PureWest Energy LLC

About

PureWest Energy LLC is a private energy company focused on developing its long-life natural gas reserves in the Pinedale and Jonah Fields of Wyoming’s Green River Basin. PureWest controls more than 126,000 gross (115,000 net) acres in and around the prolific Pinedale and Jonah Fields.

Editor's note: Updated July 7, 2021.

Headquarters Address

1550 Wynkoop Street

Suite 300

Denver, CO 80202

United States

Website

purewest.comMain Phone Number

Transactions

Ultra To Sell All Utah Assets For $75 Million

Ultra To Sell All Utah Assets For $75 Million

Ultra Petroleum Exits Marcellus Shale In Alta Resources Deal

Ultra Petroleum Exits Marcellus Shale In Alta Resources Deal

Ultra Petroleum Exits Marcellus Shale In Alta Resources Deal

Ultra Petroleum Exits Marcellus Shale In Alta Resources Deal

Ultra Petroleum Wraps Up Pinedale Acquisition From Shell

Ultra Petroleum Wraps Up Pinedale Acquisition From Shell

Ultra Petroleum Wraps Up Pinedale Acquisition From Shell

Ultra Petroleum Wraps Up Pinedale Acquisition From Shell

This content is locked until you subscribe

This content is locked until you subscribe

This content is locked until you subscribe

This content is locked until you subscribe

Subscribe to Access

Instantly unlock over 15 years of A&D transactions and financing data.

New Financings

Ultra Petroleum Corp. has terminated its previously announced private offer to exchange…

Ultra Petroleum Corp. announced that its wholly owned subsidiary, Ultra Resources Inc., has…

Ultra Petroleum Corp. has entered into agreements to effect, subject to customary settlement procedures,…

Entered into an agreement with holders of approximately $556.4 million aggregate principal amount, or 79.…

In connection with the potential transaction, the company moved forward the semi-annual redetermination…

This content is locked until you subscribe

This content is locked until you subscribe

This content is locked until you subscribe

Subscribe to Access

Instantly unlock over 15 years of A&D transactions and financing data.

News

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

More Uinta, Green River Gas Needed as Western US Demand Grows

Natural gas demand in the western U.S. market is rising, risking supply shortages later this decade. Experts say gas from the Uinta and Green River basins will make up some of the shortfall.

Investing ‘Generationally’: The Family Office View of Oil and Gas

Key family offices, whose wealth developed from other industries, are filling in oil and gas investment gaps left by the flight of endowment and institutional capital from the space.

It’s All Relative: Family Oil Companies Attract Huge M&A Attention

What role do firms controlled by descendants of the original Permian Basin wildcatters play in a sector increasingly dominated by scale?

Asset-backed Securitization Emerges as Growing Finance Opportunity

A relatively new type of financing has emerged for E&Ps—PDP asset-based securitization.

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

Public-private M&A brings new players to top slots in private operators list.

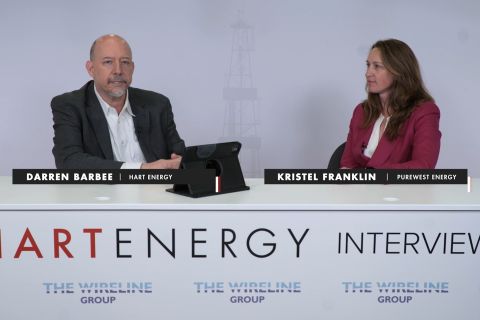

PureWest Bides Time, Positions for NatGas Demand in West Coast Markets

In this Hart Energy exclusive interview, PureWest's COO Kristel Franklin talks about how the private company is navigating the dismal natural gas market opposite public players.

Kimmeridge Exec: Chesapeake-Southwestern is Gas Sector’s ‘Most Logical Combination’

After pushing Chesapeake to pivot into a pure-play natural gas company, activist investor Kimmeridge wants to see a deal come together with Southwestern Energy—for the right price.

Exclusive: PureWest's Strategy Focuses on Pinedale Anticline [WATCH]

With its recent acquisition by a family consortium of family offices and financial institutions, PureWest is capitalizing on the "fairly unique deal" with its growth strategy going forward, says CEO Chris Valdez in this Hart Energy LIVE Exclusive.

Rockcliff CEO on US LNG: ‘Where Is All This Gas Going to Come From?’

Can Haynesville, Permian and Eagle Ford E&Ps meet skyrocketing gas demand to serve a host of new LNG projects on the Gulf Coast? These executives have concerns.

Hart Energy's 2023 ESG Awards: Cleaner, Safer, More Diverse

Hart Energy’s annual ESG Awards are here, highlighting the findings of data analysis firm Clear Rating and recognizing companies' efforts in sustainable operation, local community engagement and positive workplace culture.

Family Offices Step Up to Fund Oil, Gas

Insiders say family offices are increasingly willing to take on oil, gas investment risks as returns skyrocket.

Rockies Gas Producer PureWest Acquired for $1.84 Billion

A private consortium of family offices and financial institutions acquired ownership of Wyoming natural gas producer PureWest for $1.84 billion.

Wyoming-Focused PureWest Grows Market for Certified Gas through New Partnership

PureWest Energy will partner with Project Canary and Earn to create blockchain tokens to meet its own net-zero targets while helping customers realize their own Scope 3 goals.

Rockies Gas Producer PureWest Energy to Participate in Emissions Monitoring Program

The collaborative research program with Colorado State University will focus on PureWest Energy’s evaluation of multiple continuous emissions monitoring technologies in field testing sites in Pinedale, Wyoming.