The Exxon and Mobil merger closed 25 years ago on Nov. 30, 1999, marking the biggest corporate merger ever at the time.

This year, Exxon Mobil closed its biggest acquisition since then with its purchase of Pioneer Natural Resources in the Midland Basin for $60 billion.

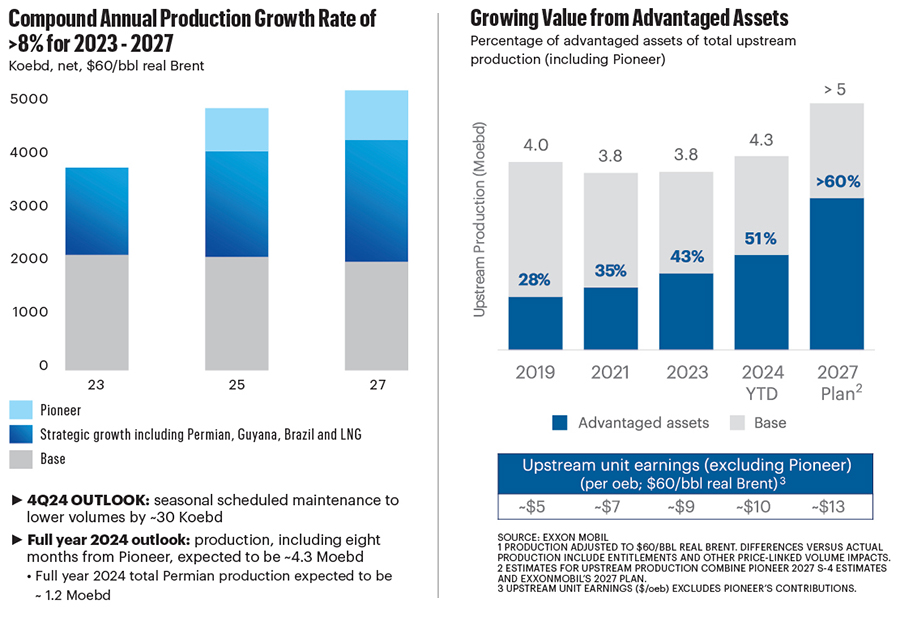

In November, Exxon Mobil announced its highest liquids production in more than 40 years, hitting almost 3.2 MMbbl/d. Overall production also spiked to nearly 4.6 MMboe/d.

Led by the Permian and deepwater Guyana, volumes are expected to surge to more than 5 MMboe/d by 2027.

This growth is overseen by Liam Mallon, Exxon Mobil’s upstream president. A native of Ireland, Mallon joined Mobil in 1990 in Aberdeen, Scotland, later serving in Nigeria, Australia, Canada, Malaysia and, now, in Texas overseeing Exxon Mobil’s global upstream operations.

Mallon sat down with Hart Energy Editorial Director Jordan Blum at Exxon’s Spring, Texas, headquarters to discuss the upstream growth and much more.

Jordan Blum: It’s the 25th anniversary of the Exxon and Mobil merger. How revolutionary was that for the company, and how do you see things evolving from then to today as the biggest oil and gas producer in the Americas?

Liam Mallon: I was in Nigeria with Mobil when it was announced. You still remember these moments in your life when you look back. As you can imagine at that time, for many of us it was filled with excitement but also anxiety. Here we are 25 years later, and here I am personally, and truthfully probably never would’ve envisioned that at that time. So, it is pretty exciting. I’m a career oil and gas upstream petroleum engineer. I’m passionate about what we do. I’m passionate about this industry, and was as passionate then 25 years ago.

For me, personally, being part of that, and then several years later acquiring XTO [Energy]. And then, of course, the Pioneer transaction. During all those periods, if I go back, we were producing around 4.5 MMboe/d. Today, we’re producing around [4.6 MMboe/d in the third quarter], and we’re going to grow that substantially as we go forward. It’s a testament, I think, to the people, the ingenuity that this is a depletion business if you think about it. This is a depletion business—depleting at 5% to 7% to 10%—depending on how much investment you include in the calculation. And it depletes at that rate every year. And, yet, here we are 25 years later producing, as Exxon Mobil, about the same. It’s pretty staggering when you look at it from that perspective. Particularly in recent years, doing that and reducing our emissions intensity dramatically makes it a very satisfying proposition. Many things have changed, but many things are the same. It’s 40 years for me in the industry this year in October.

JB: Congrats.

LM: And it feels like yesterday when I walked in at my first petroleum engineering job. Quite a journey.

JB: You were in Nigeria at the time. Of course, Exxon Mobil is still very big globally, but increasingly maybe Americas-centric with all things shale and Guyana. I wanted to just hone in on the Pioneer deal a little bit and get your take on just how transformational this is for the company, and how everything’s going with integration, assessing acreage and everything involved?

LM: Obviously, the Permian is very significant, but we still have a very large global footprint with a very large footprint even in Nigeria as we talked about. We still have a very large, very diverse portfolio that is across all the resource themes, whether it’s tight oil, tight gas, conventional oil, conventional gas, LNG, deepwater, etc.

As it relates to the Permian and Pioneer, I would use the word that you used—I do believe this will be transformational. This, for us, was strategic M&A, and we are very selective about those kinds of opportunities. We really look to find an opportunity where we can bring our competitive advantages and, in this particular case, bring our unique competitive advantages to a great, great company with great people that have their own unique competitive advantages.

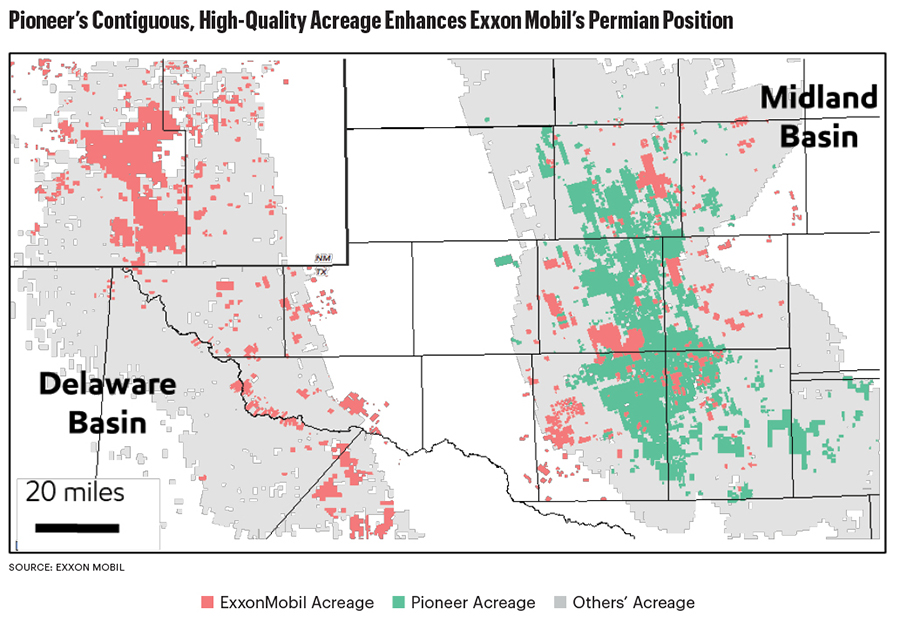

So, what we talk a lot about is bringing the best of both, and that was a very clear principle in this Pioneer-Exxon Mobil combination. We didn’t really view it as an acquisition. We viewed it as a merger of equals within the Permian from a size perspective and volume perspective. What it allowed us to do was to establish, most importantly, a hugely critical, contiguous acreage position. It’s given us the largest inventory of undeveloped wells by far in the industry. That gives us some very unique opportunities to apply our development approaches, our technologies, and bring together the best of both capabilities that you really couldn’t do separately until you stitched all this together.

The contiguous nature and the quality of the inventory really sets the foundation for everything we’ll do from here. It allowed us to bring our net-zero ambitions and apply it to an even bigger footprint, and now produce a significantly larger quantity of Permian oil with net zero emissions. I think all of those combinations made this a two plus two equals five type of opportunity. I would tell you the speed at which we closed on this was quicker than most expected, and I would tell you the speed at which we’ve been integrated is quicker than most expected. It’s going better than expected.

Particularly pleasingly, the vast majority of [Pioneer] people came and stayed. The focus and the effort on ensuring that we bring that best of both, and we make everybody feel welcome and integrate them into one team and one common approach will pay huge dividends for us. The capabilities we see in the Pioneer people exceed even what we expected, and there were high expectations going in. We match that with our people and our capabilities, and I think we built something truly transformational.

JB: You talked about having that massive contiguous footprint, so, obviously, you can do more with longer laterals...

LM: The longer laterals, you can apply higher frac intensities. We take our cube approach, our development approach, which of course industry continues to evolve that approach to optimum. We take that, and we can apply it at scale now to a much bigger footprint. Being able to drill longer laterals, we’ve now drilled several 4-milers this year, and being able to up-space and drive improved frac intensity. We believe we’ll ultimately drive significantly higher recovery than before. We’re a strong proponent of that and bringing our technologies to bear on that. I will tell you though that, equally encouraging, we’ve seen many things on the Pioneer side in terms of practices and approaches that are equally compelling. It will be bringing the best of both to deliver something that I think will be beyond even what we thought going in.

JB: A lot of companies right now have to look more at Tier 2 or 3 acreage. They’re dealing with higher expenses, lower cash flow per boe. That’s not really something you have to be concerned about at this point?

LM: The inventory position, the quality is all well above our investment thresholds with what the industry would call Tier 1, and that lasts for a long time. There is also significant inventory in the lower tiers that I’m confident we will ultimately improve efficiency over time and make that quality work as well. Obviously, two critical things are to lead on an efficiency perspective, to have the optimum development plan from both efficiency and a recovery.

We believe that our approach has always been the most value driven, and that’s always been our objective. We’ve been very clear that we were chasing the highest NPV (net present value) or the highest value development. When we can combine that with the leading efficiency and leading recovery, then you’re going to create a step up. In the early days, I think you’ll see our efficiency metrics are very, very strong on both the drilling side and the completion side. It is always hard to normalize that data because it depends on the efficiency. It’s pretty easy to measure it consistently. We feel confident on that.

JB: Is there anything you can say in terms of melding the cube development with some of the best practices of Pioneer, and any tweaks or adjustments that are being made?

LM: I think what you’re going to see is continued tweaks in spacing and in frac density. We talk openly about our cube approach. [The] industry tends to use these terms. Some best benching, although less so these days. A lot of people talk about co-development, which is sort of a pseudo-cube, but not necessarily the whole stack. And then we’re going after the whole stack in a cube, and you’ll have evolution of cubes as you optimize within that stack and learn as you go. What is the optimum spacing? What’s the optimum frac intensity? What’s the optimum execution development plan? I would just say that’s the magic sauce that we bring that won’t be the same as others bring. What I think we’ve been able to pivot to very quickly is an integrated plan on all the acreage, and it’s well ahead of where we thought we would be. We thought it would take us just a little longer to get to where we could normalize both approaches to what we think is optimum. We’ve very quickly gotten to that point. The optimum will always evolve, but we’ve been quicker to get to that point than we had expected. I think it’s partly because of that whole people integration.

JB: Now that you’re much, much bigger in the Midland Basin of course, are there any thoughts about emerging zones, such as the Barnett-Woodford? Or is that just something you don’t have to worry about quite yet?

LM: Of course, we would look at that. But we’re focused on bringing these two organizations together, do that safely, fulfill our commitments on net zero, and get the value out of the integrated development. There are other benches of interest. We remain active across many basins in the U.S. We’re still producing over 100,000 boe/d in the Bakken. We’re still active in the Eagle Ford. We’re still active in Appalachia and Haynesville. Maybe other than the D-J (Denver-Julesburg Basin), we’re pretty much active in all the basins. Obviously, the focus is the Permian given the significance. I’d say we continue to test that, but we have so much on our plate. Today, we’re running close to 40 rigs combined. It’s a massive scale of activity that we’re focused on executing.

JB: Before I pivot away from the Permian, can I get you to compare and contrast Exxon’s Midland and Delaware positions? You’ve obviously been huge in New Mexico, but now much bigger in the Midland.

LM: The Pioneer acreage is all Midland, which was the driver for the acquisition. Our [Midland] inventory was getting low. We have an incredible position in the Delaware and we’ve been primarily focused on Poker Lake, but there are other Delaware areas. Big Eddy is a very prospective, well-appraised area that is part of our future development plans. The Delaware is a little deeper on some of the zones, a little higher pressure, and that also means it’s a little higher cost. But, from a quality and profitability perspective, they’re both world-class, advantaged assets. Our focus is equally on our position in the Delaware as it is on the Midland acreage. I’d say the undrilled or undeveloped inventory is higher in the Delaware, but now you start to see that inventory getting more equalized as we brought in Pioneer. But, no question, Delaware is earlier.

There are vast differences in one state versus the other in terms of access to infrastructure. In Delaware, we elected to largely control our own destiny. We built out our own gas processing. We’ve participated in pipeline equity offtake, and I think that’s going to pay huge dividends to us as we go forward and develop that resource. I think that was a key strategic decision to build that Cowboy plant, and it’s performing very, very well.

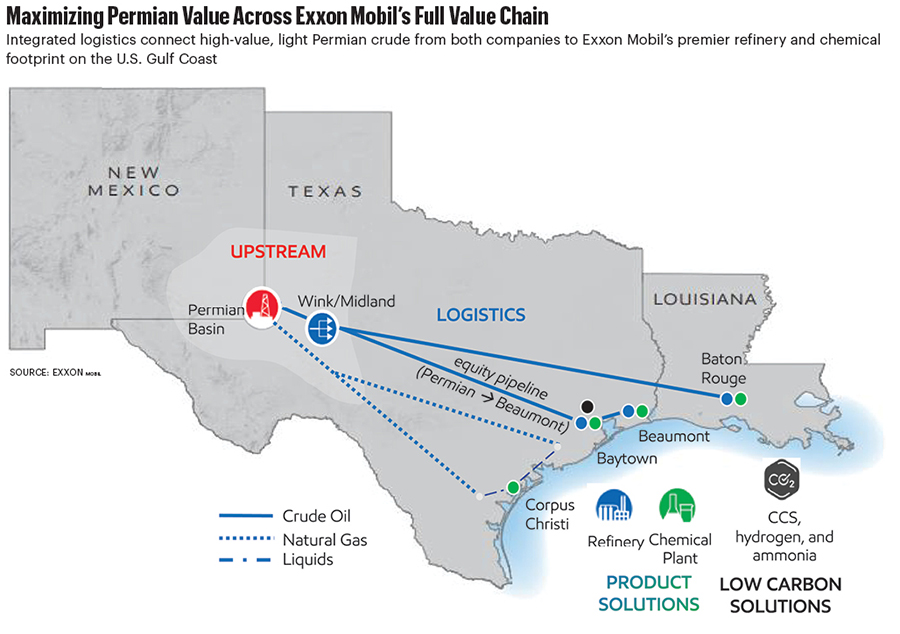

JB: And then you brought on the Wink to Webster Pipeline not too long ago, and you have the Sentinel Midstream joint venture now.

LM: It gives us an advantage because we’re integrated the whole way through the refining system. We can and will use those assets to our advantage, either blending or trading or other activities that you can’t do if you’re isolated from all that. We still have a reliance on third parties. We don’t have total control over our own destiny. Primarily, we do out of the Delaware. In the Midland, it’s less important because there is so much infrastructure that’s built. You don’t necessarily need to be all the way through that value chain. That advantage was always part of our value proposition. We see it evolving, and it’s linked to some of the expansions we’ve made in our refining systems to be able to take advantage of that both on the gas and the crude side.

JB: Switching gears just a little bit. Obviously, you got ahead of things with the Pioneer deal. But there’s clearly been a big wave of energy M&A overall. How do you see that continuing to unfold as the industry continues to consolidate and, not get smaller, but have fewer players?

LM: From an Exxon Mobil perspective, we continue to see a vital role for oil and gas. As such, we continue to project growth. That’s what we’ve been doing and that’s what we aim to continue to do. At the same time, continue to commit to our emission intensity goals. Back to where I started, it is depletion business. So, to grow, you have to not only offset depletion. And, as has always been the case in the upstream, exploration remains important and, certainly, we strategically remain very active in that space. Continuing to find and develop technology remains important to achieving that objective. Historically, much of the industry’s growth has come from technology breakthroughs, whether it’s those that unlocked tight oil and tight gas, or seismic processing or reservoir management techniques. If you look at the large fields in the world, they’ve largely gotten bigger due to technology breakthroughs over the years. So, exploration, technology breakthroughs and then, of course, the role that acquisitions may play depending on your individual objective.

I think acquisitions will continue to play an important role for us, but we would only have interest where we saw a strategic proposition that allowed us to take advantage in a unique way. That is absolutely the key. Finding that opportunity and then pursuing it at the right time is something that we will always look to see where those opportunities exist. You can debate consolidation. Does that lessen those [opportunities]? I would say that continually changes, but more important for us, is there a unique value proposition? And can we exploit it in a way that really does make sense beyond straight valuation?

JB: I want to pivot in a minute to some of those exploration successes. But continuing on M&A quickly. Obviously, not just from Exxon-Pioneer, but from lots of other deals, you’ll have lots of non-core divestments, a lot of companies are doing that. You’re looking at possible Bakken sales? Maybe some non-core Permian and Central Basin Platform or parts of New Mexico? How much can you elaborate on what you are looking to do and what might happen in the not-so-distant future?

(Editor’s note: Shortly after this interview, Exxon agreed to sell about $1 billion of mature, conventional Permian Basin assets in West Texas and New Mexico to Hilcorp Energy.)

LM: We were very clear externally back in 2019 when we set a very ambitious goal of $15 billion of asset sales. We’ve largely achieved that. Again, we are in a growth business. I think divesting very, very mature assets where, frankly, others can bring advantages that might not play to our strengths, or we may not be able to resource everything we want to do, makes sense for us. Coring up in our unconventional position has made sense, and I think that’s what you’ve seen us do is core up those assets that have enough scale, running room and potential for us to be able to continue to exploit our advantages.

To be clear, we’re not [fully] exiting the Bakken. We’re taking advantage of really good opportunities with some great partners. And the rest of it is fairly mature, a lot of dry gas. We’ve been exiting a lot of old dry gas. The Barnett [Shale] is a good example. Some of the recent stuff you’ve seen, Fayetteville and things like that. I would say very old, mature dry gas fields where we saw limited room for us to bring our unique competitive advantages.

I think you’re going to see divestment continue to play a role based on what I’ve told you. But I would say, as you look at that 2019 period to today, we have more to do to tighten the portfolio. As we go forward, it’ll be a question of balancing that growth objective with the applications of divestments. It’ll still be an important piece of the strategy, but perhaps a little less than the last few years. That will change over time, too, as depletion sets in and maturity sets in and the markets adjust.

JB: Pivoting to South America, I wanted to go in on Guyana, which is obviously a huge success. But before we get into any of the details, I was hoping to get your take on how the discovery almost didn’t happen. Can you elaborate on that?

LM: It was not that it almost didn’t happen. If you go back and trace the history of Guyana, this is the nature of exploration to some extent. As a basin, several wells were drilled in Guyana through the ’60s, ’70s. The proposition was that there were hydrocarbons there because there was a heavy oil field which still produces today in Suriname. So, the geologists, the geoscientists know there’s a source rock somewhere. The question is where, right? People were postulating it was in the shallow waters and exploring there and found nothing. Then the hypothesis that our team came up in the early part of the 2000s was that it’s potentially out in the deeper water. Of course, technology at that time wasn’t where it is today. Imaging wasn’t where it is today. And then the country, the activity was under force majeure for quite some time.

I think it was kind of a unique proposition hypothesis and the only way to test it was to go drill it. And these were expensive wells to drill and high risk. And people talk about the [government] contract. The contract is very fair relative to the risk that was taken. I think that’s widely acknowledged. We put together a proposition. Shell exited; we were 50:50. We elected to seek partners to manage that risk. Hess (Corp.) and, at the time, Nexen came in, which soon became CNOOC, which it is today. When we marketed the seismic line in the data room, it’s the same seismic line we drilled the first well on. A lot of companies came and looked at it, and the only two bidders were the ones that I told you about. Some of the biggest, best companies in the world.

And then we drill the success case. The story I tell is the second well we drilled was dry. It’s the business we’re in. Only time could tell, but if you had drilled that well first you might not have gone on. That’s just a fact. So, to me, all it talks to is the nature of exploration. By definition, it is still a business that has high risk and takes unique capabilities to discern where that potential might lead to something like Guyana. So that’s really the background. But, we made the discovery.

I’ve been with this from the very start. I was in Georgetown (capital of Guyana) in 2015, very early. And the pace at which we’ve developed this, we’ve gone from zero to now, today, greater than 600,000 bbl/d (660,000 bbl/d in September), and we’ll grow to the 1.2 MMbbl/d capacity we talked about by 2027 in a very short period of time at a pace that we’ve never seen in the deepwater industry. I do put that down to capabilities, partnerships and, frankly, it’s high quality. The rocks are very high quality, the subsurface is very good, but we’ve also done an incredible amount of things with our technologies to improve it. These boats (FPSOs), for example, let’s say they’re designed for 600,000 bbl/d. We’re producing (almost) 100,000 bbl/d more today. We’re optimizing debottlenecking, finding ways to do more than we thought we could do. And that just continues. It’s an incredible success story.

The partnership, the government relationship, the way we contracted this with our partners, SBM (Offshore), MODEC, our subsea partners, TechnipFMC, and the quality of our partnership with Hess and the Chinese. You couple all that with the best we have with our capabilities, whether it’s drilling, project management, operations, whatever it is. And you get the basics of what success looks like in our business. The end of the game would be to repeat that.

JB: You have the three FPSOs on now, and then three more to go each of the next three years.

LM: They have been coming on roughly one a year, and we’re still exploring. Of course, we hope to be able to also progress additional developments. We’re not yet ready to talk about those. I think you’ve seen that we put in an environmental impact assessment for a seventh boat, Hammerhead. That’s already in and progressing, and we’re still exploring. We have five rigs down there today. It’s a very large area. We continue to have confidence that there’ll be more potential there.

JB: The fourth project, Yellowtail, is slated to come online next year. Do we know about when in 2025?

LM: By the end of the year is what we’ve said.

JB: Obviously, there’s a lot of runway there. You’re also working with Petronas in Suriname, and I think you’ve made three discoveries. Is there anything you can say about that progress?

LM: It’s a little earlier in Suriname. It’s a little higher GOR (gas-oil ratio). I think you saw TotalEnergies progressing the first of those. It’s still early in that process. It needs more appraisal, needs more definition and further exploration, but it’s much earlier in that process.

JB: We’ve talked more oil, but I wanted to get your take on your bullishness for gas and LNG, and how things are looking with Golden Pass LNG. Obviously, it’s nice getting that (FERC) time extension.

LM: Yes, the FERC extension. Our strategic upstream, big growth areas for us were tight oil, deepwater and LNG. That’s on top of a very large base that we’re continuing to optimize. But, from the growth areas, that’s where we see our advantages and the potential. LNG, it’s unbelievably efficient, it’s low emissions, it’s very versatile and we believe the market will remain very, very strong well into the future. There’s not a lot of big LNG projects, so being in the critical ones is really important to us. We’ve stated an objective to grow our total sales to about 40 mtpa (million tonnes per annum) by 2030. Today, we’re sitting around mid-20s mtpa, but that’s critical. Golden Pass is a key piece of that growth.

Also, there’s our interest in some of the Qatar new expansions, the Mozambiques (Rovuma LNG) and the PNGs (PNG LNG in Papua New Guinea), they start to come on right at the end of that period. So, they’re not really in that number that I talked about by 2030. We believe the versatility that LNG will bring in the energy transition is really, really high in any scenario you like to think about. So, in the near term, with Golden Pass we’ve had some delays. But first LNG is now end of 2025, we believe, and we’re on track for that. The construction challenge that was publicized is largely behind us, and personnel have ramped back up at that site quite significantly. That first train is about 80% complete. We’re on schedule with what we’ve communicated externally for first LNG. That’s an important source of growth because our partner is QatarEnergy, and we each access our own offtake. That was also a change from the original setup. This was going to be marketed by a separate entity. That was changed a year or two ago to where QatarEnergy and ourselves now offtake. That’s important to us because those volumes, particularly given our trading growth, are key. We’re continuing to be pretty active in the third-party purchases from some of the (LNG) developers. You’ve seen some of those announced as an offtaker.

Importantly and strategically is growing our equity position. We are participating in the NFE (North Field East) expansion in Qatar, not in the second one, NFS (North Field South), but in the first one. That’s under construction. Of course, Mozambique and PNG are really important to us and both material. Area 4 in Mozambique is almost 90 Tcf of gas. You think about materiality and scale, which is what we need, the kind of growth objectives we’ve got, they’re really important. Accessing equity and being able to develop that and take it into a portfolio is really what the objective is. These are huge projects, huge potential. We know how to do those really difficult developments. That’s the kind of thing strategically we like to lean into.

JB: Obviously, in the U.S. you have plenty of gas—associated gas in the Permian, Haynesville and Appalachia.

LM: We have a huge gas resource. All of those things. They are all going to be, I suspect in time, vital supplies to many low-carbon products, whether it’s LNG conversion, lower carbon power, data centers.

JB: Yes, rising domestic demand.

LM: The demand outlook is very, very strong. We’re very well positioned with those assets, frankly, into multiple end uses. That makes it even more compelling. There is significant remaining resource in the U.S., and it’s pretty advantaged.

JB: What more can you highlight about the future of Exxon upstream—domestically and frontier exploration?

LM: Strategically, we are continuing to stay focused and disciplined through the cycle. We’ve created a very resilient portfolio, and you’ve seen it play out. It’s a fantastic set of advantaged opportunities that we’re still executing on. Our results are pretty extraordinary. The upstream results we’ve met or exceeded, and they were very ambitious [targets]. It’s been transformational since we put the upstream strategy together back in 2018 when we were starting from a pretty tough position.

What I see us doing is continuing to extend that. We’ve created, and we’ll need to continue to refresh, an extremely resilient portfolio. No one can predict price cycles, but being able to create that resilience positions us very, very well. Obviously, there’s unknowns in that. We are highly focused as a technology company and continuing to find ways to improve recovery in the Permian and other places we’ve talked about strategically. This is really important because I think it’s actually driven a lot of innovation, is doing all this while achieving our emissions intensity reduction objectives. We are on track or ahead on that. It’s a very motivational strategy and is resonating. We’re really proud of our leadership role in the energy transition. But we still believe oil and gas will be fundamental. As long as we stay disciplined and stay on the left-hand side of the supply curve and keep that portfolio very resilient, that should be a very successful business case.

Recommended Reading

Trump Administration to Open More Alaska Acres for Oil, Gas Drilling

2025-03-20 - U.S. Interior Secretary Doug Burgum said the agency plans to reopen the 82% of Alaska's National Petroleum Reserve that is available for leasing for development.

Electron Gold Rush: ‘White Hot’ Power Market Shifts into High Gear

2025-03-06 - Tech companies are scrambling for electrons as AI infrastructure comes online and gas and midstream companies need to be ready, Energy Exemplar CEO says.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

TGS to Reprocess Seismic Data in India’s Krishna-Godavari Basin

2025-01-28 - TGS will reprocess 3D seismic data, including 10,900 sq km of open acreage available in India’s upcoming 10th Open Acreage Licensing Policy (OALP) bid round blocks.

Artificial Lift Firm Flowco Prices IPO Above Guidance at $427MM

2025-01-15 - Flowco Holdings priced its IPO at $24 per share, above its original guidance. The oilfield services firm will begin trading on the New York Stock Exchange on Jan. 16.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.