Editor's note: This article has been updated with additional photos and maps.

After more than a century of exploration and development, the Permian Basin is the gift that keeps on giving.

And as operators jockey for scale and runway in America’s biggest resource basin, they’re knocking on the doors of wildcatting families that have been in the Permian since the play’s beginning.

Today, family-owned oil and gas companies stand out among the most coveted M&A opportunities in the basin after a historical consolidation trend.

But oil was nary a thought on the mind of David Fasken when the Toronto attorney purchased a 220,000-acre ranch in West Texas in 1913.

Fasken, who acquired the “C Ranch” sight unseen for $6.50 per acre, planned to carve out farming homesteads from the property and sell them off individually for a healthy profit.

Unfortunately, he failed to account for the lack of water in barren West Texas to support farming ventures. Left with a massive, contiguous block of land and no conceivable exit strategy, his family resigned themselves to managing cattle on the ranch.

David Fasken died in 1929, unaware of the vast fortune hiding in the rock beneath his feet, waiting to be unearthed.

Most of the ranch has been kept in the family. Fasken Oil & Ranch remains one of the largest private landowners in Texas with the C Ranch, along with a handful of other properties in South Texas.

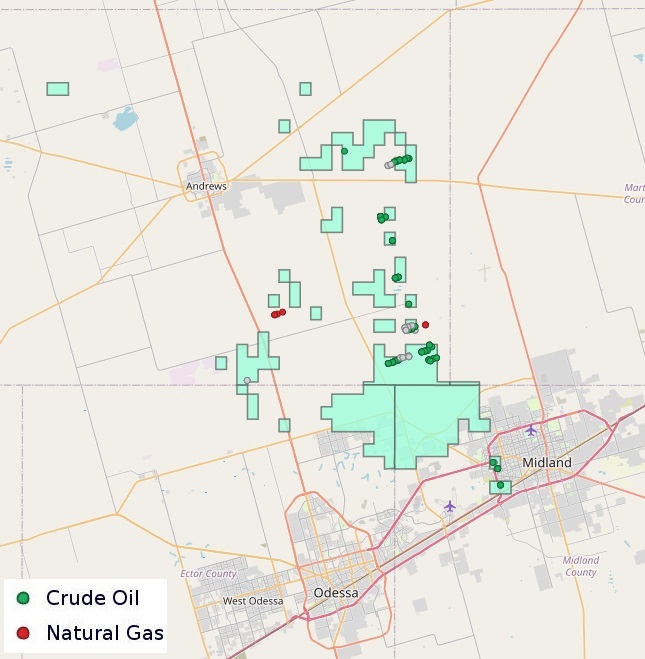

The C Ranch is on the outskirts of the budding suburbia northwest of Midland, Texas. Fasken Oil & Ranch has drilled vertical wells on the C Ranch for years. But compared to its neighbors, the C Ranch is relatively undeveloped from a horizontal standpoint.

It’s core Midland Basin inventory, the kind of land that commands massive premiums from the world’s largest oil producers.

Fasken Oil & Ranch has an inventory of more than 900 gross operated locations, with most breaking even with oil prices below $50/bbl, according to figures from Enverus Intelligence Research.

Given the relative lack of horizontal development, the Fasken property also has “extremely low” exposure to child well locations, at less than 10%, said Andrew Dittmar, principal analyst at Enverus.

“Were the Faskens to be interested in selling, the Midland inventory alone would likely be worth [$3 billion to $4 billion] before accounting for the value of production or holdings in other plays like the Eagle Ford,” Dittmar said.

Surface rights, mineral interests and other infrastructure would make the Fasken asset even more valuable. Not a bad outcome for a disappointingly arid tract of West Texas land purchased for $6.50 per acre.

But a key question remains: Will the Faskens ever sell?

It’s top-of-mind for inventory holders left standing in the Permian after a historic land grab.

In an industry increasingly dominated by scale and efficiency, the majors are growing bigger—hoarding vast swathes of land in portfolios for future development.

According to a Rystad Energy analysis, only six firms—Exxon Mobil, Chevron, Diamondback Energy, ConocoPhillips, Occidental Petroleum and EOG Resources—control about 62% of the remaining tight oil resource in the Permian Basin.

That’s after a handful of eye-popping acquisitions that have closed or been inked over the past year:

- Exxon Mobil closed an acquisition of Pioneer Natural Resources for nearly $60 billion;

- Diamondback Energy is acquiring private Permian giant Endeavor Energy Resources for $26 billion;

- Occidental is acquiring private E&P CrownRock for $12 billion; and

- ConocoPhillips is acquiring public rival Marathon Oil for more than $17 billion.

There’s a smattering of smaller private equity-backed E&Ps left in the Permian, but a fraction as many compared to the basin’s booming run last decade.

As acquisitive E&Ps scour the basin for M&A options, family-owned oil companies like Fasken Oil & Ranch and Mewbourne Oil stand out from the crowd as two of the basin’s top private inventory holders.

Generally, family oil companies are more hesitant to sell than private equity-backed E&Ps that are built for that purpose.

Mewbourne Oil and Fasken Oil & Ranch have drilled wells and produced oil and gas for several generations. They’ve weathered decades of the ups and downs of the commodity cycle. The companies are built to last.

But as the years pass and wildcatting executives age, more and more family oil companies are warming up to buyers.

Endeavor is the most prominent example. Autry Stephens launched the company that would become Endeavor Energy Resources in the Permian Basin in 1979.

This year, the 85-year-old billionaire wildcatter agreed to sell Endeavor in what would be the largest buyout of a private oil producer in the history of the sector, according to Enverus’ calculations.

Tim Dunn sold his family’s company, CrownQuest, a joint venture between CrownRock and Lime Rock Partners.

James “Jim” Henry, a longtime Permian Basin wildcatter who began his career with wells in conventional rock before moving into unconventional drilling, sold his company to Vital Energy last year. He sold his previous firm, Henry Petroleum, for $565 million to Concho Resources—now a part of ConocoPhillips.

Henry died in October. He was 89.

EOG acquired a foundational position in the New Mexico Delaware Basin from Yates Petroleum in 2016. Nearly a century earlier, it was Martin Yates Jr. who drilled the first commercial oil well on New Mexico state lands in 1924. In 2015, different members of the Yates family sold Harvey E. Yates Co. (HEYCO) to Matador Resources.

Exxon Mobil and shale subsidiary XTO Energy dug deeper into New Mexico through a $6.6 billion acquisition in 2017 from the Bass family of Fort Worth.

With Permian M&A activity coming off a record high year, will more of these storied E&Ps finally sell?

“I think we’re on the edge of extinction of the family oil business,” said Stephen Trauber, chairman and global head of energy and clean technology at Moelis & Co.

“The oil business now requires so much capital, and scale is so important,” he said, “that it’s hard to be a family office and compete.”

RELATED

Mewbourne Oil: The Biggest Little Producer in the Permian

Still hunting

Family oil companies face unique challenges, but Marshall T. Hunt thinks the reports of their demise could be greatly overexaggerated.

He knows well the unique challenges of family oil companies. He’s the great-grandson of H.L. Hunt, Hunt Oil founder and East Texas Oil Field wildcatter who during his time amassed one of the world’s largest fortunes.

H.L. Hunt founded his first oil and gas business in the 1920s in El Dorado, Arkansas, during the height of the Arkansas oil boom. He would go on to acquire the drill test of the Daisy Bradford #3 near Kilgore, Texas, the discovery well for the massive East Texas Oil Field.

Hunt Oil was incorporated in Tyler, Texas, in 1934 before moving its headquarters to Dallas in 1937. It would grow into one of the world’s largest private oil and gas producers.

H.L. Hunt’s sons, William Herbert Hunt and Nelson Bunker Hunt, discovered the massive Sarir Field in Libya in 1961. But the oil field, and Bunker Hunt Oil’s assets, were eventually expropriated by the Libyan government of Muammar Gaddafi in 1973.

W.H. Hunt later founded Petro-Hunt in the 1990s. Marshall T. Hunt, the grandson of W.H. Hunt who serves as COO of Petro-Hunt today, grew up in that unique American culture.

Black-green crude might as well run through his veins.

“Oftentimes as kids in South Texas, we’d make trips out to a well site,” Hunt told Oil & Gas Investor. “We were exposed to it at an early age.”

He always knew that he’d like to get into the family’s oil and gas business. But that didn’t mean starting out working in the company’s cushy Dallas digs.

Family members who took up the Hunt business would be required to put in their time in the oil patch.

“We worked in places like Mississippi, East Texas, West Texas and North Dakota, gaining experience from the ground up,” Hunt said. “That really gave us the foundation and knowledge to be able to expand on learning the entire business—from the field all the way up to the corporate level.”

The influence of family oil companies may have waned over the generations, but Petro-Hunt still sees a runway of growth into the future, Hunt said. The company produces about 41,000 bbl/d, making it the 16th-largest private oil producer in the U.S., per Enverus data.

But the list of private producers is set to shrink with the pending acquisitions of Endeavor Energy Resources (220,400 bbl/d), CrownQuest Operating (93,600 bbl/d) in the Permian Basin, and the acquisition of Aera Energy (78,000 bbl/d) in California.

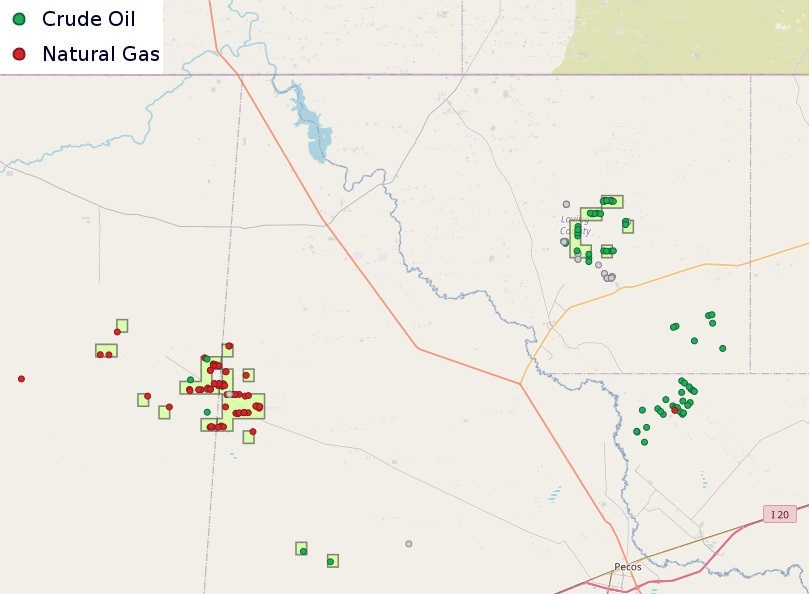

Petro-Hunt has been active in the Permian’s Delaware Basin since entering the play through an acquisition from Admiral Permian in 2022. The Admiral Permian deal included existing production and around 21,000 net acres in Reeves and Culberson counties, Texas.

Petro-Hunt complemented the Admiral Permian deal by acquiring about 4,000 net acres in Loving County, Texas, through a series of transactions. Last year, Petro-Hunt acquired a contiguous block of 7,500 net acres in Ward County, Texas.

Today, the company’s portfolio spans over 35,000 net acres in the Delaware Basin, where Petro-Hunt operates three rigs, Hunt said.

Petro-Hunt is also running one rig in the Williston Basin, where the company has had a long history and still owns a sizable portfolio.

Petro-Hunt was also a pioneer in the Bakken and Three Forks formations: The company’s predecessor entities began picking up leases in North Dakota in the 1940s.

The company grabbed headlines in 2012 when it sold a portion of its Williston position—81,000 net producing acres—to Halcón Resources (now Battalion Oil) for $1.45 billion.

Petro-Hunt is keeping its options open when it comes to future M&A.

The wildcatting E&P isn’t opposed to jumping in somewhere new. Exploration runs in the family, after all.

The company also sees value in bolting on additional acquisitions in its existing operating areas.

“We’re still opportunistic, looking at all areas across the Lower 48,” Hunt said, “such as the Haynesville, Permian, the Rockies region all the way up to the Williston.”

But the Hunt family has diversified investments outside of oil and gas production. The Petro-Hunt side of the family has verticals focused on acquiring minerals and royalties in basins around the country. The Hunt family is also a part owner in the Placid Refining Co. and a refinery in Port Allen, Louisiana.

Petro-Hunt is the owner and operator of the Little Knife Gas Plant west of Killdeer, N.D., which processes natural gas volumes from the Little Knife field.

The family actively invests in real estate development, operates a private equity alternative investment division and enjoys ranching.

That the Hunt family’s oil and gas enterprises have lasted through a third, even into a fourth generation, is an anomaly.

There’s a widely held belief, by members of the Hunt family and other family businesses, that the situation starts to get messy by the third generation of family ownership. As the years go on, families can become distant and fragmented; business dysfunction can begin to ensue. Certain parts of the family might want to pursue a sale; other parts of the family might want to stay in the business for the long haul.

Succession planning is another major pitfall for family-owned companies. Sometimes, a younger successor just isn’t ready to take over the family enterprise.

Other times, an outgoing senior executive refuses to truly cede control to a younger generation of leadership (If this sounds like an episode of HBO’s award-winning show “Succession,” the show, though fictitious, really wasn’t far off).

Chalk some of the family’s success and longevity up to luck, Hunt said.

“But also, at the same time, maybe it’s being a close-knit family unit and seeing the work and work ethic that the generations before us have put in for us today,” he said. “Knowing that we’re working for the future generations to build upon the family business.”

Hunt Oil is still around today, managed by a different branch of the family. In fact, Hunt Oil is actively marketing an expansive minerals and royalties package spanning around 20,000 net royalty acres in aggregate. The package includes interests in the Denver-Julesburg (D-J) Basin, the Permian and Uinta basins, the Midcontinent and East Texas, according to marketing materials.

“I think we see a lot of room for growth in the future,” Hunt said.

W. Herbert Hunt died at age 95 on April 9. He and his family were inducted into Hart Energy’s Hall of Fame in December.

RELATED

Hunting for Growth: Petro-Hunt Digs Deeper into Delaware, Williston

Fixing a hole

Family-owned oil companies might be less relevant today, but family capital hasn’t completely left the oil and gas sector, according to Moelis & Co.'s Trauber.

The nature of their investment has just changed, with family office capital increasingly investing in energy-focused private equity funds or directly into operators themselves.

Banks and public markets have backed away from the oil and gas sector in recent years due to poor returns, environmental pressures and other reasons.

Private equity capital is still important for the sector, but there’s a fraction of the amount of upstream-focused private equity capital deployed in the space compared to a decade ago.

But family office capital has stepped up to fill part of the void left in the wake of those exiting financiers, experts say.

Respondents in Haynes & Boone’s Spring 2024 Borrowing Base Redeterminations Survey expect to see a “meaningful drop” in the use of equity capital markets this year, with the shortfall made up by growth in equity from family offices and private equity.

Family office and private equity are more expensive from a cost of capital standpoint, said Kraig Grahmann, a Haynes and Boone partner and the survey report’s author.

But family offices seem to be increasingly tapping oil and gas since operators have become more disciplined and focused on returning money to investors. Family offices also don’t have the same kinds of environmental, social and governance (ESG) pressures that banks face.

“It has gotten bigger over time, the influence of these family offices,” Trauber said.

He recalled a recent industry event hosting around 40 to 50 family offices, many of which represented coastal family money with no real ties to the oil and gas industry.

These non-energy families are asking a lot of questions about the energy business.

“[The event was] really meant to make non-energy-sophisticated investors more sophisticated about energy,” Trauber said, “about the merits of the business, the cash flow generation of the business, the superior returns of the business today.”

A family office may not move the needle for an oil and gas company on a one-off basis. But there’s strength in numbers. Some family offices are banding together and pooling their money to invest in the oil and gas sector.

Last year, Wyoming natural gas producer PureWest Energy was acquired by a family office-led consortium for $1.84 billion in cash. The consortium included Petro-Hunt, A.G. Hill Partners, Cain Capital, Eaglebine Capital Partners, Fortress Investment Group, HF Capital and Wincoram Asset Management.

Petro-Hunt’s Marshall T. Hunt now serves on the PureWest board. He thinks other family office-led consortiums could make similar moves in the future.

“I think what you’ll see is these family offices coming in and doing equity-type investments in the oil and gas space,” Hunt said.

“That was kind of unique to us where we’re not the operator of the business,” he said. “We made the investment, but we’re not actively operating those assets.”

RELATED

Family Offices: Familiar and New Names Coming to Oil, Gas Table

From Iraan to the world

Friends and neighbors warned Ira Yates: Nothing would come of that barren land west of the Pecos River.

Ira Griffith Yates, a rancher, peanut digger and West Texas entrepreneur, operated a relatively successful dry-goods store in Rankin, Texas, when he was approached in 1915 with a tempting proposition.

Businessman Thomas Hickox wanted to offload his 16,640-acre ranch property south of the river in Pecos County. The story holds, according to Yates’ great-grandson, Ira John Yates, that Hickox proposed a trade: Yates’ mercantile store in exchange for the River Ranch.

The offer appealed to the rancher, but friends urged Yates to take caution. The ranch across the Pecos River was often beset by drought. The land’s boundaries were frequently disputed by neighbors since it was unfenced.

The ranch was also known for its “greasy” well water. Yates later recounted that “even buffalo know better than to cross the Pecos—that a crow would not fly over, and [the ranch] was not worth the taxes.”

Yates went forward with the trade, despite the warnings. And for a time, his naysayers were right: The following years were difficult ones for Ira Yates and his wife, Ann. The ranch struggled to turn a profit.

By the 1920s, Ira Yates was on the hunt for something new.

The crude oil potential of West Texas was only just beginning to be understood at that time. The W.H. Abrams No. 1 well in Mitchell County, the first commercial discovery well in the basin, began producing in February 1920 before its gusher event in July. That well, while historically significant, was a small endeavor.

But the famed Santa Rita #1, brought online on university lands on May 28, 1923, put West Texas on the map with the discovery of the Big Lake oil field. Santa Rita #1 produced for 67 years before being plugged in 1990.

Ira Yates called upon Levi Smith, president of the Big Lake Oil Co. in nearby Reagan County. Smith also operated as manager for the Transcontinental Oil Co.

Yates convinced Smith to drill at the Pecos County ranch, though its location was unfavorable. Conventional wisdom at the time held that there was no oil to be found west of the Pecos River, but Yates and his drilling partners, Transcontinental and the Ohio Oil Co. (an ancestor of Marathon Oil) accepted the risk.

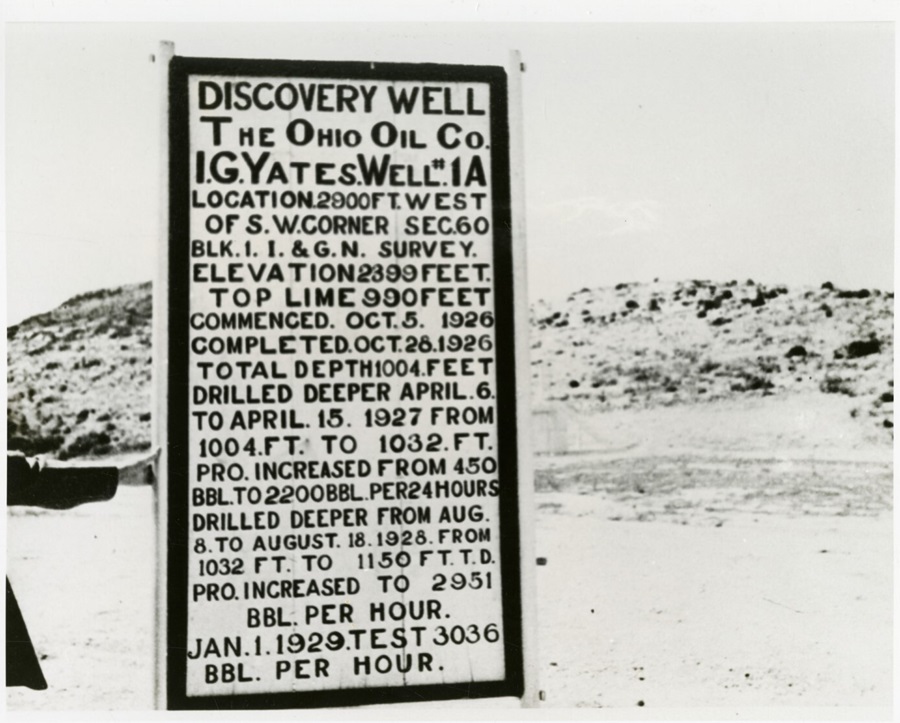

Sharing the lease with Transcontinental, Ohio Oil drilled four wells on the Yates ranch before finally striking oil on Oct. 28, 1926—Yates’ 67th birthday. The I.G. Yates A No. 1 is known today as the discovery well for the Yates oil field, one of the most prodigious and geologically unique hydrocarbon reservoirs ever developed.

The oil discovery and ensuing bonanza made an instant millionaire out of Yates, who sold drilling leases to clamoring customers from his front porch after the first gusher came in.

It yielded the town of Iraan, Texas, (pronounced “Ira-Ann”) on acreage donated by the Yates family.

The Yates field has yielded nearly a century of fortunes for its stakeholders. It also yielded headaches from squabbling court battles and the Texas Railroad Commission (RRC) field unitization process in 1976, when Marathon Oil became operator.

For Marathon Oil, the field was better known as The Crown Jewel. An article in the 1981 New York Times reported, “There is really no Marathon Oil without Yates.”

Marathon Oil eventually sold its interest in the field to Kinder Morgan in 2003. This summer, Marathon agreed to a $17.1 billion sale to ConocoPhillips.

Yates, still one of the nation’s largest oil fields by proved reserves, continues to produce after years of technical innovation. Secondary recovery techniques have been deployed at Yates to extend the life of the field since the late 1970s, after the unitization process.

Kinder Morgan Production Co. operates the Yates field today using a unique CO2 flood process for EOR.

Russ Roemer, vice president of oil and gas for Kinder Morgan CO2, said Yates uses immiscible CO2 injection for EOR.

“An immiscible flood is essentially putting CO2 as a gas into the reservoir,” Roemer said.

The CO2 effectively swells the oil, driving the sweet prize into the rock’s fractures to drain into the oil column, where it’s subsequently captured.

Other EOR projects, such as Kinder Morgan’s SACROC field unit in Scurry County, Texas, use miscible CO2 flooding, where CO2 injected under supercritical pressure acts more like a liquid in the reservoir than a gas.

“It’s the only immiscible CO2 flood of which I’m aware,” Roemer said. “It’s a prime example of West Texas can-do attitude and risk taking.”

Ira G. Yates and the Yates field helped to make West Texas almost synonymous with “oil” in the public lexicon.

As for the pioneering I.G. Yates A No. 1, it’s still in production today, after nearly a century and three modernizing recompletion projects.

But the legacy of Ira G. Yates isn’t long-lost Texas history for his great-grandson, Ira John Yates. The West Texas oil field, the town of Iraan and the Pecos River have been consistent foundations throughout the life of the Austin native.

His mother, Pauline “Polly” Blanton, was the granddaughter of I.G. Yates and took an active role in managing the family land she co-owned.

“My mother maintained a significant personal interest in the property out there and the operation of the field,” Yates told Oil and Gas Investor.

As a child, he would travel with his mother as she petitioned the RRC and Texas General Land Office to force producers to clean up abandoned wells along the Pecos River. Yates himself became involved during the RRC’s process to unitize the field in the mid-’70s.

“It was a very important education process for me,” Yates said. “But more importantly, I learned the workings of the oil industry in the Yates field, the geology, the politics, all the money and arguing.”

He also learned about the powerful toolset the RRC wielded: The bountiful production from Yates caused storage and transportation issues for producers in the late 1920s.

By the summer of 1928, the RRC had issued an order prorating production from the Yates field, the first fieldwide order of its kind in the state.

The proration model was deployed on a much larger scale after the discovery of the East Texas Oil Field in the 1930s. That model of dictating and controlling the rate of oil and gas production served as a core thesis in forming OPEC in the 1960s.

Today, Yates is focused on giving back—to the town of Iraan and to stakeholders of the lower Pecos River.

In 2021, Yates formed Friends of the Pecos River, a nonprofit organization, with a mission to enhance water quality and quantity in that section of the river. He wants to see participation from Iraan schools to get kids involved in STEM and agriculture education.

The irony of his situation—contributing to environmental conservation efforts as the heir to a massive fortune made through fossil fuel extraction—isn’t lost on Yates. Fellow mineral rights owners have had choice words for him over the years.

“And they’re talking to the great-grandson of the owners,” Yates said. “So, it’s very, very difficult.”

As the Yates field nears its first century in production, Kinder Morgan’s plans call for drilling around 50 horizontal wells per year on the historic asset.

“Without [Ira Yates’] effort, I think the Permian would still be exceptional, but it wouldn’t be nearly as colorful or prolific,” Roemer said.

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.