Editor’s note: This is part of an ongoing series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

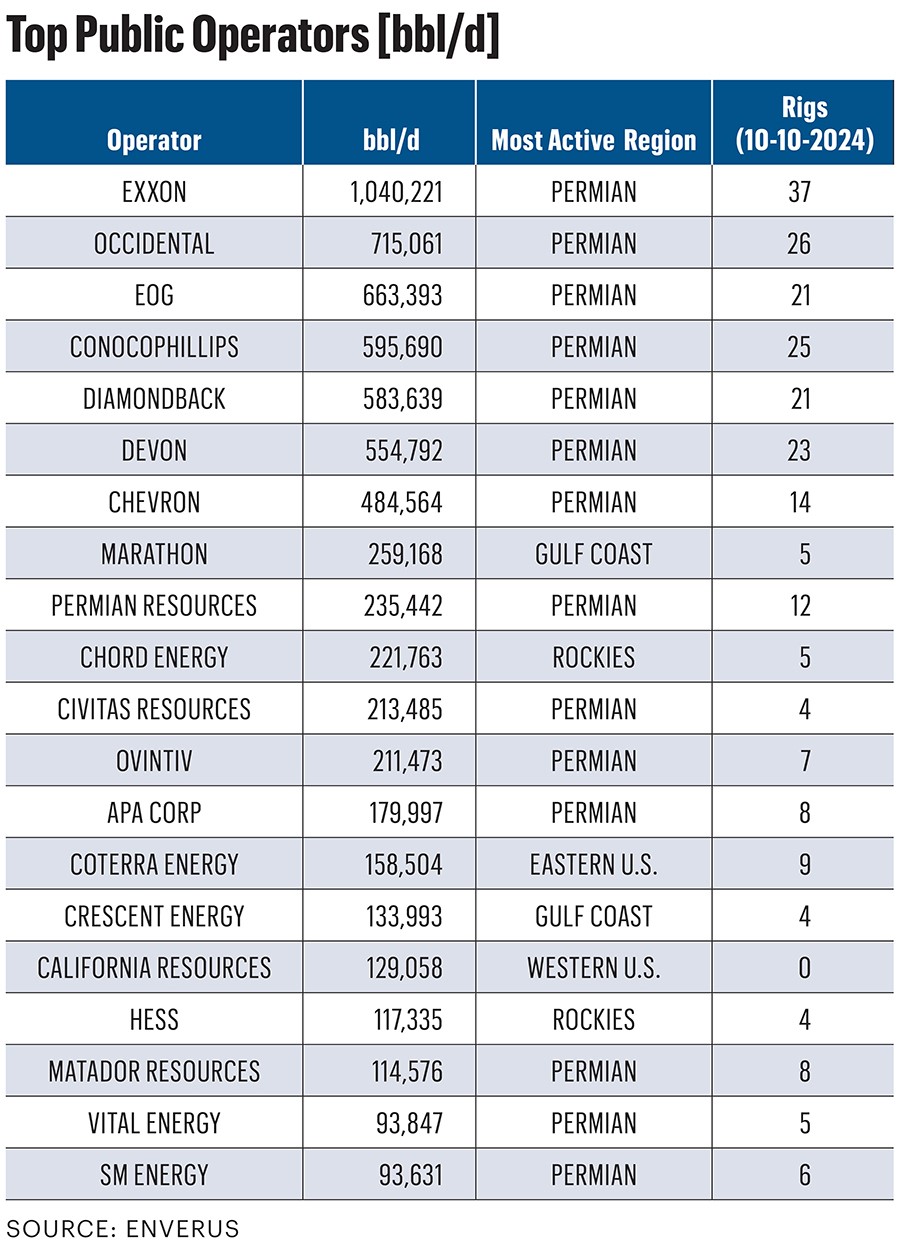

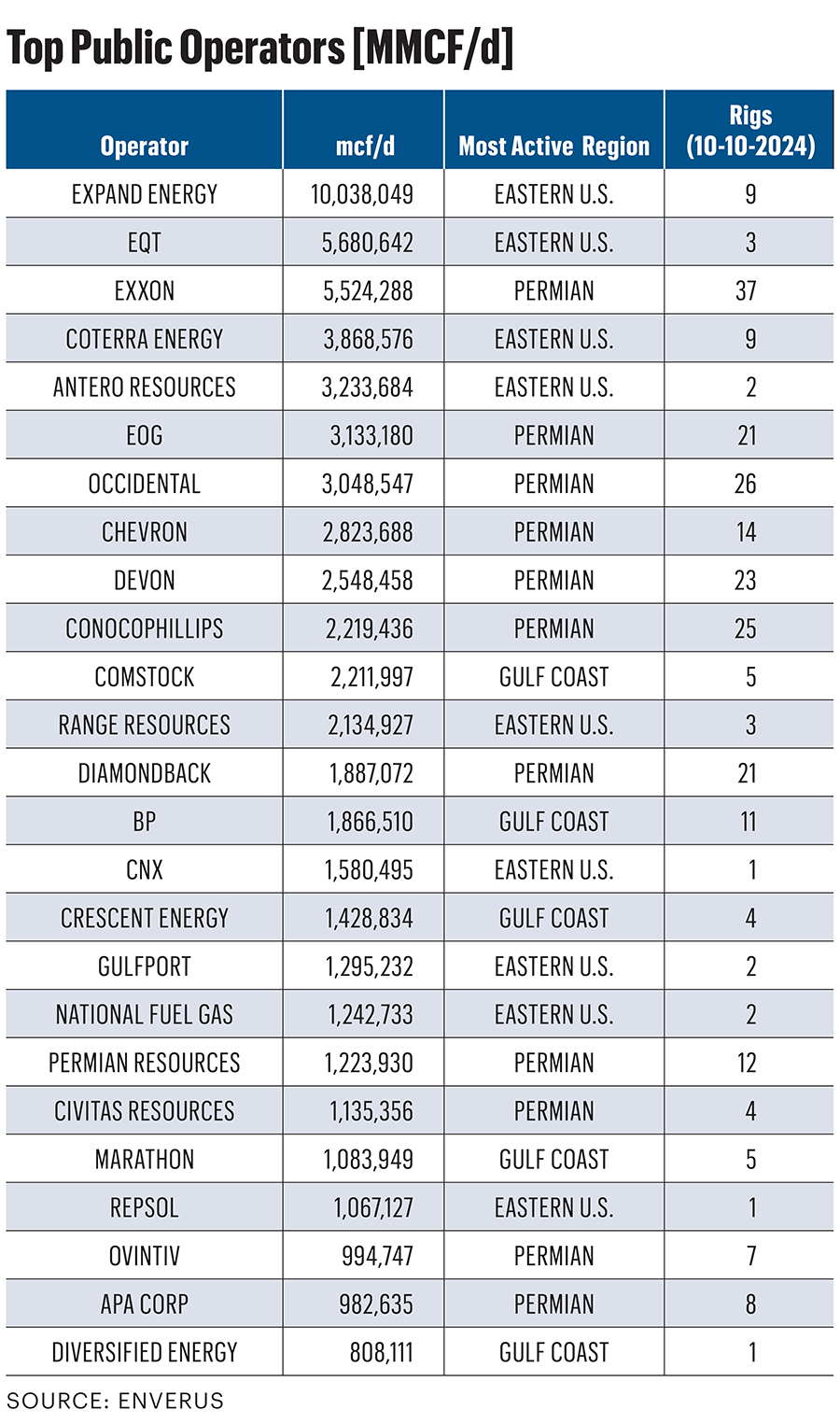

Enverus and Oil and Gas Investor have again partnered to present the annual ranking of top public producers.

The list of top private companies will be published in July (Top producing E&Ps included in this article are from October 2024). Manuj Nikhanj, who took over as CEO of the research and analytics firm in mid-2024, shares his perspective on the changing landscape and what’s next for the industry’s top players.

Oil and Gas Investor: How did the concentration of production among the top 10 names change from 2023 to 2024?

Manuj Nikhanj: [In 2023], the top 10 names represented 56% of production out of the top 50 on a boe/d basis. Due to mergers … that same figure is 62% of production—in part due to Pioneer Natural Resources being a part of Exxon Mobil, and Chesapeake a part of Southwestern [and] rolling together into the newly formed Expand Energy. This new entrant finds itself at the second position, with an impressive production of around 1.69 million boe/d, mainly from the Eastern U.S. region.

Oxy, Devon Energy and Diamondback Energy are now including pro forma volumes coming from private operators CrownRock, Grayson Mill and Endeavor Resources, respectively.

A little bit lower down the list, you see Civitas Resources with a significant jump, moving up 11 places to rank 14th based on its larger production base from closed 2023 and early 2024 deals. Mitsui also climbed 11 spots, now ranking 46th. Mach Natural Resources is also a new entrant on our list. These kinds of developments highlight the dynamic nature of the oil and gas industry, with shifts in production, regional focus and operational efficiency playing crucial roles in our rankings.

RELATED

Back to the Future: US Shale is Growing Up

OGI: Given this year’s M&A activity in which large public companies are acquiring private producers, how do you think the landscape will continue to change?

MN: The most notable shift in the just-completed quarter was the lack of consolidation between publicly traded E&Ps, the first time that has happened in a quarter since 2022. The $188 billion in public company consolidation since the start of 2023, with 11 public deals over $2 billion, leaves significantly fewer targets to pursue.

In addition, large buyers like Chevron, ConocoPhillips, Diamondback Energy and Exxon Mobil have been busy closing and integrating deals, with timelines often delayed by extra antitrust scrutiny by the Federal Trade Commission.

OGI: What is separating the upper echelon of operators from the rest?

MN: We see four names breaking at 1 million boe/d. For now, they are in a category of their own. However, if (or when) the ConocoPhillips-Marathon Oil and the Chevron-Hess deals close, those combined entities would join these ranks and round out the top six on our list.

OGI: The Permian Basin has dominated the scene for years—how much longer can this continue?

MN: Counting out the most active region operated by the Top 50 operators, the Permian appears by far the most with 20 operators counting this as their most active region—seven of the top 10 list the Permian as their most active region.

Volumewise, the Permian dominates the rankings—81% of oil production and 40% of gas production from the top 50 names come from this one basin. In terms of gas production, this puts it nearly in line with the Eastern U.S. Appalachian names on the list, which in total contribute 44% to the total gas sum.

As we’ve publicly shared, oil-directed drilling inventory that can generate adequate returns below $60/bbl WTI is limited to about five years in the U.S. at current activity levels. At $70/bbl WTI, our U.S. inventory estimates double.

OGI: Which regions have the most opportunity?

MN: While the market waits for further corporate consolidation, asset deals by public companies are likely to play a more prominent role in upstream M&A. Companies that were buyers are now likely to sell parts of the combined portfolios. APA Corp., which purchased Callon Petroleum in early 2024, has already been active on that front, selling a portfolio of Permian conventional assets for $950 million to a private buyer. Occidental also sold off a piece of its Delaware Basin position to Permian Resources for $818 million after closing the CrownRock acquisition. Future non-core sales by public companies could target lower quality or extensional areas of the Permian, the Midcontinent and areas like the Uinta Basin, where Ovintiv has been reported to be shopping its position.

OGI: What about well count?

MN: EQT stands out with the highest natural gas production, at over 5.68 Bcf/d, despite having a relatively lower liquids percentage. Exxon and Chevron have the highest well counts, with over 20,000 wells each.

OGI: What do the current rig counts (in mid-October) indicate about operator sentiment and production trends?

MN: A snapshot of rig counts at the points in time provides some color in operator sentiment. The top 50 names are running a total of 298 at the time of compilation, compared to 322 from the prior year list compiled at a similar seasonal point. Increasing rig efficiencies have led production growth while pulling back rig counts.

Exxon leads in rig activity with 37 rigs, followed by Occidental with 26 rigs. Companies like EQT and Antero Resources have fewer rigs but maintain high production levels, indicating efficient operations.

OGI: Public versus private operators, and the ways they are trending, is a question that comes up a lot. What are you seeing between the two?

MN: With fewer opportunities to get into the main shale plays, private firms are broadening the search to areas without competition for deals from public companies. That is also leading to more private-to-private transactions between groups that have been invested for a lengthy time to ones that have raised fresh capital. The sale of Caerus Oil and Gas, which operates gas assets in Colorado’s Piceance Basin and Utah’s Uinta Basin, to Quantum Capital Group for $1.8 billion is an example.

Editor’s Note: All data referenced includes the average daily rate calculated from total gross operated volumes produced over between January and June 2024, and accounts for deals that closed as of Oct 1, 2024.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Equinor’s Norwegian Troll Gas Field Breaks Production Record

2025-01-06 - Equinor says its 2024 North Sea production hit a new high thanks to equipment upgrades and little downtime.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.