Headquartered in Australia, Worley is a professional services company providing energy, chemicals and resources expertise. (Source: Shutterstock)

Worley Ltd. has been selected to design and evaluate CO2 gathering, handling and sequestration facilities for Bayou Bend CCS LLC.

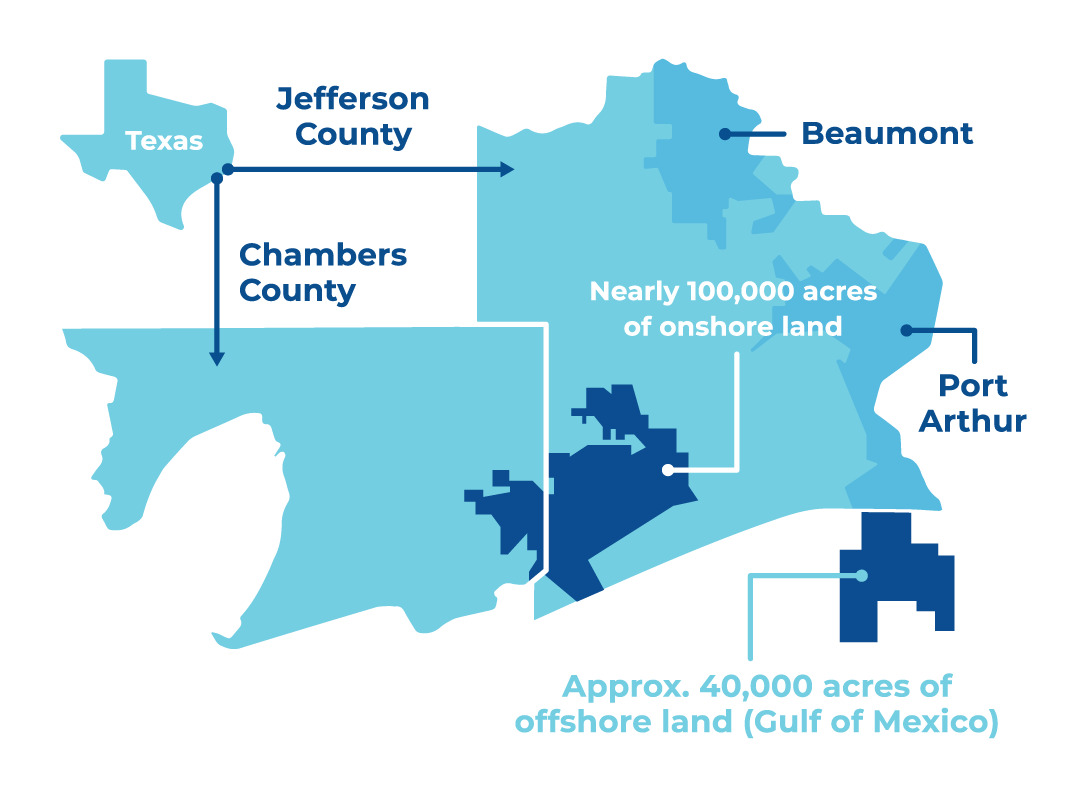

Bayou Bend is a carbon capture and sequestration (CCS) joint venture (JV) between Chevron (50%, operator), TotalEnergies (25%) and Equinor (25%) located along the Gulf Coast in Texas.

RELATED

Talos Energy Sells CCS Business to TotalEnergies

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

Being on the Gulf Coast, with CO2 emission concentrations at its highest in the U.S., Bayou Bend is expected to help abate industries difficult to lessen emissions in and including refining, cement, steel, chemicals and manufacturing.

The JV includes a CO2 storage footprint of almost 140,000 acres of pore space.

Headquartered in Australia, Worley is a professional services company providing energy, chemicals and resources expertise.

“We’re committed to a strong partnership with Bayou Bend, drawing on our global CCUS [carbon, capture, utilization and sequestration] knowledge and project execution experience," Mark Trueman, group president at Americas for Worley, said in a press release. "Innovative projects like Bayou Bend will potentially enable CCS at scale and help many more companies achieve their net zero goals, supporting Worley’s purpose of delivering a more sustainable world.”

Recommended Reading

BP Cuts Over 5% of Workforce to Reduce Costs

2025-01-16 - BP will cut over 5% of its global workforce as part of efforts to reduce costs and rebuild investor confidence.

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Shell Shakes Up Leadership with Upstream and Gas Director to Exit

2025-03-04 - Zoë Yujnovich, Shell’s Integrated Gas and Upstream director, will step down effective March 31.

Baker Hughes Appoints Ahmed Moghal to CFO

2025-02-24 - Ahmed Moghal is taking over as CFO of Baker Hughes following Nancy Buese’s departure from the position.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.