Endeavor Energy Resources LP’s future-well inventory “stands out as the clear belle of the M&A ball” in the Midland Basin as other operators look to buy replacement inventory, according to J.P. Morgan Securities analyst Arun Jayaram.

Could similarly Midland-focused Pioneer Natural Resources Co. buy it? At a J.P. Morgan dinner in June, Pioneer president and COO Rich Dealy, who will become CEO Jan. 1, “reiterated the company’s interest in Endeavor at the right price,” Jayaram reported.

“But [he] underscored that Pioneer’s current acreage position and inventory have the operator poised for success over the coming 10 [years] to 15 years, regardless.”

Dealy told Hart Energy this spring that Pioneer has 15,000 high-graded future-well locations in inventory and a total of more than 25,000.

“At [their] current development pace, operators with the most Midland Basin inventory include APA [Apache] Corp., ConocoPhillips, Pioneer and privately-held Endeavor,” Jayaram reported in June.

Pioneer has the most potential-well sites at $65-plus WTI: more than 11,000. But at its drilling pace, this inventory would be depleted in 25 years, according to the J.P. Morgan analysis. APA has roughly 1,850 potential well sites, but its current pace means it would deplete this inventory in 55 years.

Endeavor is second to Pioneer with inventory, coming in at more than 4,000 at $65 WTI. At its current drilling pace, Endeavor’s inventory life is 14 years.

The 44-year-old Endeavor is the fifth-largest U.S. privately held E&P, according to an Enverus analysis published by Hart Energy in May, with a production rate of 279,764 boe/d at 69% oil.

Ranked higher is newly private, multi-basin Continental Resources Inc., followed by Appalachia-focused Ascent Resources, Permian-focused Mewbourne Oil and Haynesville-focused Aethon Energy.

A rumor reported by Reuters in October of 2018 was that Endeavor was for sale for an estimated $10 billion or more. At the time, Endeavor’s production was 64,000 boe/d; strip was about $70.

Earlier that year, RSP Permian Inc. went for $9.5 billion to Concho Resources Inc. (now part of ConocoPhillips), and Energen Corp. sold to Diamondback Energy Inc. for $9.2 billion.

Energen had some 180,000 net Permian acres; RSP, 92,000 net acres.

“Historically, Endeavor has often been linked to both Exxon Mobil and Pioneer [as potential buyers], and we found it interesting that Endeavor was a topic of conversation in our interactions with Pioneer [in June],” J.P. Morgan’s Jayaram reported this month.

He added that Pioneer CEO Scott Sheffield “has never been shy about his desire to acquire Endeavor and marry the two” in the past. Both Pioneer and Endeavor are focused entirely on the Midland Basin.

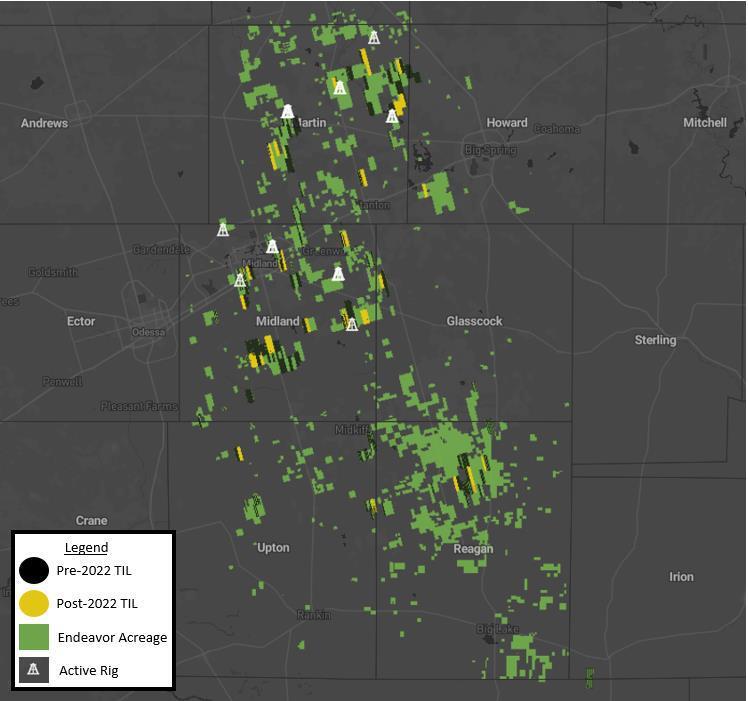

“Endeavor’s footprint is enhanced by its largely contiguous nature, which allows the company to extend lateral length for increased capital efficiency, optimize facilities and infrastructure investment and limit exposure to offset activity of other operators,” Jayaram wrote.

Also, Endeavor’s well results are comparable to Pioneer’s and Diamondback’s, he added.

Recent Endeavor completions include a couple that each averaged first-24-hour tests of 1,884 boe/d at 87% oil. Another 22 new wells each averaged 1,317 boe/d, 89% oil, Jayaram wrote in separate reports.

Endeavor has 14 rigs drilling; Pioneer has 22 rigs.

Enverus senior M&A analyst Andrew Dittmar reported recently that “there are just about 15 private companies remaining in the Permian that have more than 100 locations, and the lion’s share of those are long-time private companies like Endeavor, Mewbourne and BTA Oil Producers that are significantly less likely to pursue a sale than the typical private equity-sponsored portfolio company.”

Mewbourne’s founder, Curtis Mewbourne, passed away in 2022. The family’s intention is to continue as an independent company, president and CEO Ken Waits told Hart Energy in June.

Autry Stephens founded Endeavor in 1979 after working as a reservoir engineer for a Midland, Texas, bank. He began his career in 1962 with Humble Oil (now Exxon Mobil Corp.)

Stephens told Hart Energy in 2014 of his choice of studying petroleum engineering in college. “I was raised on the farm, but I wasn’t a very good farmer. As high school graduation loomed, my dad suggested, ‘Maybe you should find something other than farming to do.’”

Lance Robertson, Endeavor CEO, told attendees at Hart Energy’s SUPER DUG conference in the spring of 2018 that the company’s horizontal well results hadn’t been working out at first. “Our well productivity was just not competitive,” he said.

But a re-think of tactics resulted in improved results five consecutive quarters by then, totaling 43% better 30-day IPs compared with two years earlier, he added.

Robertson joined Endeavor as COO in December of 2017 from Marathon Oil Corp., where he was vice president of U.S. unconventional resources, and had previously been vice president of engineering and exploration at Pioneer.

Endeavor held back until 2016 on converting its D&C program to horizontal with mega-fracs, while other Permian operators had begun perfecting it a half-decade earlier.

“While we were good on the vertical side,” Robertson told Hart Energy in 2020, “we’ve had to learn from our peers across the basin and through our own efforts to be effective at our horizontal development.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.