Sometimes, the value of a hydrocarbon resource play can be as simple as “location, location, location.”

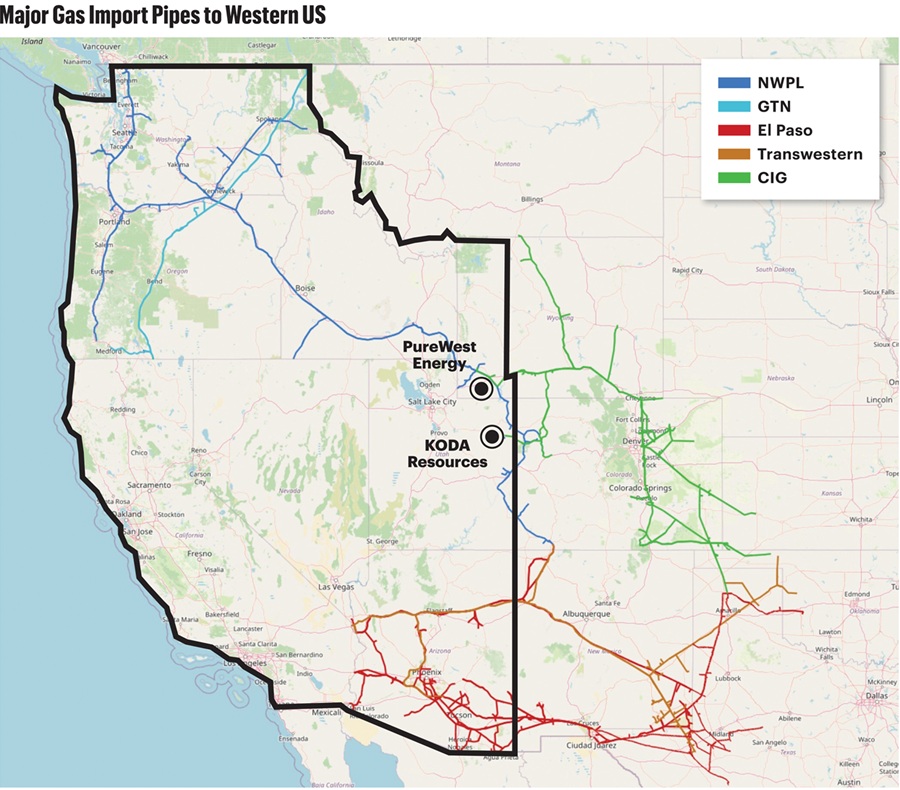

Natural gas demand is rising across the western U.S., but there are few avenues to supply the West with the gas it needs.

Western U.S. gas demand is expected to increase from around 13 Bcf/d today to 14 Bcf/d by the end of the decade, according to experts at East Daley Analytics.

Demand is growing across different parts of the West for different reasons. Gas demand within California, a leader in renewable energy deployment, is expected to remain roughly flat by 2030.

Meanwhile, gas demand is expected to rise in states like Arizona, fueled by population growth and interest from data center developers.

And gas supply from within the West—around 2.1 Bcf/d from California and New Mexico’s San Juan Basin, along with storage reserves—makes up only a fraction of its demand.

So, western states are left to import the difference from Canada, the Permian Basin and the Rocky Mountains.

But, with import capacity from Canada and the Permian effectively tapped out, gas producers in the western Rocky Mountains sit at an important crossroads to be a swing supplier to the West during periods of high demand.

Vast gas reserves lie in the eastern Rockies and the Midcontinent. But only so much pipeline capacity exists to carry the gas westward across the Rocky Mountains.

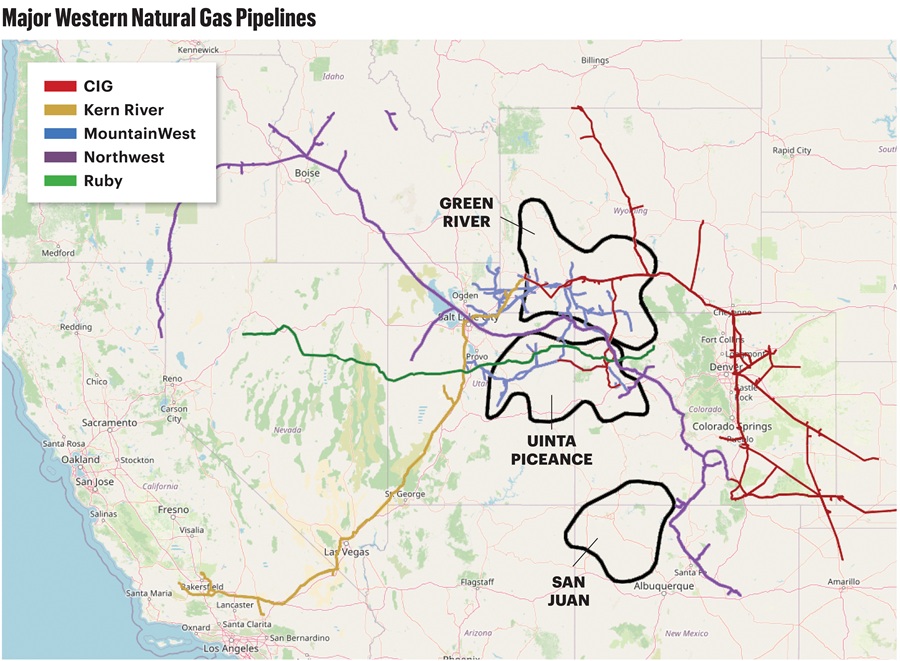

There’s a dividing line from east to west along the bottlenecked Colorado Interstate Gas Co. (CIG) pipeline in southwestern Wyoming, running through the heart of the Greater Green River Basin.

“What it’s effectively known as is the I-80 corridor constraint,” said Kristel Franklin, COO of PureWest Energy, one of the top natural gas producers in Wyoming.

It’s become a pretty common concept that bifurcates the area into east versus west, she noted.

“Essentially, you have full pipes entering that constraint point from the east,” she said. “Then downstream of the constraint, things open up and there’s ample capacity.”

PureWest’s blocky asset on the Pinedale Anticline Formation sits downstream of the CIG bottleneck.

“The way we kind of think about it is that we’re west of the wall,” Franklin said.

There are efforts to relieve some of the bottleneck across the mountains. Williams Cos. is expanding the MountainWest Overthrust Pipeline in Southern Wyoming by an additional 325 MMcf/d.

The Overthrust expansion is expected to be in service by December.

But without large-scale projects to solve the structural shortages of supplying gas demand to the West, it serves to have gas located west of “the wall.”

The availability of gas reserves and ample takeaway infrastructure gives greater upside to basins west of the divide, including the Uinta and Green River gas basins, said Ian Heming, natural gas research analyst for East Daley.

Meanwhile, production from gassy basins east of the I-80 constraint—like the Piceance and San Juan basins—is forecasted to decline while Uinta and Green River gas supply grows.

“On the West Coast, your best opportunities are going to be in the Green River and Uinta Basins,” Heming said. “Those will be followed by the Piceance and San Juan.”

RELATED

More Uinta, Green River Gas Needed as Western US Demand Grows

West of the wall

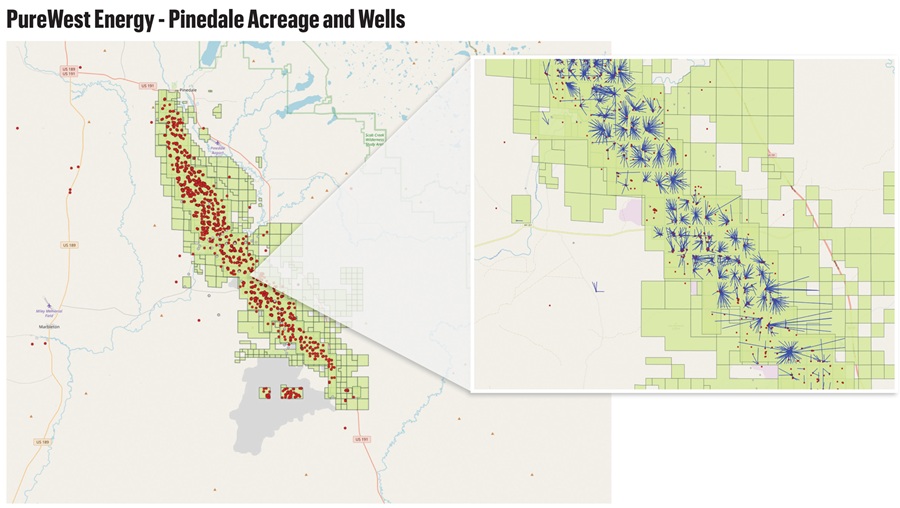

Denver-based PureWest Energy is one of the top gas producers in the Greater Green River Basin, where the company has consolidated most of the historic Pinedale Anticline Field.

Oil exploration in the Pinedale Field dates to 1939, when the California Co.’s Government #1 was drilled in the structure to a depth of 10,002 ft, according to the Wyoming State Geologic Survey. The well delivered no oil shows.

Although there were shows for natural gas, there was no market for it. The well was eventually plugged and abandoned. But significant gas production from the area came online in the early 1980s, spurred also by the prolific Jonah gas field nearby.

The Mesa 15-8 well, drilled in 1998, was Pinedale’s first multistage fracture-stimulated well.

PureWest was born out of the Chapter 11 bankruptcy of Ultra Petroleum, a longtime Wyoming gas producer from the Pinedale and Jonah fields. Ultra emerged from bankruptcy in September 2020.

The surviving entity eventually rebranded as PureWest Energy, which today manages approximately 3,500 wells across the massive Pinedale Anticline Formation.

PureWest’s current gross operated production is 625 MMcf/d; PureWest’s 2025 net production is estimated at around 300 MMcfe/d (95% gas).

PureWest operates about 1,600 of its 3,500 wells on behalf of Wincoram Asset Management.

Wincoram was a part of a family office-led private investor consortium that acquired PureWest for $1.84 billion in cash in 2023. The PW Consortium also included Petro-Hunt, A.G. Hill Partners, Cain Capital, Eaglebine Capital Partners, Fortress Investment Group, Stoneridge and HF Capital.

PureWest has been able to extend its drilling inventory by using wider spacing and larger slickwater fracs.

Compared to the company’s modern drilling projects, PureWest’s legacy wells are spaced together tightly. PureWest manages some older pads with 50 wells spaced between 8 and 20 feet apart.

“They would have mostly 10-acre development but some as tight as 5-acre development,” Franklin said.

Legacy Pinedale wells were completed using antiquated gel fracs and “hardly stimulated at all relative to what a modern slickwater frac looks like today.”

EURs from the roughly 3,500 legacy vertical Pinedale wells ranged between 2 Bcf to 3 Bcf.

“What we’re doing today with modern slickwater fracs is 20 to 30 acres per well of drainage expectation,” she said—much wider than legacy designs.

PureWest pumps 10x more fluid than the 3,500 legacy wells drilled across Sublette County over the past four decades.

EURs from 65 of PureWest’s modern Pinedale wells have ranged between 6 Bcf and 10 Bcf.

“It’s the same wellbore architecture to get there,” she said. “Now, we’re just doing more with horsepower on completions and it’s making this work from an economic standpoint.”

RELATED

Anschutz Explores Utah Mancos Shale Near Red-Hot Uinta Basin

Takeaway A-OK

Unlike gas producers east of the I-80 corridor constraint, PureWest enjoys very few takeaway challenges moving its gas to premium West Coast markets.

Production from the Pinedale Anticline is below peak levels seen in the early 2010s, according to Wyoming state data. The Pinedale Field and the nearby Jonah Field were producing between 2 Bcf/d and 2.5 Bcf/d during those years.

Today, the two prolific fields produce just less than 1 Bcf/d, Franklin said.

So, on a hyperlocal level, PureWest has ample—if not redundant at times—infrastructure for gas gathering, processing and takeaway, she said.

“Generally speaking, (there’s) ample takeaway capacity for this entire region. It’s highly interconnected,” Franklin said. “Gas moves west, but it can also move east. The gas can find a home in any number of directions.”

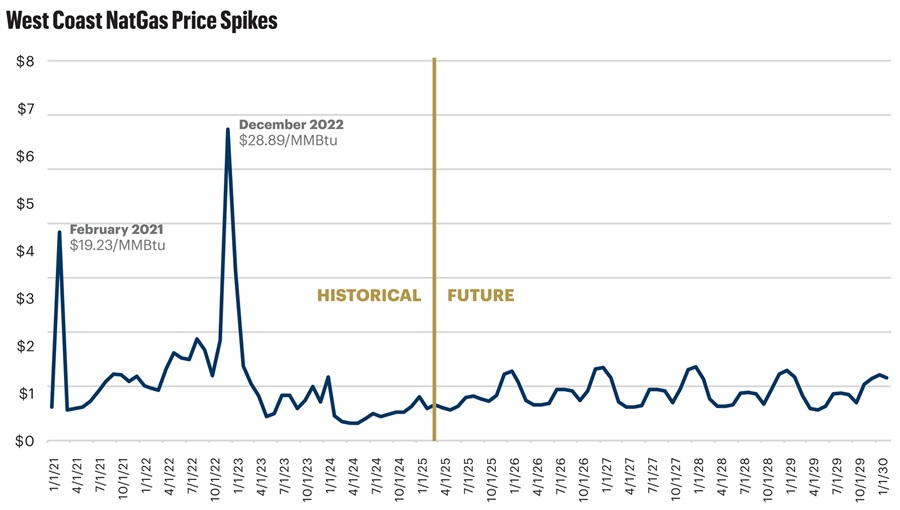

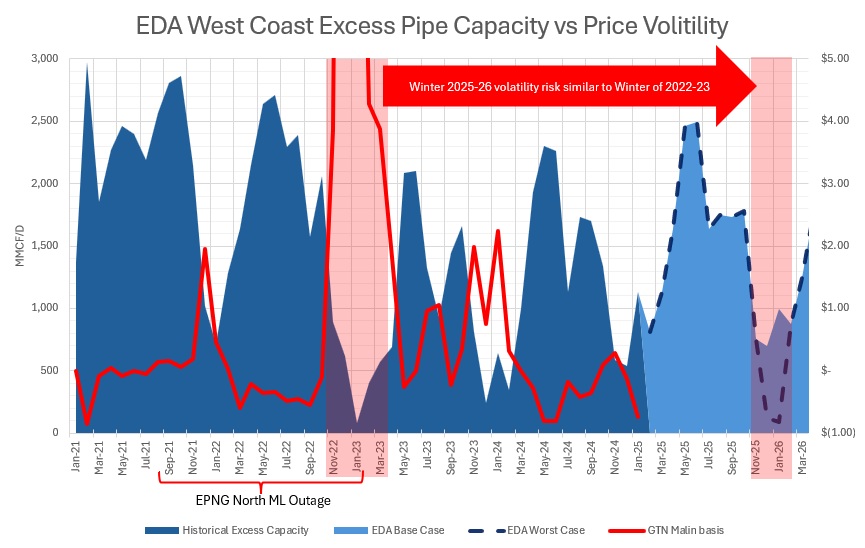

But during periods of inadequate supply, like during winter cold snaps, greater gas volumes flow from the Rockies into the West, according to East Daley Analytics data.

A particularly cold winter from late 2022 to early 2023 saw regional natural gas prices skyrocket across the West.

“It was cold everywhere, but it was especially cold in the West,” Franklin said, “and price was going nuts.”

Pipeline flows westward from the Rockies averaged about 2.67 Bcf/d during all of 2022—but grew to around 3.37 Bcf/d during the cold snap from November 2022 to January 2023, per East Daley figures.

At that point, gas imports from Canada and the Permian were operating at nearly full transportable capacity.

Permian imports, in fact, were hampered by an August 2021 explosion on the Kinder Morgan El Paso Natural Gas (EPNG) system, one of the main pipelines delivering Permian gas to the West.

Repairs took around 550 MMcf/d to 600 MMcf/d of Permian egress offline until capacity was restored in February 2023, Heming said.

The high commodity prices seen over that extended period reflect the impact of losing half a Bcf/d of supply, and how difficult it was to incentivize additional westward flows to compensate for the EPNG outage, he said.

But it was Rockies gas, with more than 1 Bcf/d of spare transport capacity, that filled the increased demand.

“This is the tipping point,” Heming said. “When gas is really needed over in the West and demand is really high, prices have to increase strongly in order to start pulling that gas from the Midcon out across the Rockies and into the West.”

RELATED

BYOP (Bring Your Own Power): The Great AI Race for Electrons

‘Knife edge’

Realistically, the entire U.S. West Coast gas-demand market balances on a “knife edge” of constraint, said East Daley Analyst Nigel Gorbold.

The California Public Utilities Commission issued a report analyzing how high natural gas prices during 2022 and 2023 “significantly burdened California ratepayers, leading to increased bills for both gas and electric utility customers.”

But little is being done to ease the structural constraints that caused prices to spike for ratepayers.

Just one outage of supply from Canada, the Permian or the Rockies could have a large impact on basis prices, like the events seen in the winter of 2022 and 2023, he said.

Oil & Gas Investor (OGI) asked East Daley to flex its models to demonstrate how entirely plausible pipeline outages or project delays could impact basis prices.

Take the “base case” scenario: The West Coast experiences average winter temperatures in December 2025 and January 2026, and the MountainWest Overthrust Westbound Compression Expansion Project is completed on time.

The expansion should add 325 MMcf/d of east-to-west capacity over the Rocky Mountains when it comes online this December, helping alleviate constraints getting gas to the West Coast.

In this relatively rosy scenario, there would be around 700 MMcf/d to 1 Bcf/d of excess pipeline capacity. Basis prices would stay in the $6/MMBtu to $7/MMBtu range shown in the forward strip.

Now, take the “worst case” scenario:

Overthrust’s expansion project sees a delayed in-service date to February 2026. The West Coast sees a colder-than-usual winter, forcing demand to match historical highs across the region.

In the downside case, December 2025 and January 2026 would see only about 100 MMcf/d of remaining pipeline capacity—close to the low levels seen in winter ’22 and ’23.

The supply shortage would likely cause price blowouts across the Western U.S., significantly burdening ratepayers once again.

Beyond next winter, Overthrust’s expansion should alleviate some of the pressure in the West.

“With the potential for some growth of Tier 2 production from western Rockies basins, there should be additional available gas for the West past 2026,” Heming said.

RELATED

SM’s First 18 Uinta Wells Outproducing Industry-Wide Midland, South Texas Results

Uinta gas (not waxy crude)

Much of the attention on Utah’s Uinta Basin has concentrated in the waxy crude oil window, which has attracted more than $4.5 billion in M&A activity in less than a year.

Instead of doubling down on the Permian Basin, SM Energy entered the Uinta Basin through a $2.6 billion acquisition of XCL Resources; Northern Oil and Gas (NOG) acquired a non-operated minority interest alongside SM.

Building on that momentum, Ovintiv recently sold its Uinta Basin crude assets to private E&P FourPoint Resources for $2 billion.

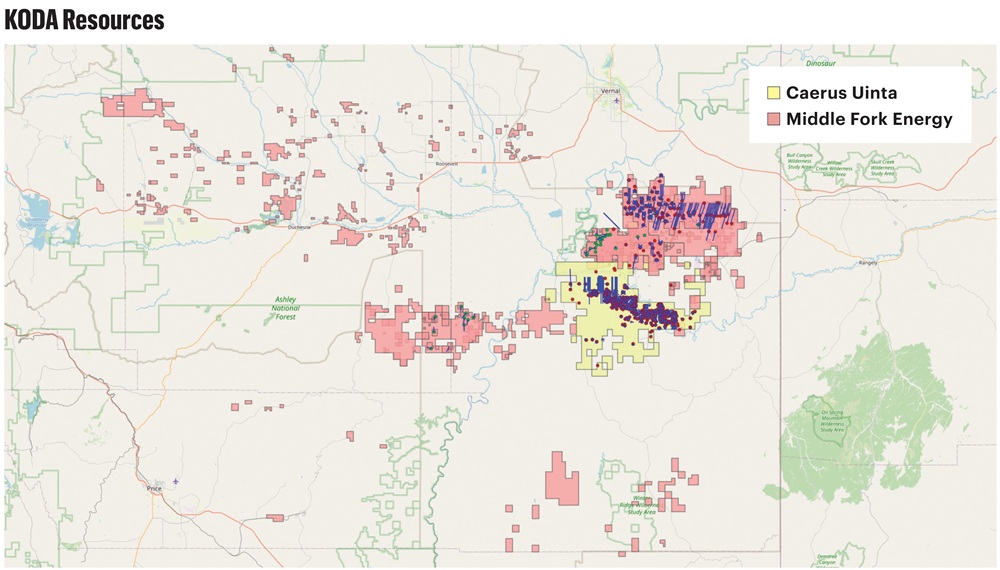

Much less attention is being paid to the Uinta’s natural gas window to the southeast, where Denver-based KODA Resources has grown into the state’s largest producer in relatively quiet fashion.

KODA, backed by Quantum Energy Capital commitments, merged with another Quantum-backed Uinta producer, Middle Fork Energy, in the summer of 2020.

Middle Fork produced approximately 252.66 Bcf of gas from the Uinta Basin—in Uintah and Duchesne counties, Utah—from 2020 through 2024, according to a company spokesperson.

Middle Fork produced 85.85 Bcf during 2024, or around 234.5 MMcf/d.

Last year, KODA’s Uinta gas empire grew larger through Quantum’s $1.8 billion acquisition of Caerus Oil and Gas.

Caerus owned Rockies assets in the Uinta Basin and in Colorado’s Piceance Basin. KODA received the Uinta assets, while Quantum-backed QB Energy nabbed the Piceance assets.

Caerus Uinta has been Utah’s largest gas producer since 2020, churning out approximately 269.26 Bcf through 2024, per Utah state data. Caerus Uinta’s 2024 production totaled 51.84 Bcf, or approximately 141.63 MMcf/d.

The Caerus acquisition included approximately 160,000 net Uinta acres and associated gathering and compression midstream assets.

Today, KODA operates most of the natural-gas focused window within Utah. The company also maintains an oily asset in North Dakota’s Williston Basin.

And it’s not just KODA and its gas-focused peers: The new horizontal wells in the Uinta’s waxy crude benches also produce associated gas volumes.

With Uinta gas volumes poised to grow, leading midstream companies Williams Cos. and Kinder Morgan are developing a series of projects to manage the increased output.

Williams’ MountainWest Pipeline began service on its 113 MMcf/d Uinta Basin Expansion (UBE) project in third-quarter 2024, adding capacity to Western Midstream’s Chipeta processing plant.

KODA processes gas volumes at both the Chipeta plant and MPLX’s nearby Iron Horse processing complex.

Williams also closed a binding open season for a second UBE project adding 66 MMcf/d of extra capacity.

In November, Williams opened a non-binding open season for a third expansion that would carry another 250 MMcf/d to the Kern River Pipeline, which flows into southern California.

Kinder Morgan also sees gas volumes growing from the Uinta. Last year, Kinder Morgan signed agreements to move forward with the Altamont Green River Pipeline, a 150 MMcf/d project carrying gas from the Altamont gathering and processing system to the Chipeta plant.

The Altamont system sits within the Uinta waxy crude window.

With an enviable position on the western side of the midstream bottleneck, KODA’s gas effectively gets priority to flow into the West.

KODA executives declined to be interviewed for this story.

RELATED

Laying in Wait: San Juan’s ‘Remarkable’ Mancos Shale Oil Wells

Longer-term themes

There are some longer-term themes that could also support increased gas supply from the western Rockies in the future, Franklin said.

Planned retirements of existing coal and nuclear power generation assets give tailwinds to western gas demand.

Coal retirements in the West through the end of the decade could require an equivalent 1.2 Bcf/d of gas supply to make up the difference, according to PureWest’s analysis.

Renewables will make up some of that difference, Franklin acknowledged. But natural gas will fill some of the gaps, too.

“It’s got to come from somewhere as you’re taking power supply out of the market,” she said.

Several new gas-fired power plants and natural gas plant conversions are planned across Nevada, Utah, Wyoming and Arizona.

Gas supply to feed LNG feedstocks on the Pacific Coast of Mexico also spell upside for western Rockies gas.

Sempra Infrastructure is developing the Energía Costa Azul LNG (ECA LNG) project at the site of a former regasification terminal in Baja California. The project’s first phase, currently under construction, includes a single liquefaction train with a nameplate capacity of 3.25 million tons per annum (mtpa).

ECA LNG has signed 20-year sale and purchase agreements (SPAs) with TotalEnergies and Mitsui & Co. Ltd. for the purchase of a combined 2.5 mtpa. The startup of ECA LNG will take additional gas supplies from the western U.S. via exports to Mexico.

AI data centers are another wild card thrown into the mix.

Phoenix is already an established hub for data center development, but experts see Salt Lake City, Utah, and Cheyenne, Wyoming, as other emerging hubs for future data center buildouts.

Wyoming already houses eight data centers, Gov. Mark Gordon said in February during the 2025 NAPE conference in Houston. Last year, Facebook and Instagram parent company Meta announced a new $800 million data center project south of Cheyenne.

“It was always interesting to me that Texas was a place that a lot of data centers were going because it’s hot, it’s humid, it’s hard to cool,” Gordon said. “Wyoming is not those things, and we rank ninth in natural gas.”

He said the opportunity set for Wyoming to attract new data centers could be “a game changer.”

“There’s no question that we need to use our resources to be able to power that,” he said.

RELATED

Mexico Pacific’s Saguaro: LNG’s Quicker Route to Asian Markets

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.