To say the geothermal industry is heating up in the U.S. might be an understatement.

Once shunned by potential investors due to project failures, poor planning and other investment risks, geothermal company leaders and others in the energy sector are turning the situation around.

And they are using techniques from oil and gas company playbooks. Think horizontal drilling and multi-well pads. Oilfield service companies are unearthing new ways to use their products, such as insulated tubing to minimize heat loss and maximize energy as fluids in geothermal wells move from the subsurface to the surface.

Experts say the technology is there, though tweaks may be needed.

“It’s a common misconception that all this innovation needs to happen in order to bring geothermal power to market. But … we have all of the technology we need,” Sarah Jewett, vice president of strategy for Fervo Energy, told E&P. “We have a pretty massive and robust customer set. So, the only thing we have to do is build the projects and deliver to the market.”

Still, roadblocks remain on the path to commercial scale. Although upfront costs are falling, they remain high. Capital constraints and financing concern some. And, geothermal is no exception to the federal permitting and grid interconnection woes the entire energy industry faces.

Hot reservoirs

Geothermal energy harnesses heat below ground using wells drilled into hot reservoirs. Conventional geothermal does not require much engineering to capture heat because it’s closer to the surface, with naturally occurring fractures and fluid, such as in volcanic areas.

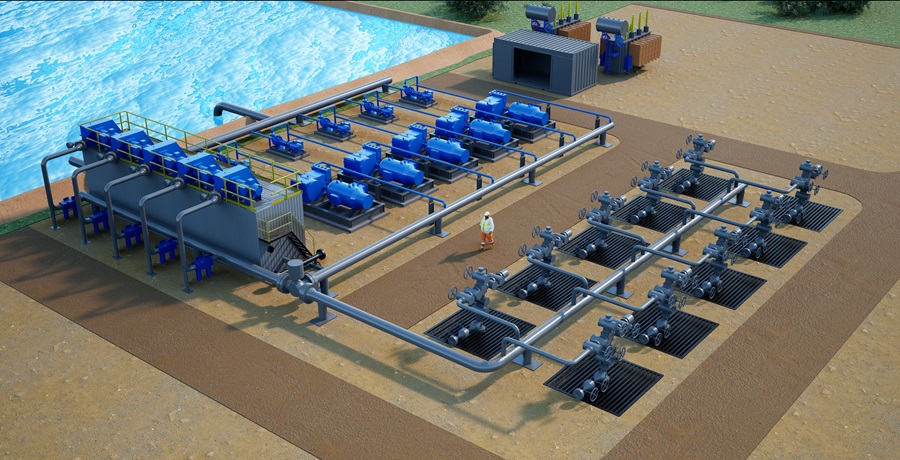

Next-generation geothermal energy, however, uses existing oil and gas technologies to harness heat and unlock geothermal energy from anywhere. With an enhanced geothermal system (EGS), fluid is circulated in a pair of wells connected by fractures created in hot reservoirs. Closed-loop geothermal systems, also referred to as advanced geothermal systems, circulate fluids through closed wellbore loops in the subsurface. The heat extracted can be used to heat or cool homes and buildings via direct use heat or generate electricity with higher temperature geothermal resources.

In addition to supplying a renewable energy source, geothermal power plants provide baseload power—meaning they consistently produce electricity—regardless of weather conditions. The renewable energy source can be used to store energy underground, and the footprint required is relatively small compared to solar and wind sources of renewable energy.

It has the potential to replace or at least reduce the number of coal- and gas-fired power plants with renewable energy.

“Next-generation geothermal power is poised to become a key contributor to a secure domestic decarbonized power sector in the United States. This is an industry that is ready to grow to large scale,” said Charles Gertler, a senior advisor for the U.S. Department of Energy (DOE) Loan Programs Office and a lead co-author of the “Pathways to Commercial Liftoff: Next-Generation Geothermal Power” report.

“There is a set of emerging technology that is just coming online that vastly expands the total resource available for geothermal power generation,” he said during a webinar discussing the report earlier this year. “The sector overall has really significant and unique starting advantages.”

That includes the oil and gas industry, which has been pumping both dollars and technical knowhow into geothermal.

The O&G effect

Oil and geothermal drillers have loads in common. Geothermal developers, like wildcatters, hunt for heat. They carry out site assessments using sensors and other geological aids and evaluate reservoirs. Downhole tools, pumps and turbines are also part of the process as are hydraulic fracturing tools and injection pumps for EGS. So, it may not be too surprising to see oil and geothermal drillers working together to bolster geothermal.

Service company Baker Hughes has been in the geothermal business for about 40 years, providing services that include geothermal well construction, reservoir subsurface and feasibility analysis, and turbine technology for geothermal power generation. Part of its current efforts focus on closed-loop systems as part of the Wells2Watts consortium.

With partners California Resources Corp., Chesapeake Energy, Continental Resources and Inpex Corp., Baker Hughes is looking to retrofit decommissioned oil and gas wells and use existing infrastructure to create closed-loop geothermal wells.

Geothermal startup GreenFire Energy’s GreenLoop technology and Vallourec’s Vacuum Insulated Tubing solutions are among the technologies that have been tested, but there also are plans to test EGS technologies in the lab.

The consortium’s data-driven approach has already led to insights on how to optimize the working fluids and maximize heat transfer in different situations and with varying flow rates, according to Ajit Menon, vice president of geothermal for Baker Hughes.

“There’s a whole list of things that we can test,” Menon said, referring to working fluids, robust technology for harsh environments and materials that improve heat efficiency. But not every well is suitable to produce geothermal energy, he said, noting that finding the right environment with enough heat requires a great deal of mapping work.

“We see a lot of opportunity here, especially in these new frontiers where you have to look at the optimization of your injection and production system to minimize fluid loss and optimize heat extraction,” Menon said. “You have to look at the power you’re generating and what’s happening on the subsurface all as one system together at the same time.”

The consortium aims to move from the lab to the field in 2024.

Customizing technology

Base technologies are available for geothermal to scale in the U.S., but tools from the oil and gas toolkit must be customized for geothermal, Menon added. And, subsurface and power systems should be optimized as one.

“We’re in well construction [and] subsurface, but we’re also in power generation. We see a lot of opportunity here, especially in these new frontiers where you have to look at the optimization of your injection and production system to minimize fluid loss and optimize heat extraction,” Menon said.

There’s also an eye toward speed, which decreases expenses in harsh environments, he added.

“You need to be able to manage that cost effectively. So, it’s really adapting technology we have today, and not just technology but processes—bringing tried and true processes that have been developed over the years to scale the oil and gas industry into geothermal,” he said.

Sage Geosystems CEO Cindy Taff agrees.

Houston-based Sage gained prominence after it reentered one of Shell’s old gas exploration wells in Starr County, Texas, and proved during testing in 2021 and 2023 that it could successfully generate energy.

Its technology involves pumping large volumes of water into an artificial reservoir created by a fracture to harvest heat from hot dry rock. Pressure causes it to balloon open and hold the water under pressure. When electricity is needed, the water is brought back to the surface, where a turbine converts the heat to electricity.

“We operate fracturing like a balloon. We want low permeability, and we also want to avoid any kind of natural faults and fractures,” said Taff, a former vice president of unconventional wells and logistics for Shell. “Oil and gas is actually looking for just the opposite. They’re wanting the high permeability, and they’re wanting those natural faults and fractures, which tend to bring the hydrocarbons to the wells.”

When it comes to repurposing old oil and gas wells, Taff said geothermal wells need a diameter that is about double that of oil wells. Plus, one never knows what might be encountered when reentering an old well.

“When we reentered our test well in Starr County, we spent probably an extra $1 million fixing the well to bring the integrity up to snuff,” she said. “You’d be better off drilling a new well and having a brand-new wellbore.”

Being able to turn the heat into electricity cost-effectively and at commercial scale is the task at hand for geothermal energy developers today.

“In Sage’s view, the challenge is now the thermodynamics and geomechanics challenges of basically getting the heat out of the rock, getting it to the surface,” to cost-effectively turn heat into electricity, Taff said. “We’re looking at both the well design and the power plant design. We think both of them are crucial.”

Sage aims to commission the world’s first commercial-scale geopressured geothermal system by the end of 2024 in Texas. It has also worked with the Southwest Research Institute in San Antonio to build a supercritical CO2 turbine designed for 22,000 rpm. A load test was scheduled for late April with ambitions to demonstrate that the turbine can produce more electricity per unit heat extracted from the ground than turbines being used in geothermal today.

“Even though the U.S. has the largest amount of geothermal generation in the world, it’s still less than 1% of our utility grid generation. And it all is represented by, again, conventional geothermal … steam close to the surface of the Earth,” near volcanoes or the Ring of Fire, Taff said.

That’s not even 5% of the world’s geothermal resources. Using today’s oil and gas equipment, next-gen geothermal could unlock geothermal resources at about 150 C for about 35% to 40% of the U.S., she said.

About 15 to 20 years from now, “if we can literally crack the code on making [geothermal] commercially viable, I think geothermal is going to represent 20 to 25% of the utility grid,” Taff added.

Scaling geothermal will not happen without success in EGS and AGS. The sector is already seeing improvements in the rate of penetration and drilling learning curves happening with first movers in the space, Menon said.

The DOE-sponsored Utah Frontier Observatory for Research in Geothermal Energy (FORGE) project is an international field laboratory managed by the Energy & Geoscience Institute at the University of Utah. Its work, including with Fervo, has enabled improvements in costs, well stimulation and drilling times—all areas that have challenged geothermal’s growth in the past.

Driving down costs

Fervo Energy, which counts Devon Energy and Helmerich & Payne among its investors, reduced drilling time during its Cape Station in Utah drilling campaign by 70% compared to its 2022 Project Red drilling campaign in northern Nevada, using modern oil and gas drilling equipment. These included polycrystalline diamond compact drill bits and mud coolers.

In a six-well drilling program, costs for the first four wells dropped by about 50%, from $9.4 million to $4.8 million per well. The campaign, which included one vertical well, reached depths as great as 14,000 ft amid high temperatures.

Fervo Energy CEO Tim Latimer said the company reduced its year-over-year drilling time through high-temperature hot rock granite from 70 days to 20 days.

The learning curve and productivity gains unlocked shale oil and gas production in the U.S., making it the world’s largest oil and gas producer, he said during CERAWeek by S&P Global.

“I think we’re well on our way to definitively proving that same trend is going to occur in the geothermal sector,” he said.

The company is constructing a 400-megawatt utility-scale geothermal project in Beaver County, Utah. The first phase is set to come online near the end of 2026 with the second phase expected online in 2028.

“It’s in full go mode right now. We’re doing subsurface development. We’re doing the procurement for the power facility and building it,” Fervo’s Jewett said.

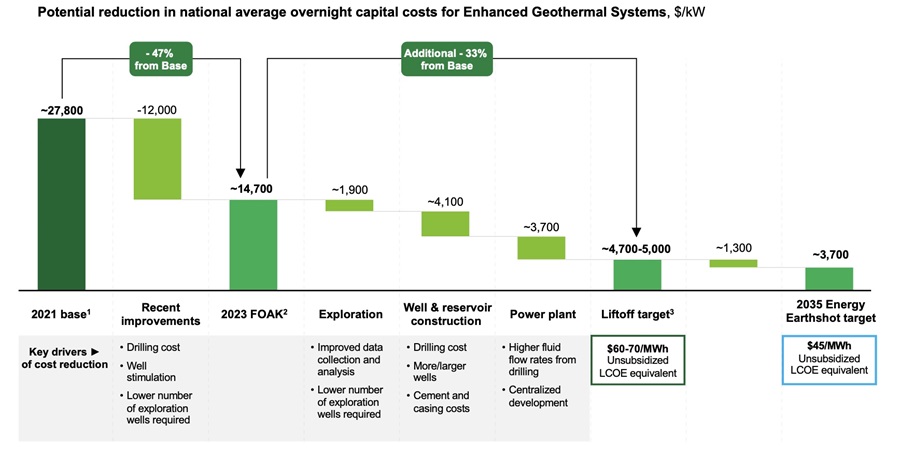

DOE’s Gertler, discussing the geothermal liftoff report, said drilling times have consistently improved, and those improvements have translated into significant cost reductions.

“There are some reports from geothermal startups recently that show early deployments demonstrating a 300% increase in drilling rate, and in the process, cutting costs in half. ... All of these advancements taken together can be seen in recent cost reductions and on projections of costs for geothermal technologies,” Gertler said.

The DOE’s Enhanced Geothermal Shot initiative aims to slash the cost of enhanced geothermal systems by 90% to $45 per megawatt hour (MWh) by 2035. The improvements, driven mainly by well stimulation and improved flow rates, show the EGS target is aggressive but achievable, he said.

The liftoff target corresponds to a levelized cost—or the lifetime costs—of energy of $60/MWh to $70/MWh, without help from government subsidies.

“If you look at the market demand side, what you’re seeing … is that firm clean power in the United States is clearing at $100 a MWh. When you go internationally, it’s often a much bigger multiplier than that,” Latimer said. “So, it’s already something that’s quite cost competitive … geothermal is already winning that cost discussion.”

In the past, the geothermal energy industry had never seen real cost efficiencies based on scale, Jewett said. Geographical constraints have prevented companies from drilling multiple wells, carrying out repetitive operations and leveraging economies of scale to reduce costs through learning, she said.

“We’re trying to basically upend that,” she added.

Drilling is a prime example.

It is difficult to achieve any meaningful learning by drilling only six to 10 wells. Applying a manufacturing mindset from a subsurface development perspective can lead to meaningful change.

“We are drilling not six or 10 wells, but we’re drilling a 100 wells. So, we’re basically able to apply the learnings of every single well to the wells thereafter,” Jewett said.

Going deeper, hotter

Drilling advances could make harnessing more energy from superhot rock possible.

Speaking during the same CERAWeek panel with Fervo’s Latimer, Terra Rogers, program director for superhot rock energy at the Clean Air Task Force (CATF), said it is focused on moving geothermal into temperatures of 400 C or higher.

CATF rolled out maps this year that show how deep drillers must go to make this possible. Its modeling tool showed 63 terawatts of clean power could be generated by harnessing just 1% of superhot rock belowground. Most drillers are not tapping into superhot rock, which is typically found in the U.S. at depths below 8 miles (12.5 km), a point at which existing rig capacity may be maxed out in terms of strength and stress.

“We know that we can get to 400 degrees …. What we don’t know we can do is complete or really construct that well in a way that has longevity,” Rogers said. “That is also a very important part in the research ingredients. … I have heard service providers say 7 km without blinking an eye.”

Eavor, which specializes in closed-loop geothermal technology, is developing technologies to go deeper and hotter.

“We’re working on it, but we’re not going to talk about it,” Eavor Technologies CEO John Redfern said during the same panel. “Like I say, deeper, hotter, faster, cheaper. That’s our mantra. And, those [technologies] will be unveiled as they come along … 7 to 9 km is sort of the limit [now].”

The company aims to deliver first power to the grid later this year, Redfern said.

The Calgary, Alberta-based company also joined the Alberta government and other stakeholders to develop the Alberta Drilling Accelerator (ADA), a “technology-agnostic, market-driven geothermal test site.”

The first-of-its-kind site in Canada will be available for use by any geothermal company pursuing novel drilling techniques and technology development, according to a news release. The ADA also aims to help the province keep pace with other government-supported geothermal test sites, such as Utah FORGE, the Continental Deep Drilling Program in Germany, the Deep Drilling Project in Iceland and China’s geothermal drilling program.

Lifting off, achieving scale

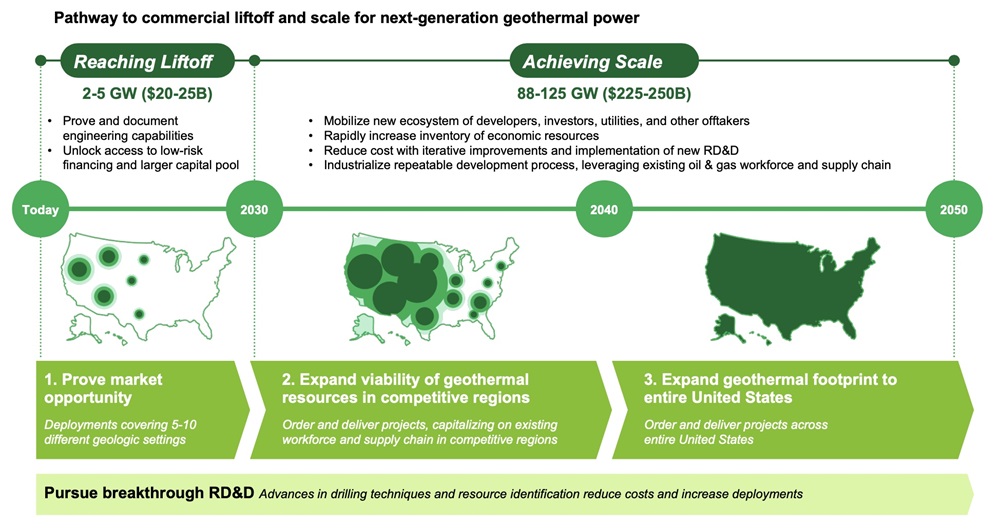

The DOE says the U.S. is positioned to produce up to 5 gigawatts (GW) of the clean energy power source across a handful of states. But it will take between $20 billion and $25 billion in investments to reach that power threshold by 2030. Producing 88 GW to 125 GW across more states by 2050 could require as much as another $250 billion.

Capacity could surpass 300 GW across the country, however, if hydrogen and direct air capture become difficult to commercialize and lead to more geothermal development, according to Michael O’Connor, lead co-author of the geothermal liftoff report and strategist for DOE’s Office of Clean Energy Demonstrations. O’Connor and Gertler discussed the potential for next-generation geothermal power and the department’s pathways to commercial liftoff report during a webinar earlier this year.

Key enablers for geothermal liftoff as detailed in the report include reducing costs to $60/MWh to $70/MWh, carrying out at least 30+ megawatt-scale demonstration projects to prove consistency and lower technology risk, locking in high-value offtake agreements with utilities or off-grid demand sources such as data centers that support new projects, and selecting sites and developing projects with communities.

“At the DOE-run Utah FORGE site, seismicity monitors are actually on display at the public library. So, community members can transparently see the impacts of drilling and drilling activities in their community in real time,” O’Conner said.

The pathway to liftoff includes demonstrating geothermal in five to 10 separate geologic settings to reduce risk and verify resource availability, according to the report. This corresponds to more than 100 developments, comprising overall deployment of 2 GW to 5 GW at a cost of $20 billion to $25 billion. Even more is required to achieve scale, defined as between 88 GW and 125 GW.

“To reach scale by 2050, next-generation geothermal will require an additional $225 to $250 billion in investment, driven by a new ecosystem of developers, investors, utilities, and other offtakers, and leveraging existing workforces and supply chains,” according to the DOE.

The biggest roadblock for growing geothermal may be convincing people to finance projects, according to Jewett. For Fervo, “it doesn’t take a ton of convincing once they lift up the hood and they see that these are good infrastructure-type return projects with long lifetimes,” she added. “We are a company that is not like geothermal companies of yore where we’re going to sort of drill all over the place and then come up empty. I think we’re a company that plans very well and plans to execute.”

When investors see that, “they become convinced pretty easily.”

As the discussion turned to funding during the CERAWeek session panel, Latimer and Redfern pointed out how their companies have been successful in raising venture capital dollars to pursue projects.

Chevron and Fervo received grants from the DOE for geothermal projects funded by the Bipartisan Infrastructure Bill.

“It’s good there’s funding there and enough to … put some points on the board and show some wins for our sector,” Latimer said.

On the flip side, a chart in the liftoff report compares how much funding geothermal received compared to other technologies.

“I couldn’t see the bar on the bar chart,” Redfern said, noting that despite that fact, funding will not hold back geothermal.

“As we prove up our different projects, there’s going to be a wall of money that wants to invest,” he said. “What’s going to hold us back is a physical limit of how fast we can scale up ourselves … because it just takes time to get people organized. It takes time to get rid of bottlenecks on the drilling rig side. There’s a whole bunch of physical limitations to how quickly you can grow.”

Rogers said tech partners are the unsung part of the geothermal’s story.

“Google and Microsoft have done an excellent job of pulling aside the green curtains and acknowledging that demand and supply need to align, especially in this space, and trying to match low-carbon expectations and the stress that these hyper-sized datacenters put on grids,” she said. “So as there is an awakening to the idea that they are a big part of the buying chain, I wouldn’t be surprised if we see some vertical integration. But in any case, they certainly are a strong source of funds. We don’t do one without the other.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.