ConocoPhillips and Marathon have highly complementary asset bases across four major U.S. basins: the Permian’s Delaware Basin, the Eagle Ford Shale, the Bakken and the Anadarko Basin. (Source: Shutterstock)

The combination of ConocoPhillips and Marathon Oil Corp. will yield an even larger U.S. super-independent producer with a footprint across the Lower 48, from the Bakken to South Texas’ Eagle Ford with a healthy swath of Permian Basin in between.

But the all-stock $17.1 billion deal— including Marathon’s net debt, the total is $22.5 billion— also brings together two of the oldest and most storied brands in the U.S. oil and gas sector.

Both companies can trace their roots back to the breakup of John D. Rockefeller’s Standard Oil Trust by the U.S. Supreme Court in 1911—a landmark decision giving rise to modern antitrust laws as it’s known today.

And experts wonder if a tie-up between ConocoPhillips and Marathon Oil will face antitrust scrutiny by a particularly active U.S. Federal Trade Commission, which since last year has been dissecting several high-profile oil and gas deals.

ConocoPhillips, with a market value of more than $155 billion, is already one of the nation’s largest oil and gas producers.

The E&P is among a handful of public super-independents with market values of more than $50 billion, including EOG Resources (~$70.4 billion) and Occidental Petroleum (~$55 billion). Diamondback Energy, following its $26 billion acquisition of Endeavor Energy Resources, is also expected to join that exclusive market cap club.

RELATED

ConocoPhillips to Acquire Marathon Oil for $17.1B

Multi-basin madness

Adding Marathon Oil’s multi-basin portfolio across the Lower 48 will yield an even larger super-independent.

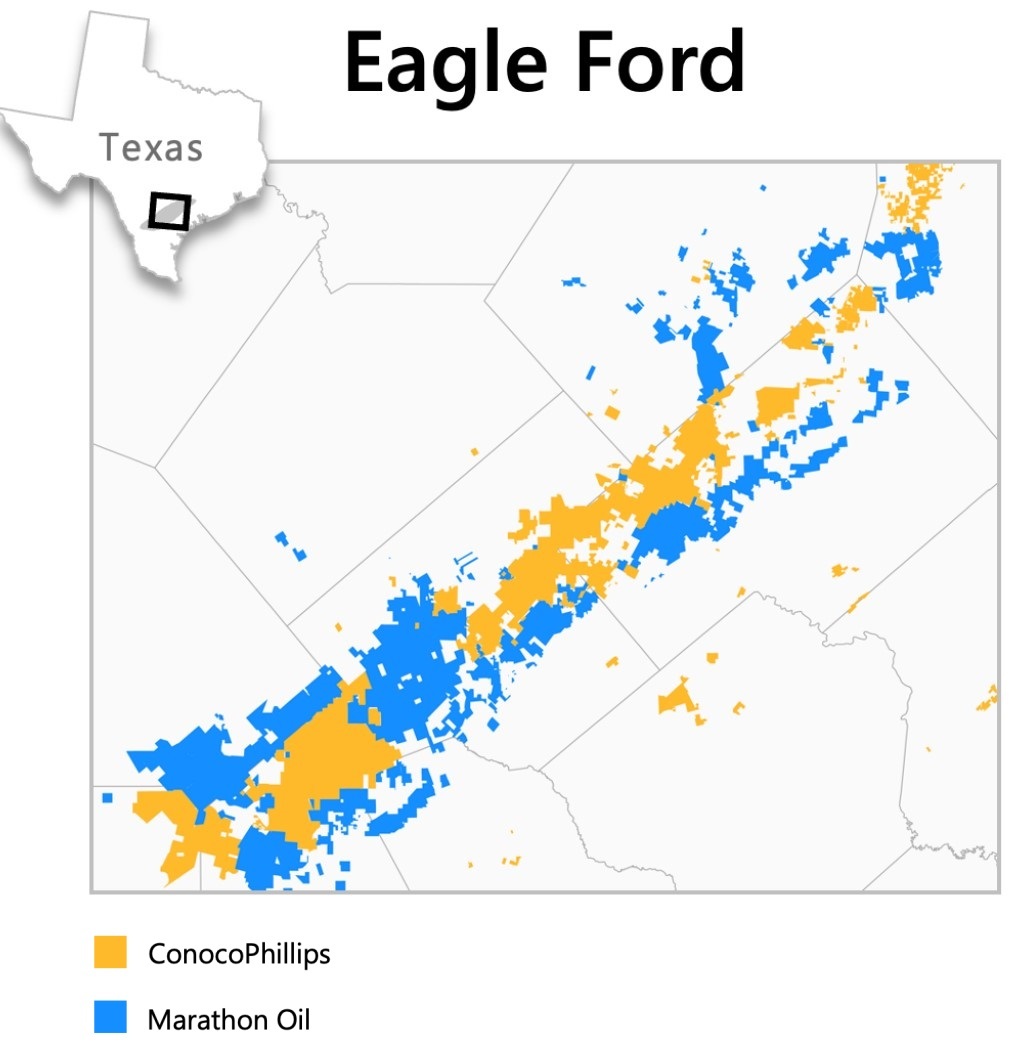

ConocoPhillips and Marathon have highly complementary asset bases across four major U.S. basins: the Permian’s Delaware Basin, the Eagle Ford Shale, the Bakken and the Anadarko Basin.

Marathon’s position in South Texas presents ConocoPhillips with significant future upside, said Andy O’Brien, senior vice president of strategy, commercial, sustainability and technology for ConocoPhillips, during a May 29 call with analysts.

The combined company will have around 490,000 net acres and production of nearly 400,000 boe/d across the core of the Eagle Ford.

Marathon Oil’s Eagle Ford assets will add about 1,000 new primary locations for future drilling.

ConocoPhillips also sees significant future upside from refrac opportunities in South Texas.

“We’ve been implementing new refrac techniques across our existing Eagle Ford position,” O’Brien said. “It’s expanded our refrac inventory at cost of supplies that compete with our Tier 1 opportunities.”

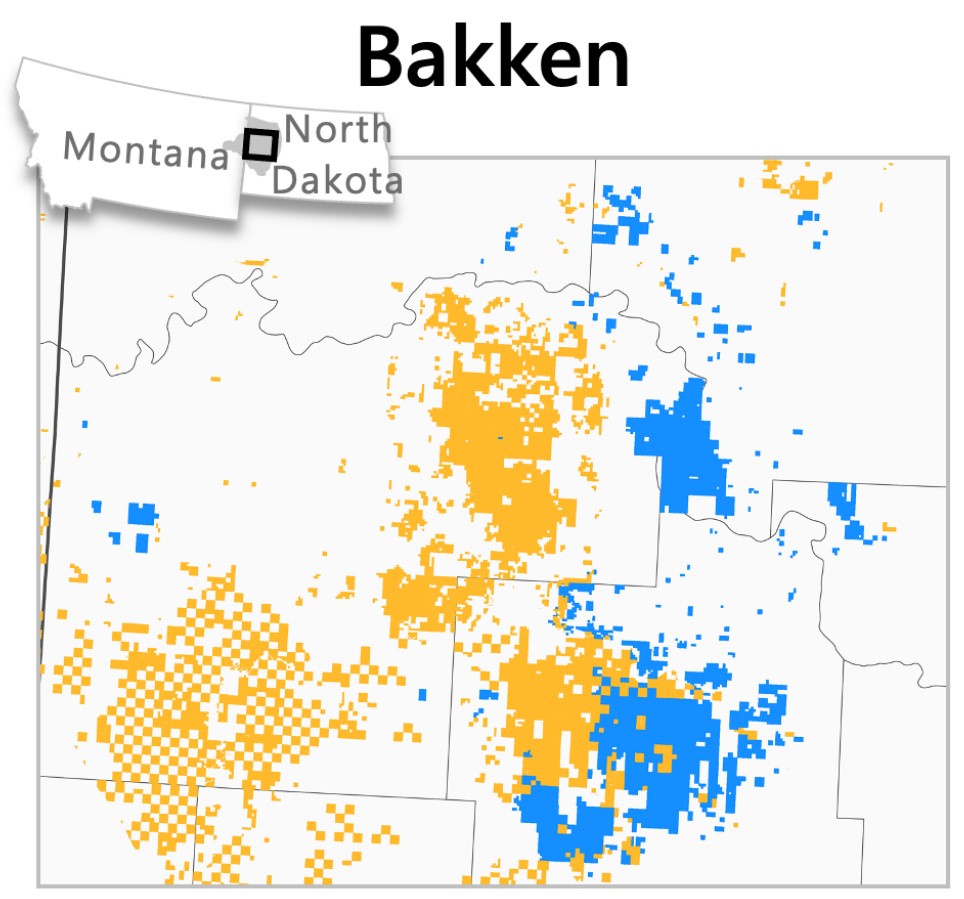

ConocoPhillips also sees upside for new-drill and refrac opportunities in North Dakota’s Bakken.

The two companies have highly contiguous footprints in the southern portion of the Bakken, where ConocoPhillips plans to look at drilling longer three-mile lateral wells.

On a pro forma basis, the company will have well over a decade of drilling inventory located in the Bakken, O’Brien said.

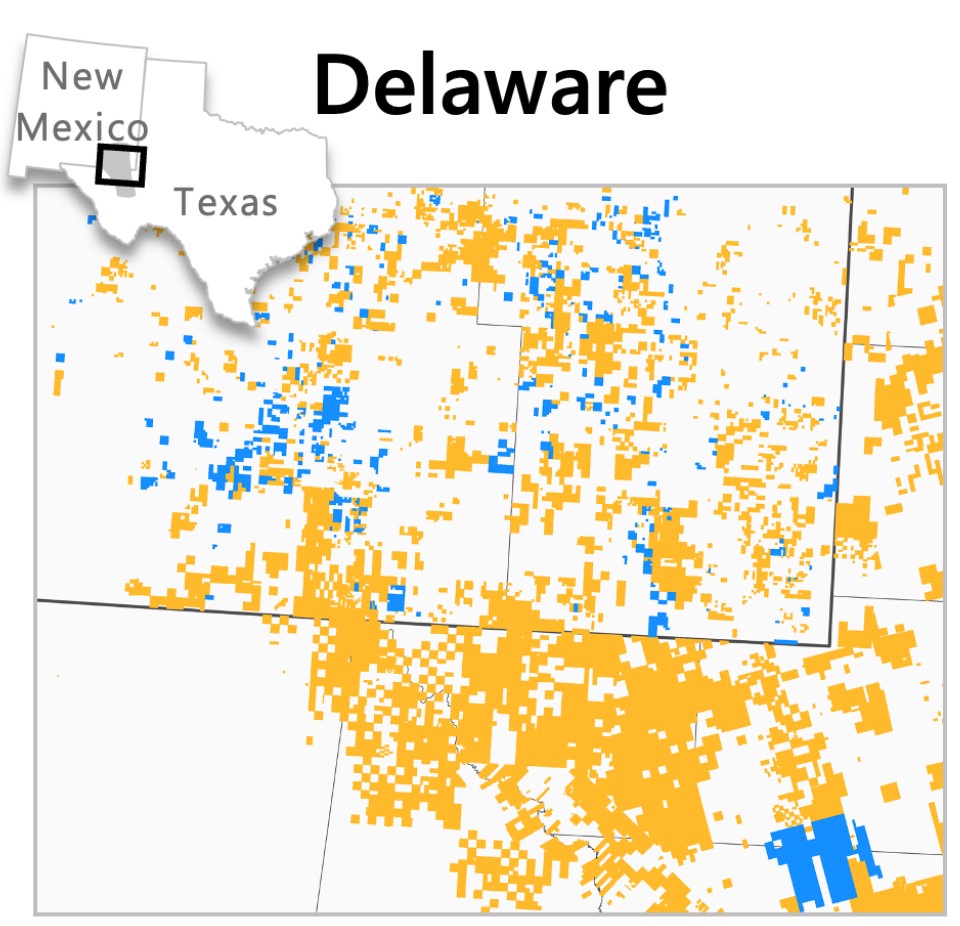

The Marathon deal also gives ConocoPhillips longer roots in the prolific Permian Basin, the Lower 48’s top oil-producing region.

Marathon’s Permian portfolio is concentrated in the Delaware Basin of West Texas and New Mexico. Marathon has acreage across the core of the Delaware oil play in Lea and Eddy counties, New Mexico.

But the company is also a leader in delineating the deeper Woodford interval from its Delaware acreage on the Texas side of the basin, Texas Railroad Commission (RRC) data show.

“Our existing [Permian] asset base is clearly much larger in size, making the Marathon acreage position more of a traditional bolt-on,” O’Brien said, “adding 400 more locations to our already deep inventory base.”

ConocoPhillips had gotten much deeper in the Midland side of the Permian through the $9.7 billion stock acquisition of Concho Resources Inc. in 2021.

The Marathon acquisition gives ConocoPhillips additional acreage in the Oklahoma Anadarko Basin.

“The Anadarko Basin is primarily focused on natural gas,” O’Brien said. “We see this as a call option on normalization of U.S. gas fundamentals—driven by growing power- and LNG-related demand.”

RELATED

ConocoPhillips CEO Ryan Lance: Upstream M&A Wave ‘Not Done’ Yet

Quest to divest?

ConocoPhillips Chairman and CEO Ryan Lance said the company has laid out a $2 billion disposition target over the coming years after closing the Marathon acquisition.

“I think people recognize we’ve been pretty good rationalizing the portfolio quite a bit over the last number of years,” Lance said during the call.

With the Marathon acquisition, ConocoPhillips recognizes the opportunity to find and monetize pieces of the combined portfolio that may not compete for capital going forward.

ConocoPhillips will look across its entire portfolio when considering divestitures, Lance said.

“It’s not focused on one area or another,” he said.

Other producers that have closed major acquisitions are beginning to tap the divestiture market to deleverage.

APA Corp., parent company of Apache Corp., recently sold $700 million in non-core Texas assets to pay down debt associated with its acquisition of Callon Petroleum.

In one transaction, APA divested a large portfolio of assets in the Eagle Ford and Austin Chalk in a sale to WildFire Energy I.

APA also monetized mineral and royalty interests in the Midland Basin in a separate transaction.

Occidental Petroleum is wading deeper into debt to make a $12 billion acquisition of CrownRock LP, a private E&P with a deep inventory in the Midland Basin. To reduce debt, Occidental plans to sell up to $6 billion in non-core U.S. assets.

The company is reportedly exploring a sale of assets and acreage in the southern Delaware Basin that could fetch more than $1 billion.

Occidental is reportedly working with a financial adviser to market the assets in the Barilla Draw region in Reeves County, Texas.

RELATED

Permian M&A: Oxy Shops Delaware Assets, Family Oil Cos. Stand Out

FTC scrutiny?

The FTC has been particularly active amid a record amount of corporate consolidation in the U.S. oil patch.

The Ohio Oil Co. and the Continental Oil and Transportation Co.—ancestor companies of Marathon Oil and ConocoPhillips, respectively—were born out of antitrust scrutiny when Standard Oil was broken apart.

Over a century later, analysts believe the combination of ConocoPhillips and Marathon Oil is likely to receive close scrutiny by the FTC.

The deal is primed for FTC intervention “given the increased regulatory scrutiny for oil and gas deals and Conoco’s existing scale,” said Andrew Dittmar, principal analyst at Enverus Intelligence Research.

“Working in its favor for approval is the multi-basin nature of the Marathon assets versus concentrated regional exposure like the recent large combination in the Permian,” Dittmar wrote in a May 29 report.

Siebert Williams Shank & Co. Managing Director Gabriele Sorbara also expects some FTC scrutiny to arise but ultimately anticipates that the deal will close.

The commission previously requested additional information regarding the largest energy industry deals signed last year—Exxon’s Pioneer acquisition, the Chesapeake-Southwestern merger and Chevron’s $53 billion acquisition of rival Hess Corp.

In order to close the Pioneer acquisition, Exxon Mobil agreed to an FTC order barring Pioneer chairman and founding CEO Scott Sheffield from sitting on the Exxon board; Sheffield has since fired back at the FTC’s complaint.

RELATED

Sheffield Responds to FTC: Ban from Exxon Board a ‘Dangerous Course’

Recommended Reading

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

US to Favor Existing Investors for Venezuela Oil Licenses, Say Sources

2024-05-16 - The U.S. is preparing to prioritize issuing limited licenses to operate in Venezuela to companies with existing oil production and assets over those seeking to enter the sanctioned OPEC nation for the first time.

OPEC Output Cuts Seen as Bearish by Analysts

2024-06-03 - WTI and Brent oil prices inched lower as investors weighed extended OPEC+ supply cuts.