PICTURED: An oil pumpjack near Midland, Texas. The Permian Basin is expected to drive U.S. oil production growth in 2025 and 2026, according to EIA forecasts. (Source: Shutterstock.com)

It’s full steam ahead for oil producers in the mighty Permian Basin. But for other maturing Lower 48 basins, the train may be leaving the station.

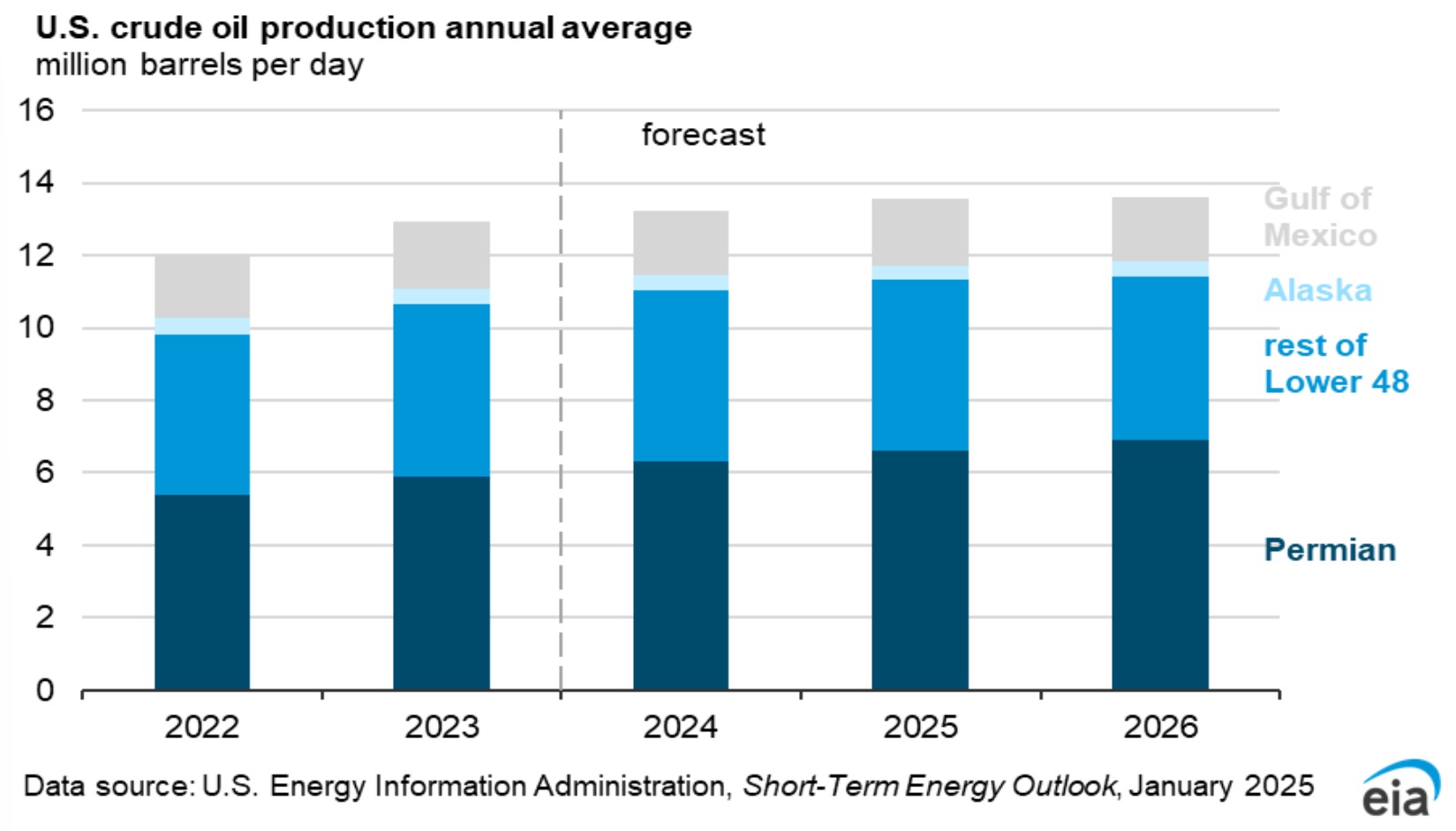

Crude production across the Lower 48, outside of the Permian Basin, is expected to remain flat this year, according to new forecasts published Jan. 14 by the U.S. Energy Information Administration.

In 2026, non-Permian Lower 48 oil production is expected to decrease by approximately 170,000 bbl/d, or about 4%.

“The declines in other regions are because of reduced drilling and completion activity, partly in response to lower crude oil prices,” EIA researchers said in the January 2025 Short-Term Energy Outlook.

“In addition, regional well productivity, takeaway capacity and access to international markets are more limited in other regions than in the Permian,” they said.

The Permian will account for the largest source of U.S. oil production growth this year and next. Permian oil output will grow by about 300,000 bbl/d in both years, averaging 6.6 MMbbl/d in 2025 and 6.9 MMbbl/d in 2026.

Drilling capital and M&A dollars are pouring into the Permian, where major producers like Exxon Mobil, Chevron, ConocoPhillips, Occidental Petroleum and Diamondback Energy have significant portfolios.

Exxon Mobil took the Permian’s top spot as oil producer after completing a transformational $60 billion acquisition of Pioneer Natural Resources in May 2024.

Oil production from the Gulf of Mexico (GoM) is also expected to provide a lift this year, growing to 1.8 MMbbl/d in 2025.

Earlier this month, Shell announced first oil from its Whale floating production facility in the GoM, less than eight years after the field’s discovery in 2017.

The Whale production facility, located in the Alaminos Canyon Block 773, is operated and 60% owned by operator Shell Offshore. Chevron USA Inc. owns the other 40%.

Last summer, Chevron announced first oil from its deepwater Anchor project in the GoM. It was the first oil production from any of the region’s super high-pressure formations at 20,000 lb psi.

Experts say the Anchor breakthrough could enable future projects to move forward in ultradeep, ultra-high-pressure GoM fields.

RELATED

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

Lower 48 plateau

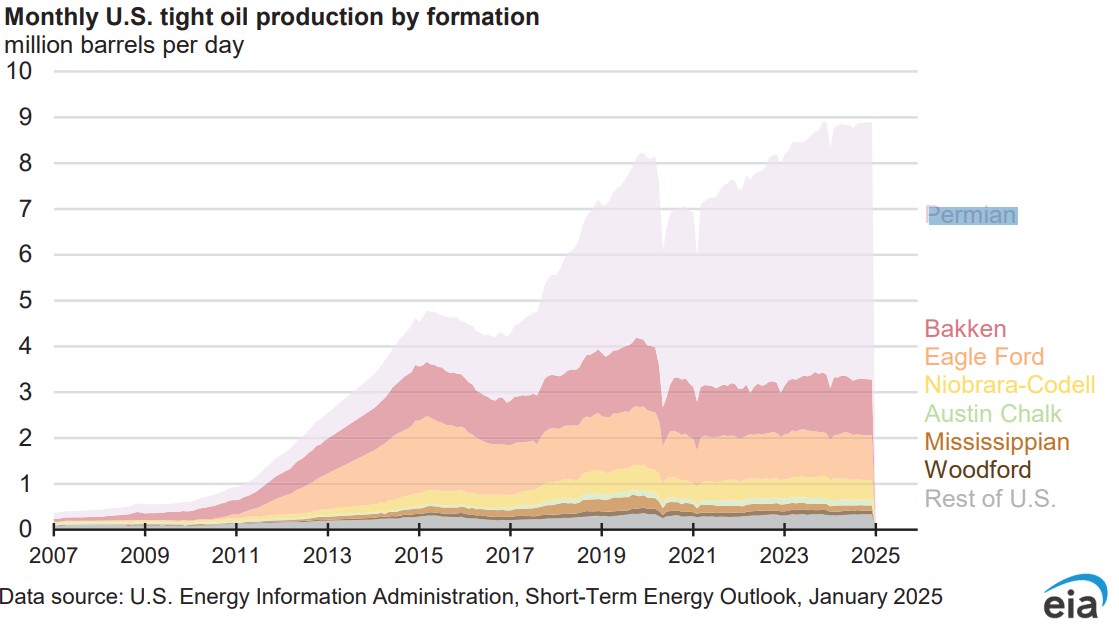

With so much attention on the Permian, other U.S. shale oil plays—like the Williston Basin’s Bakken and the South Texas Eagle Ford Shale—have seen a decline in investment.

Bakken oil production averaged 1.23 MMbbl/d in 2024 and the Eagle Ford 1.16 MMbbl/d, per EIA figures.

Both basins pale in comparison to the prodigious Permian, which produced 6.31 MMbbl/d last year.

Bakken and Eagle Ford oil production has largely flatlined. Bakken output is forecast to average 1.25 MMbbl/d this year and 1.23 MMbbl/d in 2026.

Eagle Ford oil production is expected to average 1.16 MMbbl/d this year and 1.12 MMbbl/d in 2026.

RELATED

Shale Outlook Permian: The Once and Future King Keeps Delivering

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.