But E&Ps’ well-documented Permian inventory scramble has led to increasingly slim M&A pickings in the basin that may be leading them to look elsewhere. (Source: Shutterstock)

Times are good for Permian Basin E&Ps—provided, of course, that they aren’t looking to buy something.

So far, Permian companies that have braved deals outside of the vaunted center of the shale universe haven’t necessarily been treated kindly by investors or analysts.

Exhibit 1 is the aftermath of SM Energy Co.’s recent $2 billion deal to buy Uinta Basin producer XCL Resources. The transaction set the company’s stock reeling in late June, with share prices gradually returning to pre-deal levels by July 18.

Generally, Permian Basin deals, where multiples are seemingly irrelevant, have been gold for equity prices. Not so for entering basins. For SM Energy, negative investor sentiment may have centered on a foray into Utah’s less well-known Uinta.

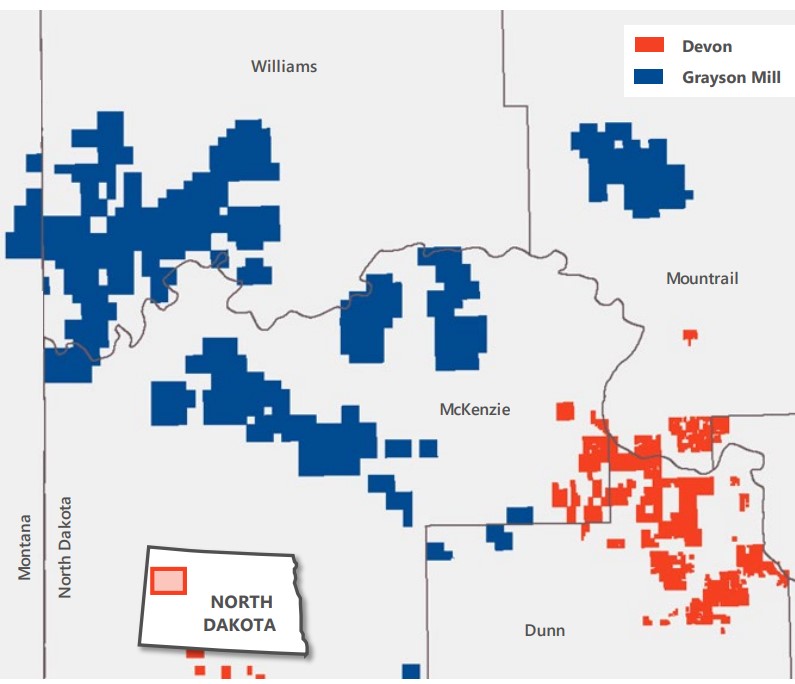

Next, Devon Energy, looking to fortify its portfolio in the Williston Basin, agreed to purchase Grayson Mill Energy in a $5 billion acquisition in early July. Devon’s deal caused a brief flutter in share prices but the chief fallout was criticism over relatively high multiples paid for Bakken inventory.

But E&Ps’ well-documented Permian inventory scramble has led to increasingly slim M&A pickings in the basin that may be leading them to look elsewhere. The Permian’s scarce A&D options are clearly starting to show, “with the exception of Double Eagle IV in the Midland, and the bulk of likely acquirers still early in the integration of other deals,” Mark A. Lear, senior research analyst at Piper Sandler, said in a July 18 report.

RELATED

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

To be clear two deals do not make a trend, Lear said. But the fact that two established Permian operators—Devon and SM Energy—went shopping outside of the Permian has not gone unnoticed.

“Both deals got a decent amount of pushback, with Grayson Mill (Bakken) trading at a premium multiple to CHRD [Chord Energy], while XCL Resources (Uinta) appears to be a difficult asset to grow and scale despite strong project returns,” Lear wrote in the report.

Piper Sandler noted that Chord Energy’s $4 billion acquisition of Enerplus Corp., which closed May 31, didn’t get more attention despite trading at “a ~0.75-turn discount” to the Devon deal on estimated fiscal year 2025 EBITDA.

That’s despite Enerplus bringing among the best remaining undeveloped inventory in shale, let alone the Bakken, Lear said.

While Devon acknowledged the premium valuation paid for Grayson Mill, Lear said the deal was “accretive on our FY25E estimates [for Devon] and replenishes a big inventory hole for the company in the Bakken which has not seen a similar level of capital allocation as year’s past as a result.”

And Devon has acknowledged that the company will continue to look for opportunities to replenish inventory in other parts of its legacy portfolio, Lear said.

In advance of second-quarter earnings reports, here’s how analysts surmise dealmaking opportunities, plans and delays for E&Ps in their coverage.

Diamondback’s wait continues

The early darling of the second quarter is clearly Diamondback Energy, with analysts previews almost poetic. TPH & Co. described the company “as the lone survivor of the large-cap Permian pure play companies.”

Diamondback (FANG) is still awaiting federal approval to close its $26 billion merger with Endeavor Energy Resources. Since April, the company has been answering a second request for information from the Federal Trade Commission (FTC).

TD Cowen analysts said they continue to favor FANG as a top pick “as the company continues to realize greater field efficiencies that should continue to benefit the company post-Endeavor close as the company expects $150/ft in capex synergies per well in addition to $325m [million] of annualized opex savings.”

Synergies “should largely be driven by simulfrac implementation. The deal is expected to close in 4Q following a second FTC request and 70-day review period,” TD Cowen managing director David Deckelbaum wrote on July 17.

TPH agreed that “all signs point to a Q4 close.”

Still, after the FTC’s left turn in the Exxon Mobil-Pioneer Natural Resources deal, which forced former Pioneer CEO Scott Sheffield off Exxon’s board, it’s unclear what regulators might demand of Diamondback, if anything. (Also unclear is why other large deals, such as Occidental Petroleum’s $12 billion acquisition of Permian E&P CrownRock LP, evaded more intensive scrutiny.)

Sheffield, responding to the FTC barring him from Exxon’s board, might have been summing up the commission’s tenor of late.

The commission’s decision, Sheffield said, was “arbitrary, capricious, an abuse of discretion, beyond the FTC’s lawful authority and not in the public interest.”

RELATED

SUPER DUG: Diamondback's Van't Hof Talks Endeavor Merger, Future of Legacy Delaware Acreage

From Comedy Central to Exxon Mobil-Pioneer Deal, a New FTC Emerges

Matador going to ground?

For Matador Resources’ second-quarter earnings, attention is likely to focus on its June agreement to purchase a subsidiary of Ameredev II Parent LLC and certain oil and gas properties in West Texas and New Mexico. Ameredev is backed by EnCap Investments LP.

The $1.9 billion Delaware Basin deal and other potential bolt-ons will likely garner most of investors’ interest in fiscal year 2025—the first full year of impact from the acquisition, Deckelbaum said.

The deal also colors Matador’s M&A outlook.

The company “will likely continue to execute its ground game, while large M&A is still to be decided with near-term focus on integrating Ameredev assets,” Deckelbaum said. “However, we note the company held a similar stance after purchasing Advance Energy in 2023 and then later purchased Ameredev in 2024.”

Occidental’s deal bait?

Permian Resources announced deals in January and May to add to its Delaware Basin position while continuing to digest its acquisition of Earthstone Energy in November 2023.

Accordingly, the expectation is for Permian Resources to continue a “strong ground game and tactical bolt-ons, though larger acquisitions may be harder to come by given less optionality in the market following a series of transactions last year,” Deckelbaum said.

In the first quarter, the company completed 150 grassroots leasing and working interest acquisitions as well as an acreage swap.

“Most of these acquisitions are set for near-term development, likely making them highly accretive,” Deckelbaum said. Combined with earlier Eddy County, New Mexico, transactions, the company has spent about $270 million for 3,500 boe/d, 45% oil, according to TD Cowen.

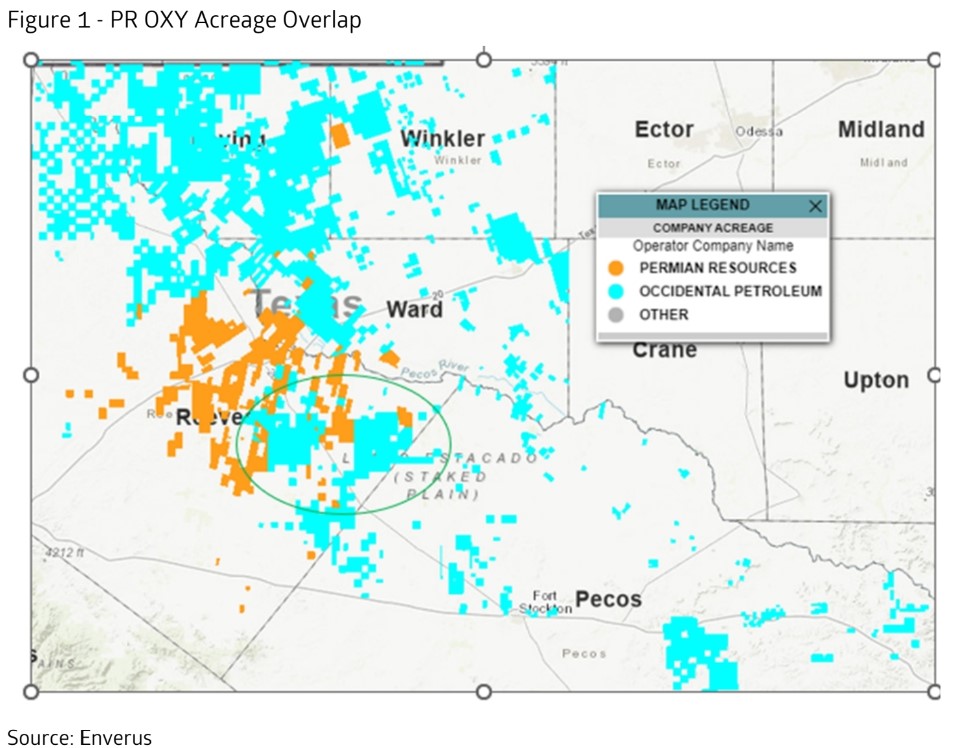

However, Deckelbaum expects Permian Resources to be looking at new asset packages that emerge as M&A generates divestitures. That includes Diamondback and Occidental Petroleum, which expects to close its CrownRock LP deal in August.

Cowen has observed on May 2 that Occidental’s Barilla Draw asset, reportedly on sale for a $1 billion price tag, makes “strong industrial [logic] for PR [Permian Resources] given acreage overlap in Reeves County.”

Civitas M&A likely muted

Civitas Resources started off 2024 going deeper into the Permian with a $2.1 billion acquisition of Vitol-backed Vencer Energy LLC—a deal announced in October 2023. The company also recently sold off non-core Denver-Julesburg Basin acreage.

Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co. noted in a July 17 report that Civitas still has payments due to Vencer—$37.5 million in May and July 2024 and $475 million before January 3, 2025. With about $122 million in proceeds from its asset sale that closed in May, Civitas has estimated net debt of ~$4.9 billion and $1.07 billion of total liquidity.

With a first-quarter net-debt/EBITDA of 1.3x, CIVI is committed to a long-term leverage target of 0.75x, Sorbara said.

“On the M&A front, CIVI [Civitas] is focused on ground game-type deals (bolt-ons, WI deals and acreage trades/swaps) in the Delaware Basin, which allows for increased inventory count and longer laterals,” Sorbara said.

Otherwise, the company’s emphasis is on executing on the operational front following recent acquisitions.

Standing pat or just browsing?

Sorbara also rounded up M&A prospects for Gulfport Energy, Coterra Energy and EOG Resources.

Gulfport may have big dealmaking ambitions, but faces the realities of market-based limitations.

Sorbara said the company’s preference is “a large or transformational transaction to increase its size.” The stumbling block for the Utica Shale and SCOOP producer remains is its undervalued equity, despite the “cheapest EV/EBITDA and highest FCF yield in its peer group.”

Coterra Energy aims to return at least 50% of free cash flow on an annual basis, as well as a remaining $1.4 billion in buybacks, tying up a lot of its capital.

That doesn’t mean Coterra, with footprints in the Permian, Marcellus Shale and Anadarko Basin, isn’t looking.

“The bar for M&A is high, as the returns would need to be competitive with its current portfolio,” Sorbara said.

Coterra continues to “look at everything and is commodity/basin agnostic and would not be afraid to enter a new basin if the right opportunity presented itself.”

RELATED

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

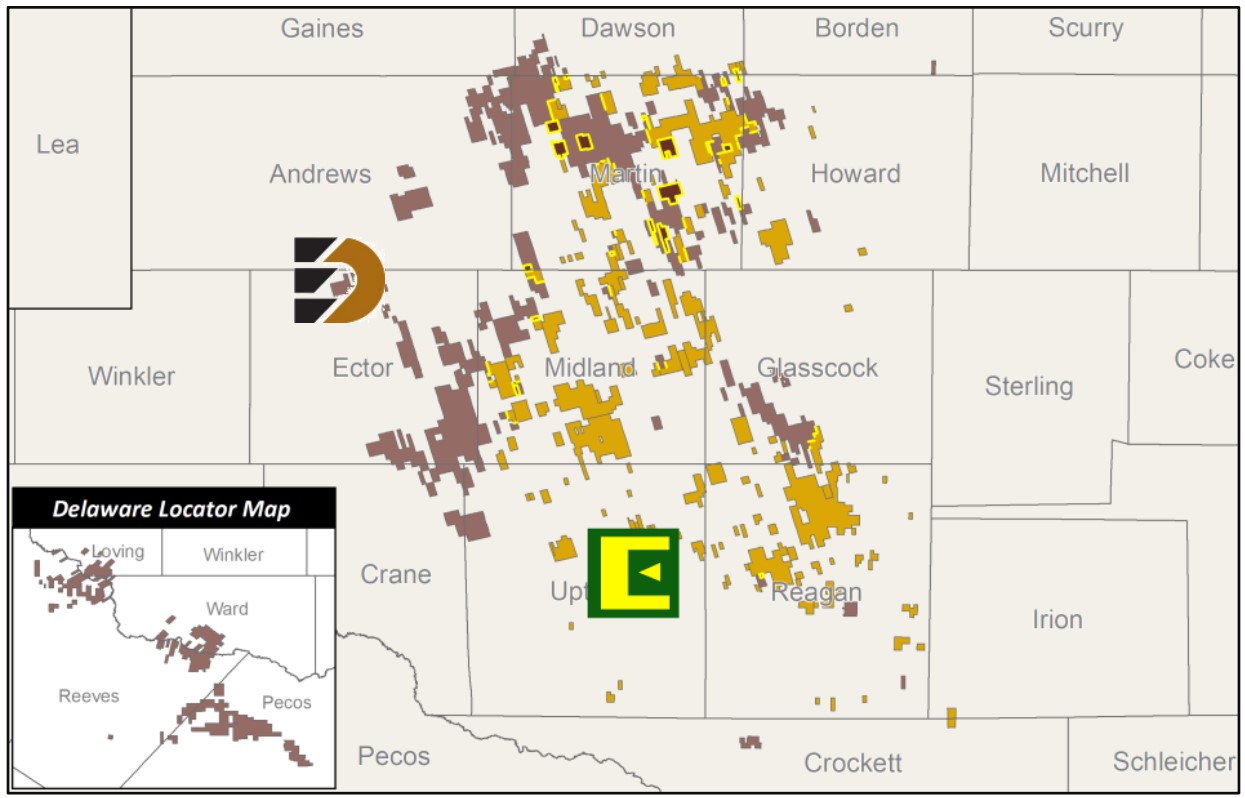

As for EOG Resources, EOG remains EOG. The company is one of a few E&Ps to robustly engage in exploration efforts ranging from the Austin Chalk and Utica Shale to more recent stepouts in the northern Midland Basin and Eagle Ford Shale.

“EOG has previously stated it has no interest in expensive M&A, as it is encouraged by its existing inventory and exploration plays,” Sorbara said. “However, the company expects to continue to opportunistically bolt-on acreage in its core operating areas and for exploration.”

RELATED

EOG Resources Wildcatting Pearsall in Western Eagle Ford Stepout

Northern Midland: EOG Brings on Dean Oil Well in SE Dawson Stepout

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.