The hottest soap opera to follow in 2024 energy M&A involved Kimmeridge’s takeover bid of SilverBow Resources and the resulting war of words between the two.

But the emerging upstream power Crescent Energy had quietly lurked behind the scenes since October 2022, when CEO David Rockecharlie first struck up a conversation with Eagle Ford Shale player SilverBow.

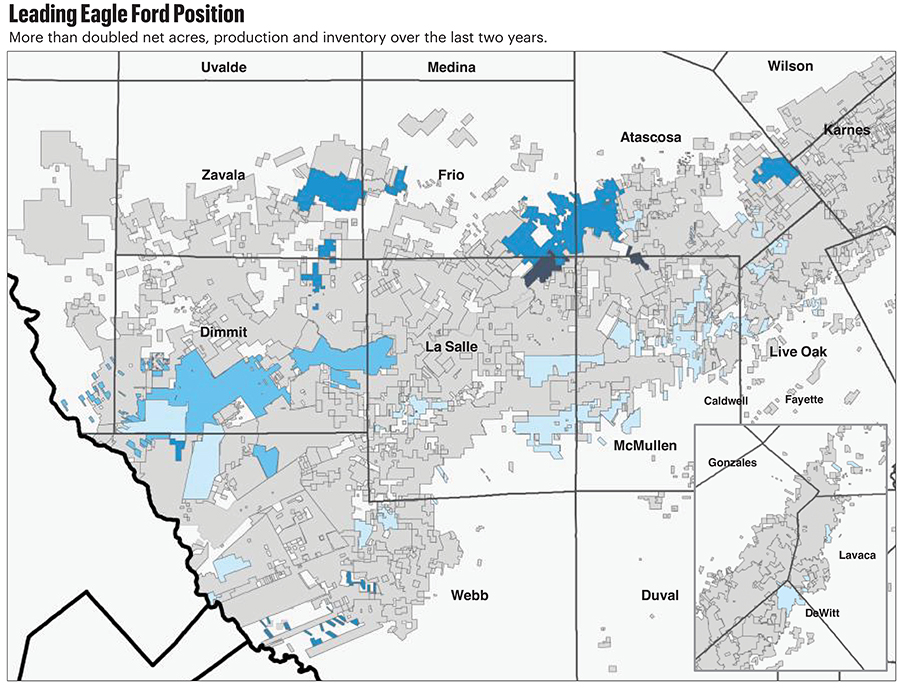

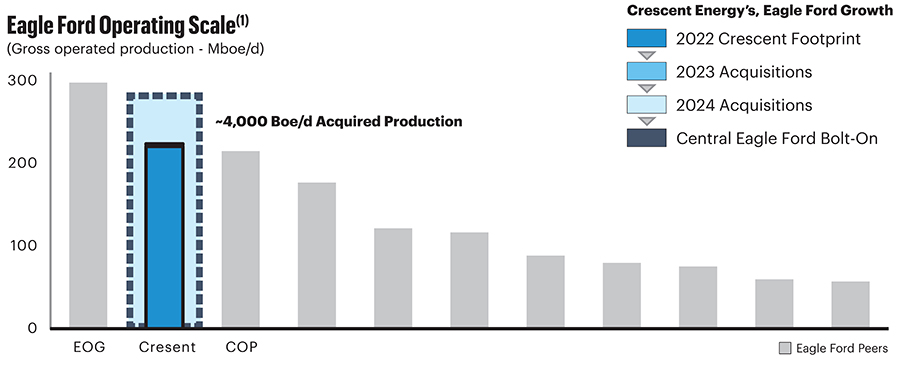

Kimmeridge, a major SilverBow investor, aimed to combine its Kimmeridge Texas Gas assets and may ultimately have forced SilverBow into making a deal. But “a” deal is key, because SilverBow ultimately chose the more secretive Crescent bid, which temporarily turned Crescent into the second-largest producer in the Eagle Ford behind EOG Resources.

Crescent’s first offer came in January at a 10% premium of $29.94 per share, and the final, $2.1 billion deal reached at a nearly 17% premium of $38 per share, including up to $400 million in cash, which ended up upon closing at about $358 million.

The acquisition, which closed at the end of July, was the third-largest energy deal announced in the first half of 2024, behind ConocoPhillips’ massive acquisition of Marathon Oil and just narrowly behind SM Energy scooping up XCL Resources. When and if the Marathon deal closes, Conoco would push Crescent back down as the third-ranked Eagle Ford producer.

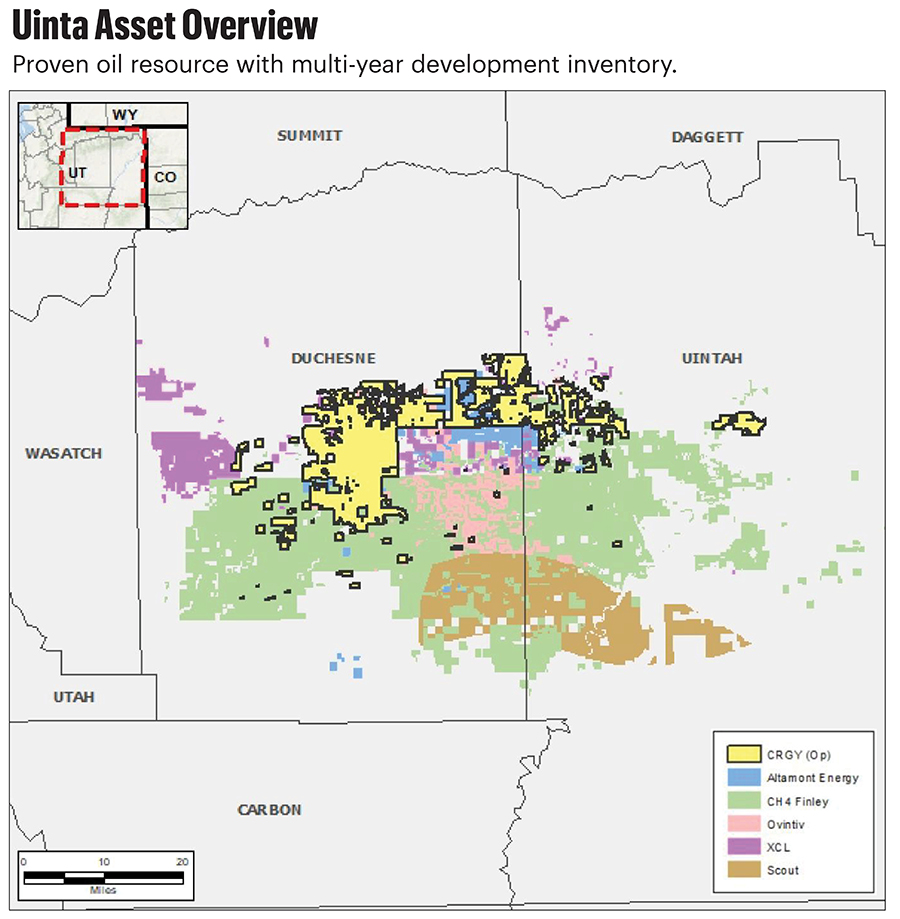

As with SM after the XCL deal, Crescent also is a major player in the emerging Uinta Basin in Utah, having acquired in 2022 the EnCap Investments-backed Verdun Oil assets, which had previously been held by EP Energy.

An additional smaller, bolt-on Eagle Ford deal came in September with the acquisition of Cheyenne Petroleum assets. The seller was not identified, but Oil and Gas Investor identified Cheyenne through Hart Energy’s Rextag mapping and data services.

The Crescent name emerged in late 2021 when Rockecharlie and KKR-backed Independence Energy acquired the publicly traded, John Goff-led Contango Oil & Gas in a reverse merger. The Verdun deal and a series of modest deals ensued, positioning Crescent strongly in the Eagle Ford and Uinta plays.

Rockecharlie sat down with Hart Energy Editorial Director Jordan Blum to discuss the SilverBow and Cheyenne deals, the Eagle Ford and Uinta Basin, and the future of Crescent and the energy sector.

Jordan Blum, editorial director, Hart Energy: The SilverBow deal is obviously the biggest news. So, please tell me why the deal made a lot of sense, and what you make of the combined position in the Eagle Ford now that the deal is closed?

David Rockecharlie, CEO, Crescent Energy: The acquisition is consistent with our strategy. The company was founded with a differentiated vision and discipline—the growth through M&A strategy. I think this is a great example of what we’ve been doing for the last 10-plus years as a company. First, it met all of our financial and operational targets. We typically describe our investment and financial targets in terms of returns on capital, multiple of money, we expect to make two times our money or better. We think we’ll get paid back on that acquisition in five years or less. Operationally, we want to do things that are consistent with our core areas, and also our areas of expertise. The Eagle Ford has been a core area of the company from our founding. This is really strong overlap with the business that we already had in a number of places.

We’ve got adjacent lease positions, so we see significant synergy opportunities, operational efficiencies. But, overall, this is just consistent with our long-term strategy and makes the company bigger and better. The other important thing is we feel like we’ve been doing the same thing for a long time, but this particular transaction also has put all the hard work of our employees a little bit more on notice to the market. I don’t think we did anything different, but it is definitely the biggest acquisition we’ve done.

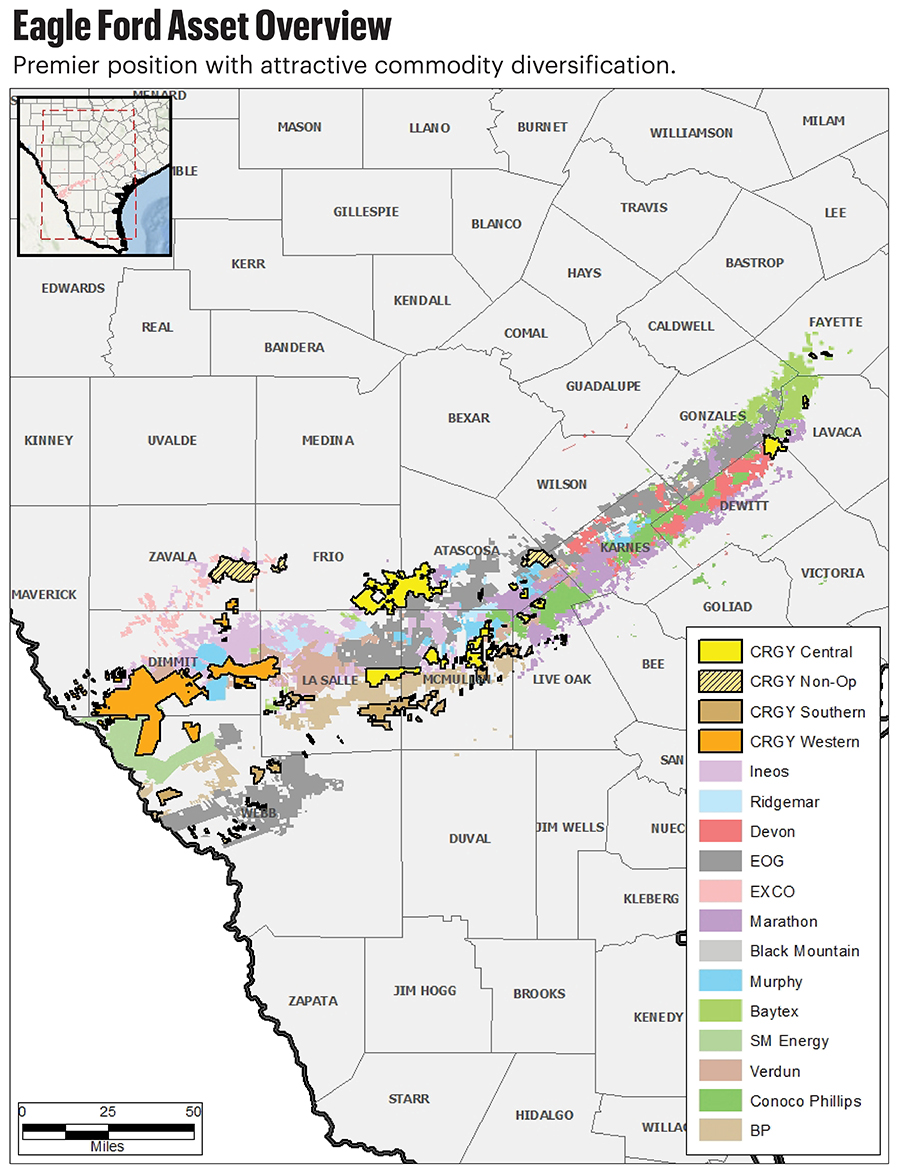

JB: And what about how the acreage fits together and the importance of focusing so much on the Eagle Ford?

DR: I think it’s great. Our position over time at Crescent, prior to the acquisition, had been built in two areas. In particular, we’ve had an oil-focused area in what we call the central Eagle Ford, and then across the oil, gas, and condensate window in what we call the western Eagle Ford. SilverBow, over the last three years, had made a number of acquisitions. We also had done so. When you look at the two companies coming together today, both had really strong central and western positions. So, in our two core areas within the Eagle Ford, SilverBow had strong overlap.

When we looked at the two companies separately, we had some things we were doing better. In particular, time and efficiency on drilling and completions that we now think we can apply to their program. But they were also doing some things that were interesting and different. They had started some refrac programs, and they had been doing different things with their facilities. When you’re able to put two companies together that have really strong positions in the same area, you can take the best of both. They were two really strong companies beforehand, but they also had some strengths that were different.

JB: Can you take me through how all of this came about? Obviously, it was very public with Kimmeridge’s hostile approach. But I thought it was interesting that we now know you started talking to SilverBow back in October 2022 and how it played out from there.

DR: We really try to look at everything going on in the industry. So, it’s no surprise that we would have conversations with our peers and, in particular, with folks who are in our operating areas. To your point, I think there’s a lot of things in the acquisition business that are out of your control. We tend to focus on what is in our control, which is knowing where we’re good, paying attention to the areas where we think we can grow—both because we’re strong operators, but also because there’s activity—and what we would consider fragmentation and consolidation opportunity. The Eagle Ford has clearly been an area of fragmentation, but also consolidation.

Really, we just maintained a strong relationship with the company. A lot of it was just as good industry partners, which we do with as many folks as we can. I would say it was opportunistic that SilverBow decided that they were open at that point in time to have conversations with multiple potential partners. Consistent with our strategy, we didn’t know when that opportunity might come available, but we were prepared to engage and react when it did. So, yes, we were at it for a long time and then it kind of felt like it came together pretty quickly, but I’d say we were prepared for it. It’s just another good example of how the company thinks about and prepares for things to come.

JB: Was it advantageous to be kind of quietly bidding as opposed to, let’s say, Kimmeridge’s slightly different approach?

DR: (smiling) I only comment on Crescent. I think we are, in particular, very focused on doing what we can control, doing the right thing. We want people to recognize Crescent for doing what we say we’re going to do. So, we tend to be very transparent about what our objectives are. We’re a growth-through-M&A company. We want to operate in areas where we have expertise, but we typically don’t talk about success until we’ve actually completed it. We’re not really talking about things until we get them done. Flying below the radar is more of our style.

JB: In reading the background, it looked like you and John Goff at times, and maybe I’m misreading, kind of took turns taking the lead on negotiations, and I’m sure in a very concerted way. I wanted to get your take on how that dynamic works with you and the chairman working together.

DR: I think it’s a great question and a good observation. We met John Goff really as peers in the industry. One of, obviously, the results of that is the predecessor to Crescent ultimately went public through a reverse merger with the company that John was chairman of. We felt very aligned with his strategy, which was focused on cash flow and risk management and return on capital. John is a big supporter of the company. He’s a large shareholder. He has not sold any stock since he was part of the merger with us. He’s very involved and he’s also well connected in the industry. I wouldn’t say that we necessarily handed things off back and forth. I think it’s really just a team effort. That, maybe, is a small example of how the whole company works. This is really a team-oriented business and everything we have achieved and will achieve will be because we have good alignment.

JB: Now that the deal is closed, how is the integration going?

DR: It’s going great. No surprises. If anything, we’re seeing more opportunity in bringing the best of both [companies] together than we could see from the outside. Prior to closing, you’re really just allowed to plan and do things at a high level. We closed on July 30, and we were ready for that date. The integration starts on what we referred to as day one following closing. We’re still in the integration phase, but it’s going really well. It all starts with the people. I think we’ve brought together a great team from both sides, and everybody’s really motivated and excited about the challenge of bringing the business together.

JB: In September, you did a bolt-on deal to add more adjacent acreage in the Eagle Ford. Why is that a good deal and fit, and should we expect to see similar deals in the future?

DR: It’s literally adjacent to our acreage. We’ve been familiar with this company for many, many years similar to our interactions with SilverBow. Everything we do on the acquisition side is opportunistic. The company is in great shape, we’re delivering free cash flow, we’re making operational improvement, and we don’t have to do anything [in M&A]. With the people and the asset base we have, it allows us to be disciplined and patient. But, with that, when assets come up for sale that we like at attractive value, we’re also going to be prepared to do it.

We’ve gotten confidence from integrating a number of Eagle Ford assets over the years. We can come back to it. We had really strong execution on integration of our western Eagle Ford acquisition last year. The planning and beginning stages of the SilverBow acquisition have gone great. So, when this opportunity came up, we felt very confident both in the value and the operational fit, but also in our ability to take it on. It is a smaller acquisition, but we treat them all the same.

JB: As more consolidation occurs in the Eagle Ford and good acreage gets scarcer, how do you see dealmaking continuing to play out?

DR: It’s still one of the least-consolidated basins. When we compare it to the Permian and look at what I’ll call scaled positions, the amount of acreage and production that is held by public companies with a market capitalization greater than $5 billion, over 80% of the Permian is held in larger-cap, public companies. In the Eagle Ford, that statistic would be closer to 30%. There are a few large operators in the Eagle Ford, namely EOG and ConocoPhillips. We’re obviously in the top three. But the rest of the play is really wide open, both publicly and privately. There are a number of other public operators, but they’re really not of what would be considered large scale. In some cases, they may not even be core assets of those companies.

I think we have a really interesting and exciting opportunity over the next three to five years as there continues to be consolidation across the sector. We see that for sure continuing in the Eagle Ford as well. And there are private operators and public operators that are maybe subscale, and then there’s individual lease and trade opportunities as well. We’re focused in the central and western, and I think those areas line up pretty well for us to continue to add on to.

JB: And maybe ramp up activity on the western side as natural gas prices recover?

DR: Rather than ramp up, I would say allocate capital in a way that’s highest returning. The reason I say that is we do think we have a very differentiated strategy. We founded the company at the time when the industry was really pursuing shale exploration through leasing of land and drill bit growth.

We’ve always been focused on free cash flow. We really manage the company for low-to-moderate growth through the drill bit, and we try to deliver all of our growth through disciplined profitable acquisition. We do get asked a lot as cash flow increases and prices rise, will you ramp drilling? We want to be viewed as steady and efficient and profitable with our base business. I’d say the allocation of capital could be different, but I wouldn’t expect us to be “ramping.” So that’s a long answer to one vocabulary word that is important to us to clarify.

JB: Obviously, the Eagle Ford is a bit more mature than some other basins, and this is cliché, but how much can refracs and recompletions change the game in the Eagle Ford and add more life?

DR: I would put refracs in what I’ll call a long list of really significant future economic productive opportunities. The Eagle Ford has a lot of attributes that would lead an investor to call it mature. It was one of the early shale basins to be developed. But, while it has been drilled over a wide range of the basin, a lot of it was done early. A lot of it was done by large companies testing things. Our position came together through numerous acquisitions, but some of the larger companies that we’ve acquired from include Anadarko [Petroleum] and Cabot [Oil & Gas] and Chesapeake [Energy], which are larger-cap companies with a disciplined approach to exploration.

A lot of the things that were done early on didn’t have the benefit of what we’ve now learned over the last decade-plus. We bring best practices to assets that may have been developed in a different way early on. One of the things you’ve seen us do on the drilling completion side is bring better, more efficient, faster techniques. We’ve, for example, used the latest anaged pressure drilling techniques, which really were not used significantly onshore a decade ago. Simul-frac operations, which is something that certainly had been pioneered a number of years ago, but it’s still not widespread onshore. We’ve brought that to our operations, and it’s allowed us to be much more efficient. Refracs are another great opportunity, and I put that also with incremental in-field development, and recognition that spacing of wells may need to be different today with the different completion designs we’re using, and better understanding of the reservoirs.

When you think about all those things, refracs is just one opportunity, but it is a big one. Some of the largest-cap companies are pursuing successful programs. SilverBow had just gotten started. We at Crescent had not done any refracs yet. That’s actually part of our strategy. We tend to watch others in the industry that are doing leading things, and then go apply them. The asset base we own lends itself to that type of redevelopment or expanded development. It’s held by production, and we can afford to take our time to do it. I think refracs, incremental development and different production techniques will all be part of our ability to expand and make more profitable our existing asset base. It’s also something that we look at new acquisitions to try to identify whether those opportunities may be available there. With the most recent acquisition, we see significant improvement opportunity on those assets really by applying the best practices we’ve developed.

JB: Taking just a bit of a step back, I wanted to see if you would discuss your journey in the industry from KKR and leading the Independence-Contango merger, and how it is working in both the PE and public producer worlds?

DR: I really like building things, and I like working on teams. That’s been a part of my career, also part of my upbringing. I grew up in Houston in the ’70s and ’80s, so I’ve seen what volatility looks like on the ground. I’ve been a part of both financial firms and operating companies. My background is in math and economics, and I got started in the industry at a financial firm, Donaldson, Lufkin & Jenrette, that was really helping other high-growth companies in the energy sector. My first operating company job was at El Paso Corp. So, I’ve seen significant volatility in large and small companies, and I think one of the key things that we really wanted to make sure we built into Crescent was that ability to anticipate change and really be prepared for opportunities. I think that background of being both on the financial side of things and on the operating side of things has allowed me to really be part of and contribute to a team that really has a lot of different skills and experiences in this company to make us successful.

JB: In that vein, how do you see the direction of the industry right now and how Crescent fits together with it?

DR: I see the direction of the industry today in consolidation and in a stronger focus on financial discipline and, in particular, free cash flow and investor returns. And, also, a stronger focus on operational excellence as we’ve come out of a high-growth phase.

Everything used to be about leasing, exploration, significant growth through the drill bit. Today, things have become much more operationally and manufacturing oriented, and focused on profitability. We started Crescent over 10 years ago wanting to operate in this way. It was differentiated at the time to focus on free cash flow and risk management and investor returns. It’s still differentiated today in our view.

We want to continue to grow. We want to continue to attract new investors at the same time as we retain our existing investors. Sticking to that strategy and being opportunistic and well prepared will allow us to participate in that consolidation and grow profitably and deliver really strong value to our investors.

We’ve always had a disciplined financial strategy. The leverage metric we use debt-to-EBITDA. We’ve operated with an average leverage of 1.2x. And that’s over the history of the company. We tend to say we target about 1.0x, and we’ve operated in the 1.0x-1.5x range, which is where we still are today. Our reinvestment rate—and our capital discipline—has been between 40% and 50% of EBITDA over the history at a time when many in the sector were outspending cash flow.

We like the assets we have. We bought them. But they’ve allowed us to execute the strategy. One of the things we highlight and have maintained is a much lower decline rate of current production than the rest of the industry. We target a 25% corporate declines or less over the next 12 months of our asset base. It just allows us to have a much lower risk, lower operationally intensive strategy, still grow profitably, and then be prepared really for whatever the cycle may bring to us because we want to be proactive when things come our way, not reactive. We’ve made dozens of acquisitions over the years and, obviously, since going public people have a brighter light and ability to see what we’ve done.

We’ve tripled the company since we went public. Our vision for the next five years is, I think, we can double it again. If we do that, we’ll be an investment-grade company. We use that term because it really signals that we have a strong belief we can grow, and we’ll grow in a disciplined and profitable way. The other thing we talk about internally is we want to grow again when we see the opportunity, not just to grow. We want to be proud of what we’ve built.

JB: I’m assuming you see Crescent as undervalued right now. I wanted to just see if I could get you to elaborate a bit more on the overall stock, debt and dividend strategies?

DR: We’ve got a really strong balance sheet. Our capital allocation strategy, which we describe as 1A and 1B, is investor first. The 1A is take care of the balance sheet, and 1B is pay a dividend. We’ve paid a dividend consistently over the life of the company. When we went public, we did not change our financial strategy or capital-allocation approach. The only thing I would highlight we’ve done in the public markets that was different than privately is we did announce earlier this year that we simplified our dividend strategy to just make it a fixed dividend.

We’re now paying 12 cents per share per quarter. But that is consistent with how we’ve paid dividends over the life of the company. That is 1A, 1B. No. 2 would be looking for attractive investment opportunities. We don’t have to do anything; we’ve got a really strong, deep inventory of drilling locations focused both in the Eagle Ford and the Uinta basins. We typically reinvest about 50% of our EBITDA every year. The other thing we announced earlier this year that just strengthened our commitment to investor returns is we do have a publicly announced share-buyback authorization that’s available for us to use opportunistically.

JB: With the acquisitive strategy, you’re not really built to flip. What are your thoughts on that and your forward-looking, long-term plans?

DR: The business was set up to be a long-term strategy, and I think one of the core commitments of everyone here is, we’re building for the long term. I think we’ve been able to invest in the company in ways that you wouldn’t if you had a shorter-term mindset just to make sure that we’ve got stability. We plan to be a much bigger company than we are today.

One of the things I say a lot is, “You get what you think about.” If you expect that your company is going to be twice the size five years from now than it is today, you can plan for that and you can plan the right way. I do think you do things differently when you believe and are committed to operating for the long term. When we make acquisitions, there are things you know can improve on day one, and then there are other things that may take longer either to study or assess or even implement. We’re still evaluating production that we acquired within the last year, and now we’ve brought a really significant amount of production in with SilverBow. They were in the process of evaluating things that they had bought. I see tremendous potential from our teams operating in the field and evaluating production techniques and opportunities across our asset base over the next three to five years that may not show up tomorrow.

JB: When Independence and Contango came together, you also had positions in the Permian, Midcontinent and Denver-Julesburg. So how did you end up focusing specifically on the Eagle Ford and Uinta?

DR: We described the company as focused on Texas and the Rockies. In Texas, that’s the Eagle Ford. One of the fun things for me about the SilverBow acquisition is, I think the market has a lot more clear understanding of what we meant when we said we were going to be a growth-through-acquisition company focused in the Eagle Ford. I think we’ve done a lot now. We were confident that we would be able to achieve those goals, but it’s nice to have added significantly to that track record. You’ve seen us make a number of acquisitions. We’ve announced six transactions since going public, and they’ve all been in the Eagle Ford or the Rocky Mountain region. That’s just allowed us to take core areas and make them an even greater part of the company.

We are in the acquisition and divestiture business, and so you’ve seen us also sell some sub-scale positions over time. We had some assets in the Permian Basin. It was not an area that we thought we could grow, and we’ve divested a few things there. Over the last 18 months, we’ve sold approximately $150 million of non-core assets. While we are a growth company, we also really are focused on being efficient and focused in our core areas. We are a multi-basin company, and we intend to be. It’s allowed us to balance our business and grow successfully and manage through the cycles.

RELATED

With ‘Pipeline of M&A,’ Crescent Ready for Another Deal

JB: Please tell me about your bullishness for the Uinta Basin, especially now that there’s more takeaway capacity there. And do you see more M&A with the Federal Trade Commission concerns?

DR: It is an absolutely great resource basin with multiple formations that are proven productive. We’re really excited about the way we got into that position, which was really through an acquisition of production, but we hold a tremendous amount of resource there. So, we see a very significant opportunity for us to continue to develop the resource base there.

There has been a lot more attention on that basin. I think that is for a couple of reasons. One, the basin is generally smaller geographically, and so there aren’t as many operators in the area. There are, largely, four operating companies there that have significant amounts of rigs running. So, over the last number of years since our acquisition, there’s been a lot more public company commentary about it. Obviously, we’re a public company and are talking about the Uinta. Ovintiv has made a significant investment and progress on developing additional resource in the basin. And now with SM entering (SM Energy acquiring Uinta-focused XCL Resources), we’re very pleased to have another, what I’ll call resource-oriented public company in the basin helping develop it. I think that is all positive from our perspective.

The other thing I would highlight is that, because the basin was generally smaller geographically and had a fewer number of operators, the horizontal drilling and completion techniques came later to the basin. So, we’re still seeing significant improvement in well performance and completion design and drilling techniques there. I think that’ll continue to attract attention in the basin. But, again, similar to our strategy, we don’t expect to have a significant rig ramp there. We expect to be steady and methodical. We’ve got contracted capacity in the local Salt Lake City refinery complex. We’re able to move our oil and gas to market in a relatively consistent way. Really, over my whole career [since] that basin’s been discussed publicly, a lot of the challenges came from companies trying to grow too fast. I think this latest stage of growth has been more methodical and learned a lot from other shale basins in doing that. Today, the export capacity from the basin has grown significantly, and we’re really excited.

No comment on the FTC situation, but I would say we’re in a consolidating industry and there are lots of transactions getting done. So, I think that’s exciting.

JB: And any interest since Ovintiv might be looking to sell there?

DR: (laughs) Yeah, I can only tell you what we know, and we’re really excited about our position there. I can tell you that.

RELATED

Ovintiv to Divest Permian Assets Amidst M&A Rumors

JB: What are you seeing in the potential for the different formations/benches in the Uinta, as well as the technical strategies?

DR: I think what’s most notable is that the development techniques in the Uinta Basin are very similar to what’s happened in all the other shale basins. We were able to bring a lot of the expertise we had from the Eagle Ford. I would also highlight that the other operators there have been very strong and have advanced the development techniques, and we’ve been able to learn from that. I would expect to see more of the same, which is just more efficiency, more advanced designs, and learning from experience as more completions and well performance happens. There has been a significant ramp in production over the last three or four years, and so there’s a lot to learn.

When we acquired the assets, what we really got was a strong production base. It was at a time in the market when the resource potential was really option value for us. The Uteland Butte Formation has been the primary formation that was under development. But now, some of the other public operators have listed many formations that we agree are productive. In particular, the Wasatch and the Castle Peak and the Douglas Creek are areas that we’re seeing significant development and more well performance come out. The production performance and economics from those formations have been very positive. And so, I would say we see multiple formations that we hold and have significant future development value and opportunity.

I’ll also bring that back to the Eagle Ford. We got into the Eagle Ford many years ago, and most of our acquisitions have been based around just developing the Lower Eagle Ford Formation. But we’re starting to see, across large areas of our position, the ability to go back differently in the Lower Eagle Ford, but also into the Upper Eagle Ford and even potentially multiple zones within the Austin Chalk Formation, depending on where you are in the play. We definitely have productive and economic acreage within our portfolio across all of those benches, both in the Uinta and in the Eagle Ford-Austin Chalk.

JB: What else might you want to highlight?

DR: The No. 1 thing about this company is we know where we’re headed, and we’ve had a consistent strategy from the founding. I don’t think we’re going to surprise anybody with the actions we take, but I do expect us to continue to grow the business opportunistically.

This company is the best-kept secret in Houston, and I think investors will get to know this company better. We believe this is going to be a mid-cap, must-own business, and we want the investors who come in and join us today to look back five years from now and say, “We’re proud that we were part of this company. We’re proud of what we built.” I’m really excited. In a lot of ways, we’ve been at this a long time, but we have that beginner’s mindset and excitement of a growth-oriented company. We’re just getting started. We feel like people are just starting to notice what we’re doing. And I think that’s exciting.

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.