Three companies. Ten projects. Twelve years. One prolific offshore block.

And a combined capex that could reach as high as $105 billion.

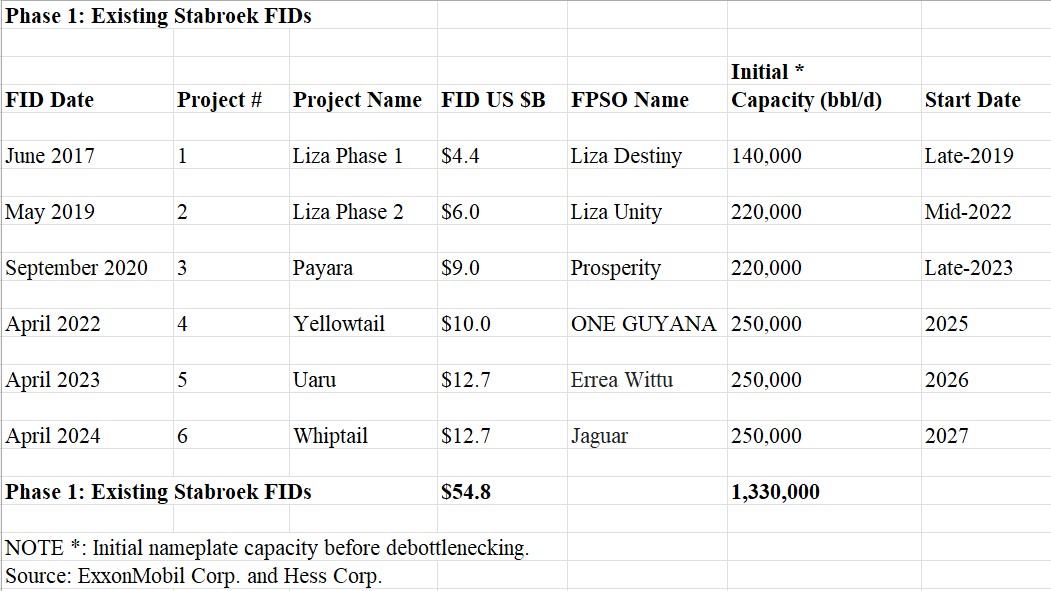

The consortium of Exxon Mobil, Hess Corp. and China National Offshore Oil Corp. (CNOOC) has already made final investment decisions (FID) worth $54.5 billion on six projects in the Stabroek Block offshore Guyana. Moving forward is simply a matter of figuring out the best way to exploit a resource estimated at 11 Bboe.

Alistair Routledge, the president of Exxon Mobil Guyana, said the resource figure was based on a lot of analyses but also a lot of uncertainty. Each partner is working with its own numbers, he said during a panel discussion at the Offshore Technology Conference (OTC) in May.

“The six initial [projects] are developing around 4.9 billion oil equivalent barrels. So, we are already getting close to developing half of that resource through the commitments that we’ve made to date. That still leaves another 6 billion,” Routledge said. “We’re basically working through that resource base to understand it, [and] one of the particular areas of focus … is the gas resource.”

He reiterated that the figures were resources, not reserves. Future updates to the resource estimate could take time owing to the huge amount of data to sort through and understand.

“Our focus has actually shifted to: are we moving the resource into project execution? We are focused on getting those matured,” Routledge said. “We are very encouraged with the work that has been going on with all the technical teams around concepts and maturing the understanding of that resource, both from a reservoir static and dynamic performance perspective.”

Combined production from the first phase of development will reach 1.33 MMbbl/d by 2027, according to Exxon.

“In general, if you look at the entirety of Exxon’s portfolio, this is the place that they want to spend money,” Rystad Energy Senior Vice President and Head of Latin America W. Schreiner Parker told Oil and Gas Investor (OGI).

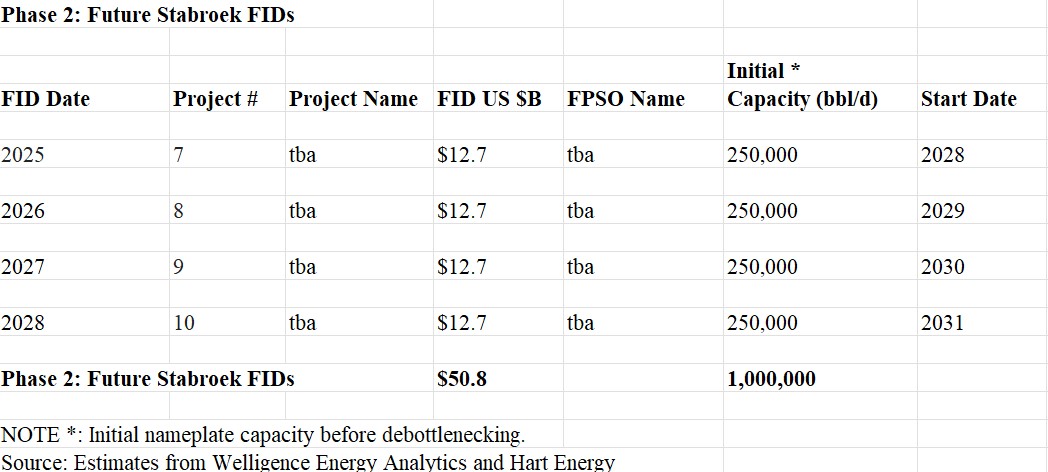

A second phase of development will require four new FPSOs in Stabroek over the near term. The last project sanctioned by the consortium, Whiptail in April 2024, cost $12.7 billion with associated FPSO production capacity of 250,000 bbl/d. Assuming future projects will be of the same magnitude, the combined FIDs will total about $51 billion and add at least 1 MMbbl/d of production.

Parker expects the consortium to spend an average of about $10 billion per year between 2025 and 2030, mostly on development but also on exploration.

The expense will not divert Exxon from its “build one, design many” mindset in Guyana. Parker expects the consortium to move forward with construction of the FPSOs. Welligence Energy Analytics Vice President Andre Fagundes agrees.

“Our valuation model considers the installation of five additional FPSOs at Stabroek by 2029 with a total capex of $52 billion, and followed by two additional [FPSOs] in 2030 and 2031,” Fagundes told OGI. He doubts the consortium will be constrained by finances.

“Given the exceptional fiscal terms and projected production growth, we estimate the projects to be practically self-funded from their own free cash flow,” Fagundes said. “Consequently, we believe that the project partners are financially equipped to support this development.”

Stabroek is located approximately 120 miles offshore Guyana and covers 6.6 million acres. The block is equivalent in size to 1,150 U.S. Gulf of Mexico (GoM) blocks and contains multiple prospects and play types, according to Hess.

Exxon Mobil Guyana operates Stabroek and holds a 45% interest. Its local partners include Hess Guyana Exploration (30%) and CNOOC Petroleum Guyana (25%).

Quick rise

Guyana was colonized by the Dutch in the 17th century, but by 1815 had become a British possession. It is the third-smallest country in South America after Suriname to its east and Uruguay to the south. It is almost twice the size of Tennessee with a population of about 800,000.

Exxon initiated exploration offshore Guyana in 2008 and drilled its first exploration well, Liza-1, in 2015. That well encountered over 295 ft of high-quality oil-bearing sandstone reservoirs and was safely drilled to 17,825 ft in 5,719 ft of water.

“Guyana is a long-time gold producer and also had a history where there was this big belief that there was going to be the ‘El Dorado,’ the big find of oil in Guyana,” Exxon’s Routledge said during OTC.

“Well, finally we have it and it’s catapulting Guyana up the league tables and becoming a true emerging powerhouse of energy in South America, and a vital source of energy … in a world that needs that diversity of supply to give us all security and affordability of energy supply,” he said.

To grasp the impact of the “big find,” consider that oil production is responsible for Guyana’s GDP soaring to $14.7 billion in 2022 from $1.1 billion in 2005, according to the World Bank.

Exxon’s first three Stabroek projects—Liza 1 (using the Liza Destiny FPSO), Liza 2 (Liza Unity FPSO) and Payara (Prosperity FPSO)—produce just north of 600,000 bbl/d, analysts estimate.

“In terms of the production, we’re kind of in a little bit of a plateau here in 2024 to 2025, but it will essentially double between next year and 2030 off the back of all that investment that’s going to take place between 2025 and 2030,” Rystad’s Parker told OGI.

The fourth, fifth and sixth Stabroek projects have been sanctioned but have yet to start producing. All will use FPSOs with production capacity of 250,000 bbl/d.

Yellowtail, sanctioned in April 2022, will use the ONE GUYANA FPSO with first oil expected in 2025; Uaru, sanctioned in April 2023, will use the Errea Wittu FPSO, with first oil expected in 2026. Whiptail, sanctioned in April 2024, will use the Jaguar FPSO, with first oil expected in 2027.

Follow the money

Exxon’s Routledge said about one-third of the capital spend in Guyana was on the wells that are drilled, another third on subsea umbilicals, risers and flowlines (SURF), and the remainder on the FPSOs.

“We tend to focus on the FPSOs because that’s what we see every day, and when we go offshore, we get to land on those, and that’s where our workforce is. But the reality is, most of the work goes into what sits on the seabed or indeed the wells that go down into the reservoirs,” Routledge said.

Stena Drilling and Noble Corp. are Exxon’s main drilling contractors. They have provided the Stabroek consortium with six deepwater rigs, which are operating at a “benchmarking and industry-leading pace,” Routledge said.

“They set an aspirational goal just a year and a half ago that they would achieve zero/five/35 in the drilling operations. And that was zero safety incidents, less than 5% non-productive time and 35 days to drill and complete these deepwater wells. They have already achieved wells in less than 30 days, drilled and completed, which in all the benchmarking you look at just sets a new level of performance,” Routledge said.

Each of the FPSOs in Stabroek can store up to 2 MMbbl of oil. Exxon’s cargo lifts can total 1 MMbbl, so the FPSOs need to unload a cargo every four days.

“Sometimes we’re using the very large crude carrier (VLCC), which are 2 MMbbl vessels. They will take two separate cargoes, so we will attach them to one of the FPSOs, lift a 1 MMbbl cargo, and then they’ll disconnect and either go to one of the other terminals or reconnect afterwards. These are vast vessels, and once connected are less than 492 feet apart in the ocean,” Routledge said, adding it takes around 24 hours to pump 1 MMbbl from the FPSO onto the carriers.

‘Tiger economy’

“Guyana is a tiger economy moving at a rapid pace and this is probably the last time you will see such a development in the world,” Guyana Office for Investment Agency Head Peter R. Ramsaroop told OGI on the sidelines of OTC. “So, if you are in the oil business and you’re not in Guyana, you’re missing out.”

Ramsaroop said that the next wave of Guyana’s economic growth would focus on agriculture sustainability, food security, climate security and energy security. Ramsaroop said Guyana would “lead CARICOM (Caribbean Community) in those areas.”

Ramsaroop said the government of President Mohamed Irfaan Ali plans to continue to grow the country while ensuring that the people benefit. He warned that Guyana needed a lot more skilled people.

“Like Dubai or Qatar, we are out of resources. If you win a contract to build a 20-mile road or a bridge, you have to bring your people,” Ramsaroop said. “We’re working on new immigration policies and making it easier for work permits over time. But by 2030 plus, we may have around 3 million people in Guyana.”

The country occupies 83,000 square miles, or about the size of Great Britain, he said. But Great Britain’s population is about 65 million. “For us to develop Guyana to the level that Guyana is being developed, you need people.” Ramsaroop reiterated.

“We have a low-carbon development strategy. We have the lowest deforestation rate. We’re doing things in a sustainable manner, but don’t tell us to keep our people poor,” Ramsaroop said. “If the other option is to cut our $95 billion forest down, we won’t do that [either].”

Guyana’s impressive growth story has attracted the attention of government and companies alike. Chevron’s $53 billion all-stock offer for Hess is as much about Guyana as much as it is about Chevron adding assets in the GoM, offshore Southeast Asia and in the Bakken Shale.

Hess’ assets in Stabroek instigated a spat between Chevron and Exxon, drawing in CNOOC as the latter two claim they have a right of first refusal (ROFR) to Hess’ interest. Arbitration among the three companies continues.

Chevron’s deal with Hess could close in 2025, TD Cowen managing director David Deckelbaum wrote in an April commentary.

Routledge told OGI that “Our balance sheet is in good shape [and] what we are looking for are just good investments.”

“We are not in position to make any decision on other equity in Stabroek Block right now, but we are focused on [finding] the right opportunities—whether in Guyana or elsewhere in the world,” he said. “And if they compete [financially], then we have the resources to get after them.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.