Gas-weighted assets’ M&A values have declined with gas futures since 2022, according to J.P. Morgan Securities analysis. (Source: Shutterstock.com)

Permian Basin M&A remains the onshore Lower 48’s priciest market in terms of dollars paid per flowing barrels of oil equivalent per day, while values in all other regions have fallen this year, according to a J.P. Morgan Securities analysis.

In deals to date this year, including the $26 billion Diamondback Energy bid for the Midland Basin’s Endeavor Energy, the average winning offer is $38,398 per boe/d, analyst Arun Jayaram reported.

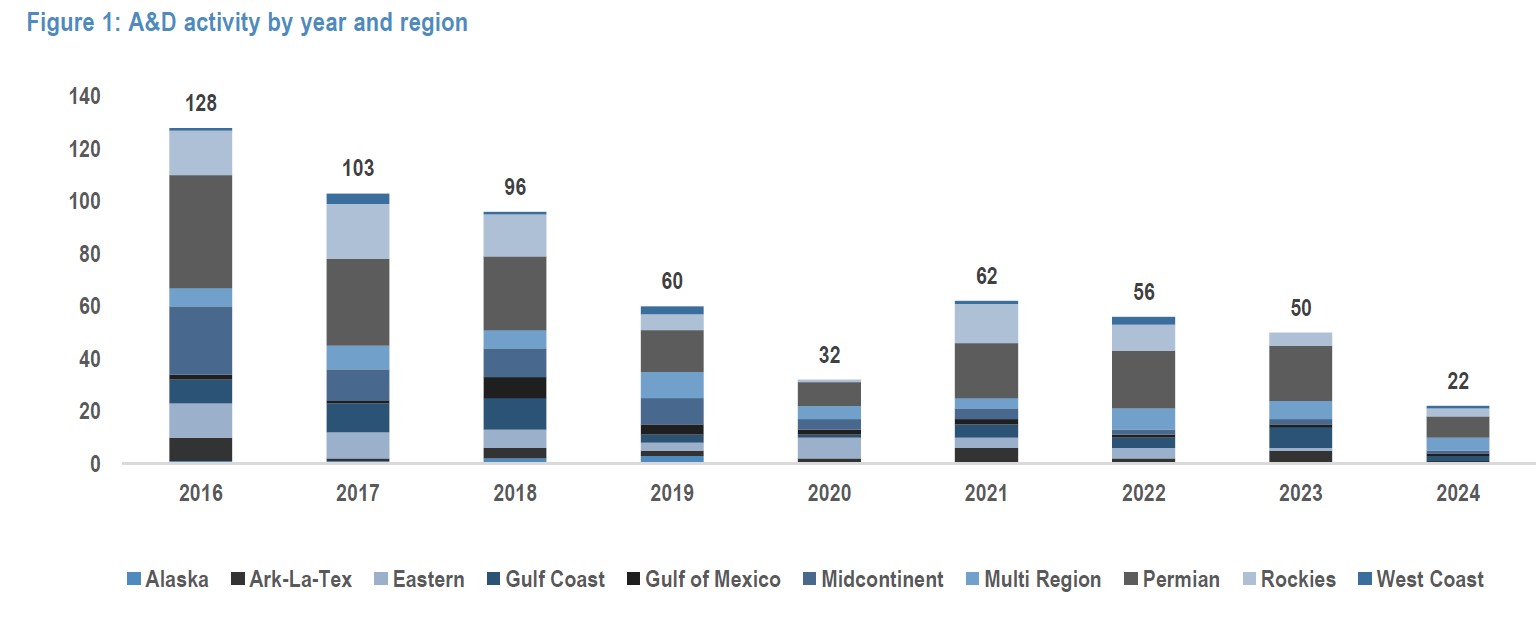

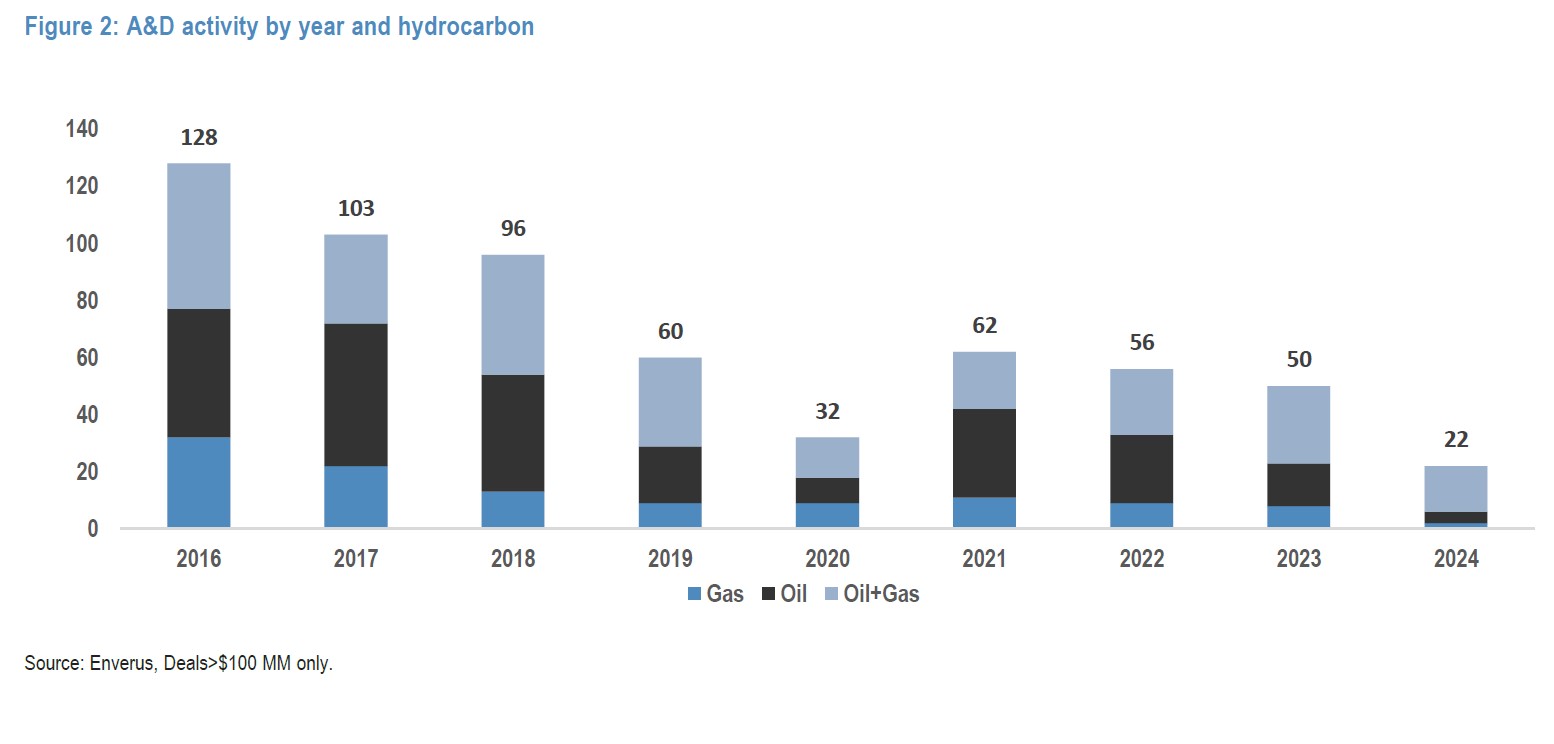

Jayaram reviewed deals valued at more than $100 million in Enverus’ database.

The 2024 price for Permian barrels and associated gas is up from an average $36,778 per boe/d in 2023, which included Exxon Mobil’s winning $59.5 billion bid for Midland Basin-focused Pioneer Natural Resources.

In Enverus’ Rockies region, which includes the Bakken and the Powder River and the Denver-Julesburg basins, values fell by 5%. Data show Rockies M&A values averaging $34,952 per boe/d value so far this year, down from $36,778 in 2023.

In the Midcontinent, which includes Oklahoma’s Anadarko Basin, values declined to $24,167 from $27,149, or 11%.

And the Gulf Coast, which includes the Eagle Ford, has received winning bids averaging $27,181 per boe/d, down a precipitous 41% from $36,694 in 2023.

The gas-weighted Ark-La-Tex area, which includes the Haynesville, has seen its value decline in step with gas futures. Deal values fell to $9,120 per boe/d so far this year compared to 2022’s $15,492. Natural gas spot prices rocketed in 2022 due to new European demand for LNG as a result of the start of Russia’s newest attempt to annex Ukraine.

More M&A underway

Overall, the average price paid this year per boe/d throughout the U.S., including Alaska and the Gulf of Mexico, has declined sharply to $30,364 per boe/d from the 2023 average of $35,109 and 2022’s $39,765, according to Jayaram’s analysis.

But more dealmaking is underway, he added.

“At the J.P. Morgan energy conference in mid-June, most E&P operators echoed expectations of further consolidation activity in the industry,” he reported.

Two major deals have been announced since the mid-June conference: SM Energy’s $2-billion bid for Uinta Basin-focused XCL Resources and Devon Energy’s $5 billion bid for Bakken-focused Grayson Mill Energy.

“An additional observation from our analysis is a decline in the mix of gas-focused transactions in 2024 vs. 2023 … while the share of ‘oil+gas’-focused transactions has increased in 2024,” Jayaram reported.

But 2024’s profile may be updated before 2025, he added. “We caveat these metrics by noting that deal activity trends may change as the year progresses.”

Recommended Reading

Equinor Subsidiary Contracts Valaris Drillship Offshore Brazil

2024-07-22 - Valaris and Equinor Energy do Brasil’s multi-year contract is valued at approximately $498 million.

Upstream, Midstream Dividends Declared in the Week of July 8, 2024

2024-07-11 - Here is a selection of upstream and midstream dividends declared in the week of July 8.

Texas Pacific Land Declares Largest Special Dividend

2024-06-14 - Texas Pacific Land’s $10 per share dividend will cost the company approximately $230 million.

Cheniere Increases Share Repurchase Budget by $4B Through 2027

2024-06-18 - Cheniere will also increase its quarterly dividend by approximately 15% to $2 per share annualized.

Talos Ups Buybacks, Pays Down Debt Post $1.29B QuarterNorth Deal

2024-07-22 - Talos Energy said it repaid $325 million in debt since closing its $1.29 billion cash-and-stock acquisition of E&P QuarterNorth in March.