Editor’s note: This is part of an ongoing series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

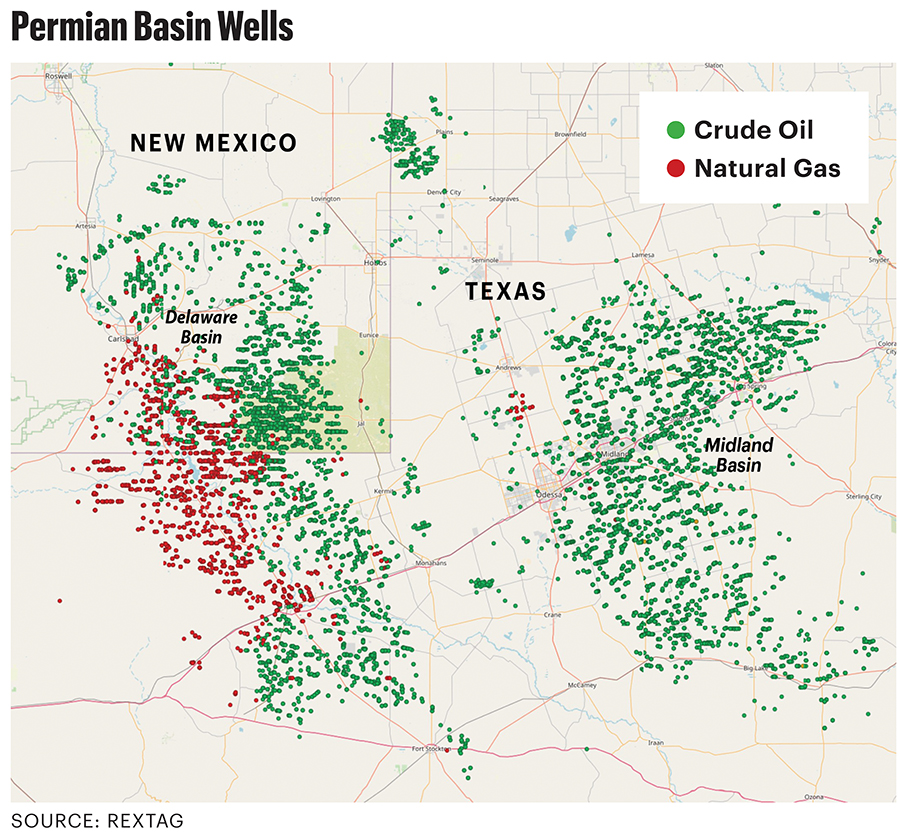

Some counties in the Permian Basin are among the least populated areas in the contiguous U.S., where electricity, water or basic infrastructure are relative luxuries.

But this remote corner of West Texas and southeastern New Mexico plays a key role in U.S. energy security and broader global geopolitics.

The Permian Basin is expected to drive U.S. crude oil production growth for the foreseeable future as other domestic basins wane and decline, industry experts say.

It’s a matter-of-fact outlook for the basin today. But not long ago, experts considered the Permian drilled up and exhausted.

The speed in which horizontal drilling ignited the Permian’s meteoric rise surprised U.S. rivals, the OPEC+ cartel and even the producers themselves.

“The Permian is a basin unlike any other in the world,” said Occidental Petroleum CEO Vicki Hollub during Hart Energy’s Executive Oil Conference in Midland, Texas, in November.

“The Permian is going to be one of the last remaining basins, I believe, to produce oil in the world.”

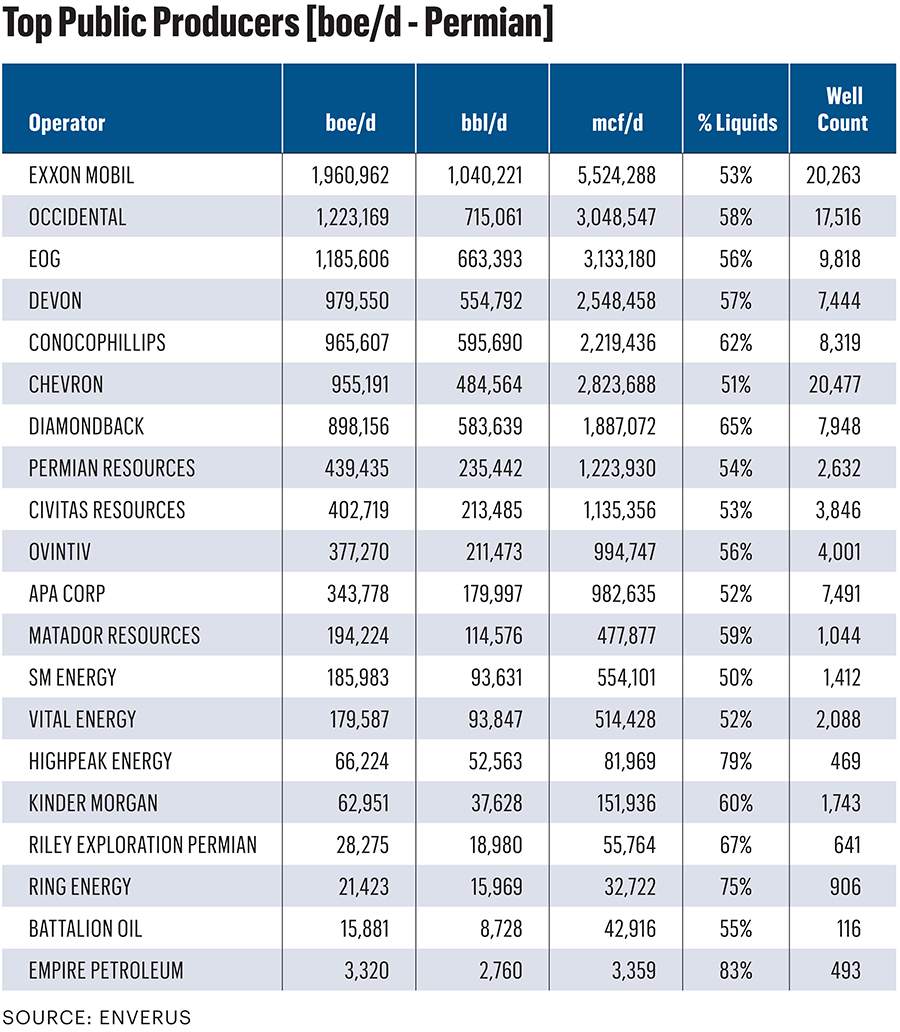

Permian oil production averaged 6.36 MMbbl/d in the third quarter, according to U.S. Energy Information Administration figures. Production is expected to average 6.42 MMbbl/d in the fourth quarter and more than 6.5 MMbbl/d in 2025.

E&Ps are willing to pay their weight in gold for a piece of the Permian. Several of the largest shale oil transactions in history were inked there in just the past year.

The Midland Basin attracted the most M&A investment. Exxon Mobil acquired Pioneer Natural Resources for $60 billion, cementing the Midland as a key asset in its global portfolio.

Diamondback Energy acquired private producer Endeavor Energy Resources for $26 billion, while Occidental acquired private E&P CrownRock for $12 billion.

Producers are after the Midland’s popular Spraberry and Wolfcamp benches. But they’re also increasingly exploring the Dean sands and Barnett Shale zones.

RELATED

Birch Resources Mows Dean Sandstone for 6.5 MMbbl in 15 Months

The more western Delaware Basin—where targets are deeper, and the geology is more complex—has attracted a healthy amount of M&A, too.

The Wolfcamp and Bone Spring benches are king in the Delaware. Operators are also landing in the Harkey, Avalon and Woodford zones as they search for new locations.

Even the fringier conventional zones on the shelves of the basin are attracting drilling capital. Operators like Riley Exploration Permian and Ring Energy are developing the Permian’s Central Basin Platform and Northwest Shelves, targeting the San Andres, Blinebry and Paddock intervals.

Permian producers are also seeing benefits of drilling fewer wells with longer laterals underground, leading to meaningful savings on D&C costs. Exxon Mobil has drilled a handful of 4-mile laterals in the New Mexico Delaware Basin—and the company is now looking to drill more 4-mile wells in the Midland Basin after closing the Pioneer acquisition.

SM Energy, Permian Resources, Franklin Mountain Energy and GBK Corp. are other players drilling 3- to 4-mile laterals in the Permian, according to Enverus data.

RELATED

Coterra to Acquire Permian Assets from Franklin, Avant for $3.95B

Producers will be manufacturing the Permian Basin’s stacked pay for decades to come. But the kingly Permian is not without challenges.

The gas-oil ratio (GOR) across the basin is creeping up, spooking some watchful public investors.

Operators should also expect to see higher GORs from certain secondary Permian zones, Hollub said.

“We have the ability to complete secondary intervals that may be gassier,” she said, “but the value from those intervals, because the infrastructure already exists, is tremendous—and in some cases, even better than the primary development.”

Gas takeaway capacity from the basin does need to be addressed, Hollub said. But several pipeline projects coming online or in progress are alleviating some of the stress.

The Matterhorn Express Pipeline, a 2.5-Bcf/d project that started operations in the fourth quarter, is filling up faster than any other natural gas pipeline in the basin’s history, according to East Daley Analytics. Five weeks after startup, flows had already reached 1.5 Bcf/d.

In 2026, Kinder Morgan’s recently announced Gulf Coast Express expansion project will add about 500 MMcf/d of capacity, and the WhiteWater Midstream-led Blackcomb Pipeline project is expected to add 2.5 Bcf/d of capacity.

Recommended Reading

Baker Hughes Wins LNG Technology Orders for Venture Global

2025-01-30 - Baker Hughes Co. also signed a multiyear services agreement to support the first two phases of Venture Global’s Plaquemines LNG project in Louisiana.

LNG Canada Receives Cooling Cargo, Signals Project Start-Up

2025-04-03 - LNG Canada expects to start exporting LNG by the middle of 2025.

Excelerate Energy, Petrovietnam Gas Sign MOU to Secure US LNG

2025-03-19 - Excelerate Energy Inc. and Petrovietnam Gas Joint Stock Corp. are collaborating to secure LNG from the U.S. as early as 2026.

NextDecade, Aramco Agree to 20-Yr LNG Offtake Deal for Rio Grande Train 4

2025-04-08 - Aramco will buy 1.2 mtpa from NextDecade Corp. upon completion of its Rio Grande Train 4 at a price indexed to Henry Hub.

Canadian Government to Fund Portion of Cedar LNG’s $5.96B Development Cost

2025-03-24 - The Government of Canada has pledged to contribute up to $200 million to help the Haisla Nation and Pembina Pipeline Corp. develop the $5.96 billion Cedar LNG Project

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.