Four formations, 20 wells, four pads.

After more than half a year of efforts, Vital Energy made a mega-well-count drilling spacing unit (DSU) in the Midland Basin’s Glasscock County, Texas, completing some 57 miles of lateral hole.

In addition to the time involved in drilling, completions took three months alone, said Katie Hill, Vital Energy COO.

Beginning to come online in February, production had not yet peaked by mid-May. In early May, the DSU was making more than 18,000 bbl/d—15% more than Vital’s expectations.

And the total output was still growing, Hill told investors at that time.

Each well’s lateral is some 15,000 ft—kicked off at up to 8,200 ft of total vertical depth—for a total of 90 miles of hole southeast of the city of Midland, Texas.

On the four pads, one hosts six wellheads; two host five each; one hosts four. Ten of the wells were made in the Camp F 21 lease; 10 in the Halfmann 21 lease.

In wine-rack fashion, five wells were landed in Lower Spraberry, eight in Wolfcamp A, two in Wolfcamp C and five in Wolfcamp D.

“This is the largest package Vital has ever developed,” Hill said. “And our team did an incredible job, safely executing [the package] ahead of schedule.”

The job employed two completion crews, and the wells were online 19 days ahead of schedule.

Wolfcamp C appraisals

The two Wolfcamp C wells are appraisal tests. “Our current public inventory does not include Wolfcamp C,” Hill said. So far, “we’re particularly encouraged by the performance.”

If they work, it “could significantly extend our inventory life.”

Jason Pigott, Vital’s president and CEO, said, “We’re really working through ‘How do we co-develop these new zones?’”

More production data will give light to a go-forward plan. “It’s the first test with this kind of new higher-intensity design, but very, very promising,” he said.

“And those C zones are one of the contributors to our outperformance of that western Glasscock package. … [We] are getting more out of these wells via the new completion techniques.”

The seven Wolfcamp C and D wells “had a lot of pressure during drill-out and, in fact, free-flowed to 5.5-inch casing at start for a number of weeks before we ultimately put them on ESP [artificial lift],” said Kyle Coldiron, Vital vice president for new well delivery.

“So strong bottomhole pressure [and] strong results so far. We’re encouraged with what we see.”

Drilling began in mid-2023 and completions were underway beginning in the fourth quarter.

Midland, Delaware frac trends

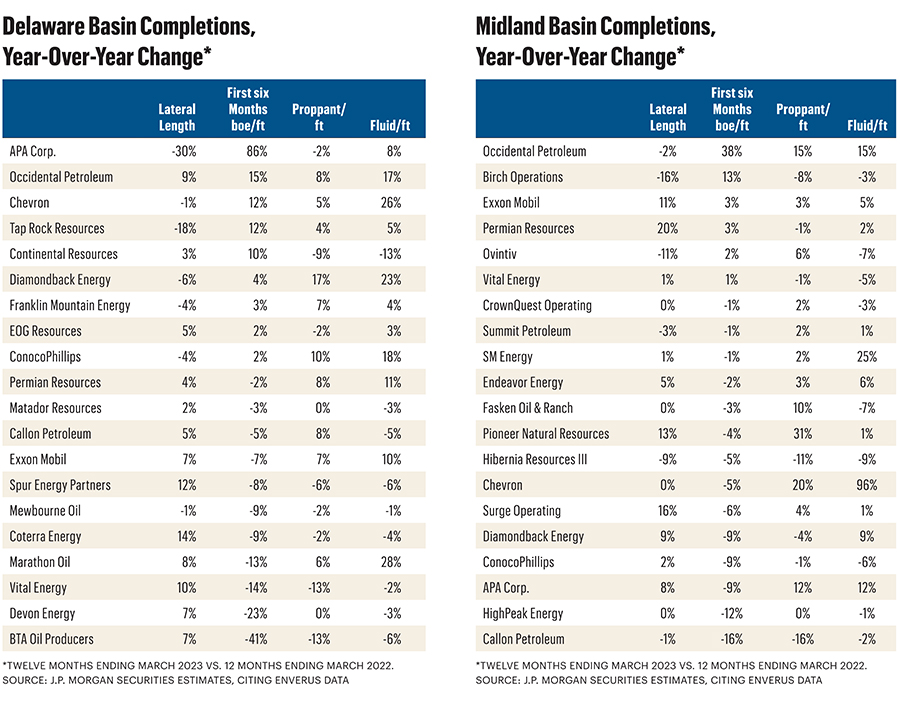

Arun Jayaram, an analyst for J.P. Morgan Securities, reported earlier this year that a look into current completion techniques in the Midland Basin showed productivity is up for some operators.

Posting higher first-six-month oil output were Chevron (12.2 bbl per lateral foot), SM Energy (11.8), ConocoPhillips (10.9), Diamondback Energy (10.7) and Vital (10.2).

“Average proppant loads were up 6% on a year-over-year basis at 2,147 pounds per lateral foot,” he added.

Pumping the most intense completions were SM Energy, Ovintiv, APA Corp., Pioneer Natural Resources and Chevron, he added.

In a survey of Delaware Basin completions, Jayaram found leaders in first-six-month oil productivity were EOG Resources (17.6 bbl per lateral foot), ConocoPhillips (17.3), Occidental (17.1), Marathon Oil (14.8) and Coterra Energy (14.2).

“Average proppant loads [in the Delaware] were down 1% on a year-over-year basis at 2,416 pounds per lateral foot,” he added. “The most intense completion designs were utilized by Tap Rock Resources—now a part of Civitas Resources—and ConocoPhillips.”

Ovintiv trimul-fracs

While Vital was trying a 20-well DSU in southern Midland Basin, Ovintiv was doing trimul-fracs—that is, completing three pads simultaneously—on its leasehold.

Ovintiv brought 35 Midland Basin wells online this year through early May.

The company’s tri-fracs jobs are 30% faster this year compared to 2023.

“At an industry leading 4,200 feet per day, we expect to utilize trimul-fracs on more than half of our program this year,” Greg Givens, Ovintiv COO, told investors in a May call.

“This approach yields a 15% savings in completions cost per foot and essentially doubles the completed feet per day versus a traditional [one pad] zipper frac.”

To date, Ovintiv has applied the trimul-frac to some 70 wells in the Midland Basin. It began the program in 2022. Frac stages to date are more than 3,400.

Wells perform just as well after a trimul-frac than those completed one at a time, Givens said. "We’re seeing no degradation to well performance really at all.

“… The performance from these wells is very much in line with the other wells in the field.”

The tri-job is showing “lower treating pressures and the ability to pump these jobs faster, which generates cost savings, which will flow straight to the bottom line,” he added.

One-third of Ovintiv’s 2023 completions were trimul-fracs. “This year, it will be a little over half and we see no reason why we couldn’t continue to push that up even higher in the future as we continue to use the technology,” Givens said.

Brendan McCraken, Ovintiv’s president and CEO, said, “The rock doesn’t know it’s being trimul-fracked.

“So, the way we design these completions—the rate of slurry, sand and water that’s going through each cluster—is exactly the same in either a zipper, a [two-pad] simul-frac or a trimul-frac.”

Thus, the gains are all in dollars in above-ground efficiency. “The reservoir feels the exact same frac it would otherwise.… The wells would produce exactly the same because the completion downhole is exactly the same.”

Devon, Delaware

In its Delaware Basin position, Devon Energy is using simul-fracs, particularly on its 13-well Van Doo Dah project in Lea County, New Mexico, in its Cotton Draw project area straddling the Eddy-Lea counties’ border.

Van Doo Dah came online two weeks ahead of schedule. IPs averaged 4,000 boe/d, 52% oil, from each of the 10,000-foot Upper Wolfcamp laterals in their first 30 days.

“The massive scale of this project was showcased by the peak flow rates that reached nearly 30,000 gross bbl/d,” Clay Gaspar, Devon COO, told investors in May.

“This success further reinforces why I believed the stacked-pay potential in Cotton Draw to be one of the best tranches of acreage in all of North America.”

He added that simul-fracs have “been a key driver of compressed cycle times.”

Diamondback, Midland

In the Midland Basin, Diamondback Energy is shedding days in lateral feet completed, Travis Stice, chairman and CEO, told investors in May.

The company is working on lowering costs by getting its pressure-pumping operations onto power lines.

“A lot of that’s going to come in the way of getting these e-fleets off of generated power and onto some form of grid power where we can recognize a lower energy-source cost,” said Danny Wesson, Diamondback COO.

Diamondback has between three and four simul-frac crews working continuously in the Midland, said Kaes Van’t Hof, Diamondback president and CFO.

Costs have been squeezed so much by now, though, Wesson said, that “we’re getting to a point where the fixed cost of the wells is a significantly larger portion of the cost of the well,” Wesson said.

The variable costs are affecting “pennies and nickels and not as much dollars anymore.” To drive costs yet lower, “we’re going to have to think about doing things differently.”

Recommended Reading

NGP Backs Wing Resources with $100MM to Buy Permian Mineral Interests

2025-04-02 - Wing Resources VIII, which is backed by NGP Royalty Partners III, will focus on acquiring “high-quality” mineral and royalty interests across the Permian Basin, the company said.

Boardwalk Project to Grow Southern Access for Appalachian NatGas

2025-04-02 - Midstream company Boardwalk Pipeline is holding an open season for future new capacity on the Texas Gas Transmission pipeline.

Exxon Mobil Vice President Karen McKee to Retire After 34 Years

2025-04-02 - Matt Crocker will succeed Karen T. McKee as vice president of Exxon Mobil and president of its product solutions company.

Paisie: How a World in Flux Impacts Oil Prices

2025-04-02 - Sanctions, tariffs and production strategies are buffeting crude markets as wild cards like tariffs and geopolitical conflicts make headlines.

Oil Prices Fall into Negative Territory as Trump Announces New Tariffs

2025-04-02 - U.S. futures rose by a dollar and then turned negative over the course of Trump's press conference on April 2 in which he announced tariffs on trading partners including the European Union, China and South Korea.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.