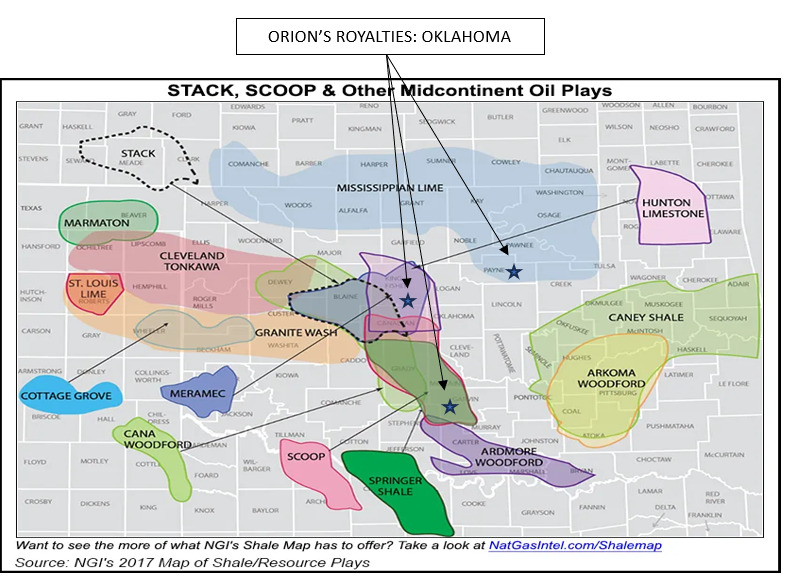

Orion Diversified Holding Co., a revenue-generating diversified company, closed on an acquisition of a royalty interest in the Midcontinent's SCOOP/STACK play in Garvin County, Oklahoma, the company said. (Source: Orion Energy)

Orion Diversified Holding Co., a revenue-generating diversified company, closed on an acquisition of a royalty interest in the SCOOP/STACK play in Garvin County, Oklahoma, the company said.

The Austin, Texas-based company said it acquired a 0.59% royalty interest on 170 acres with active drilling leases already permitted in the area. With the deal, Orion said it now owns mineral ownership in 34,200 acres in all major U.S. onshore oil and gas regions.

"We have received notice from the State of Oklahoma that Citizen Energy is planning to drill multiple well horizontals on our Kingfisher County acreage,” Orion CEO Tom Lull said. “We are being pooled into a 320-acre horizontal drilling and spacing unit.”

Lull said the company is also negotiating with several oil companies in the Permian Basin to acquire producing and non-producing oil and gas assets, according to a Nov. 6 press release.

Orion Diversified invests in operated majority working interest, non-operated working interest and mineral interests in producing oil and gas properties with a core area of focus in U.S. basins. Orion receives monthly income from operators including Chevron, ConocoPhillips, APA Corp.’s Apache, Occidental Petroleum, EOG Resources and several other E&Ps.

RELATED

Serial-acquirer Orion Diversified Adds Hugoton Field Interests

Recommended Reading

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

IOG Resources II Buys Non-Op Utica Shale Interests

2025-02-26 - IOG Resources II is expanding in Appalachia with an acquisition of Utica working interests in eastern Ohio.

Matador Exits Eagle Ford Shale, Preps for ‘Turbulent Times’

2025-04-04 - Matador Resources Co. divested its Eagle Ford Shale assets “in preparation for turbulent times” but doesn’t expect tariffs to affect well costs until the second half of 2025.

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.