It’s a truly extraordinary American tale in a sense.

A failed, 150-year-old transcontinental railroad eventually turned into a sleepy, liquidating land trust in West Texas.

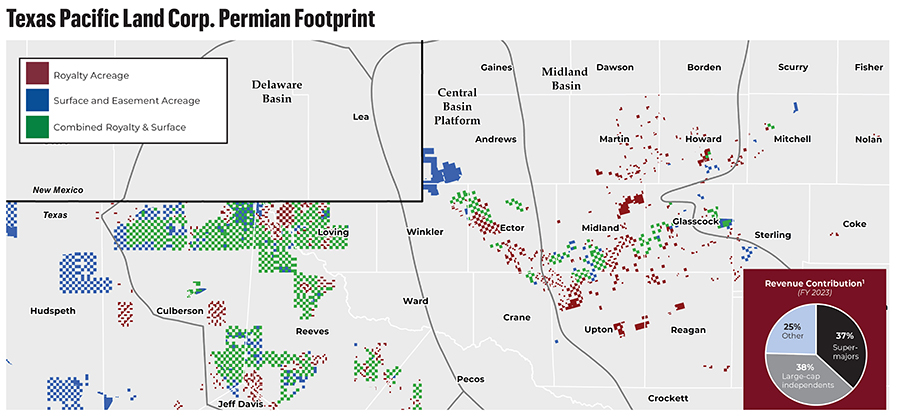

Fast forward another century and the Texas Pacific Land Corp. (TPL) dramatically transformed into a nearly $20 billion oil and gas royalties giant in the booming Permian Basin, controlling nearly 900,000 acres in the top oil play in the Americas, as well as water and proppant supplies and energy infrastructure.

After an investor feud, Texas Pacific Land converted in 2021 from a trust with a three-person board and lifetime appointments into a more modernized corporation and a 10-person board of directors.

At the end of February, TPL successfully resolved another shareholder dispute in court over a plan to substantially increase the number of authorized shares of common stock.

TPL then announced a three-for-one stock split in March, positioning the company with more liquidity and the potential to make acquisitions and keep growing. In June, the company joined the S&P MidCap 400 and announced a large special dividend of $10 per share.

Essentially, the New York Stock Exchange-traded Texas Pacific Land is now ready for prime time on Wall Street.

“Where else can you get an option on oil, water and real estate in the Permian?” said TPL President and CEO Tyler Glover in an exclusive interview. “That’s a pretty valuable proposition. If you look at the value chain, where our revenue comes from, TPL is really the purest way to gain access to the entire lifecycle of the Permian.”

Making the case for Texas Pacific Land

The catch: TPL remains relatively less known and scrutinized, and its mix of royalties, surface leases, water operations and much more makes it a more complicated sell to generalist investors.

“It makes this a harder model for sure,” Glover said. “I think Wall Street understands minerals pretty well, but surface is still something that is probably not as well understood. And the difference in our water company and other water peers is probably not as well understood.”

But word is catching on. After all, TPL has undergone a great deal of change in a short period of time, growing from eight employees in 2017 to about 100 today, said Glover, who joined TPL as a young landman in 2011 and became CEO in 2016.

“This thing was a mailbox, very passively managed, essentially a liquidating trust that was collecting royalties,” Glover said. “So, you didn’t need a large board, modern governance necessarily and a lot of industry experience and financial expertise. But, with the growth of the Permian and what we saw in the future, it made a lot of sense to modernize.”

Today, the pitch is that TPL is strongly positioned in both the Delaware and Midland basins with 868,000 surface acres and 23,700 core Permian net royalty acres. TPL has no debt, and oil and gas production on its assets has surged 270% since 2017, according to the company.

Of $632 million in 2023 revenues, 57% came from oil and gas revenues and more than 42% were from surface estate ownership. Of that 42%, 18% is from water sales and transportation; 13% from produced water royalties; and 11% from surface leases, easements and materials, including pipeline easements, sand sales and leases for wind and solar farms, among others.

“It’s kind of like a hedge built into the business against the volatility of commodity prices,” Glover said of all the surface estate revenue streams. “I think that’s pretty unique when you compare us to other minerals companies.”

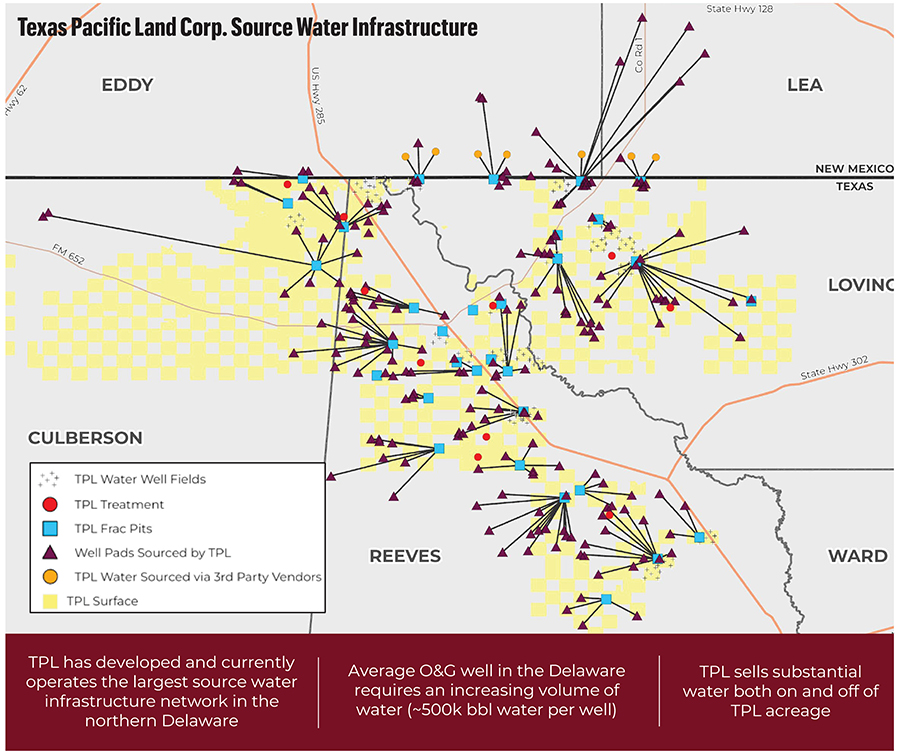

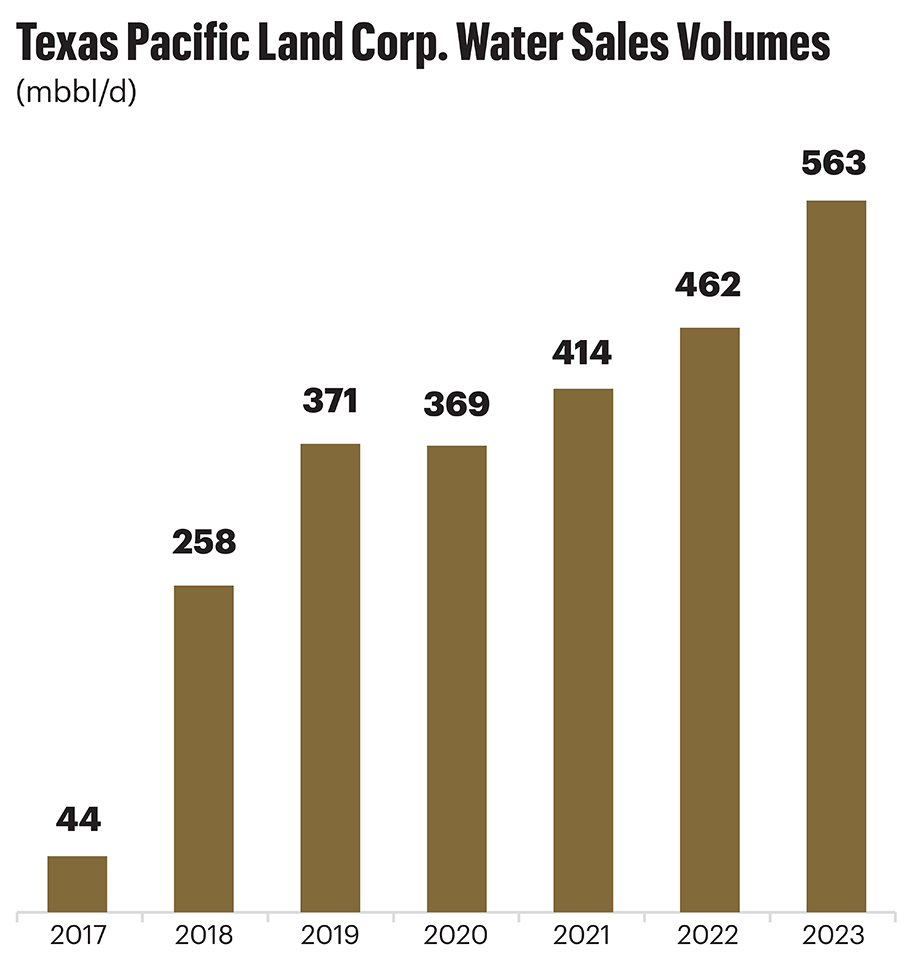

Starting in 2017, TPL spent just more than $140 million building up its water business and then another $130 million on surface and easement acquisitions.

“We actually own the groundwater, have the ability to move water across the entire northern Delaware Basin, and then own the pore space to take produced water and charge a royalty to that pore space or transmission across our properties,” Glover said. “We put around $140 million in that business and it’s generated [more than] $500 million of cumulative cash flow since 2017.”

The next area TPL is exploring is produced water desalination for reuse using a “fractional freezing” process, including a planned test facility, despite the seeming incongruity of making ice in the West Texas desert, Glover joked.

TPL has long-term water agreements with BPX Energy and others, and TPL also is exploring opportunities in carbon capture and storage.

The vast majority of production on TPL assets is controlled by supermajors and the largest independents, including Chevron, Exxon Mobil, Occidental Petroleum, ConocoPhillips and others. So, Glover feels TPL is even better positioned amid record-high Permian production, despite the wave of industry consolidation and declining rig counts.

“If the consolidators are operators we have really good working relationships with, then that just creates new opportunities for us,” he said. “And that’s kind of what we’ve seen historically, and what I think we will see with at least the consolidation that’s on the table.”

Because of its low profile, few analysts watch TPL closely. But one of them is BWS Financial analyst Hamed Khorsand.

He is a fan of the stock because TPL is a minerals and royalties business, and only a little more than half of the revenues come from the oil and gas royalties. “That’s a valuation widening potential, and that’s why I think it’s a big deal,” Khorsand said. “You can see how the stock has reacted.”

He started following TPL more closely when it moved away from its more antiquated trust structure.

“Then you start taking advantage of being a corporation,” Khorsand said. “And that means being able to do acquisitions. As long as it’s accretive, it makes a lot of sense. That is what really matters. If they’re staying within their niche and what they’ve always specialized in, then, yeah, why not?”

From Glover’s perspective, he said he’s focused on optionality and not necessarily going on a buying spree, arguing he wants TPL set up to thrive for another 150 years.

“We like surface, we like water, we like minerals, we like a combination of that, and that’s what we’ll be focused on in the future,” Glover said. “Having access to those additional shares does give us the ability to look at larger deals, but we’re focused on deal quality, not deal size. At a certain size, there’s less competition, which is attractive. But we’ll focus on assets that look like what we own today.”

“But we don’t feel like we have to make acquisitions,” he added. “We’re going to continue to remain disciplined and look for really high-quality assets. And that could be 2024, it could be ’25. I don’t know.”

And Glover contended TPL is well set up to seamlessly operate at a larger scale when and if any deals are made.

“We’ve built out sophisticated data management systems and mapping systems, and we’ve got the business in a place today where we can acquire those types of assets without adding any real costs to our business,” he said.

History in the making

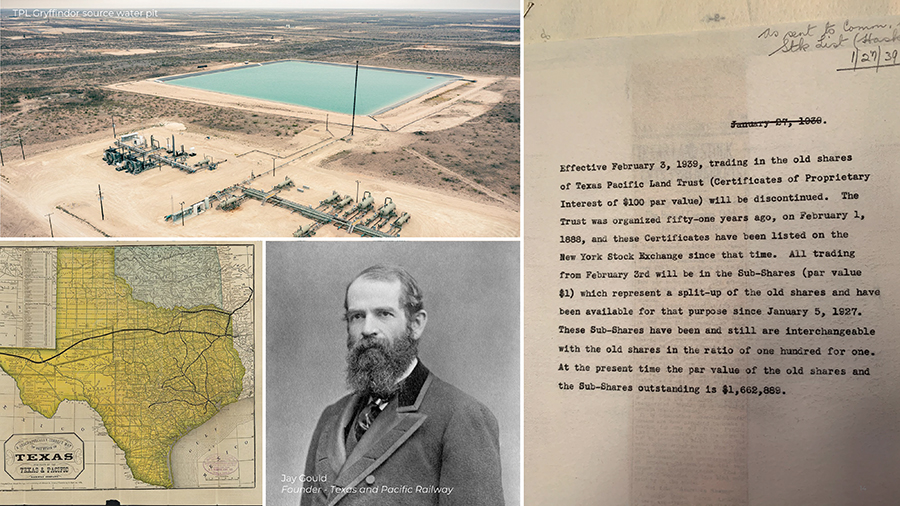

The legacy of TPL dates to 1871, when a federal charter was granted for the Texas Pacific Railway Co. to build a national railroad from Texas to California. At the time, railroad companies received federal land grants in exchange for laying tracks.

For a variety of financial reasons, the railroad effort failed but, by 1881, 972 miles of track were built, ceasing just east of El Paso, Texas. That led to the formation of the Texas Pacific Land Trust in 1888 to manage the railroad’s roughly 3.5 million acres of Texas land.

The trust was originally intended to steadily sell off land to pay back the railroad’s creditors. Conveniently, in hindsight, most of the seemingly unsellable land was sitting in the heart of the Permian Basin. The calculus changed quite a bit with the discovery of oil in 1920 in the Permian, leading to TPL certificates being listed on the NYSE starting in 1927.

Much of the Permian mineral estates were eventually spun off as TXL Oil. Texaco purchased the spinoff in 1962, including more than 2 million undeveloped acres in West Texas. But the trust kept most of the surface rights. That made Chevron a top producer on TPL’s position after Chevron acquired Texaco nearly 25 years ago.

Not much changed for decades as the trust quietly sat making money passively for investors. Everything changed again about a decade ago when the tight oil boom shifted to the Permian. For many years, TPL had used proceeds from leases and asset sales to repurchase shares. It turned out that TPL was buying back assets at a great discount that would become some of the industry’s best shale acreage.

After much internal consternation, TPL in 2017 decided to create the Texas Pacific Water Resources business to more actively participate in the shale revolution.

“It was pretty dramatic,” Glover said. “I mean, it was something that took a lot of time to convince the [three] trustees that it was the right move. But it was a fairly simple business model. The need was obviously there.”

“Everybody, especially on the Delaware side, was kind of running into the same problems,” he added. “They couldn’t find sustainable sources of drilling and completions water. You had some landowners that were selling water, but nobody was really selling water at scale. It’s a super arid region of Texas.”

The more remote Delaware Basin required much more water infrastructure that TPL could provide. But, also, the Delaware production has higher water cuts, requiring more disposal wells that TPL could help provide with all of its pore space.

Last year, former TPL co-chairmen David Barry and John Norris III acknowledged in the annual report: “Back then, that decision, to go from a passive, liquidating trust toward an active, growth-oriented enterprise, was a controversial one.”

Barry and Norris, who are no longer board members, did not respond to multiple messages for this story.

In 2019, the drama intensified when longtime TPL trustee Maurice Meyer III died at age 84. Both his father and grandfather had served as trustees, as well.

But his passing created a rare opportunity for hedge fund investors to launch a proxy fight to pick the next trustee. The effort was led by TPL’s largest shareholder, Horizon Kinetics, which still owns about an 18% stake in TPL, and SoftVest Advisors, which holds roughly 2%.

Horizon CEO Murray Stahl and SoftVest President Eric Oliver also were leading the push to transform TPL into a corporation with a modernized governance board.

They ultimately succeeded via compromise in the contentious proxy fight and legal battle, and now both sit on the 10-person board.

Five years ago, Oliver told this reporter, “If we were debating 900,000 acres on the surface of the moon, we wouldn’t be having these conversations. But we’re talking about 900,000 acres of arguably the lowest cost for barrel of oil in the world, so the stakes are much higher.”

Stahl declined comment for this story. Oliver called TPL a “great company,” but deferred to TPL for additional comment. The company opted to keep Glover as the sole spokesman.

However, last year, after acquiring board seats, Horizon and SoftVest opposed the plan to increase the number of authorized TPL shares.

In a January letter to Horizon clients, Stahl wrote he still agrees with TPL management on most things.

“Philosophically, we are not opposed to acquisitions or to asset disposals; we just desire that rigorous financial analysis be presented,” Stahl said. “It would need to be a unique and rare asset (acquisition target) to justify trading away a single TPL share, as there are exceedingly few companies or opportunities that we believe can compete with TPL’s return or prospects.”

Horizon and SoftVest ultimately lost in court in February.

Glover said he is pleased with TPL’s board dynamics since then.

“It is nice to have the litigation out of the way, and I would just say that having that settled, the dialogue on the board has been good,” Glover said. “I think we’re moving forward constructively. Murray and Eric have both recently been buying shares. I think that’s a good signal that they’re happy with where the business is at. I think we’re in a really good place now to capitalize on the opportunities that we have and continue to grow the business and enhance shareholder value.”

As someone with prior upstream oil and gas experience in the Permian, Glover saw the Texas Pacific Land name pop up periodically in documentation, and he was amazed when he ultimately interviewed there in 2011.

“I didn’t realize the expanse of their assets,” Glover said. “At that time, their maps were like old [parchment] maps. And so, when I saw that position, I was like, ‘Wow, this is incredible.’”

Now, he has TPL positioned in a much more active position and ready to grow.

“As we continue to expand our footprint, we’ll build out a bigger network within the industry,” Glover said. “I hope the industry looks at us as an innovator of land management and a good partner, and not as a hindrance to development.”

Recommended Reading

South Bow Shuts Down Keystone Pipeline After Oil Release

2025-04-09 - South Bow Corp. reported a release of approximately 3,500 bbl near Fort Ransom, North Dakota, and it is evaluating the return-to-service plans.

Targa Buys Back Bakken Assets After Strong 2024

2025-02-20 - Targa Resources Corp. is repurchasing its interest in Targa Badlands LLC for $1.8 billion and announced three new projects to expand its NGL system during its fourth-quarter earnings call.

Canadian Province Gives Environmental Warning to Pipeline Project

2025-03-19 - The Prince Rupert Gas Transmission Project is a 497-mile project that would ship up to 3.6 Bcf/d of natural gas to an LNG facility on the Canadian west coast.

Brookfield Infrastructure Partners Buys Colonial Pipeline for $9B

2025-04-04 - Brookfield Infrastructure Partners LP has agreed to acquire Colonial Enterprises, the owner of the Colonial Pipeline, in a deal valued at $9 billion.

Intensity Infrastructure Partners Pitches Open Season for Bakken NatGas Egress

2025-02-04 - Analysts note the Bakken Shale’s need for more takeaway capacity as Intensity Infrastructure Partners launches an open season for a potential 126-mile natural gas transport line out of the basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.