Global energy giants including Exxon Mobil Corp. and Chevron Corp. posted another round of huge quarterly profits, benefiting from surging natural gas and fuel prices that have boosted inflation around the world and led to fresh calls to further tax the sector.

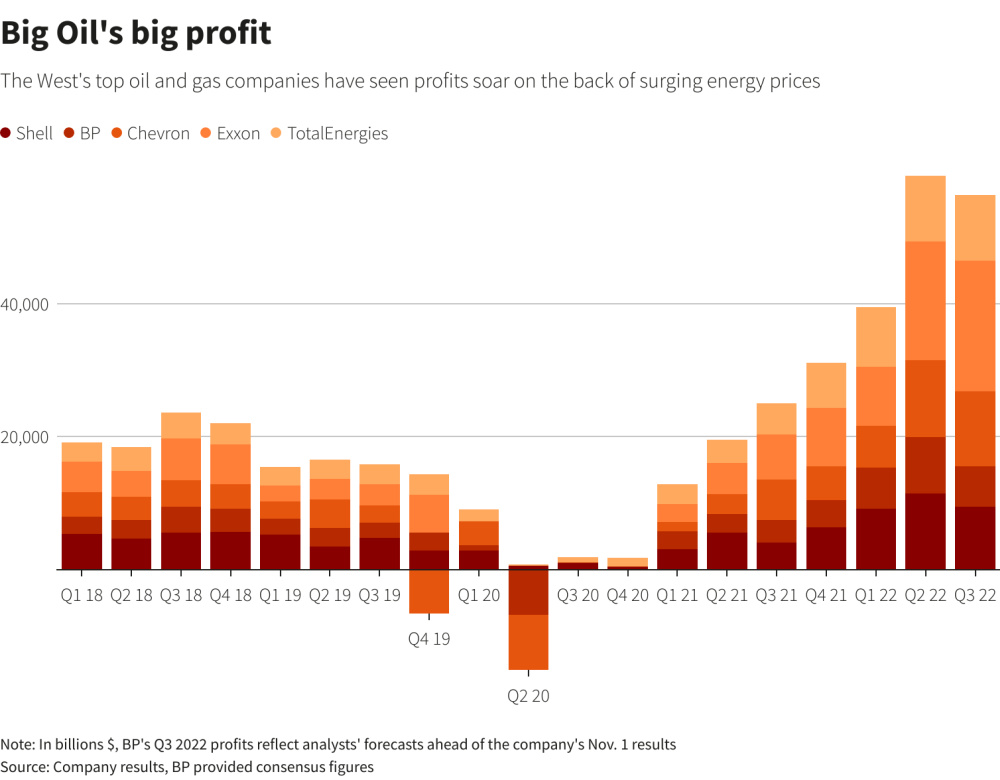

Four of the five largest global oil companies have now reported results, combining for nearly $50 billion in net income, lifted by tight global markets and disruption following Moscow’s invasion of Ukraine.

The sheer size of the profits has revived calls from politicians and consumer groups to impose more taxes on the companies to raise funds to offset the hit to households, businesses and the wider economy from higher energy costs. They have also criticized big oil companies for not doing enough to raise production to offset rising fuel and heating costs.

Chevron CFO Pierre Breber warned in an interview with Reuters that “taxing production will just reduce it.”

The company reported its second-highest profit of $11.2 billion. However, the company’s global production is down so far this year from a year ago, and other U.S. oil companies signaled that output in the top-producing U.S. shale region is waning already.

“If you raise the costs on energy producers, it will decrease investment so that goes against the intent of increasing suppliers and making energy more affordable.”

U.S. President Joe Biden, who earlier this year said Exxon Mobil was making “more money than God,” told oil companies this month that they were not doing enough to bring down energy costs.

Hours after Shell Plc reported a quarterly profit of $9.45 billion and raised its dividend by 15% on Oct. 27, Biden said the company was misusing its profits.

On Oct. 28, he noted on Twitter in response to a comment from Exxon Mobil’s CEO that “giving profits to shareholders is not the same as bringing prices down for American families.”

In the U.K., the president of the COP26 climate summit Alok Sharma said on Oct. 29 that Prime Minister Rishi Sunak’s government should explore extending a windfall tax on oil and gas firms.

“These are excessive profits, and they have to be treated in the appropriate way when it comes to taxation,” Sharma said.

Shell CEO Ben Van Beurden has said the energy industry “should be prepared and accept” that it will face higher taxes to help struggling parts of society. Shell earned more than $9 billion in the third quarter, putting it on track to surpass its record annual profit of $31 billion set in 2008.

Windfall

Exxon Mobil, the largest U.S. major, reported nearly $20 billion in net income in the quarter ending in September, exceeding expectations and surpassing its previous record set just three months earlier.

Exxon Mobil led the five oil majors in overall revenue, nearly doubling its peers Shell and TotalEnergies SE in the quarter. Exxon Mobil’s shares lagged those companies’ stocks for several years, but have rebounded in 2022 even as it has not made the same commitment as its European competitors to ramp up spending in renewables. BP Plc, the fifth major, reports results next week.

“Where others pulled back in the face of uncertainty and a historic slowdown, retreating and retrenching, this company moved forward, continuing to invest,” Exxon Mobil CEO Darren Woods said.

Shares of the five majors have all posted a total return of at least 29% this year. Exxon Mobil leads the way with an 86% increase, while the broad-market S&P 500’s total return is minus 19% on the year, according to Refinitiv Eikon data.

European governments have scrambled to fill gas storage after Russia cut off most of its natural gas exports to the continent, its primary customer.

On Oct. 29, Norway’s Equinor ASA also broke new ground helped by the all-time high in European gas prices, and Italy’s Eni SpA nearly tripled its profit from a year ago, beating the consensus with earnings of 3.73 billion euros (US$3.72 billion). France’s TotalEnergies reported a record profit of $10 billion on Oct. 27.

“The Russian war in Ukraine has changed the energy markets, reduced energy availability and increased prices,” Equinor CEO Anders Opedal said in a statement.

Recommended Reading

Haslam Family Office: ‘We Need Hydrocarbons’

2025-01-29 - The managing director of HF Capital—the office for Tennessee's Haslam family—says that as long as oil, gas and other energy sources are lacking capital, there’s an investment opportunity.

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.