Ajay Bakshani is director of midstream equity and Kristine Olesczek is a crude market analyst at East Daley Analytics.

Kinder Morgan plans to convert the Double H crude oil pipeline out of the Williston Basin to NGL service. In doing so, Kinder will challenge ONEOK as the lead midstream service provider for Bakken NGL, and in the process could tip a delicate balance in crude oil and NGL markets.

Kinder Morgan announced the Double H conversion in its second-quarter earnings update. Double H runs 462 miles from Dore, North Dakota, in the heart of the Bakken play, to the Guernsey market in Wyoming, adjacent to ONEOK’s Bakken NGL and Elk Creek pipelines. Kinder is targeting first-quarter 2026 to begin service on the conversion, giving producers and midstream companies in the play a short window to adapt.

Pipeline egress from the Williston Basin is tight all around, and disruptions to one commodity market can create imbalances in others. The project will add capacity for NGL yet also constrain crude oil flow to Guernsey, providing a big opportunity for other pipeline expansions.

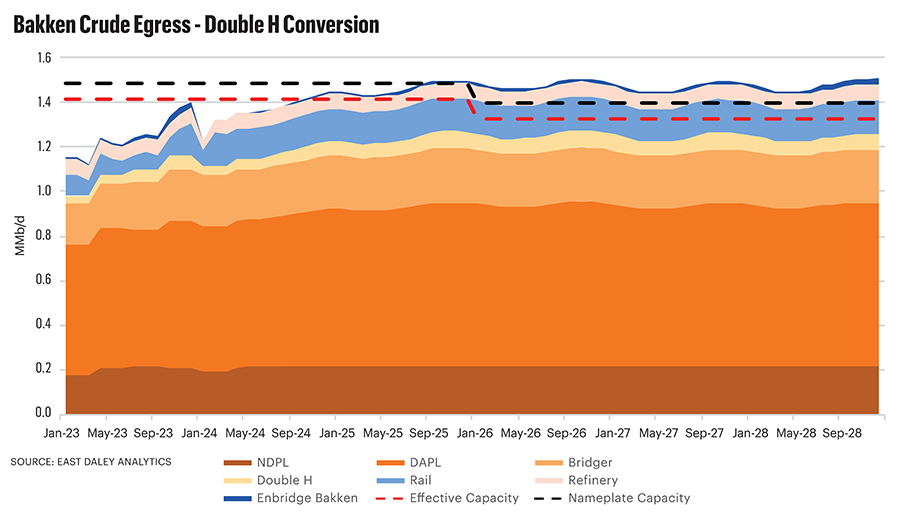

Crude constraint

In the crude oil market, the Kinder project will take away one option for Bakken barrels to reach the Cushing hub. Double H can move up to 88,000 bbl/d of crude oil, and along with True Companies’ Bridger Pipeline, currently transports Bakken barrels to Guernsey. From Guernsey, the Saddlehorn and Pony Express pipelines provide favorable netbacks to ship crude to Cushing.

Once Double H converts to NGL service, the Bakken-to-Guernsey corridor becomes immediately constrained, according to East Daley’s Crude Hub Model. Bridger Pipeline picks up a portion of Double H’s volume and fills to capacity, and shippers divert other crude oil to the Dakota Access Pipeline (DAPL) and to secondary markets. These secondary markets include shipping by rail or using Enbridge’s Bakken North Pipeline to move barrels into Canada and then south into the Midwest (PADD 2). Both of these are relatively expensive options, and we would expect to see downward pressure on Bakken crude prices if shippers lean on them to transport more crude oil.

Battle for Bakken NGL

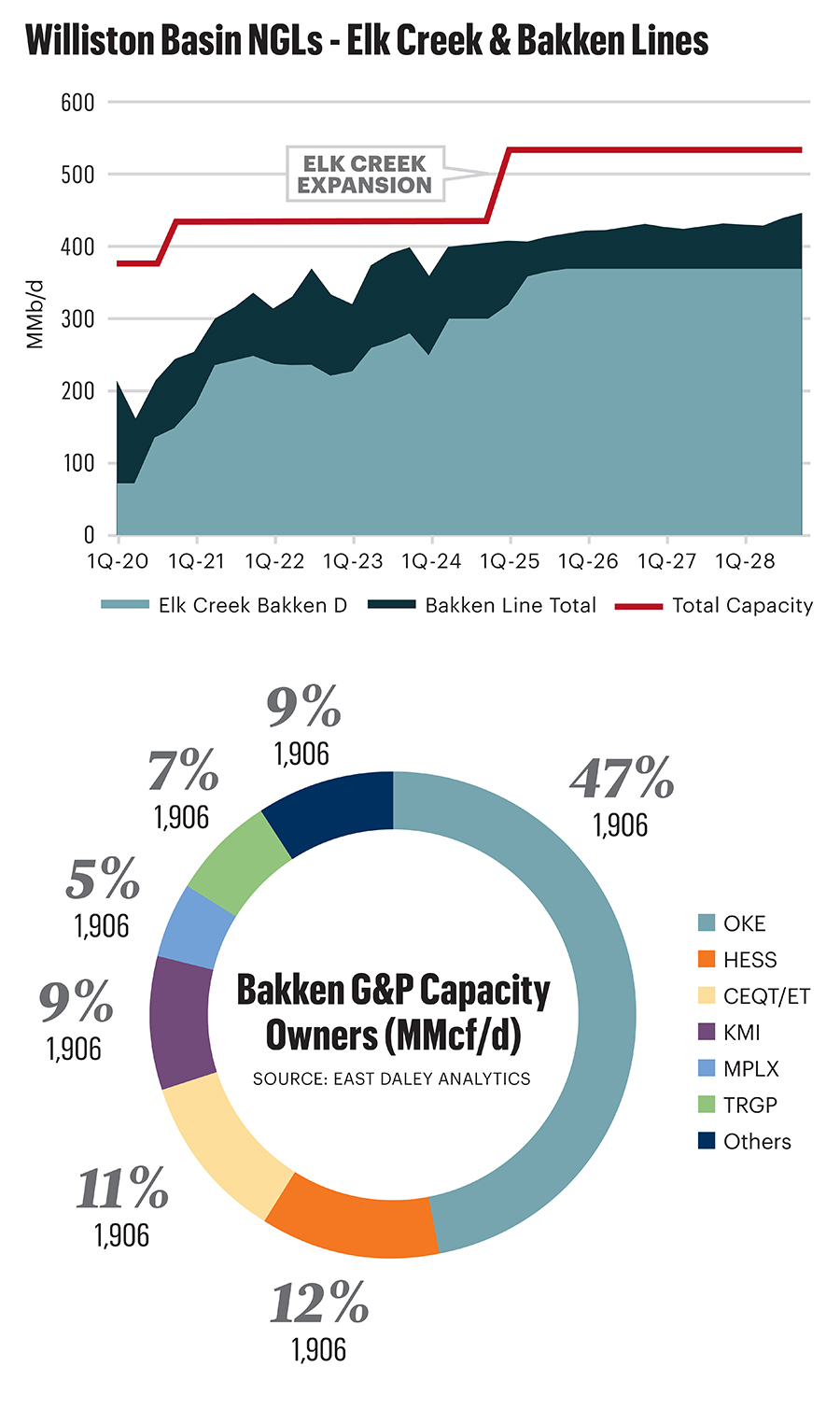

NGL infrastructure from the Williston is the most pressing bottleneck for now. Spare capacity is very limited on the Elk Creek and Bakken NGL pipelines, the two routes out of the basin, according to East Daley’s NGL Hub Model. Constraints moving NGL out of North Dakota are forcing some operators to blend more butane into the Bakken crude stream, sources tell East Daley.

ONEOK plans to start a 100,000 bbl/d expansion of the Elk Creek pipeline in first-quarter 2025 that will open new NGL egress and resolve the constraint. In fact, our regional model shows that producers in the Bakken play don’t really need the additional NGL capacity from the Double H conversion once OKE expands Elk Creek. Nevertheless, we expect operators will welcome an alternative.

The Double H project creates not only new NGL pipeline takeaway, but also new competition for ONEOK. Kinder is positioning itself as an alternative provider for producers, a move that could potentially enhance the competitiveness of Bakken supply in NGL markets. As E&Ps consolidate in the Bakken, we expect larger firms like ConocoPhillips, Devon Energy and Chevron to take a closer look at NGL netbacks and be willing to shop around for the best options.

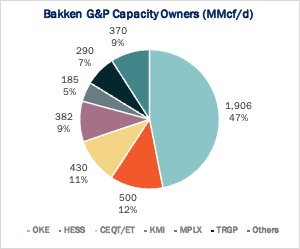

ONEOK will still be the dominant midstream player as it controls about 48% (about 1.9 Bcf/d) of the gathering and processing capacity in the Bakken, and its assets produce about 250,000 bbl/d of NGL. Kinder owns 9% (380 MMcf/d) of Bakken gathering and processing capacity and its plants average about 30,000 bbl/d of NGL production. We estimate a converted Double H line will have capacity to move about 66,000 bbl/d of NGL (using the same ratio from Enterprise Product Partners’ conversion of the 150,000-bbl/d Seminole NGL pipe to the 200,000-bbl/d Midland-to-ECHO 2 crude pipe). Thus, Kinder should be able to fill approximately half of the Double H capacity with NGL from its own plants. Hess Midstream, Energy Transfer, MPLX and Targa Resources combine for 1.4 Bcf/d of gas processing capacity in the basin and could benefit from diversification on Double H.

To challenge ONEOK, Kinder will need to build out connections between Double H and (possibly third-party) plants, as well as partner with other pipelines to move NGL to market, either to Conway, Kansas, or, ideally, Mont Belvieu, Texas. Two options are Energy Transfer’s White Cliffs pipeline from the Denver-Julesburg Basin, or Williams Cos.’s Overland Pass Pipeline. Energy Transfer also has a presence in the gathering and processing business in the Bakken via its Crestwood Equity acquisition (430 MMcf/d of capacity), which could help fill up Double H and allow Energy Transfer to recover those barrels for its downstream NGL assets.

Similarly, Williams’ Overland Pass eventually connects to Targa’s Grand Prix pipeline, and Targa can leverage its 300 MMcf/d Bakken system and Double H to execute a similar strategy. We do not know the length of the commitments between ONEOK’s NGL pipes and the Energy Transfer/Targa plants, so it could take longer to migrate those barrels to Double H.

According to East Daley’s Blueprint Financial Models, a 30,000 bbl/d drop in ONEOK’s Bakken NGL Pipeline gathering volumes and Elk Creek long-haul volumes would result in an impact of about $85 million to annual EBITDA. This hit represents about 8% of ONEOK’s combined Bakken NGL and Elk Creek pipeline earnings, or 1% of total company earnings for fiscal year 2024. The impact on ONEOK could be offset by higher-than-expected Bakken production, specifically from increased ethane recovery. On the downside, there may be rate risk as well, but we expect joint rates between Double H and downstream pipes would be in line with current Elk Creek rates (about 21 cents/gal).

Kinder’s announcement is only the first move in this potential battle over Bakken NGL. There are still many unknowns in terms of who else will back the conversion and how companies will transport barrels from Guernsey to Mont Belvieu. One thing is certain: the fight over NGL barrels is moving beyond the Permian.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.