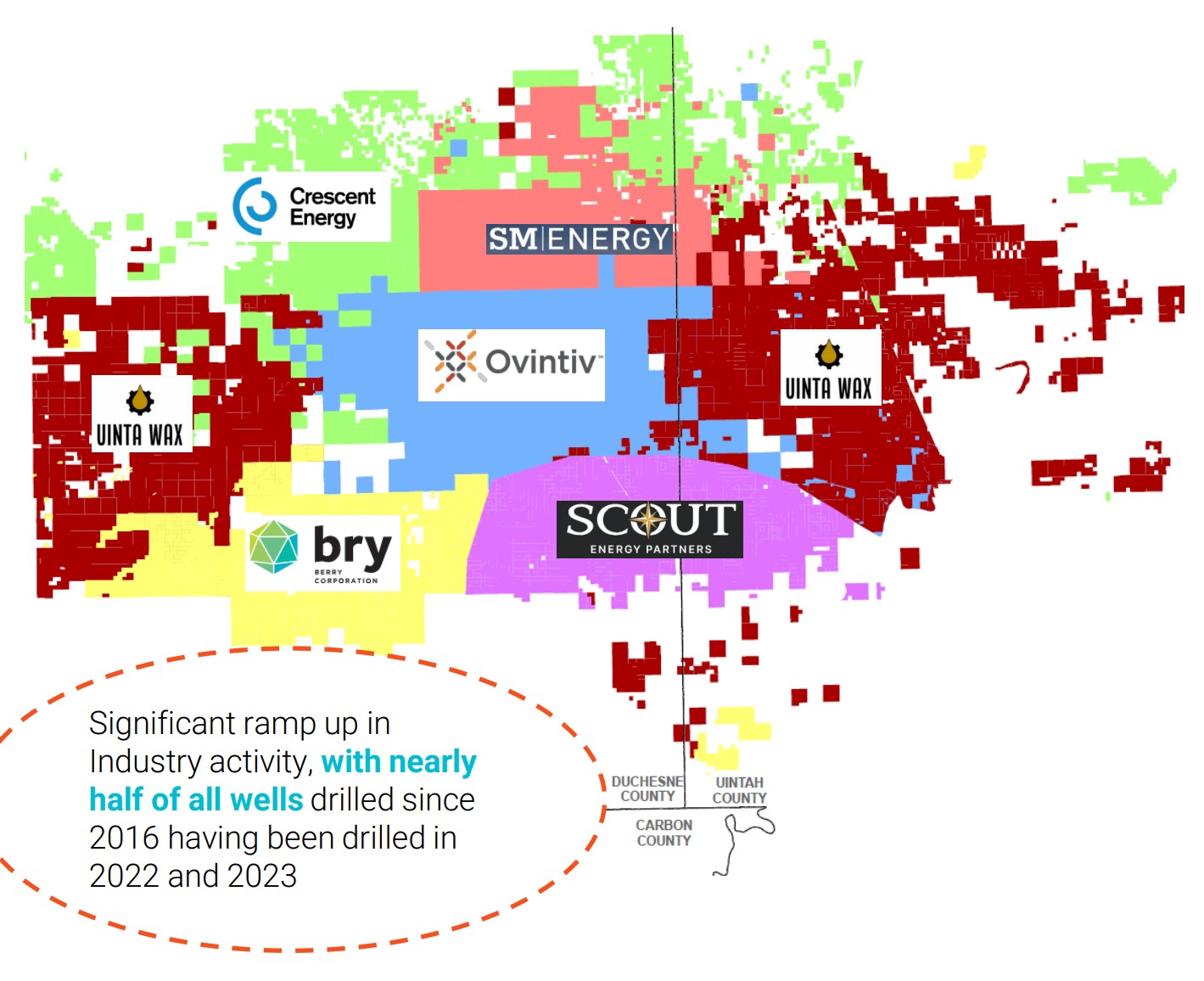

Public producer Berry Corp. has assets in California and in Utah’s Uinta Basin (pictured). (Source: Shutterstock.com)

Berry Corp. has a large California footprint, but the E&P might be more interested in the deals and drilling happening near its acreage in Utah.

“The Uinta Basin has seen increased activity and consolidation, and this is exciting,” said Fernando Araujo, CEO of Dallas-based Berry Corp., during the company’s second-quarter earnings call on Aug. 9.

California still makes up an important part of Berry’s business. The company’s conventional assets in California’s prolific San Joaquin Basin (100% oil) produced an average of 21,100 bbl/d during the second quarter.

But during the second quarter, there was an outsized amount of activity near Berry’s assets in the Uinta (60% oil, 40% gas), where the company holds around 99,000 net acres, regulatory filings show.

In June, SM Energy and Northern Oil & Gas (NOG) teamed up to acquire leading private Uinta producer XCL Resources for $2.55 billion.

NOG will own a 20% undivided stake in XCL valued at $510 million; SM will own the remaining 80% and operate the XCL assets.

Before being bought out itself, XCL had been working through its own acquisition of fellow Uinta E&P Altamont Energy.

But now, Altamont has been offered to NOG and SM under a right of first refusal in connection with the XCL deal. As a result, NOG will acquire a 20% stake in Altamont for $17.5 million net to NOG.

As Uinta activity heats up, Berry is taking steps to evaluate horizontal drilling opportunities on its own Utah asset.

In April, Berry purchased a 21% working interest in four, 2-mile-to-3-mile lateral wells in the Uteland Butte reservoir, which were put into production during the second quarter.

“These wells are adjacent to our existing operations and their results will be used to evaluate similar horizontal opportunities on our own acreage,” Araujo said. “This four-well horizontal program is exceeding pre-drill estimates.”

The wells had an initial production (IP) rate of around 1,100 boe/d (90% oil, 10% gas), Araujo said on the earnings call.

“But also remember that we are at the shallow end of the basin with lower reservoir pressures,” he said. “So, our IPs are slightly lower compared to some of the IPs…in the deep basin.”

While the four horizontal wells targeted the Uteland Butte reservoir, Araujo said, it’s one of three or four main intervals currently being targeted for horizontal development in the Uinta Basin.

Deeper landing zones include the Uinta, Douglas Creek and Wasatch formations, he said.

“[There are] a few operators targeting with success at those reservoirs,” Araujo said.

Berry drilled 19 wells during the second quarter—15 in California and four vertical wells in Utah.

Utah crude volumes averaged around 2,300 bbl/d during the second quarter; gas volumes averaged 8.9 MMcf/d.

Other public E&Ps with assets in the Uinta include Ovintiv Inc. and Crescent Energy.

RELATED

After $2.55B Deal, NOG and SM to Buy More Uinta Basin Assets

California dreaming

Compared to operating in Utah, Berry and its Golden State peers face significant hurdles to expanding drilling and production within California.

Berry has faced “significant delays in the issuance of permits to drill new oil and gas wells in Kern County,” where all its California assets are located, the company said in a quarterly report. Other producers, like California Resources Corp., have experienced similar delays.

But Berry has seen some interesting momentum in California in just the past year.

In May, California Geologic Energy Management Division (CalGEM) approved 10 permits for Berry to drill new wells in Kern County’s Midway-Sunset field. They were the first permits issued for new drills in Kern County since December 2022, according to state data.

The new permits will help Berry’s California development plans for 2025, Araujo said on the call. The company already has permits in hand to support its 2024 drilling plans.

Berry is also looking at doing more M&A in California after closing a $70 million takeover of Kern County operator Macpherson Energy last fall.

Berry was able to lower its operating expenses by 40% with the Macpherson acquisition and would like to replicate that success with future deals, Araujo said.

“We're talking to different parties, mostly small privates,” he said. “These would be considered bolt-on opportunities, and this is really part of our base business.”

On July 1, California Resources (CRC) closed a $1.1 billion combination with Aera Energy. The deal yielded California’s largest oil and gas producer, leapfrogging over former leader Chevron Corp.

And earlier this month, Chevron announced plans to relocate its corporate headquarters from the supermajor’s longtime home in San Ramon, California, to offices in Houston.

RELATED

Come Together: California Resources, Aera Merge for Scale, Drilling Runway

Recommended Reading

DNO to Buy Sval Energi for $450MM, Quadruple North Sea Output

2025-03-07 - Norwegian oil and gas producer DNO ASA will acquire Sval Energi Group AS’ shares from private equity firm HitecVision.

Hunting Buys EOR Technology Rights from Its Founding Shareholders

2025-03-07 - Hunting Plc is acquiring the rights to organic oil recovery, an EOR technology—including 25 patents and distribution rights—from its founding shareholders.

Vitesse Energy Closes $220MM Acquisition of Bakken Pureplay Lucero

2025-03-07 - Vitesse Energy Inc. agreed to purchase Bakken E&P Lucero Energy Corp. in December in an all-stock transaction valued at $222 million.

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Ring Sells Non-Core Vertical Wells as it Closes in on Lime Rock

2025-03-06 - Ring Energy Inc. said it sold non-core vertical wells with high operating costs as it works to close an acquisition of Lime Rock Resources IV’s Central Basin Platform assets.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.