Fracking operations typically produce only about 10% of the available oil in place from a reservoir. (Source: Shutterstock)

Over the years, the hydraulic fracturing recipe has changed and with inventory always a concern for operators, some E&Ps are returning to shale plays —particularly the Eagle Ford Shale— to forage through wells that may yet have some meat on the bone.

Fracking operations typically produce only about 10% of the available oil in place from a reservoir.

Since the early days of fracking, companies have improved most aspects of operations, from water use and proppant loading to the number of stages and the spacing of wells. Now they’re turning to vintage wells, some drilled years ago with more primitive methods, to squeeze out more barrels.

The upside is that refractured wells have the potential to provide considerable value across an operator’s asset base, although results have been mixed. Generally, they provide a healthy amount of initial product followed by a massive decline.

The focus of attention for refracs has most recently been seen in the Eagle Ford with large and small E&Ps returning to the shale play.

In the first-quarter 2024, for instance, SilverBow Resources implemented a successful refrac program in the Eagle Ford. Many of the company’s legacy wells were originally completed with what the company termed “less than optimal completions.”

“From a completion standpoint, we almost can look at the refracs numbers that we provided on to get a sense of how these wells were originally fracked,” Sean Woolverton, CEO of Silverbow told analysts during the company’s May 2 earnings call. “Many of them had cluster spacing of 50 to 100 feet and pretty big, significant stage spacing and had proppant intensities probably in the 1,200 pounds per foot or less.”

In SilverBow’s first two refracs — the Shannon 1H and Idylwood 01H — SilverBow increased the number of stages to every 19 ft and increased proppant loads to 2,000 lb/ft.

The Shannon 1H and Idylwood 01H saw production skyrocket from 20 boe/d in the Shannon 1H to 475 boe/d. The Idylwood 01H, which was not producing, averaged 355 boe/d after refracturing.

Each was completed for less than $4 million and demonstrated IRRs of more than 100%. SilverBow estimates that the projects will achieve payout in less than 10 months and has plans for additional refracs in 2024.

“The initial results [of our refrac program] clearly show that restimulating existing wells with larger jobs in tighter cluster spacing can materially enhance well productivity,” Woolverton said. “We have more than 100 refrac opportunities across our portfolio and we are moving additional refracs into this year’s program.”

SilverBow’s success in the Eagle Ford can be attributed its approach to wells they plan to refracture: going back into the well, cementing in a brand-new liner and starting over in terms of the completion. They also use artificial lift methods at the outset to ensure no significant drop offs after initial production returns.

“Why we have confidence is, we’ve got the long-term production from other operators that have done it over the last couple of years using similar techniques there that they used on ours,” Woolverton said. “We’ve got about 45 to 60 days of production thus far and production is actually holding fairly steady.”

SilverBow is currently drilling a 10-well pad developing four stacked zones: the Upper and Lower Eagle Ford and the Middle and Lower Austin Chalk.

Conoco, Devon’s aggressive approach

While Silverbow was initially cautious about venturing into Eagle Ford refracs, larger competitors ConocoPhillips and Devon Energy took a more aggressive approach.

But not every Eagle Ford operator is sold. EOG Resources has seemingly dismissed the approach, which executives say can be clumsy, for more lucrative drilling elsewhere.

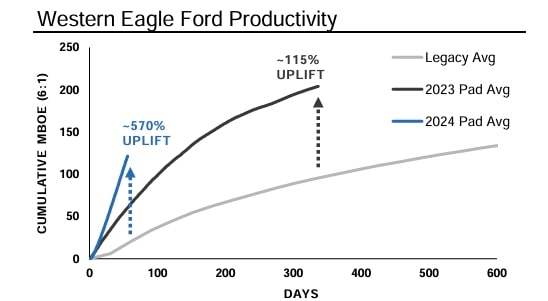

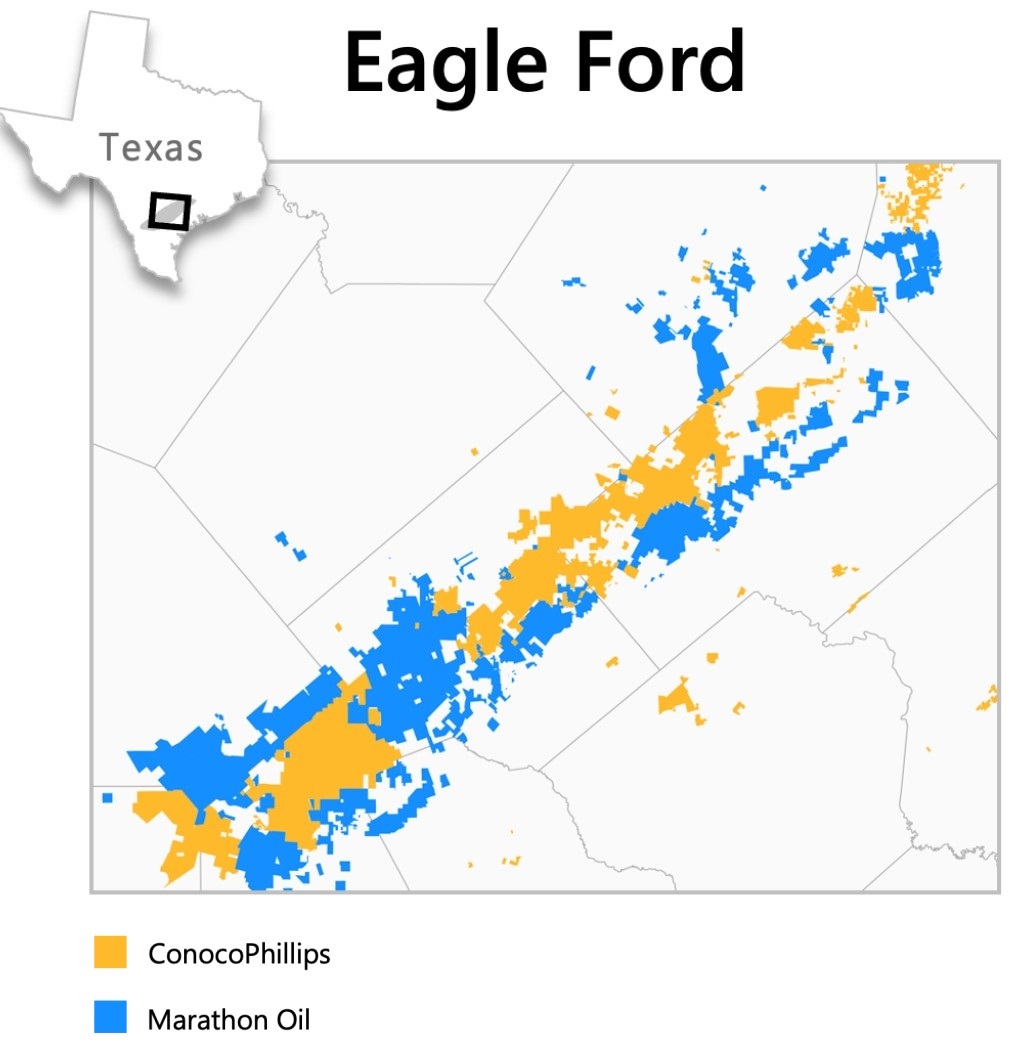

After announcing a deal to buy Marathon Oil Corp. in a $17.1 billion deal, ConocoPhillips’ footprint in the play will expand to about 490,000 net acres averaging 400,000 boe/d across the core of the Eagle Ford. With the newly acquired acreage, ConocoPhillips sees significant future upside from refrac opportunities in South Texas.

“We’ve been implementing new refrac techniques across our existing Eagle Ford position… it’s expanded our refrac inventory at cost of supplies that compete with our Tier 1 opportunities,” Andy O’Brien, senior vice president of strategy, commercial, sustainability and technology for ConocoPhillips, said during a May 29 call with analysts.

Devon brought online 26 infill wells and completed 25 refractured wells in the first quarter, resulting in an oil growth rate of 7% year-over-year.

“I would say the wells that we are putting online this year, approximately 25 refracs, compete very favorably with the wells that we’re drilling on a heads-up basis [with] new well construction.” Devon COO Clay Gaspar told analysts during an earnings call earlier this year.

While SilverBow, ConocoPhillips and Devon have seen success in the Eagle Ford though refracturing from mature wells, not every E&P sees the benefit.

EOG Resources executives have said they don’t see the value in restimulating their older wells.

After multiple well tests conducted across their multi-basin portfolio, Jeffrey Leitzell, executive vice president and COO of EOG, said that the company is better off drilling new wells in a new location or offsetting an existing completion, citing concerns with current refracture technology.

“For refrac technology, I think there’s still a long ways to go,” he said. “There’s pretty crude approaches to where you kind of do some Hail Mary fracs or have to install expensive additional casing strings, and you never quite get the product activity uplift that you’re looking from an actual new well.”

Fine-tuning fracs

However long the journey, the initial results have intrigued ConocoPhillips, SilverBow and others enough to prioritize learn more about their acreage and improve wells, the earliest of which were drilled in play in the late 2000s.

Devon sees a promising refrac program developing.

“When you start fine-tuning a little bit and look at more recent performance, some of the work that we're doing, you see some really encouraging results,” Gaspar said. “And that's on the back of making sure that we understand the well construction, the opportunity from a geology standpoint, that initial completion design and really focusing on the best opportunities.”

SilverBow also decided to learn from both the successes and missteps of their early Eagle Ford peers to help them weigh the risks and rewards of their new refrac program.

“We’ve looked at other operators to see how their wells performed to kind of put a risk percentage on consistent performance… You do run into risks around mechanical issues going back into wells, but in talking with other operators, they’re seeing high percentages there,” Woolverton said. “What’s always great when you do acquisitions is when you unlock even more value on than what you paid for.”

Recommended Reading

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

2025-03-12 - Operators are looking to the Haynesville to fill rising natural gas demand for U.S. LNG exports. Haynesville E&P Aethon Energy says producers need sustained higher prices to step up drilling.

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Haynesville Horsepower: Rigs Needed to Crest the Coming ‘Wall of Demand’

2025-04-01 - How many drilling rigs are needed in the Haynesville Shale to meet growing natural gas demand for LNG exports? Keybanc ran the numbers.

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

2025-03-01 - Futures are up, but extra Haynesville Bcfs are being kept in the ground for now, while operators wait to see the Henry Hub prices. A more than $3.50 strip is required, and as much as $5 is preferred.

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.