For May, across all basins and among all operators, J.P. Morgan counted 1,185 new permits for horizontals—roughly the same as April and March. (Source: Shutterstock)

Private operators are continuing their dominance in pulling new drilling permits in the Anadarko and Powder River basins and have regained their lead in the Haynesville Shale, D-J Basin and Williston Basin, according to a new report.

The overall ratio of new permits issued to private E&Ps remains on a monthly average between 39% and 46% this year, while public operators have been pulling the balance, according to J.P. Morgan Securities, citing Enverus data.

“The mix of private-company permits dropped to 40% [in May] after rebounding to 46% in April and compares [with] 39% in March and 45% in February,” analyst Arun Jayaram reported.

Overall, private operators received 478 permits for horizontals in May, compared with 707 pulled by public E&Ps, Jayaram wrote.

Among those, 53 permits were for new Delaware Basin wells, where public operators dominate, down from 160 permits in April. In the Midland Basin, private E&Ps received 181 permits, or 44% of total Midland permits, up from the 116 permits issued in April.

In the Eagle Ford, private operators pulled 36 permits at a third of the total issued that month; in the Powder River Basin, 12 permits were issued out of 13; and in the D-J Basin, 48 out of the total 70 permits were issued.

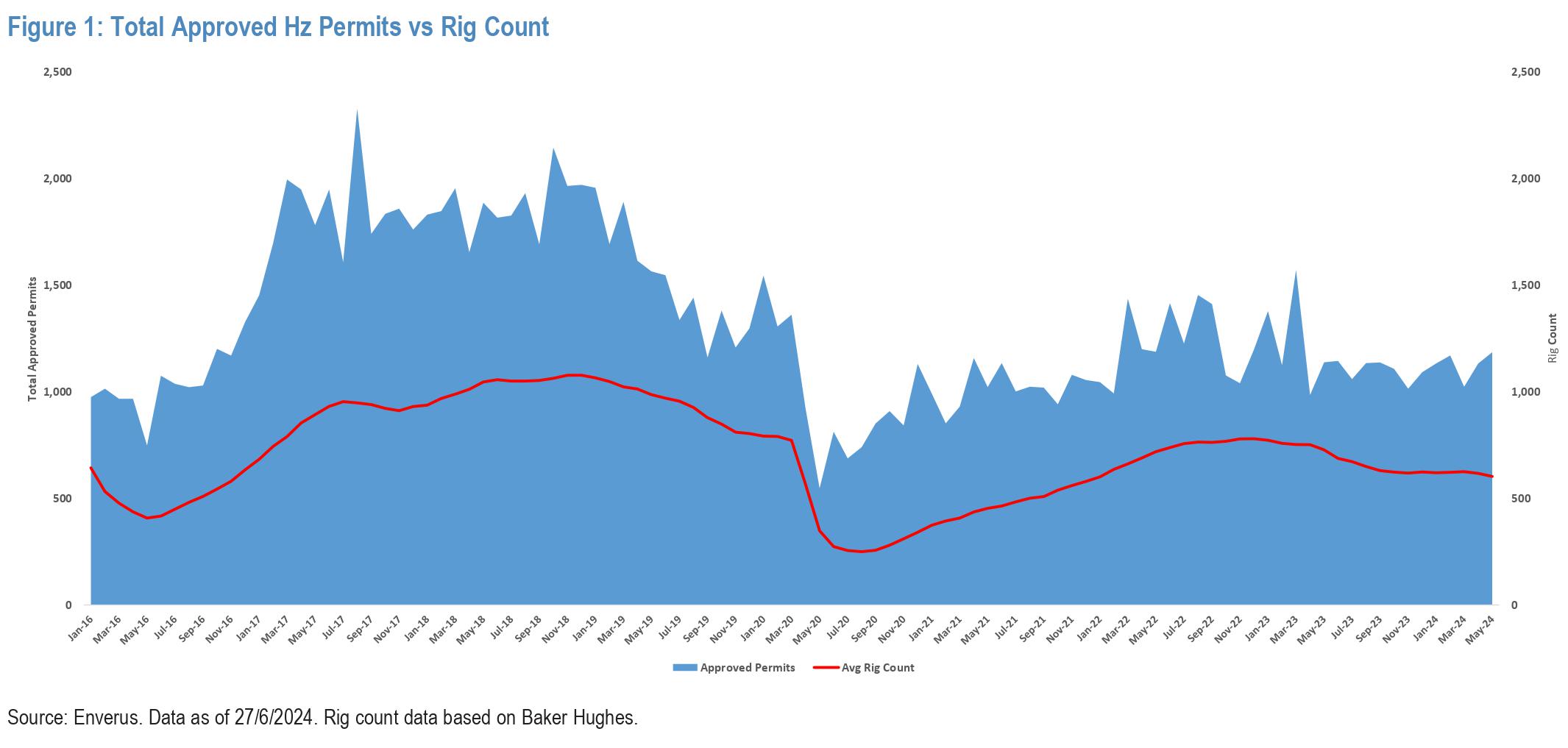

For May, across all basins and among all operators, J.P. Morgan counted 1,185 new permits for horizontals—roughly the same as April and March.

Among those, “public E&Ps received 707 permits—versus 604 permits in April and 628 permits in March—while privates received 478 permits, versus 528 permits in April and 395 permits in March,” Jayaram wrote.

Among public operators, pulling the most permits in May was Exxon Mobil with 90 permits, followed by Devon Energy with 74 permits, Jayaram reported.

Among total outstanding permits, EOG Resources has the most with 1,206 permits, followed by Exxon Mobil (983), Chevron Corp. (858), Devon (772), ConocoPhillips (566), Occidental Petroleum (559), Permian Resources (391) and Marathon Oil (293).

J.P. Morgan’s counts deduct antique permits, calculating “active permits” instead, “ignoring active permits for wells that are [already] active or have already been completed/abandoned,” Jayaram wrote.

“We consider ‘New Drill’ permits for oil, gas, oil and gas and confidential well types in our methodology of calculating approved permits for horizontal wells.”

Recommended Reading

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.