Editor’s note: This is part of an ongoing series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

One of the nation’s earliest and most mature shale plays, the Eagle Ford’s runway is being extended through consolidation and recompletion projects.

The Eagle Ford Shale remains the third-most productive onshore basin in the U.S., behind only the mighty Permian Basin and North Dakota’s Bakken, according to U.S. Energy Information Administration (EIA) figures.

But while oil output from the Permian and Bakken grows, production from the Eagle Ford is expected to remain largely flat through 2025—at an average of around 1.16 MMbbl/d, per EIA forecasts.

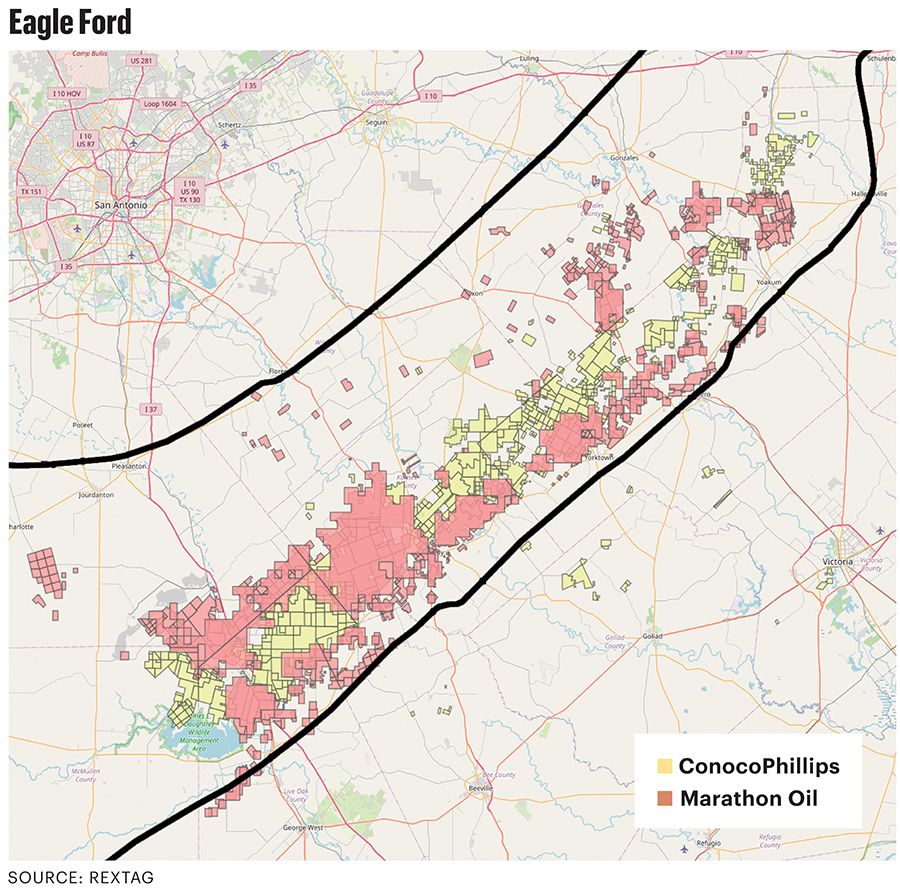

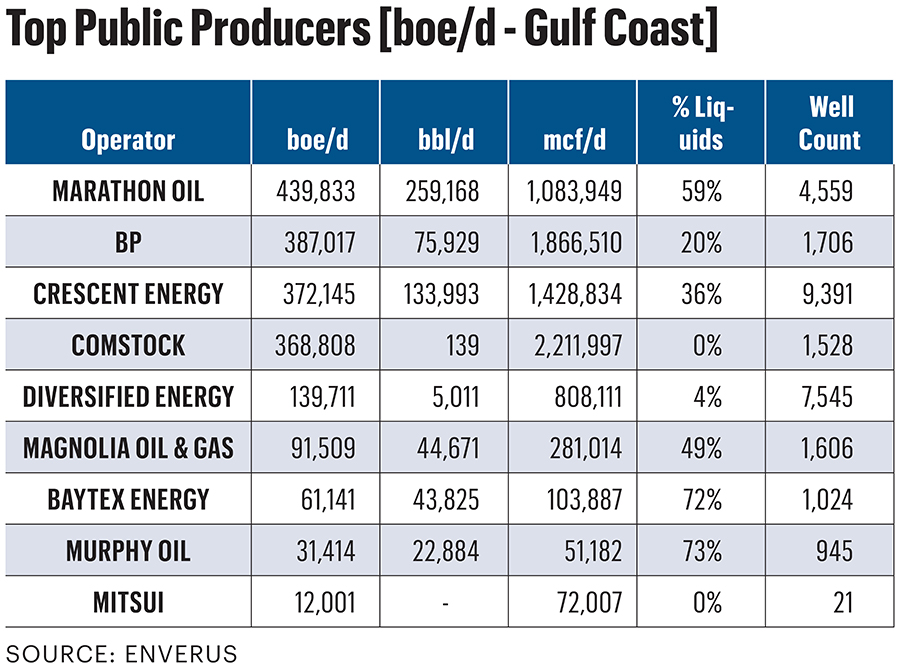

ConocoPhillips and Crescent Energy have been notable consolidators in the Eagle Ford to extend their inventories in the basin.

The $17.1 billion merger between ConocoPhillips and Marathon Oil, completed in late November, brings together two of the top producers in South Texas.

Of the approximately 2,000 additional drilling locations added through the Marathon transaction, roughly half are in the Eagle Ford.

Crescent Energy also continued to roll up acreage across the Eagle Ford in 2024, closing a $2.1 billion acquisition of SilverBow Resources and a $905 million acquisition of Ridgemar Energy.

In the Austin Chalk play, Magnolia Oil & Gas continues to add leasehold to its position in the Giddings Field.

Refrac attack

As one of the first shale plays to be developed horizontally, the Eagle Ford has relatively little white space left. Most of the highest quality drilling inventory is already owned in the portfolios of a handful of large producers.

With new drilling locations scarce, operators are increasingly evaluating recompletion projects to breathe new life into older horizontals.

A growing number of Eagle Ford producers are leaning into refracs, re-entries, recompletions and other redo jobs—using modern drilling techniques to extend production from declining wells.

Eagle Ford operators touting refrac projects include ConocoPhillips, Devon Energy, BPX Energy, Crescent Energy, Baytex Energy and Verdun Oil.

Refracs are a hot topic today, but they’re old news for Verdun, a private E&P backed by EnCap Investments. The company started developing a refrac strategy around 2018, when Verdun completed what it says was the first full linear isolation refrac performed in the Eagle Ford trend.

The wells Verdun identifies for refracs generally have average lateral lengths of around 6,000 ft and were completed before 2016.

LNG Future

Certain operators see future opportunity stemming from the natural gas windows in the far western Eagle Ford.

EOG Resources is developing the Dorado gas play in the southwestern area of the play near the Texas-Mexico border.

Last year, EOG brought online the 100-mile Verde Pipeline, a 1 Bcf/d project transporting Dorado gas to the Agua Dulce sales hub near Corpus Christi, Texas.

EOG is running a single rig on its Dorado gas play, but the company anticipates growing activity in South Texas as demand for LNG, and gas prices, increase in the future.

“As the market starts to open up for us, we’d like to increase that,” EOG CEO Ezra Yacob said during the company’s third-quarter earnings call.

A handful of large-scale LNG export facilities are under construction near the Agua Dulce Hub, including Rio Grande LNG and Corpus Christi LNG State III. Several more are under construction along the U.S. Gulf Coast, including Golden Pass LNG and Port Arthur LNG.

LNG export capacity from the U.S. is expected to grow by nearly 10 Bcf/d through 2027, according to EIA data, as new liquefaction projects tick online, including Plaquemines LNG, which started production in December.

Gas production from the Eagle Ford will grow from 6.7 Bcf/d to 7 Bcf/d this year, the EIA forecasts.

Recommended Reading

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

NAPE Panelist: Occidental Shops ~$1B in D-J Basin Minerals Sale

2025-02-05 - Occidental Petroleum is marketing a minerals package in Colorado’s Denver-Julesburg Basin valued at up to $1 billion, according to a panelist at the 2025 NAPE conference.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.