Experts say opportunities to add high-quality drilling inventory remain in the Permian Basin after a record run of consolidation. (Source: Shutterstock)

After a whirlwind run of record-setting Permian Basin M&A, there are fewer options left to buy. But experts say opportunities to add high-quality drilling inventory remain in the basin—if you’re willing to pay up.

The U.S. upstream space saw over $192 billion in corporate M&A get inked in 2023, and dealmaking has continued in the first half of 2024. The bulk of the activity came from the Permian Basin, the nation’s top oil-producing shale basin.

Acquisitive operators are looking for drilling runway around the Permian, with an eye toward high-quality locations that break even at or below a $50/bbl oil price. But buyers will need to get creative to find them.

To hoard or divest?

One area where E&Ps might potentially find needle-moving, accretive Permian deals is the divestiture market, said Andrew Dittmar, senior M&A analyst for Enverus Intelligence Research.

It’s a question the firm gets asked a lot: When will E&Ps engaging in massive corporate mergers begin marketing non-core assets?

Large-scale merger terms typically include taking on loads of debt, which begets divestiture activity as the combined company monetizes non-core assets to deleverage.

Occidental Petroleum is wading deeper into debt to make a $12 billion acquisition of CrownRock LP, a private E&P with a deep inventory in the Midland Basin. To reduce its debt load, Occidental plans to sell up to $6 billion in non-core U.S. assets.

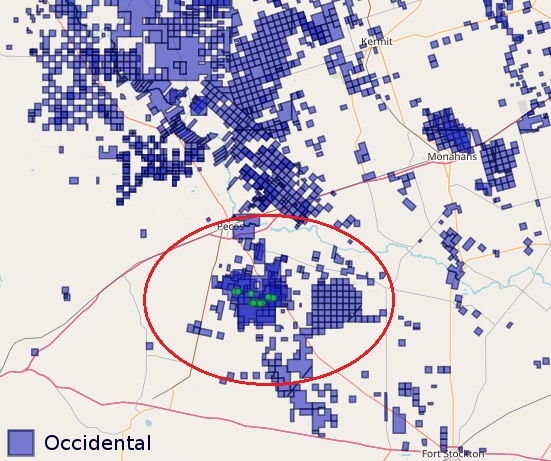

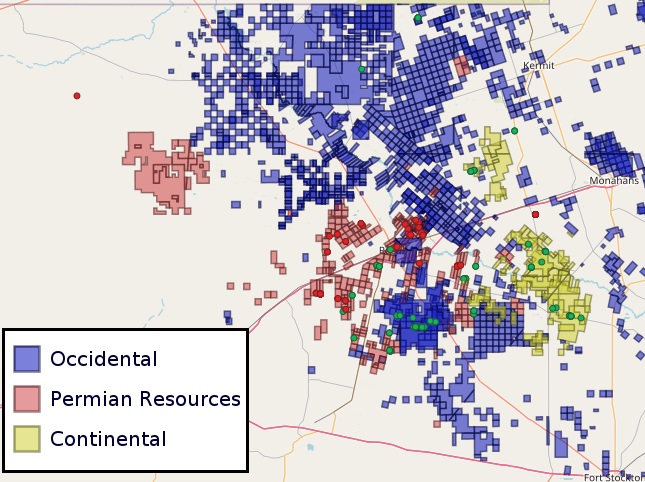

Occidental has reportedly already started work on a divestiture program in the Permian Basin.

The company is exploring a sale of assets and acreage in the southern Delaware Basin that could fetch more than $1 billion, Reuters reported earlier this month.

Occidental is reportedly working with a financial adviser to market the assets in the Barilla Draw region in Reeves County, Texas.

It’s a part of the southern Delaware that’s home to several acquisitive E&Ps. Permian Resources, which grew in the Delaware through a $4.5 billion acquisition of Earthstone Energy last year, has a major footprint in the neighborhood.

Continental Resources, the private E&P owned by Bakken wildcatter Harold Hamm, is also deep in the area. Continental entered the southern Delaware through a $3.25 billion acquisition from Pioneer Natural Resources in late 2021.

Continental has also been adding leases in the Midland Basin, including land and assets previously held by Occidental, according to Texas Railroad Commission (RRC) records. Occidental disclosed selling certain non-core Permian properties for a net gain of $142 million in its most recent annual report.

Large E&Ps with footprints in the area include Devon Energy, EOG Resources and ConocoPhillips.

Occidental’s southern Delaware assets might interest buyers seeking depth in the neighborhood. But would-be buyers might need to rely less on a robust divestiture market in this current cycle of M&A, Dittmar said.

Investors and analysts are essentially wholly focused on inventory quality right now. Companies with deeper portfolios of high-quality drilling inventory are typically valued higher and trade at higher multiples than companies with weaker inventories.

But, for the most part, E&P balance sheets are strong, free cash flow is bountiful and debt levels are low. Companies that are still worried about inventory depth aren’t necessarily incentivized to sell that longevity off to a competitor.

“You don’t want any nasty downsides or surprises where you have less inventory than what you thought you had because of parent-child well interference or you’re having to use wider spacing,” Dittmar said during the 2024 Enverus Evolve conference in Houston.

Three of the Permian’s top inventory holders have been acquired in massive deals since last fall:

- Exxon Mobil acquired Midland Basin giant Pioneer Natural Resources for around $60 billion. The deal closed May 3;

- Diamondback Energy inked a deal to acquire private Midland producer Endeavor Energy Resources for $26 billion—currently delayed by requests from the U.S. Federal Trade Commission; and

- Occidental’s $12 billion acquisition of CrownRock gives the company a deeper portfolio of low-breakeven Midland locations.

Smaller E&Ps Permian Resources, Civitas Resources, Ovintiv Inc., Vital Energy and Matador Resources also added Permian depth through M&A last year.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

Holding the line

Large-scale corporate M&A dominated the end of 2023. But private equity exits made up a large chunk of the shale M&A activity in preceding years, as commodity prices improved emerging from the COVID-19 pandemic.

Significantly fewer attractive privately held inventory holders remain in the Permian after that wave of consolidation.

But an interesting list of family-owned oil companies—and a handful of private equity backed E&Ps—stand out among the private pack left standing in the Permian.

“We do have quite a bit of private inventory still in the Permian Basin—I think that’s the good news,” Dittmar said. “The bad news is, it’s largely held by the private family companies, as opposed to the institutionally backed companies.”

Family oil companies operate differently than other private E&Ps. Private equity backed E&Ps are built with the intention of selling them to a larger player for a significant return on investment.

Family-owned oil companies are generally built to last and have different considerations for selling.

Many of these companies have produced oil and gas for decades and through several generations—companies like Mewbourne Oil and Fasken Oil & Ranch, two of the top private inventory holders remaining in the Permian Basin.

But unlike private equity, family oil companies don’t necessarily have a fund timeline or a goal to exit. The finances of a family oil company are closely tied to the family’s private trust, which typically diversifies investments into other sectors.

But don’t rule out the possibility: 85-year-old billionaire wildcatter Autry Stephens sold Endeavor, a company he first launched in 1979, in the largest buyout of a private oil producer Enverus has ever tracked.

Enverus also singled out a few attractive institutionally backed Permian E&Ps with inventory depth:

Franklin Mountain Energy has built a position in Lea County, New Mexico, in the core of the Delaware Basin oil play. The company was launched in 2018 and is backed by the founders of Western Refining, which sold to Tesoro Corp. for $6.4 billion in 2017.

Ameredev II LLC, backed by EnCap Investments LP, has also grown a sizable footprint in the Delaware Basin. EnCap has reportedly explored a sale of Ameredev II.

The Double Eagle IV team is building up a position in the core of the Midland Basin, RRC data show. The private E&P launched in 2022 with over $1.7 billion in investor commitments.

The latest iteration of Double Eagle is led by co-CEOs Cody Campbell and John Sellers, who in 2021 guided Midland Basin E&P Double Eagle III—a subsidiary of DoublePoint Energy LLC—through a $6.4 billion sale to Pioneer Natural Resources.

FireBird Energy II, backed by private equity firm Quantum Energy Partners, is also building a core Midland Basin position, including leases in Midland, Upton, Glasscock and Crane counties, Texas.

FireBird II produced 782,167 bbl of crude in January, or an average 25,200 bbl/d, according to the most recent RRC figures.

RELATED

Mewbourne Oil: The Biggest Little Producer in the Permian

Go big

To think about the future of Permian M&A also requires a new look at the basin’s biggest players.

Scott Hankey, a Goldman Sachs managing director for the bank’s U.S. upstream coverage, disagrees with the notion that all the big Permian players are gone after the deluge of dealmaking in the basin.

Exxon Mobil plucked Pioneer Natural Resources, a roughly $70 billion company, off the drawing board. But in Pioneer’s place, the tie-up between Diamondback and Endeavor will yield a new public E&P with a market value of more than $50 billion.

A void left by Diamondback might be filled by a company like Permian Resources, which grew into a large-cap player with a roughly $13 billion market valuation after a string of acquisitions last year.

“It’s just a change and it’s changed quite a bit,” Hankey said during the Enverus Evolve conference.

Analysts say more public-public merger activity could be on the horizon as opportunities to acquire deep private portfolios decline.

RELATED

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

Recommended Reading

Oil Jumps 4% After Trump Pauses Tariffs on Many Countries, Raises China Levy

2025-04-09 - Oil prices bounced back after U.S. President Donald Trump said he would further increase tariffs on China but pause the tariffs he announced last week for most other countries.

Oil Prices Fall into Negative Territory as Trump Announces New Tariffs

2025-04-02 - U.S. futures rose by a dollar and then turned negative over the course of Trump's press conference on April 2 in which he announced tariffs on trading partners including the European Union, China and South Korea.

Oil Prices Extend Losses on Global Trade War, Recession Fears

2025-04-04 - Investment bank JPMorgan said it now sees a 60% chance of a global economic recession by year-end, up from 40% previously.

E&P Execs Level Scathing Criticism at Trump's Drill Baby Drill 'Myth'

2025-03-26 - E&P executives pushed back at the Trump administration’s “drill, baby, drill” mantra in a new Dallas Fed survey: “’Drill, baby, drill,’ does not work with [$50/bbl] oil,” one executive said.

Trump to Host Top US Oil Chief Executives as Trade Wars Loom

2025-03-19 - U.S. President Donald Trump will host top oil executives at the White House on March 19 as he charts plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.