A multi-frac job being completed for Berry Corp. in Duchesne County, Utah, in the Uinta Basin. (Source: Berry Corp.)

Natural gas demand in western U.S. states is rising, despite growing output from renewable energy sources.

Demand is growing across different parts of the West for different reasons. California, the nation’s most populous state, is the largest gas consumer. But California demand is expected to remain roughly flat through the end of the decade, according to East Daley Analytics (EDA) forecasts.

Demand is rising in states like Arizona, fueled primarily by population growth and interest from data center developers.

“What we’re looking at [across the West] is relatively steady demand growth increasing from about 13 Bcf/d to 14 Bcf/d by the end of the decade,” said Ian Heming, natural gas research analyst for East Daley.

For a region with growing demand, getting natural gas to the West involves many moving parts. And it can be easier said than done, with analysts predicting the western U.S. market will face supply shortages well into the late 2020s.

Researchers at East Daley Analytics say buyers will call on greater gas volumes from western Rockies basins—the Uinta and Green River basins, in particular—to make up part of the shortfall.

“On the West Coast, your best opportunities are going to be in the Green River and Uinta Basins,” Heming said. “Those will be followed by the Piceance and San Juan.”

RELATED

Anschutz Explores Utah Mancos Shale Near Red-Hot Uinta Basin

Uinta, Green River gas

Uinta and Green River gas stand out from other Rockies plays due to their relatively low breakeven well costs and the availability of infrastructure in place.

With natural gas prices so low, much of the drilling activity in those plays has been directed in the Uinta’s liquids window.

Operators SM Energy and FourPoint Resources are pouring billions of M&A dollars into the Uinta’s oily stacked pay. SM closed an acquisition of leading Uinta oil producer XCL Resources last year.

Privately held FourPoint Resources is acquiring Ovintiv’s Uinta Basin assets for $2 billion. The deal is expected to close in the first quarter.

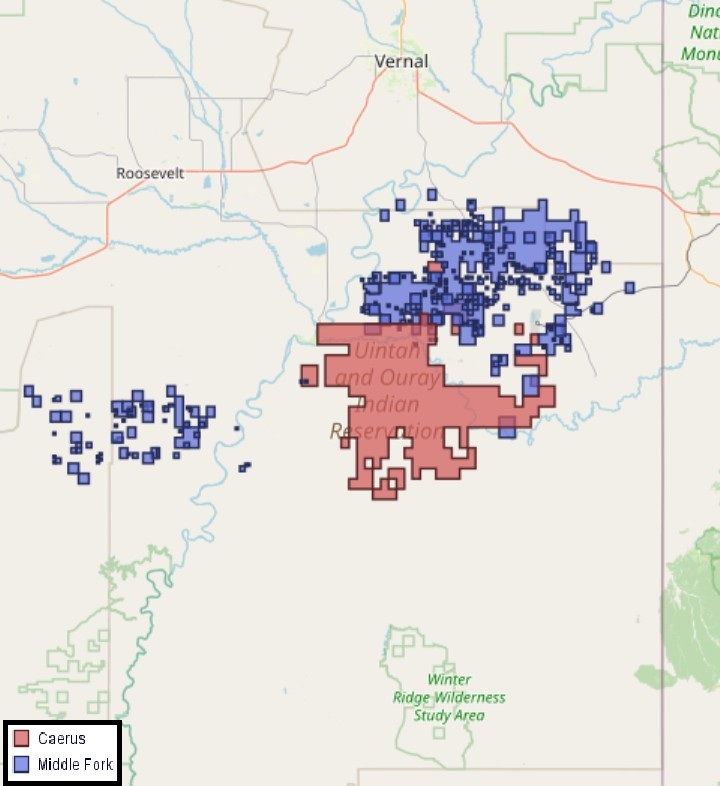

Less attention has been paid recently to the Uinta’s natural gas window with commodity prices so low. Middle Fork Energy Partners and Caerus Uinta LLC have been leading producers from the gas window in Uintah County, according to Utah state data.

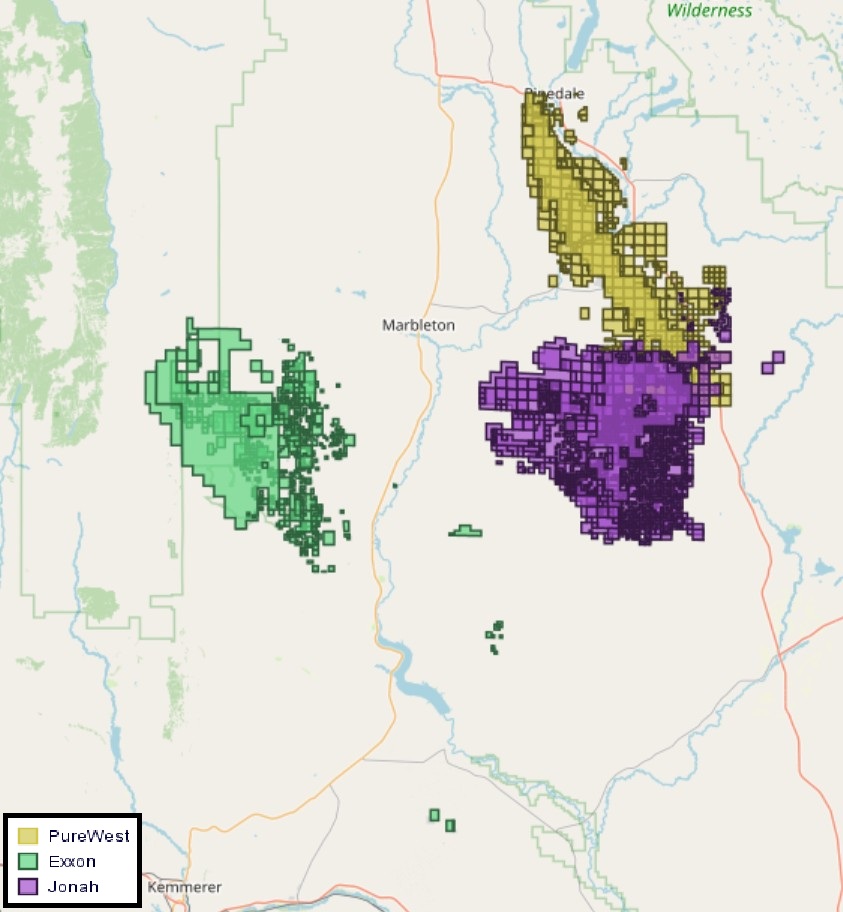

Momentum has also slowed in Wyoming’s Green River Basin. Green River rigs fell from an average of four rigs in November to two in December, per EDA data.

Operators including PureWest Energy, Exxon Mobil and Jonah Energy are among the top Greater Green River gas producers.

But the growing demand for gas in the West should support higher prices—and in turn, increased drilling activity in the Uinta and Green River gas plays.

M&A interest is growing in these gassy plays. Last year, Caerus sold to Quantum Capital Group in two transactions valued at $1.8 billion.

Caerus’ Uinta gas assets were transferred to KODA Resources, an existing Quantum portfolio company. Caerus’ Piceance assets are being managed by a new portfolio company, QB Energy.

In 2023, a private investor group led by family offices acquired PureWest Energy for $1.84 billion in cash.

Infrastructure

Available infrastructure and new projects planned in the Uinta and Green River basins also support increased activity.

The Chipeta gas processing plant in the Uinta Basin, for example, is operating at roughly 20% to 25% capacity.

“They’re able to build some pipeline, gathering and takeaway infrastructure to help fully utilize that capacity at the plant,” said EDA Analyst Alex Gafford.

Williams Co. is expanding MountainWest’s southern lateral, Fidlar, to pull an additional 250 MMcf/d from the Uinta’s Chipeta plant to the Kern River pipeline, which flows into southern California.

Takeaway infrastructure from the Greater Green River Basin also operates under capacity. Drilling activity and gas production from the Green River has declined since its peak in 2009, according to Wyoming state data.

PureWest Energy reports producing comfortably beneath its infrastructure limits from the Pinedale Anticline Field, COO Kristel Franklin said at Hart Energy’s Super DUG conference last year.

The San Juan and Piceance basins are also both major contributors to western supply. But forecasts show San Juan and Piceance output declining through the end of the decade as drilling activity is directed elsewhere in the Rockies.

The San Juan does have the capacity to grow production, but new takeaway expansions aren’t being planned for the region in the near term, said EDA’s Nigel Gorbold.

RELATED

Laying in Wait: San Juan’s ‘Remarkable’ Mancos Shale Oil Wells

Go west

Production within the western U.S. comes from California, New Mexico’s San Juan Basin and the western Rockies plays—the Uinta, Piceance and Green River basins.

But production from the West only makes up a fraction of its demand, so cheaper gas volumes are also sourced from Canada and the Permian Basin, Heming said.

“Usually, the first lever pulled is that [Alberta Energy Co. (AECO) hub] gas—the gas coming in from Canada,” Heming said.

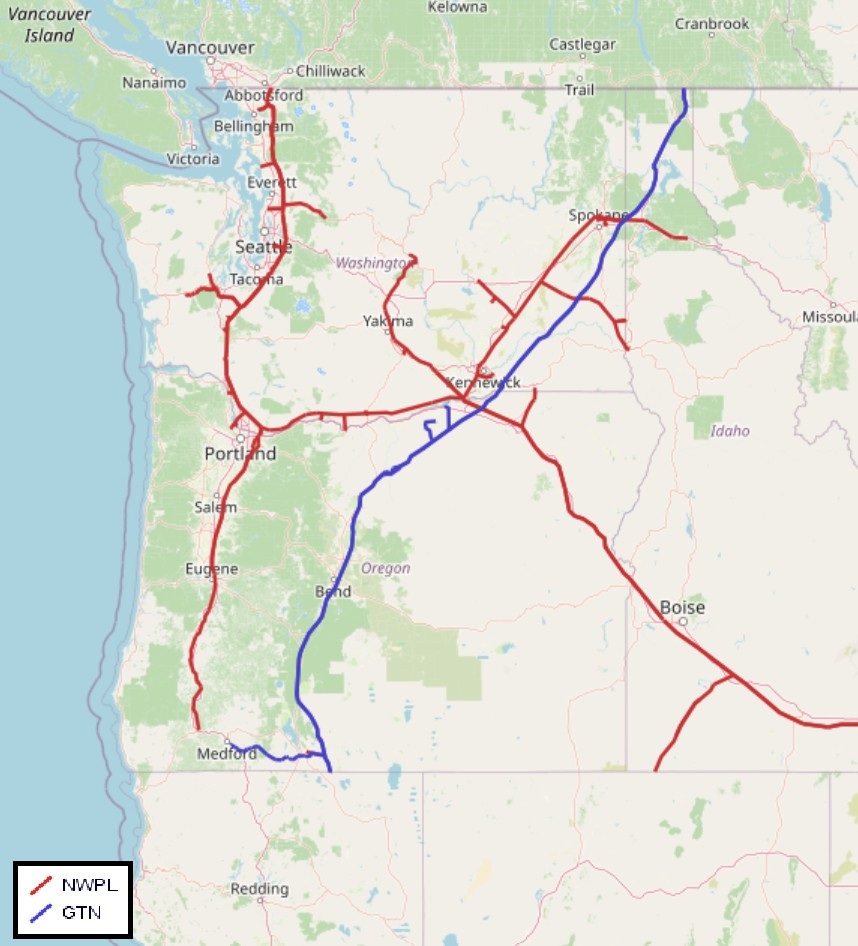

AECO gas coming in from southern Alberta is one of the lowest-cost trading hubs with access into Western states, including the large California market. Williams’ Northwest Pipeline (NWPL) and TC Energy’s Gas Transmission Northwest (GTN) system are major inbound pipes carrying Canadian gas to the western market.

To the south, Energy Transfer’s Transwestern Pipeline system and Kinder Morgan’s El Paso Natural Gas (EPNG) system brings gas volumes westward from the Permian Basin.

Record volumes of associated gas production from the Permian have pushed Waha Hub prices to depressed levels, frequently dipping into negative territory. The startup of the new Matterhorn Express Pipeline last October provided some relief to Permian gas producers.

“Matterhorn starting up has changed things a little bit on that pricing side, but typically we’d still expect to see Waha be the next lowest prices,” Heming said.

Gas from the Rockies is the third option. But there aren’t many pipes that can pull gas from the Eastern Rockies and Midcontinent across the mountains into the West.

Midstream operators are hoping to ease capacity constraints across the Rocky Mountains. Williams is expanding the MountainWest Overthrust Pipeline in Southern Wyoming by an additional 325 MMcf/d. The expansion is expected to be in service by December 2025.

RELATED

BYOP (Bring Your Own Power): The Great AI Race for Electrons

Recommended Reading

ConocoPhillips to Sell Interests in GoM Assets to Shell for $735MM

2025-02-21 - ConocoPhillips is selling to Shell its interests in the offshore Ursa and Europa fields in the Gulf of Mexico for $735 million.

Howard Energy Partners Closes on Deal to Buy Midship Interests

2025-02-13 - The Midship Pipeline takes natural gas from the SCOOP/STACK plays to the Gulf Coast to feed demand in the Southeast.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Voyager Midstream Closes on Panola Pipeline Interest Deal

2025-03-19 - Pearl Energy Investments portfolio company Voyager Midstream Holdings has closed on its deal with Phillips 66 for its non-op interest in the Panola Pipeline.

Archrock to Buy Natural Gas Compression Systems for $357MM

2025-03-11 - Archrock Inc. will buy privately held Natural Gas Compression Systems Inc. in a cash-and-stock deal that deepens Archrock’s operations in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.