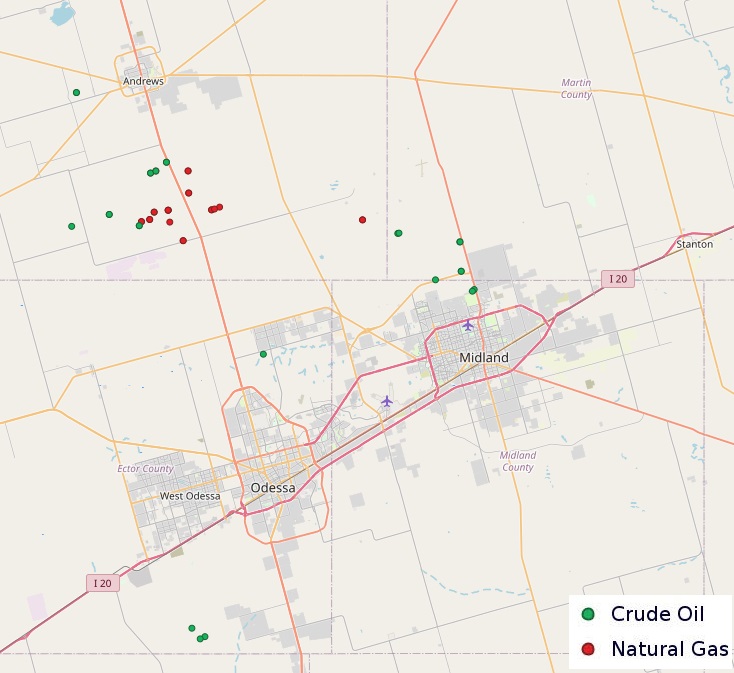

E&Ps are scouring the area around Midland, Texas (pictured), for drilling locations in the less-targeted Barnett Shale, Texas Railroad Commission data show. (Source: Shutterstock.com)

Permian operators are looking at deeper intervals and extensional windows of the basin in the never-ending search for drilling runway.

Drilling and permitting activity has picked up for less-targeted intervals in the Permian Basin, like the Barnett Shale and the Woodford formations, according to Texas Railroad Commission (RRC) filings.

A handful of operators are also delineating new horizontal activity in more far-flung extensions of the Permian, like Dawson County to the north of the basin.

Most E&Ps in the Permian are targeting the basin’s most popular intervals—the Spraberry and Wolfcamp formations in the Midland Basin, and the Bone Spring and Wolfcamp formations in the Delaware Basin.

But a growing number of operators are evaluating the potential of less-tapped zones underground as top-tier Permian drilling locations become scarce.

RELATED

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

Barnett Shale

Producers have used horizontal wells to target the Barnett shale gas field outside of Fort Worth, Texas, for a long time. In fact, George Mitchell’s pioneering efforts in the Barnett Shale gas field put U.S. horizontal drilling and hydraulic fracturing on the map in earnest.

But targeting the Barnett Shale in the Permian Basin is a relatively new development, even though operators like Elevation Resources have tapped the Permian Barnett since the middle of last decade.

The number of drilling permits approved for new horizontal wells targeting Permian Barnett zones has increased steadily coming out of the COVID-19 downturn, RRC records show.

The bulk of the new Barnett drilling activity has emerged on the Midland side of the basin, to the west of the play along the Central Basin Platform.

Occidental Petroleum is among the leading operators drilling new Permian Barnett horizontals in Martin County, Texas.

The company submitted data on 14 new horizontal wells targeting the Emma Barnett Shale field in Martin County since the start of the year, RRC data show. Occidental has been drilling Barnett wells on its South Curtis Ranch and East Cross Bar Ranch leases.

Occidental is getting larger in the Permian Basin through a $12 billion acquisition of private producer CrownRock LP. The company expects to close the CrownRock deal in August after clearing antitrust scrutiny by the U.S. Federal Trade Commission (FTC) earlier this month.

Other large Permian operators, including ConocoPhillips, Endeavor Energy Resources and Continental Resources, have submitted data on their own Permian Barnett wells this year.

ConocoPhillips subsidiary COG Operating has drilled two Barnett horizontals—one in Ector County, Texas, the other in Andrews County, Texas, per RRC data.

ConocoPhillips is also getting deeper in the Permian through a $17.1 billion acquisition of public rival Marathon Oil.

Endeavor Energy Resources, another large-scale private producer, submitted data on a Barnett horizontal brought online in Midland County earlier this year.

Diamondback Energy is acquiring Endeavor in a $26 billion transaction, a deal that’s also drawn FTC scrutiny.

Continental Resources, the private E&P owned by billionaire wildcatter Harold Hamm, has also been applying its exploration expertise in the Permian Barnett.

Continental was a relatively late entrant into the Permian Basin when it acquired Pioneer Natural Resources’ Delaware Basin assets for $3.25 billion in 2021. But Continental has quietly been adding leases on the Midland side of the basin as it explores for future drilling runway.

Continental has been drilling Barnett wells in the Midland Basin and targeting the deep Woodford interval in the Delaware Basin, records show.

Elevation Resources and Fasken Oil & Ranch, a family-owned oil producer that’s attracted M&A interest from larger operators, have also actively targeted the Permian Barnett with horizontal wells this year.

Permitting records show a greater number of operators with interest in the Permian Barnett.

This year, the RRC has approved permits for new Permian Barnett horizontal wells for Diamondback, Pioneer Natural Resources, Vital Energy and private equity-backed E&P Double Eagle IV.

Diamondback drilled a handful of wells in past years targeting the Peart Barnett Field along the Ector-Crane county line.

RELATED

Royale Reports Favorable Results in Permian’s Mississippian Interval

Dawson dive

Horizontal stepout activity has also continued in Dawson County, on the northern fringes of the Midland Basin.

Interest in Dawson is being led by EOG Resources Inc., which has been exploring across different leases along the southern edge of the county.

SM Energy has been exploring the Dean Formation, which overlies the oily Wolfcamp A, in Dawson County.

Private E&Ps Birch Operations and Ike Operating (formerly Pinon Operating) have also been testing wells in Dawson County this year.

Hibernia Resources IV has also been approved for a handful of new horizontal wells in Dawson County, according to RRC permits.

The previous iteration of Hibernia, Hibernia Resources III, sold to Civitas Resources last year for $2.25 billion in cash. Hibernia III had developed around 38,000 net acres in Upton and Reagan counties.

RELATED

Northern Midland: EOG Brings on Dean Oil Well in SE Dawson Stepout

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Exclusive: Halliburton's E-Fleets Lower Haynesville Completions Costs

2025-04-14 - Halliburton’s Neil Modeland, senior business technology development manager, shares insight into the company’s electrification services and efforts to minimize associated completions costs in the Haynesville Shale, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.