Darren Woods, Chairman and CEO of Exxon Mobil, speaks during the 2023 CERAWeek by S&P Global conference. (Source: CERAWeek by S&P Global)

Exxon Mobil Corp. is gushing in the Permian Basin after closing its acquisition of Pioneer Natural Resources in the second quarter.

The Spring, Texas-based supermajor achieved record production of 680,000 boe/d from its heritage footprint in the Permian Basin, Exxon reported in second-quarter earnings Aug. 2.

The $63 billion Pioneer acquisition, closed in May, gave Exxon even greater scale and drilling runway in the Permian Basin. The transaction also represented Exxon’s largest deal since the merger between Exxon and Mobil Corp. in 1999.

Production from the Pioneer’s assets averaged a record 782,000 boe/d in the second quarter; volumes averaged 792,000 boe/d in June.

The incremental production attributable to Exxon was more than 520,000 boe/d, reflecting the two months since the Pioneer acquisition closed, Exxon Chairman and CEO Darren Woods said.

The companies have already hit the ground running on reducing costs and sharing best practices in the field.

“We are using Pioneer’s remote logistics operations center in our own drilling and Ccompletions operations to improve supply chain efficiency,” Woods said during Exxon’s Aug. 2 earnings call with analysts. “We are also leveraging Pioneer's water infrastructure network—the largest in the Permian—to serve the combined asset base at the lowest cost.”

Combined with Pioneer, Exxon forecasts its 2024 total Permian production to average around 1.2 MMboe/d.

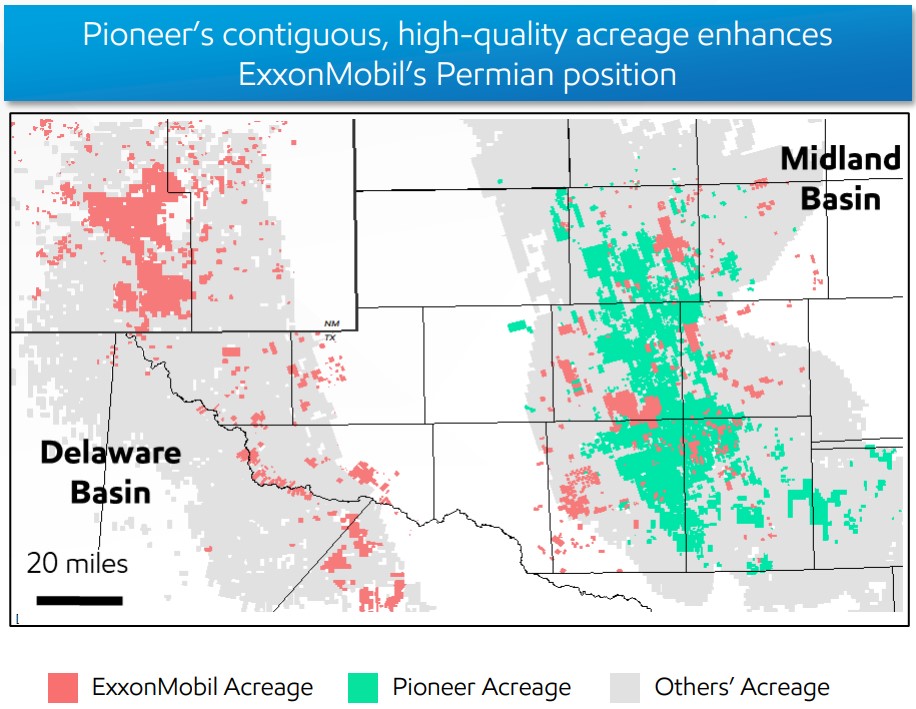

Pioneer’s assets are concentrated on the Midland Basin side of the Permian. Before the acquisition, Exxon, and its shale drilling subsidiary XTO Energy, were much more concentrated on the Delaware side of the basin.

XTO gained a foundational acreage position in the New Mexico Delaware Basin through a $6.6 billion acquisition from the Bass family of Fort Worth, Texas, in 2017.

Exxon is bringing its drilling skillset to bear on the Pioneer acreage with advanced cube development to drive recovery higher.

Exxon has been a leader in “cube” development in the Permian—drilling multiple wells targeting different stacked intervals from a single pad, to boost recoveries and use land and drilling resources more efficiently.

With a larger acreage block to work in, the companies also aim to drill longer 3- and 4-mile lateral wells in the Midland Basin.

Exxon has drilled the longest laterals in the Permian Basin so far, including a handful of 4-mile wells at its Poker Lake, New Mexico, operating site, according to data form Enverus Intelligence Research.

“We are now the largest producer in both the Permian Basin and the entire United States, with a business that has the largest high-return U.S. unconventional inventory,” Woods said.

Pioneer contributed approximately $540 million to Exxon’s overall second-quarter operating earnings, excluding $230 million in one-time acquisition costs and other related expenses.

The entire Permian Basin has been awash in M&A activity since Exxon announced the Pioneer acquisition in October 2023.

Exxon closed the Pioneer deal May 3. The company issued 545 million shares of Exxon Mobil stock—with a fair value of $63 billion as of the acquisition date—and assumed $5 billion in debt.

Other major transactions include Occidental Petroleum’s $12 billion acquisition of private Midland producer CrownRock LP, which closed on Aug. 1.

Diamondback Energy is acquiring Endeavor Energy Resources LP, another private Midland producer, for $26 billion. The acquisition is still pending, facing further scrutiny by antitrust regulators.

ConocoPhillips’ $17.1 billion acquisition of Marathon Oil will consolidate large swathes of Permian Basin acreage—though the deal’s impact might be greater in the Eagle Ford and the Bakken. The ConocoPhillips-Marathon deal is also facing Federal Trade Commission scrutiny.

RELATED

Beyond the Horizon: Exploring the Permian’s Longest Laterals

Divestiture market

Analysts expect to see a healthy supply of non-core asset sales after the dust settles from a historic run of corporate consolidation and upstream M&A across the Lower 48.

Buyers are wading further into debt by making large-scale acquisitions. To reduce leverage after closing, producers tend to sell off parts of their portfolio that might not compete for capital in the near term and direct new investment in their best assets.

Exxon has laid out plans to divest $15 billion in non-core assets, Woods said.

The company reported assets sales of approximately $1.6 billion during the first half of 2024, including $926 million transacted during the second quarter, cash flow statements show.

Exxon reported net favorable items of $380 million in its upstream segment from the divestments, partially offset by one-time expenses with closing the Pioneer deal.

Woods said Exxon will continue to evaluate ways to high-grade its global portfolio of assets but doesn’t see “any big step changes here in the medium term.” Executives didn’t offer specifics on which parts of its global portfolio could be considered for non-core sales.

In February, Exxon said it would exit its position offshore Equatorial Guinea during the second quarter.

The Permian Basin is Exxon’s flagship unconventional asset, but the company has footprints in other shale basins in the Lower 48.

Exxon owns a sizeable portfolio of producing assets in the Bakken play of North Dakota. In southern Oklahoma, Exxon is the leading operator drilling deep Woodford wells in the Marietta Basin. The company also maintains a footprint of gas-rich assets in West Virginia.

Exxon’s other flagship upstream asset in the Western Hemisphere is Guyana, the world’s latest and largest offshore oil discovery. Exxon has grown production from zero in 2019 to a gross average of 633,000 bbl/d in the second quarter.

For other U.S. operators seeking to reduce leverage, non-core sales are already underway.

Occidental agreed to sell non-core assets in the southern Delaware Basin to Permian Resources for $817.5 million, the companies announced July 29. The deal includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d.

APA Corp., parent company of Apache, sold royalty interests in the Midland Basin and assets in the Eagle Ford Shale for an aggregate of $660 million in June.

Post Oak Minerals V, an affiliate of Post Oak Energy Capital LP, acquired 24,000 net royalty acres (NRA) in the Midland Basin from APA. The company’s 237,000 net acres in the East Texas Eagle Ford play were acquired by private E&P WildFire Energy I.

APA’s divestitures follow a $4.5 billion acquisition of Permian producer Callon Petroleum in April.

Chevron Corp. is reportedly shopping a sale of largely undeveloped Haynesville gas assets in East Texas.

In Appalachia, gas producers EQT Corp. and BKV recently sold non-operated asset packages of Marcellus assets. EQT is seeking to sell the remaining 60% of its non-op footprint in northeast Pennsylvania.

RELATED

An Untapped Haynesville Block: Chevron Asset Attracts High Interest

Recommended Reading

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.