Coterra added 23 Culberson County wells in 2024 near the Texas-New Mexico border, including eight in its Leonatus DSU, six in Clyde Van Dusen and three in Lookout, according to Texas Railroad Commission (RRC) data. (Source: Shutterstock/ Coterra Energy)

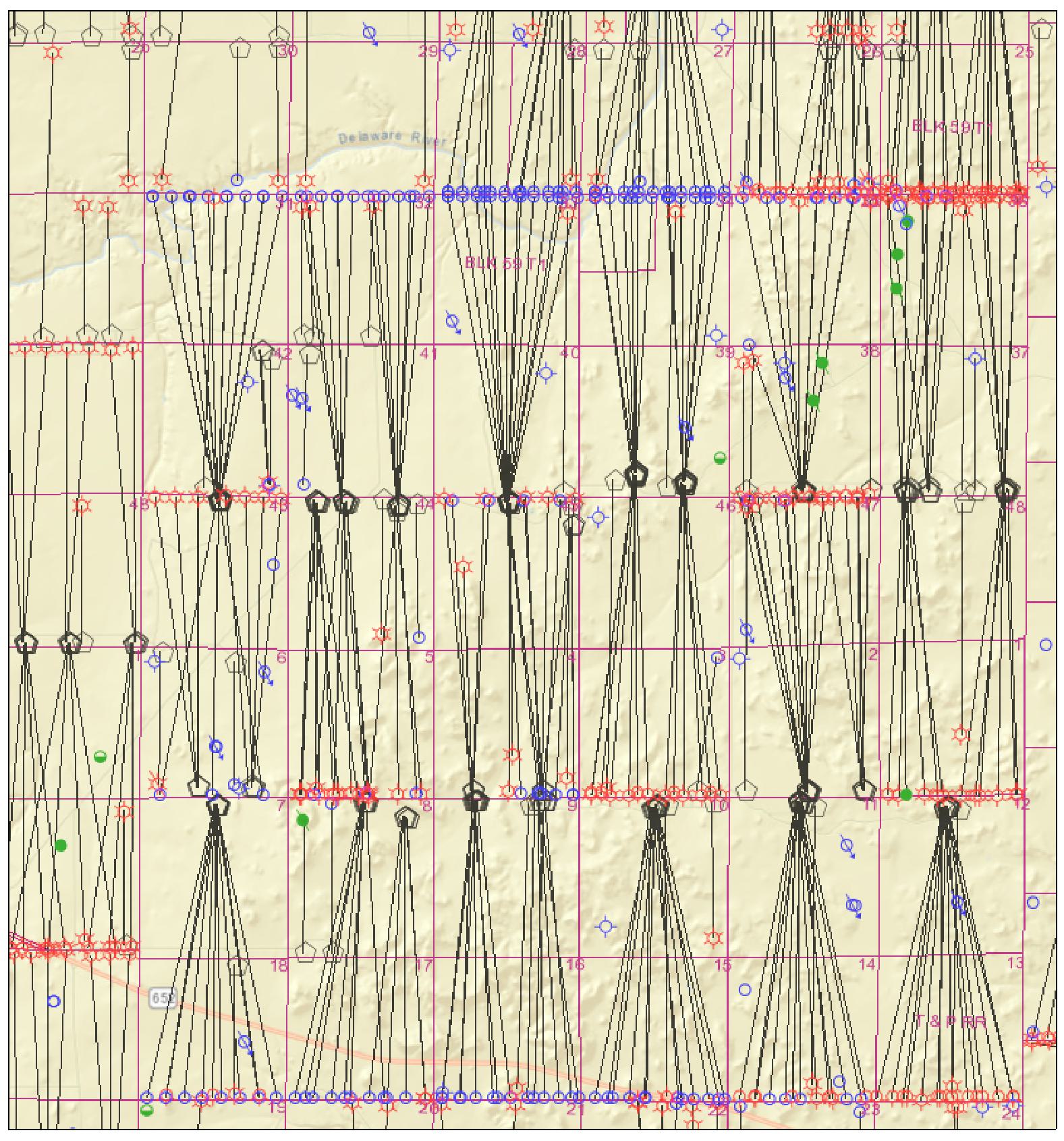

Coterra Energy is now adding 16 more Harkey wells in the 57-well “row” development of Wolfcamp A and Harkey sandstone laterals it now has online in northeastern Culberson County, Texas.

The Delaware Basin mega-DSU (drilling spacing unit) is in a 50:50 joint venture with Chevron Corp., which with Coterra, produces 84% of the county’s barrels—all condensate.

Coterra’s 1.2 MMbbl and Chevron’s 1.4 MMbbl of condensate from Culberson in December were among the 3.1 MMbbl of liquids from all Culberson operators that month, according to Texas Railroad Commission (RRC) data.

Other Culberson operators include BPX Energy, Capitan Energy, ConocoPhillips, Permian Resources and Petro-Hunt Permian.

Coterra added 23 Culberson County wells in 2024 near the Texas-New Mexico border, including eight in its Leonatus DSU, six in Clyde Van Dusen and three in Lookout, according to the RRC data.

Chevron Corp. added 64 wells, including in the Hay Henley DSU, Hay Maddilyn, Hay Olivia, Hay Rosalie, Hay Thane, Hay Trinity, Hay Valerie, Hay Yenglik and Taylor Ranch State.

Coterra’s 16 additional wells underway now in the eventual 73-well, mega-DSU “Windham Row” will be Harkey overfills. Drilling began in the third quarter and all 16 are expected to be online before June 30.

Coterra is drilling another row, Barba Phase 1, nearby with 20 Wolfcamp A and eight Harkey landings where it has 80% working interest. Drilling began there in the third quarter. All of the wells are expected to be online in the second quarter.

Its 62-well Bowler Row development also nearby will include 42 Wolfcamp A and 20 Harkey landings with 50% working interest. Drilling is underway now; the wells are to be online in the fourth quarter and into 2026.

‘Rigs just stay camped out’

At press time, it had 13 rigs making hole for it in the Delaware Basin and three frac crews at work.

“Our projects are so large now that our rigs just stay camped out and we minimize mobes [rig mobilizations],” Blake Sirgo, senior vice president, operations, said in an investor call Feb. 25.

Coterra’s D&C in Culberson is expected to cost $830 per lateral foot in 2025.

“On the frac side, our frac efficiencies are up dramatically year over year,” Sirgo added. “And that's due to some strategies that we've been working with our frac partners that really focus on maximizing all the available horsepower and minimizing transition times.”

The completions are with what Halliburton has described as a “push-button frac.”

“’Auto Frac’ is, in simple terms, a push-button frac,” Steven Jolley, Permian Basin technology manager for Halliburton, told attendees at Hart Energy’s DUG Executive Oil Conference & Expo in Midland in November.

“You can come in, push a button and let it pump the design as intended without any human intervention,” Jolley said.

“And customers are able to access that from an app-based platform and make changes based on what they see as well.”

Coterra’s Sirgo told investors, “We have transition times now that are averaging close to 20 minutes between stages, which is pretty unheard of from a few years ago.”

As for trying to push 57 or more laterals into a multi-section DSU and in two formations, “we're always really focused on well trouble,” he added.

“It's not a matter of ‘if’; it's a matter of ‘when’ we poke a lot of holes in the ground and things go wrong sometimes.

“But we have a really rigorous program to deal with well trouble and to get out of it as quickly and cost effectively as we can.”

Full year of simul-frac

Among the 57 wells, 80% were made with simul-frac completions. D&C averaged $864 per lateral foot.

In Eddy County, New Mexico, where Coterra is landing in Wolfcamp A and Bone Spring, D&C cost $990/ft, it reported.

In Reeves County, Texas, for Wolfcamp A wells, it was $1,020 per ft; in Lea County, New Mexico, for Wolfcamp A and Third Bone Spring, $1,050.

Coterra expects to bring between 150 and 165 more wells online this year in its 346,000-net-acre Permian Basin property, all in the Delaware, it reported.

Fourth-quarter production from the basin was 268,000 boe/d, 68% liquids. Estimated Permian D&C spend in 2025 is $1.6 billion.

“The 2025 plan we have laid out sets several new bars with the most Permian activity we've ever deployed, including a full year of Culberson simul-frac[ture stimulations],” Sirgo said.

The 57-well Windham Row cost $500 million gross or $250 million net to Coterra’s 50% working interest.

Reservoir performance

As for reservoir performance in Windham Row, the data are still coming in, said Tom Jorden, Coterra chairman, president and CEO.

“We are in a data-collection and -analyzing mode on the need to either co-develop [Harkey] or overfill later,” Jorden said.

“Based on everything we've seen, we're very encouraged and we will continue to co-develop where we can, but it's still an open question.”

Michael DeShazer, senior vice president, business units, said Coterra has more than 40 Harkey wells in Culberson to date and 30 more are planned this year.

“The six that we've co-developed on the Windham Row [with Wolfcamp A] and the 16 that [are being] overfilled, that data's still coming in,” DeShazer said.

The plan currently is “to default to co-development. That's the path forward for now.”

Halliburton’s Jolley said in an interview in November of the push-button frac jobs, “We're able to complete these wells remotely now—and so less pad movements.

“You can't get more than 24 hours in a day, but you can take other operational efficiencies such as simul-frac and pump more volume in a day than you can.”

Completing Coterra’s row development is a dream job for completion engineers, he added. “It's a dream for both [of us]: It's a dream for Coterra and a dream for us.”

Sirgo concluded in the investor call Feb. 25, “Culberson County row developments are some of the largest and most efficient projects in the shale patch and you can expect many more from Coterra in the coming years.”

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.