Audrey Robertson, co-founder and executive vice president of finance at Franklin Mountain Energy. (Source: Hart Energy)

Franklin Mountain Energy was a relative nobody when the company bid in a 2018 Bureau of Land Management (BLM) lease auction for New Mexico acreage.

“Everyone thought we were crazy,” said Audrey Robertson, executive vice president of finance and co-founder of Franklin Mountain.

Several big public E&Ps were lured by the BLM’s tempting offer: a chance to buy drilling rights for undeveloped acreage in the core of New Mexico’s Delaware Basin.

Successful bidders included large-cap independents like Occidental Petroleum and Marathon Oil. Matador Resources, operating under a stealthy alias, later revealed itself as the top bidder in the federal lease sale.

“But people thought, ‘Who the heck is Franklin Mountain?’” Robertson said during Hart Energy’s SUPER DUG Conference & Expo in Fort Worth, Texas.

It wouldn’t take long for the industry to learn just who the heck Franklin Mountain was: Today, the E&P is one of the largest privately held oil and gas producers in the nation, according to data from Enverus Intelligence Research.

And among private Permian Basin E&Ps, Franklin Mountain owns some of the most attractive and coveted drilling inventory left across the entire basin.

Experts and analysts believe Franklin Mountain will be a target for acquisition by a larger player seeking drilling runway in the Delaware Basin.

The Denver-based E&P could fetch somewhere in the “$3 billionish range” through a sale, Stephen Trauber, chairman and global head of energy and clean technology at Moelis & Co., recently told Hart Energy.

The growing E&P has an experienced leadership team charting its course: Co-founders Paul Foster, Jeff Stevens and Scott Weaver previously founded El Paso, Texas-based Western Refining. Western Refining completed a $5.8 billion sale to Tesoro Corp. in 2017, before Tesoro sold to Marathon Petroleum for $23 billion.

Robertson previously worked at a big private equity firm before founding her own fund focused on minerals and non-operated investments. The Western team eventually became investors in Robertson’s fund.

Between 2017 and 2018, the thesis for a New Mexico-focused Delaware Basin E&P was born. By combining a private equity-backed position with the big, blocky acreage packages from the BLM auction, Franklin Mountain could put together a substantial undrilled Permian portfolio.

“If it worked, it would be beautiful,” Robertson said, “but there were a lot of things that had to happen.”

“Namely, we probably needed a quarter of a billion dollars in one day in September,” she said.

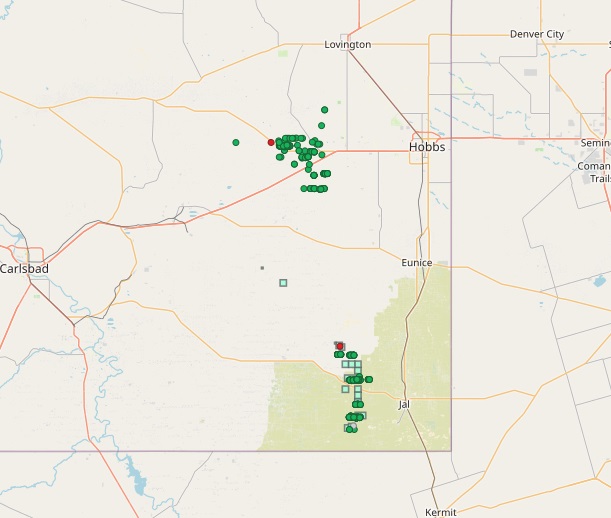

Franklin Mountain is currently producing around 50,000 boe/d from its blocky acreage position in Lea County, New Mexico.

But just a few years ago, output averaged only around 50 boe/d from a handful of legacy wells Franklin Mountain picked up through acquisition.

The BLM lease sale in September 2018 gave Franklin Mountain around 4,000 acres of undeveloped virgin rock in Lea County.

Later that month, the company added another 4,280 net acres through the acquisition of OneEnergy Partners Operating LLC, a portfolio company of private equity firm Carnelian Energy Capital.

RELATED

The Shape of M&A to Come: Is Devon Up Next to Join the Spree?

Trust the process

It took heavy lifting for Franklin Mountain to grow into one of the Permian’s top private producers.

The company financed operations out of its own pockets for its first 33 months in business. Franklin Mountain didn’t want to go public, and it also didn’t want to bring in additional outside investors, Robertson said.

“That was mostly driven to the fact that we wanted to make these operating decisions based on the asset,” she said. “We didn’t want to have to answer to anyone else.”

Franklin Mountain didn’t go out to source bank capital early on, either. And frankly, the big banks probably wouldn’t have loaned Franklin Mountain the money it needed.

“They probably would not have agreed with our path, to be honest,” Robertson said.

A series of countercyclical investments—zigging when most of the rest of the big publics zagged at the direction of their squawking investors—helped Franklin Mountain get to where it is today.

Operators around the nation were slashing drilling activity and cutting budgets when Franklin Mountain picked up its first rig in late 2020; oil prices languished around $38/bbl.

“I would say it was a hostile energy environment coming off of negative oil prices,” Robertson said. “But we had conviction that we had the right asset and we had the right team, so we were moving forward.”

Oil prices had rebounded to around $62/bbl when Franklin Mountain’s first well pad came online in July 2021.

Franklin Mountain also prioritized building out its own infrastructure needs in the Delaware Basin, like midstream takeaway.

“It led to us having partnerships with midstream providers, landowners, regulators and trying to build long-standing opportunities for growth,” Robertson said.

The company did start to approach banks for financing around the time it was drilling the first well pad. Franklin Mountain had invested $100 million into its drilling program at that point; the company was looking for a $40 million bank revolver.

But Franklin Mountain, drilling its first wells, was a relative newcomer to the upstream sector. Several major banks weren’t willing to lend the money.

However, small- and medium-sized banks—Bank of Oklahoma (BOK Financial Corp.) in particular, Robertson said—were willing to play ball with Franklin Mountain.

“Great banks like Comerica, UMB Bank and Fifth Third jumped in and we got our $40 million revolver,” Robertson said.

Today, Franklin Mountain’s credit revolver includes 16 bank lenders and hovers in the range of $1 billion.

“And it will always be led by Bank of Oklahoma because of that support they gave us early on,” she said.

RELATED

Permian M&A: Oxy Shops Delaware Assets, Family Oil Cos. Stand Out

M&A mayhem

Public E&Ps are clamoring for Permian Basin drilling inventory, and they’re willing to pay up.

The frenzied hunt for drilling runway fueled a record amount of corporate M&A and asset transactions in the Permian Basin.

Several of the basin’s largest producers—Pioneer Natural Resources, Endeavor Energy, CrownRock LP and others—were snapped up in a matter of months.

ConocoPhillips recently announced a $17.1 billion acquisition of Marathon Oil, a deal that will further consolidate the Permian Basin. The deal also includes complementary positions in the Eagle Ford, the Bakken and Midcontinent.

After exits by numerous private equity-backed E&Ps, there are fewer M&A opportunities left hiding in pockets around the basin.

It’s why private companies like Franklin Mountain stick out so much as potential M&A targets, said Andrew Dittmar, senior M&A analyst for Enverus Intelligence Research, during the 2024 Enverus Evolve conference.

Other private M&A targets include family-owned oil companies like Mewbourne Oil and Fasken Oil & Ranch.

There are also a handful of interesting private equity-backed E&Ps still growing in the Permian: One is Double Eagle IV, which is building an attractive position in the Midland Basin.

Double Eagle IV is reportedly exploring a sale in the range of $6.5 billion.

Ameredev II LLC, backed by EnCap Investments LP, has also grown a sizable footprint in the Delaware Basin. EnCap has reportedly explored a sale of Ameredev II.

FireBird Energy II, backed by private equity firm Quantum Energy Partners, is also building a Midland Basin position, including leases in Midland, Upton, Glasscock and Crane counties, Texas.

FireBird II is developing the popular benches—and exploring some deeper intervals—on the western side of the Midland Basin. FireBird II currently holds the bulk of its leases and production in Upton and Midland counties.

RELATED

CEO: FireBird II Prowls Western Midland Basin for M&A, Deep Exploration

Recommended Reading

Court Weighs Postponing Citgo Auction Bid Hearing to September

2024-06-28 - A U.S. court has been asked to postpone a hearing to present the high bid in an auction of shares in the parent of Venezuela-owned refiner Citgo Petroleum.

Laredo Oil Subsidiary Hell Creek Begins Drilling in Montana’s Midfork

2024-06-28 - Laredo Oil expects the well to be production-ready by late July.

Energy Transition in Motion (Week of June 28, 2024)

2024-06-28 - Here is a look at some of this week’s renewable energy news, including plans for another offshore wind energy lease sale.

Hess Midstream Repurchases $100MM Class B Units

2024-06-28 - Hess Midstream repurchased more than 2.7 million Class B units as part of its strategy to deliver shareholder returns.

Global Grid Infrastructure to Double by 2050, DNV Says

2024-06-19 - To meet growing electricity demand, global grid infrastructure is set to double by 2050, according to Oslo-based DNV.