Almost 90% of the projected output is hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF). (Source: Shutterstock)

Six of the world’s major oil and gas companies are boosting their biofuels investments, with 43 projects already running or targeted to start by 2030, Rystad Energy said in a report.

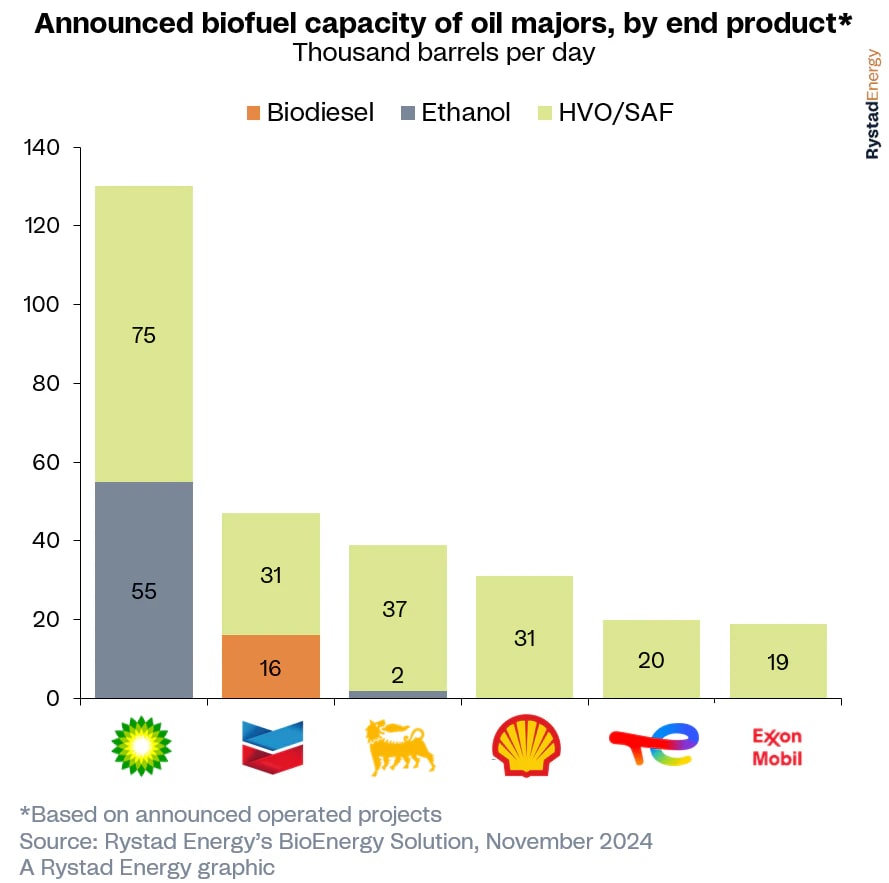

Between BP, Chevron, Shell, TotalEnergies, Exxon Mobil and Eni, the projects could add 286,000 bbl/d of production capacity, according to Rystad Analysts Lars Klesse and Kartik Selvaraju.

Of the 43 projects, 31 are greenfield developments and six are conversions of refineries to produce biofuels exclusively. Six more projects involve co-processing, in which refineries blend bio feedstock and fossil fuel feedstock. BP announced plans for 130,000 bbl/d of biofuels production capacity. Chevron is second with 47,000 bbl/d.

Almost 90% of the projected output is hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF). Biofuels are attractive to operators because they can run in existing engines with lower emissions than fossil fuels.

“Supermajors are accelerating investments in biofuels like HVO and SAF, recognizing their potential as low-carbon ‘drop-in’ fuels that can be swiftly integrated into existing aviation, heavy transport and marine fuel systems,” Klesse said.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

TechnipFMC Awarded EPCI for Equinor’s Johan Sverdrup Phase 3

2025-03-25 - The Johan Sverdrup Field, which originally began production in 2019, is one of the largest developments in the Norwegian North Sea.

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.