Saying you’re going to ‘do more with less’ typically rings false as an empty platitude spouted by cost-cutting executives. But even prosaic phrases can prove true on occasion, and that’s occurring with the productivity of energy producers in 2024.

The potentially fleeting phenomenon is playing out in real time because of a confluence of events, or, to borrow another hackneyed cliché, a perfect storm.

The combination of industry consolidation, technological advancements, efficiency gains, services deflation and a focus on the best remaining acreage are allowing many producers to churn out more oil and gas from wells while drilling and completing them more quickly and cheaply.

This was the main theme emanating from the fourth-quarter earnings season that focused heavily on 2024 outlooks, said Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co.

“You’re seeing companies target their best acreage and have more efficient capital budgets,” Sorbara said. “It’s really about capital allocation being dedicated to the most efficient and most core areas.

“The core stuff is more mature. You’re just crushing it and executing.”

The U.S. drilling rig count plunged 17% in a year, but domestic crude production continues to hover near a record high of 13.3 MMbbl/d, according to the March 8 rig count report from Baker Hughes. Drilling is even down nearly 10% in the booming Permian Basin, while Permian volumes approach new highs of 6.1 MMbbl/d.

The story is different for pure-play natural gas producers because of weak pricing, but top players such as Chesapeake Energy and EQT Corp. are curtailing volumes and winning praise. Optimism exists after the calendar eventually flips over to 2025 and new LNG infrastructure starts driving up demand.

And it is proving helpful–at least in the short term–to set relatively low bars for performance goals.

“The best way to attract institutional investors is to provide conservative guidance and beat it quarter over quarter,” Sorbara said. “There’s more optimism now that you’re going to see continued beats. Efficiencies are getting better and they’re outperforming on the productivity front.”

M&A on steroids

The industry is consolidating at a rapid pace and most companies have realized they either need to buy or capitulate.

Scale is critically important for longer-term survival both for inventory and to satiate investors. But consolidation and scale also equate to greater efficiencies and cost savings.

Scale means more leverage on negotiating with services companies. Scale means more knowledge and technological gains from combining operator teams. And scale creates the ability to drill longer and more productive laterals from wells because of the larger blocks of acreage created from dealmaking.

The breaking news headline is, “‘Flash: Everybody Looking at Everybody Else in E&P Space’—because that’s what we have,” said Coterra Energy CEO Thomas Jorden during an earnings call.

And that’s coming from a CEO who hasn’t pulled the trigger on any big deals since Coterra was formed in 2021 from the combination of Cabot Oil & Gas and Cimarex Energy.

“We remain deeply curious about what consolidation could offer for Coterra owners,” Jorden said, “but the bar is very, very high.”

U.S. upstream M&A activity totaled $192 billion last year, including a whopping $144 billion transacted in the fourth quarter alone, according to Enverus Intelligence Research. Of course, the massive jump at the end of the year came from Exxon Mobil scooping up Pioneer Natural Resources and Chevron acquiring Hess Corp. And not to be outdone, Occidental Petroleum swept in at the end of the year with a deal for private Permian player CrownRock.

The A&D market isn’t slowing down in 2024 either, and it’s not just the supermajors doing all the buying. Diamondback Energy (FANG) won the top Midland Basin prize, privately held Endeavor Energy Resources. And, in the merger of natural gas players, Chesapeake is gaining Southwestern Energy in an all-stock deal. Those two deals alone add up to nearly $40 billion in sales in just two months. Meanwhile Apache Corp. bought Callon Petroleum in the Permian and Chord Energy is acquiring Enerplus in a Williston Basin consolidation.

Diamondback President and CFO Kaes Van't Hof touted the benefits of the pending Endeavor deal and of overall competitor research in an earnings call.

“We spend a lot of time looking at ourselves. We also spend a lot of time looking across the fence line at what other people are doing, either through the M&A process or just general competitor analysis,” Van’t Hof said.

For instance, competitor learnings have helped Diamondback add the Wolfcamp D and Upper Spraberry benches into more of FANG’s core development plans, he said. And acreage that was previously deemed Tier 2 becomes closer to so-called Tier 1 assets.

Diamondback CEO Travis Stice agreed, arguing the company has historically done a “really good job of checking our egos at the door” when integrating acquired companies “and finding out what’s really working.

“It’s a culture of seeking first to understand as opposed to being understood,” he added. “It’s culturally ingrained not only to rigorously examine our own internal results, but also spend intellectual capital on looking across the barbed wire fence at what others are doing.”

And M&A brings on a lot of scale that also de-risks the company, Stice said. If Diamondback did one or two big drilling projects each quarter, then that puts a lot of pressure on each individual project.

“But here we can have four, five, six of these coming on every quarter. And that allows us operational flexibility to move around and plan our business. And that's just one of the other benefits of size and scale that will only be magnified with the potential of the Endeavor merger,” Stice added.

There’s also small-ball M&A. The Permian’s Vital Energy, for instance, paid a combined nearly $2 billion last year to scoop up the bulk of acreage from Driftwood Energy, Forge Energy, Henry Resources, Tall City and Maple Energy.

The deals added 88,000 net acres, 465 gross oil-weighted locations and 280 future well locations. And Vital added another 185 via new geology and geophysics evaluation, improved economics and higher well performance.

“We're switching a little bit more to ‘Moneyball,’ which is ‘Let's spend [via] testing new zones and get wells—not for free, but almost for free,’” Vital CEO Jason Pigott said.

Efficiencies galore

A few years ago, many companies struggled with too-tight well spacing and interference as the shale game evolved. But most of those mistakes are now in the past and drilling and completions practices are becoming increasingly efficient.

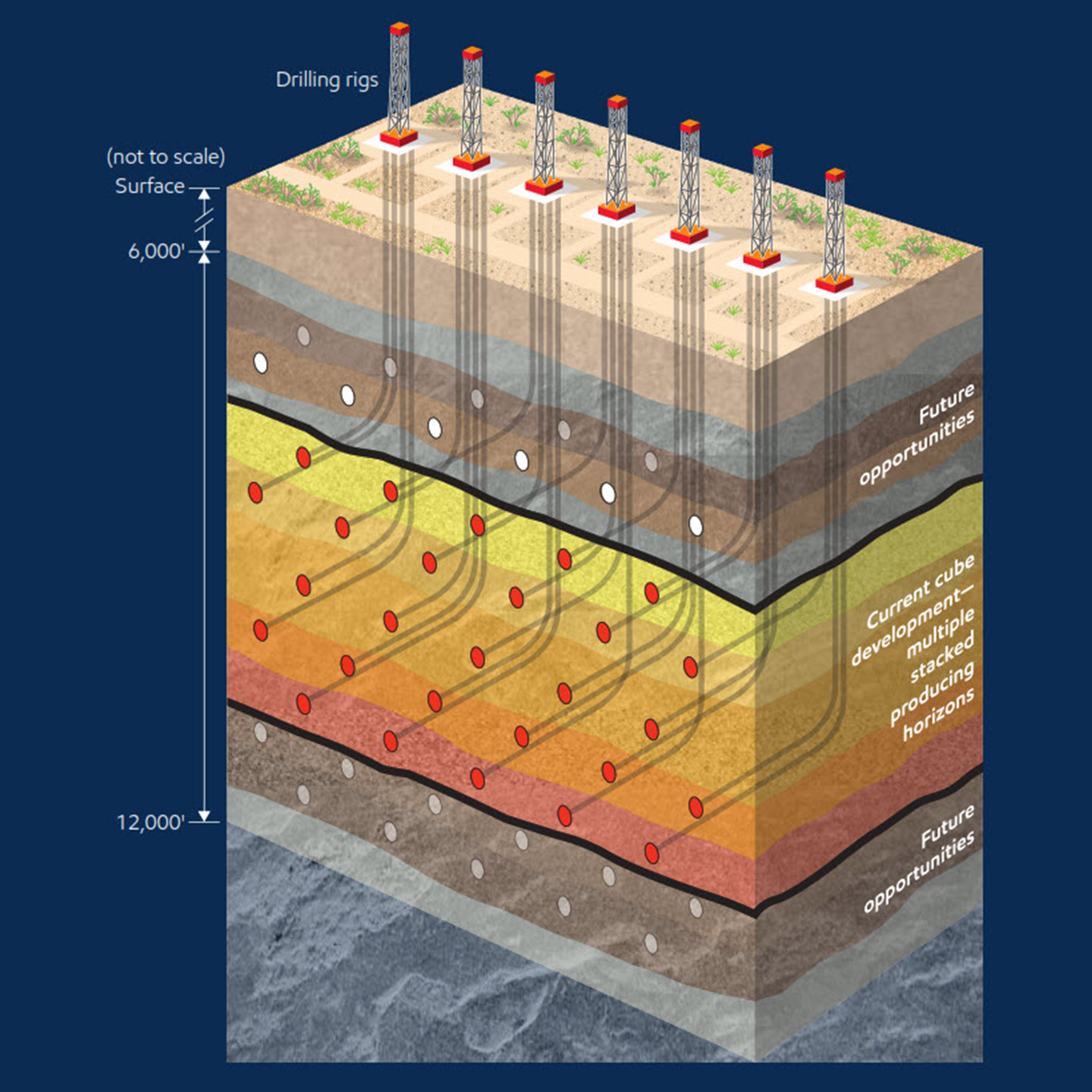

There is more refined cube development and ever-longer laterals with more drilled four miles long. There are more precise completion designs and higher-intensity fracs with additional sand and water.

The projects are larger and producers are working with the same drilling and completions crews for longer periods, maintaining consistency and knowledge.

Simul-fracs became a big deal a few years ago to complete wells more quickly and, now, so-called “trimul-fracs” are in vogue–stimulating three wells simultaneously–led by Ovintiv and others.

“We are constantly looking for ways to improve cycle time and reduce the number of days on location,” said Ovintiv COO Greg Givens, arguing that the company’s average completion speed of more than 4,000 feet per day with trimul-frac wells was 9% faster than in 2022. Ovintiv pumped nearly 30% more slurry and increased equipment utilization almost 15% for an average of 18 pumping hours a day, he said.

“We expect to utilize trimul-frac on more than half of our program this year,” Givens said. “This approach yields a 15% savings and completions cost per foot, and essentially doubles the completed feet per day versus a traditional zipper frac.”

Vital also praised its frac design on gains, said Kyle Coldiron, vice president of new well delivery.

“We put a high-intensity, tight cluster-spacing, high proppant-loading completion design on these wells, and we think that certainly contributes,” Coldiron said.

Exxon Mobil leans heavily on cube development in the Permian and likes to touts its “manufacturing approach.” For Exxon, that also means building up a bigger backlog of DUC wells in 2024, said CEO Darren Woods during an analyst call.

Having a backlog of strategically located DUCs helps maintain manufacturing consistency when you’re overseeing a complex system of drilling and fracking, Woods said.

“It is a very paced continuum of work and production,” Woods said. “So there are constraints that you hit as you're doing that consistently across all that acreage, and having some DUCs available to us allows us, when we run into an issue with what we're doing in the immediate vicinity, to have some other opportunities to continue the production. So we use it like any other inventory.”

On the other hand, EOG Resources CEO Ezra Yacob specifically criticized relying on a manufacturing system in the Permian, although he didn’t name any companies. So there’s no cookie-cutter approach that works for every company.

“We actively avoid falling into manufacturing mode where one well design is stamped out across a basin,” Yacob said in a call. “Rather, we adhere to the discipline of continuous improvement such that the latest learnings get embedded into the next well and transferred to the next basin.”

EOG recently hit the milestone of producing more than 1 MMboe/d in overall volumes.

EOG President Billy Helms touted the company’s “motor program” for reducing downtime, yielding a 15% improvement in footage drilled per rig.

RELATED: EOG Resources Wildcatting Veteran Billy Helms to Retire

For completions, EOG continues to expand its super-zipper operations, reduce frac fleet move times and decrease stage pump times due to increased horsepower for frac fleet, resulting in a 7% improvement in completed footage per frac fleet in 2023. “And we expect to continue seeing the benefit of those gains throughout 2024,” Helms added.

Crews shedding tiers

The results may be a bit more subjective, but crew consistency is another big reason for efficiency gains, Sorbara said.

Companies are hesitant to add drilling rigs and scare off shareholders with rising spending. But they also are afraid to cut drilling rigs, including their crews.

“Most producers are maintaining the status quo,” Sorbara said. “You don’t want to lose a crew that’s operating faster and faster.

“It’s a more refined approach now,” he said. “There’s less experimentation overall. Even if it’s Tier 2 acreage, you’re just upsizing your completion.”

Most companies are keeping production relatively flat in 2024, but they’re doing so without adding to their expenses either. Any time you add a rig, you risk bringing on either older equipment or inexperienced crews, and the hard-won efficiency gains can start to slip away, he said.

And, for companies with multiple-basin strategies, they can shift spending from gassy plays to more liquid ones to avoid adding overall costs.

Coterra, for instance, will increase spending in the Permian for 2024, but the overall capital budget is down 12%. That’s because it is cutting its Marcellus Shale capital budget by more than 50%.

EQT said in early March it started to cut gross production by about 1 Bcf/d in “response to the current low natural gas price environment.” EQT expects to maintain the curtailment through March and then reassess.

And EQT isn’t alone. Gas players Chesapeake, Comstock Resources and Antero Resources all said they would notably cut back production or pull back because of the low natural gas pricing environment.

Chesapeake lowered its previous capex guidance by about 20%. Antero said it expected its gas production to decline by 3% in 2024, and that its drilling and completion capex budget would plunge 26%. Comstock plans to cut two rigs in the Haynesville Shale.

And, while gas prices remain low, some producers, such as Chesapeake, are building up their DUC backlogs for a sunnier pricing environment.

“They can just flip the switch in 2025,” Sorbara said.

Still, these efficiency gains can’t last forever. Deflation is temporary and the core acreage zones only have so much life left in them.

“There’s not a lot of the core left,” Sorbara said. “They’re all acquiring and depleting assets. It’s just tough to pinpoint when we’re going to see a decline.”

And the industry has a history of surprising to the upside when it comes to innovation, especially as more machine learning and artificial intelligence continue to enter the fray.

“Every time you think capital efficiency has peaked, then it just keeps getting better and better,” he said. “Every time you think you hit a technical limit, you just keep pushing forward. The technology keeps making life easier.”

Hart Energy editors Nissa Darbonne, Jennifer Pallanich and Chris Mathews contributed to this report.

Recommended Reading

Nabors, Corva Expand Alliance to Boost AI-Driven Innovation at Rig Sites

2025-04-11 - Nabors Drilling Technologies and Corva AI will use the RigCloud platform to provide real-time insights to crews directly at drilling sites, the companies said.

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.