With up to $1.2 billion secured from the U.S. Department of Energy (DOE) and $11.4 billion in public and private matching funds, California has launched a renewable hydrogen hub after a landmark agreement was signed this week.

Led by the Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES), the hub was one of seven projects selected for negotiations last year to receive part of up to $7 billion to create hydrogen hubs across the U.S. The hubs, which position hydrogen producers and consumers together with infrastructure, are part of an effort to boost a sector that could have a big role in lowering greenhouse-gas emissions.

The ARCHES hub could lower CO2 emissions by about 2 million metric tons annually. The reduction is equivalent to the annual emissions of about 445,000 gasoline-powered cars, according to the DOE.

“The Department of Energy’s announcement to fund ARCHES is a monumental step forward in the state’s efforts to achieve its air quality, climate and energy goals, while improving the health and wellbeing of Californians and creating new green jobs across the state,” said ARCHES CEO Angelina Galiteva. “We are grateful to the DOE for its commitment to building a sustainable hydrogen ecosystem and marketplace and look forward to working with our project partners, stakeholders and diverse communities throughout the state to make this project a success.”

The DOE’s Office of Clean Energy Demonstrations (OECD) announced the successful completion of award negotiations during what it calls an Award Wednesdays notification on July 17. OECD said it awarded the hub $30 million, a first tranche of funding for the project. ARCHES is eligible for up to $1.2 billion in federal cost sharing.

The project now moves into Phase 1 to carry out planning, analysis, design activities and more stakeholder and community engagement. The phase is expected to last up to 18 months, according to the DOE.

ARCHES said it plans to produce renewable hydrogen at more than 10 sites to fuel projects that include replacing diesel-powered cargo-handling equipment with hydrogen at the ports of Long Beach, Los Angeles and Oakland; building more than 60 hydrogen fueling stations for fuel cell electric heavy-duty trucks and transit busses; and transitioning key power plants to hydrogen among other projects.

“California is leading the nation with the first hydrogen hub to sign a cooperative agreement, and we will continue to lead by decarbonizing goods movement, the energy sector, and heavy industry,” Senator Alex Padilla (D-Calif) said.

Partners include Air Liquide, Amazon, Brookfield Renewable US, Chevron, General Motors, Microsoft, Nikola, Plug Power and others.

Here’s a look at other renewable energy news this week.

Energy storage

Intersect Power Taps Tesla for Energy Storage Systems

Intersect Power has signed a contract with EV maker Tesla for 15.3 gigawatt-hours (GWh) of Tesla’s Megapack battery energy storage system for the clean energy company’s project portfolio through 2030.

Serving as a backup power source for intermittent renewables, energy storage system usage has taken off in the U.S. along with the rise of solar power generation. The U.S. Energy Information Administration (EIA) forecasts battery storage capacity will nearly double, adding about 14 gigawatts (GW) of battery storage this year to the existing 15 GW available, if developers’ plans pan out.

On July 18, Intersect said it plans to use half of the latest Tesla Megapack order for four projects expected to begin operations in California and Texas by the end of 2027. The rest will be used for solar and energy storage projects scheduled to come online from 2028 to 2030.

Intersect Power said it currently has 2.4 GWh of Tesla Megapacks in operation or under construction. The company is installing an additional 1 GWh of Tesla Megapacks at its Radian and Lumina solar and storage facilities in Texas, which the company said will be fully operational within the year.

The company announced July 17 it closed $837 million in financial commitments for Lumina I, Lumina II and Radian. Each will have a capacity of 320 MWh of battery storage with a two-hour duration, using Tesla Megapacks.

“Morgan Stanley was selected to provide tax equity, and funds and accounts managed by HPS Investment Partners will be making construction debt and term debt investments,” Intersect said in a news release. “Deutsche Bank is partnering in the construction debt facility and providing the operational letters of credit to the projects.”

The three projects qualify for investment tax credits under the Inflation Reduction Act.

Root-Power Selects E-Storage for UK Project

Root-Power, the battery energy storage system specialist with plans to build over 1 GWh of projects in the U.K., has awarded a contract to Canadian Solar’s e-STORAGE.

The contract for 11 megawatts (MW) of energy storage solutions for Root-Power’s Coryton Energy Park project in Corringham, Essex, England, Canadian Solar said July 18.

The project will utilize SolBank 3.0, which Canadian Solar said achieves over 5 megawatt-hours nominal capacity within a 20-ft container. The technology features high-density lithium-iron-phosphate cells, an active balancing battery management system and an innovative liquid cooling thermal management system, the company said.

Project construction started in May.

Arizona Lithium Makes Discovery at Prairie Project in Williston Basin

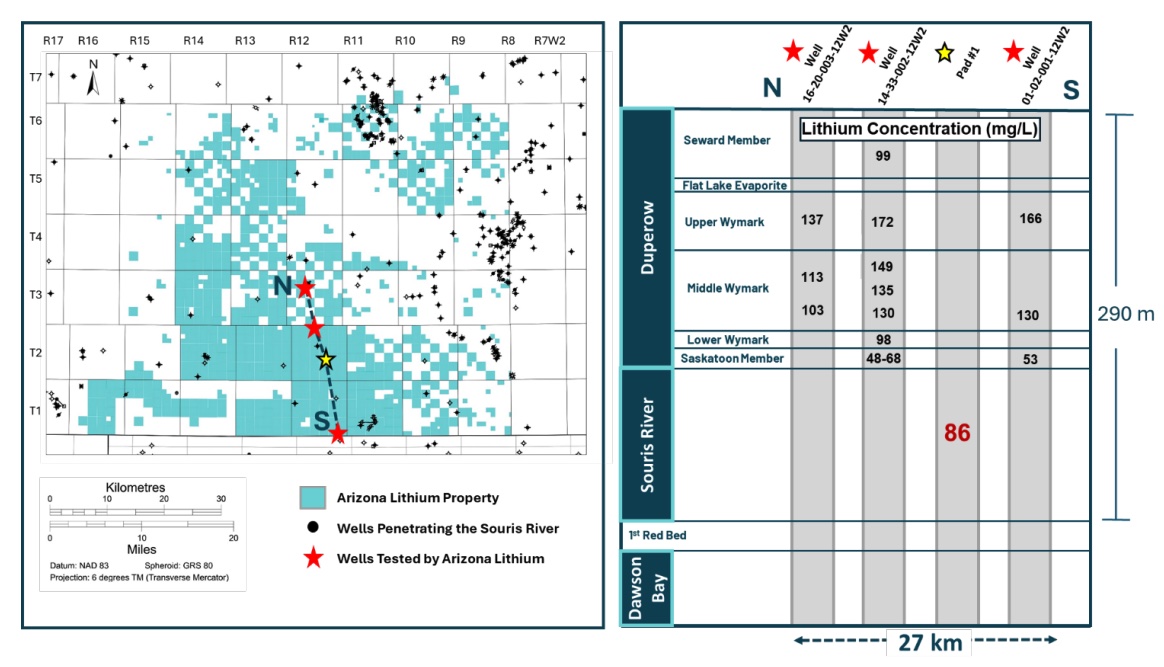

Arizona Lithium Ltd. (AZL) on July 15 said it discovered a new lithium formation at the site of its Prairie Lithium project in Saskatchewan, Canada’s Williston Basin.

The discovery was made by an exploration well drilling in the Souris River Formation, which sits directly beneath the Duperow Formation. Samples of brine from the Souris River indicate a lithium concentration of 86 milligrams of lithium per liter (mg/L), the company said in a news release.

The exploration well was converted to a Duperow production well and was pumped at a stable rate of 500m3 per day. It produced about 2,400 cu. m of brine before it was shut in for a build-up test to monitor reservoir pressure response, Arizona Lithium said.

Arizona Lithium Managing Director Paul Lloyd called the exploration results fantastic.

“The discovery of the Souris River lithium in Saskatchewan highlights the exploration upside that exists across the project. …This discovery will result in future wells by AZL and other lithium companies in the province, targeting this deeper formation and providing information to increase our large resource,” Lloyd said.

Additional wells will be drilled into the Souris River and Dawson Bay at Pad #2 and Pad #3 as part of the company’s drilling campaign, the company said.

In a separate news release, Arizona Lithium said Prairie Lithium’s Pad #1 was conditionally approved for up to $21.6 million in transferable royalty credits under the Saskatchewan government’s Oil & Gas Processing Investment Incentive (OPGII) program. The credits, which can only be claimed once the project becomes commercially operational and are transferable, are applied against crown royalties payable on lithium production at a rate of 20% in the first calendar year of operations; 30% the second year and 50% the third, reducing the company’s liability for crown royalties, the release states.

Strata, Arizona Public Service Enter Battery Storage Tolling Agreement

Electric utility Arizona Public Service (APS) and Strata Clean Energy have entered a 20-year tolling agreement for the 150-MW Justice Energy Storage project in Phoenix, according to a July 15 news release.

Once completed in April 2026 and connected to the APS power grid, the project will have the capacity to store enough energy to power about 24,000 homes over a four-hour period.

“Under the new tolling agreement, APS will be able to charge and discharge the system for energy as needed,” Strata said in a news release. “In return, Strata will ensure the system’s capacity, reliability, and efficiency through the term of the agreement.

Great Quest Gains Stake in Belmont Mineral Exploration

Great Quest Fertilizer Ltd., a Canada-based mineral exploration company, has closed its acquisition of a 25% ownership interest in Belmont Mineral Exploration, according to a July 17 news release.

With the acquisition, Great Quest gained a stake in Namibia-based Belmont’s 14 exclusive prospecting licenses, including the Omatjete gold and lithium project as well as the Khorixas and Outjo gold projects. Great Quest paid an initial US$60,000 and committed to fund $1.4 million for project exploration within 24 months of the transaction’s closing, the release states.

The company also has the option to acquire an additional 26% ownership interest in Belmont if it commits to funding $1.4 million for exploration.

Hydrogen

3M Invests in Electrolyzer Maker Ohmium

U.S. conglomerate 3M has completed an investment in Ohmium, an electrolyzer manufacturer.

“Our investment in Ohmium demonstrates 3M’s dedication to fostering innovative technologies that can lead to a more sustainable future,” Mark Copman, senior vice president of 3M New Growth Ventures, said in July 16 news release. “We see significant potential for collaboration in areas such as advanced materials, which can further enhance the efficiency and scalability of green hydrogen production.”

Ohmium specializes in proton exchange membrane electrolyzers, which are used to produce green hydrogen.

3M, which is decarbonizing its operations, is one of nearly 30 blue-chip corporations that invested in the Ohmium’s Series C funding round led by TPG Rise Climate.

Spain Launches $2.5B Plan to Support Green Hydrogen, Renewables

Spanish Prime Minister Pedro Sanchez announced on July 17 a new clean energy transition plan worth 2.3 billion euros (US$2.5 billion) that includes subsidies for green energy industries and hydrogen made from renewable power.

The plan will also include measures to help agriculture, infrastructure and villages transition to green energy, Sanchez said in an address to the lower house.

He did not provide more details of the new plan.

Spain has positioned itself as a renewable energy leader in Europe, taking advantage of its abundant sunshine and strong winds to produce energy. With renewables breaking records, the country is now vying to be one of the major producers in the region of green hydrogen produced from renewable electricity.

Earlier this month, Madrid approved a 794 million-euro package of subsidies for large green hydrogen projects in the country with a potential overall electrolysis capacity of 652 MW.

Subsidies are vital for green hydrogen projects due to high costs and are not competitive without public support.

Spain’s draft climate strategy a 2030 target of 11 GW for electrolyzers, up from a previous 4 GW.

RELATED

Gold H2, Oil Company Ink Deal for Microbial Hydrogen Technology

Aramco to Acquire 50% Stake in Blue Hydrogen Industrial Gases

Solar

First Solar Commissions Solar R&D Center in Ohio

First Solar has commissioned a 1.3 million-sq-ft R&D innovation center in Lake Township, Ohio, the company said July 18.

The facility features a pilot manufacturing line allowing for the production of full-sized prototypes of thin film and tandem photovoltaic (PV) modules. The company plans to commission a perovskite development line at its Perrysburg, Ohio, campus in second-half 2024.

“Thin films are the next technological battleground for the solar industry because they are key to commercializing tandem devices, which are anticipated to be the next disruption in photovoltaics,” said First Solar CEO Mark Widmar. “While the United States leads the world in thin film PV, China is racing to close the innovation gap. We expect that this crucial investment in R&D infrastructure will help maintain our nation’s strategic advantage in thin film, accelerating the cycles of innovation needed to ensure that the next disruptive, transformative solar technology will be American-made.”

The new facility is named the Jim Nolan Center for Solar Innovation in honor of late First Solar board member James “Jim” F. Nolan.

Solar Projects in Puerto Rico Get $861MM US Loan Guarantee

The U.S. Energy Department said on July 18 it is offering a conditional loan guarantee of up to $861 million for two utility-scale solar-energy projects in Puerto Rico that are expected to boost energy security after recent hurricanes severely damaged the U.S. territory's grid.

The conditional commitment from the department's Loan Programs Office goes to Clean Flexible Energy LLC, to finance construction of two solar photovoltaic farms equipped with battery storage and two standalone battery energy storage systems, the LPO said. The projects will be built in the coastal communities of Salinas and Guayama in south Puerto Rico.

The projects comprise 200 MW of photovoltaic solar panels and up to 285 MW of stand-alone battery energy storage capacity. The solar arrays will power about 43,000 homes, it said.

Clean Flexible Energy is an indirect subsidiary of AES Corp. and TotalEnergies Holdings USA Inc. and managed under a joint-venture agreement.

JinkoSolar Partners to Build Solar Cell Manufacturing Unit

China-based JinkoSolar said on July 16 it would form a joint venture (JV) with Saudi Arabia’s sovereign wealth fund and a privately owned Saudi renewable firm to build a solar cell and module manufacturing facility.

The company said the facility in Saudi Arabia is expected to have a total investment of about $1 billion and would be funded through a combination of internal and external financing.

Renewable Energy Localization Co., a unit of the Public Investment Fund (PIF) of Saudi Arabia, would hold 40% equity interest in the JV and Vision Industries 20% .

JinkoSolar’s Middle East unit would hold the rest of the equity interest, the company said.

The facility is expected to hit an annual production capacity of 10 GW for each of high-efficiency solar cells and solar modules, JinkoSolar said.

Saudi Arabia aims to reach net zero emissions by 2060 and its energy ministry had said in June the country would start annual tenders this year for new renewable energy projects with total capacity of 20 GW, with the aim of reaching between 100 GW and 130 GW by 2030.

RELATED

US’ Largest Co-located Solar, BESS Project In Service

Wind

Ørsted Begins Sunrise Wind Construction Offshore NY

Construction of Ørsted’s 924-MW Sunrise Wind farm offshore New York has started, according to a July 17 news release.

“Sunrise Wind builds on the momentum from South Fork Wind as we deliver jobs, economic development, and clean power for hundreds of thousands of New York homes and businesses,” Ørsted Americas CEO David Hardy said.

Sunrise Wind will be the largest wind farm off New York, producing enough clean energy to power about 600,000 New York homes, the company said. It is expected to begin commercial operations by 2026.

“By breaking ground on Sunrise Wind and advancing the next wave of offshore wind projects, New York is passing a tremendous milestone to combat climate change,” New York Gov. Kathy Hochul said.

New York also announced the launch of its fifth offshore wind solicitation administered by the New York State Energy Research and Development Authority.

The state’s ambitions include reducing its greenhouse gas emissions 40% by 2030 and 85% by 2050 from 1990 levels. It is targeting development of at least 9 GW of offshore wind capacity by 2035.

Community Offshore Wind Selects Fugro for Geotechnical Work

Fugro will conduct a geotechnical investigation of Community Offshore Wind’s 510-sq-km New York Bight lease area, the geodata specialist said July 17.

The investigation will refine an earth model, produced during a site characterization program in 2023, that detailed geophysical and environmental conditions to support the wind farm’s concept design.

“Our lease area in the New York Bight has the capacity to power more than one million US homes with renewable energy from offshore wind,” said Doug Perkins, president and project director for Community Offshore Wind. “This survey work is a vital step forward that will ensure our projects are developed sustainably and responsibly, while preparing us to bring new clean energy to communities across the region and help New York and New Jersey meet their nation-leading climate targets.”

As part of the work, Fugro is using one vessel to focus on seabed sampling and downhole in situ testing and a second vessel for advanced seabed cone penetration tests. The testing aims to ensure safe and efficient engineering of the wind turbine foundations, Fugro said in a news release.

Vineyard Wind Warns of More Debris from Offshore Wind Turbine

Vineyard Wind on July 18 warned that more debris from a broken offshore wind turbine could wash ashore along the Massachusetts coast after a large remaining portion of the damaged blade fell into the ocean.

Vessel crews are working to remove the debris, but weather conditions are difficult, the company said.

Vineyard Wind, a JV between Avangrid and Copenhagen Infrastructure Partners, said late July 17 that the remaining blade was compromised and could detach from the turbine, which was made by GE Vernova.

Reuters and Hart Energy staff contributed to this report.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.