Oilfield services and equipment providers in the Permian Basin are competing against one another to woo a dwindling number of E&P customers, executives reported in the latest Dallas Fed Energy Survey. (Source: Shutterstock)

Oilfield services and equipment providers in the Permian Basin are competing against one another to woo a dwindling number of E&P customers.

According to the second-quarter Dallas Fed Energy Survey published June 26, a historic run of upstream consolidation has had broad downstream effects—from oilfield services to energy industry employment to the outlook for future U.S. production growth.

Consolidation by producers has been most evident in the prolific Permian Basin, the nation’s top oil-producing region.

Exxon Mobil closed a $60 billion acquisition of Midland Basin giant Pioneer Natural Resources in early May.

Meanwhile, Diamondback Energy and Occidental Petroleum are working to close their own respective acquisitions of Endeavor Energy Resources and CrownRock LP. Both deals are facing regulatory scrutiny by the U.S. Federal Trade Commission (FTC).

A tie-up between ConocoPhillips and Marathon Oil will also consolidate huge swathes of Permian acreage.

Many of the most active and prodigious U.S. operators have gotten snapped up in less than a year, and the oilfield players that serviced those operators are feeling the pressure.

“Oil and gas operator consolidation is squeezing an over-supplied vendor market for all services, which will require consolidation or extensive bankruptcy in the vendor pool to rightsize the market,” one oilfield services executive said in response to the Dallas Fed’s survey.

Those concerns were echoed loudly by services industry peers.

“Too many equipment providers are chasing too few E&P customers,” another executive wrote. “Without consolidation within service or equipment providers, it will be a race to the bottom for pricing.”

“The continued approval of these mergers by the [FTC] is surprising and will ultimately harm the Permian Basin,” the executive continued.

Seeing the writing on the wall, a handful of large oilfield services players have started to merge.

In April, international services giant SLB announced a $7.7 billion all-stock acquisition of ChampionX.

Patterson-UTI and NexTier Oilfield Solutions combined last year in a merger valued at $5.4 billion.

In the offshore services space, Noble Corp. is scooping up Diamond Offshore Drilling for $1.6 billion.

The Dallas Fed’s second-quarter survey included responses from 138 energy firms across Texas, southern New Mexico and northern Louisiana. Survey responses were collected between June 12 and June 20.

RELATED

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

Production impact

Oilfield services players are sure about one thing: upstream consolidation spells trouble for their neck of the woods. But survey respondents are uncertain how E&P consolidation will impact U.S. oil and gas production over the long term.

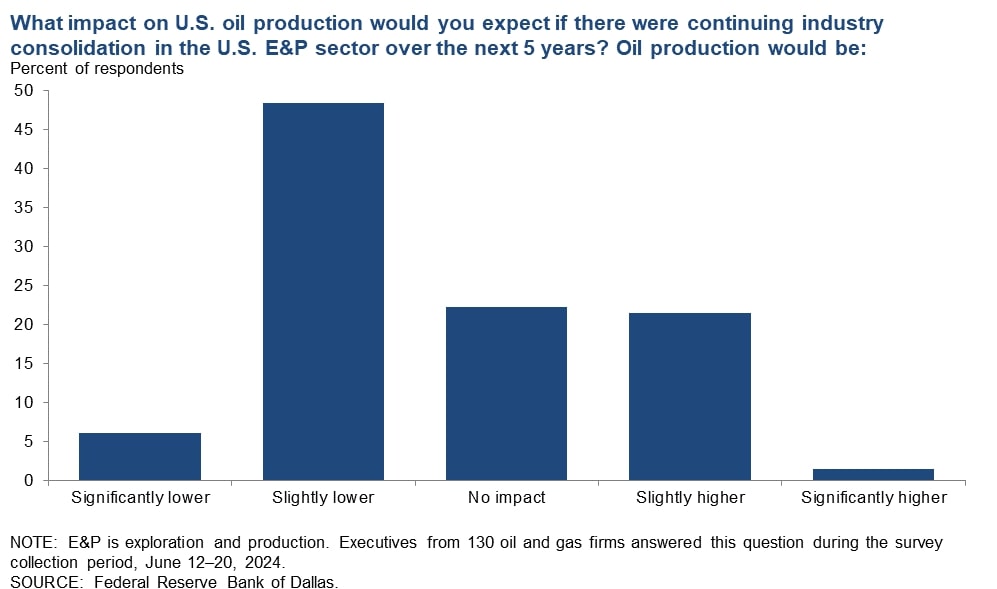

If E&P industry consolidation were to continue unabated for the next five years, 48% of respondents said that U.S. oil production would be “slightly lower,” according to the Dallas Fed.

Around 22% reported there would be “no impact” from the continued consolidation, while another 22% believe output would be “slightly higher.”

Consolidation seems to be weighing more on the small producers, rather than the big players. All executives from E&P firms producing 100,000 bbl/d or more said there would be “no impact” to U.S. oil and gas production forecasts due to industry consolidation.

The benefits of scale are also being brought to bear in the Permian, where operators have weathered a prolonged period of depressed natural gas prices.

Spot prices at the West Texas Waha gas trading hub have frequently dipped into negative territory.

Natural gas prices are so low in the Permian that most large E&Ps don’t factor natural gas pricing or economics into their drilling plans.

Among the large E&Ps with Permian presences, 58% of respondents reported that low Waha hub gas prices would have no impact on their Permian drilling and completion plans this year; 33% said it would have a slightly negative impact, while 8% said it would have significant negative impacts.

Among small E&Ps—producing 10,000 bbl/d or fewer—50% reported that low Waha gas prices would have a slightly negative impact on their drilling plans; 31% reported no impact, while 19% reported a significantly negative impact.

RELATED

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.