When Midcontinent-heavy E&Ps were filing for bankruptcy and leaving for other plays, Tom Ward and Mach Natural Resources dug in.

Ward is someone who knows well Oklahoma and the Midcontinent plays: He previously co-founded Chesapeake Energy with Aubrey McClendon and served as its president and COO.

He later formed and led SandRidge Energy and Tapstone Energy, both of which developed deep Midcontinent positions.

Those roles gave him a front-row seat to the intense horizontal development—overdevelopment, he argues—of the Midcontinent over the past decade.

Wells were drilled too closely together, causing interference issues. Massive swathes of land traded hands for huge premiums. Costs soared, as did debt.

“The amount of drilling going on in the Midcon was just excessive,” Ward told Oil and Gas Investor (OGI), “and prices were excessive.”

Ward saw turmoil brewing on the horizon, and that turmoil eventually arrived.

Several notable E&Ps with major stakes in Oklahoma sought protection through the Chapter 11 bankruptcy process in the ensuing years, including Linn Energy, Alta Mesa Resources, Chapparal Energy and Gulfport Energy.

Even the companies Ward founded, Chesapeake and SandRidge, weren’t spared. (Of course, both companies are still around today; Chesapeake is bigger, and arguably better, than ever).

Midcontinent shale drillers that avoided bankruptcy themselves massively pulled back investment in the region. Other players, like Harold Hamm’s Oklahoma mainstay Continental Resources, never stopped drilling the Anadarko.

Around 32% of Continental’s total production came from the Anadarko Basin during the second quarter, the company told investors in August.

But Oklahoma, by and large, has left a sour taste in the mouths of operators since the middle of last decade, said Ryan Hill, principal analyst at Enverus Intelligence Research.

“One of the biggest fundamental reasons why a lot of those bankruptcies happened, in our view, was focusing on some of the lower-quality intervals, like the stuff north of the SCOOP/STACK toward that Kansas area,” Hill said. “The stuff on the shelf is a lot more challenged on economics.”

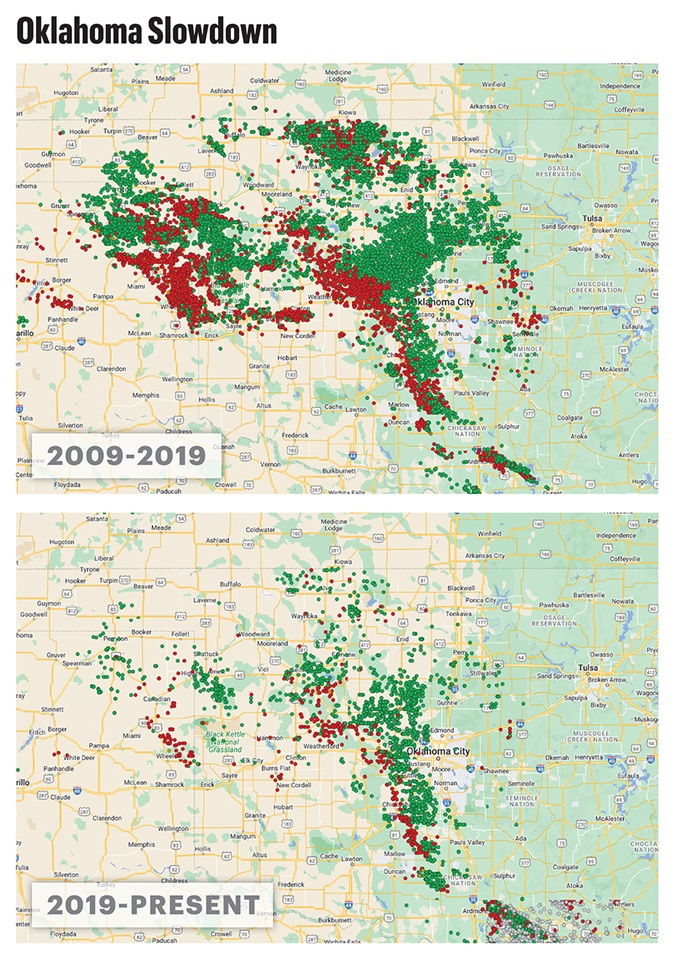

Since the bankruptcy bout, Midcontinent drillers have adjusted their strategies. Most of the new drilling since the COVID-19 pandemic has focused on the core of the SCOOP/STACK and less on the northern fringes of the play.

Operators have also pivoted to wider well spacing and bigger fracs as they’ve learned more about the subsurface characteristics of the Woodford and Meramec intervals.

And as dealmaking and prices heat up in other parts of the Lower 48—namely the Permian Basin—operators are taking a hard look at what’s still left to drill in the Midcontinent.

“From an economic standpoint, the SCOOP/STACK holds the vast majority of the unconventional resource in the Midcontinent,” Hill said.

Mach is certainly seeing competition and prices for Midcontinent assets creeping up, Ward said.

“Our focus was always on the Midcon because it was the cheapest molecule in the U.S.,” Ward said, “and that might be moving away from us.”

RELATED

Tom Ward: Mach Looks to Other Basins as Midcon Competition Heats Up

Cash cow

The multitude of bankruptcies across the Midcontinent last decade left traumatized memories for many operators, but some never left Oklahoma.

Continental Resources and Devon Energy, both headquartered in Oklahoma City, remained active through the lows of the pandemic.

Other large publics, including Marathon Oil, Coterra Energy and Ovintiv, have also kept up drilling programs on their Oklahoma acreage. Gulfport, while much more active in Appalachia today, still retains a footprint in the Midcontinent.

A handful of private operators also drill in the Anadarko, including private equity-backed E&Ps Citizen Energy III and Camino Natural Resources. Family-owned private E&P Mewbourne Oil has a large footprint in the western Anadarko and the Texas Panhandle.

The public E&Ps left in the basin are pumping less capital into the Anadarko than they are into other parts of their portfolio, like the Permian Basin.

But operators have their reasons for staying in Oklahoma. Ovintiv’s Anadarko position has the lowest base decline rate across the company’s entire portfolio and continues to generate significant free cash flow, which supports its goal of paying out larger dividends to shareholders each quarter.

“We are targeting the oiliest parts of our acreage to leverage the strong oil performance we saw in 2023, where the wells displayed first-year oil cuts of more than 55%, with about 85% of first year revenue coming from oil,” Ovintiv COO Greg Givens said during the company’s second-quarter earnings call.

“For Ovintiv, it’s a big part of their cash flow,” said Enverus’ Hill. “Obviously, they’ve pulled a lot of the activity away and, from our perspective, it seems like they view the basin as non-core or secondary—but like I said, it is pretty strong on cash flow.”

Coterra is running a single rig in the Anadarko and completed the bulk of its 2024 frac activity during the second quarter.

It’s a basin that’s shown resiliency in 2024 despite headwinds to the natural gas market, said Blake Sirgo, senior vice president of operations for Coterra.

“Our Anadarko assets’ proximity to Henry Hub provides us some of the strongest gas realizations in our portfolio,” Sirgo said during Coterra’s second-quarter earnings call. “Those realizations, combined with significant liquid contributions from NGLs and condensate, buoy our economics, making the Anadarko an attractive place to invest capital.”

Devon Energy’s bread and butter today is the Delaware Basin, where the company is sending most of its capital spending. But Devon is still active in the Anadarko Basin under a joint venture (JV) with chemical giant Dow to jointly develop Devon’s STACK acreage.

In the second quarter, around 21% of Devon’s companywide gas volumes and 16% of companywide NGL volumes came from its Anadarko acreage.

Devon COO Clay Gaspar said the partnership with Dow helps promote returns to continue competing for development capital.

“In the Anadarko, our capital program driven by our joint venture with Dow delivered both solid returns and double-digit production growth in the quarter,” Gaspar said during Devon’s second-quarter earnings call.

RELATED

Powder in the Hole: Devon May Fire up its PRB in Coming Years

Commodity confluence

Part of the reason the Midcontinent hasn’t attracted the investment of other geographies, like the Permian, is the Midcon’s commodity mix.

The Permian Basin is an oil basin. It’s getting gassier over time as the basin gets drilled and developed, but operators buy in the Permian for crude oil exposure.

Operators consider the Midcon as an oil basin, too, Hill said. But for an oil basin, the Midcontinent is “still pretty gassy,” he said.

Compared to other basins, natural gas and NGL prices play larger roles in the economics of the Anadarko and the SCOOP/STACK plays.

The up-and-down volatility of gas prices can impact a producer’s plans more in the Midcontinent than in the Permian Basin, where Waha gas prices frequently dip into negative territory (however, Permian E&P Diamondback Energy reported shutting in gassy Permian oil wells during the second quarter because of dismally low natural gas prices).

So, it shouldn’t come as a surprise that the Midcontinent saw a healthy increase in drilling rig activity when natural gas prices skyrocketed in 2022—bolstered by Russia’s invasion of Ukraine and the global economic reemergence from the COVID-19 recession.

When prices collapsed heading into 2023, so did Anadarko drilling.

Rig activity “really fell off a cliff in early 2023 when the gas prices really fell,” Hill said. “Definitely, it’s a basin that will be a lot more associated with that commodity price.”

Anadarko rig activity has declined massively over the past five years. There was an average of 117 rigs across the Anadarko during January 2019, according to Enverus figures. Just a year later, there were 39 rigs drilling across the same land mass.

Rig activity in the Anadarko bottomed out at seven rigs during June and July of 2020, as the world suffered the height of the COVID-19 pandemic.

Natural gas prices are still low today, though they’re moving up from record lows seen earlier this year. Operations still active in the Anadarko have mostly shifted development toward oil- and liquids-rich sections of the SCOOP/STACK plays.

But as more gas is needed to fuel U.S. LNG exports and growing domestic usage in power generation, manufacturing and advanced computing, operators are not forgetting the Anadarko.

The Midcontinent still has a significant and relatively untapped resource of dry gas, said John Frey, vice president of business development and land for FourPoint Energy.

FourPoint previously developed a footprint in the western Anadarko Basin before the company restructured and assets were transitioned to an affiliate of Maverick Natural Resources in late-2020.

FourPoint is active in the Permian, but the company is considering new M&A opportunities in the Midcontinent today.

“If gas prices got to a certain level, there would be massive development and significant [dry gas] resource produced from the Midcon,” Frey said.

Rather than the Midcontinent, experts anticipate seeing greater future LNG feed-gas volumes emerging from the Haynesville, the Eagle Ford, the Permian and Appalachia.

RELATED

Exclusive: Aethon M&A Gambit Pays Off with Woodside-Tellurian Deal

Hot spots

Since the E&P bankruptcy bout and the pandemic, most Midcontinent drilling activity has centered around the core of the SCOOP/STACK plays. But certain operators see opportunity in less developed nooks and crannies hiding around the region.

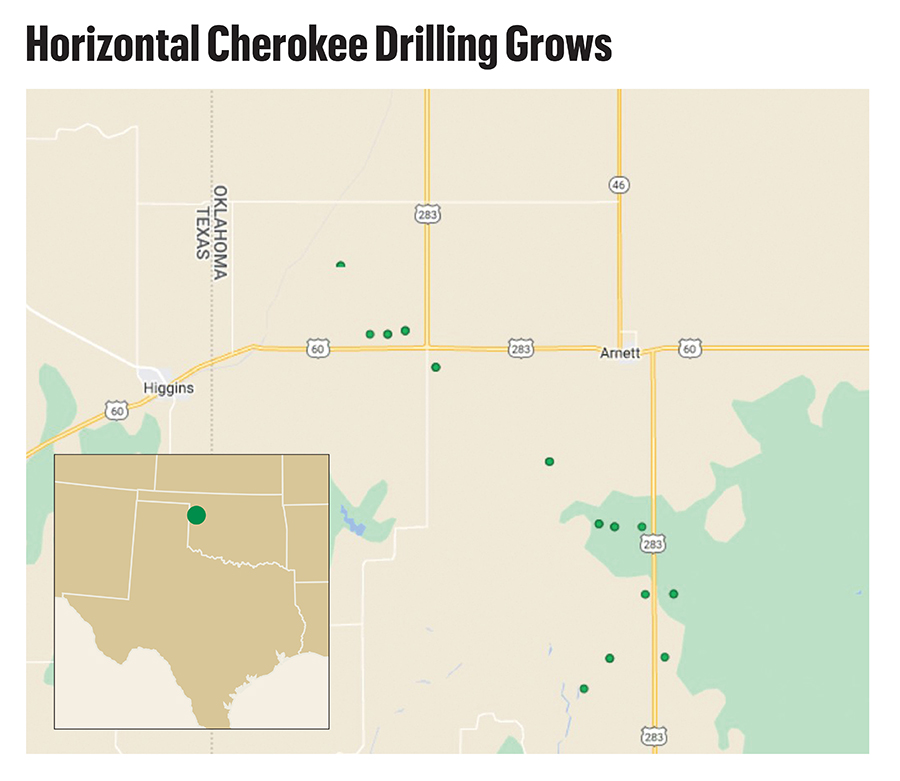

Dealmaking activity is heating up in the western Anadarko Cherokee play, where private E&Ps have been delineating horizontal drilling locations.

Exxon Mobil is one of the only companies drilling in the Marietta Basin of southern Oklahoma, not far from the Texas border. North of the Marietta, development of the Ardmore Basin has been led by Continental Resources.

During the second quarter, SandRidge inked a $144 million acquisition of Cherokee assets from Upland Operating, according to regulatory filings.

The transaction includes 42 wells, four DUCs and net production of approximately 6,000 boe/d (about 40% oil) in Ellis and Roger Mills counties, Oklahoma.

SandRidge is picking up leasehold interest in 11 drilling spacing units (DSU), adding inventory of up to 22, 2-mile lateral wells in the core of the Cherokee play.

Upland was one of the leading developers of the Cherokee play, along with family-owned Mewbourne Oil.

“[The Cherokee play] looks very interesting,” Ward said. “We have close to 20,000 acres of leasehold that’s held by production and we’re just watching that play.”

Exxon Mobil’s flagship shale asset is the Permian, and its Permian footprint expanded significantly through its $60 billion acquisition of Pioneer Natural Resources. Exxon is also still active in the Bakken.

But Exxon unit XTO Energy has quietly continued drilling Woodford wells in Love County, Oklahoma.

The Marietta Basin is somewhat of a geologic anomaly—one of the only places in the Lower 48 where black oil is deposited at depths between 15,000 ft and 16,500 ft, Continental Resources’ Anadarko Basin Vice President Aaron Chang told Hart Energy.

XTO has been wildcatting in the area for more than a decade, but it’s unclear how the Woodford wells compete for capital in the company’s increasingly Permian-heavy portfolio. Exxon declined to be interviewed on the Marietta Basin for this story.

The hunt for oily zones across the Midcontinent also brought operators like Continental to the South SCOOP in the Ardmore Basin.

It’s been an active development area for operators like Continental and Camino, which have touted flatter declines and lower gas-oil ratios (GORs) from Ardmore wells compared to other Midcontinent plays.

Mach has even continued drilling new wells across the border into southern Kansas, state data show.

RELATED

SandRidge Energy Buys Western Anadarko Cherokee Assets for $144MM

Primed for deals

It’s hard to say which operators will pull away from the Midcontinent and which could dig in further through M&A.

“On the who stays and who goes—we definitely see more consolidation likely to be happening,” Hill said.

Mach is hunting for deals in the Midcon, as well as in other basins. SandRidge continues to be acquisitive in the western Anadarko extensions.

Citizen Energy and Camino are at least two private E&Ps with private equity sponsors that will eventually look for a sale. Warburg Pincus is reportedly seeking a buyer for Citizen in the range of $2.5 billion.

But for larger operators, like Marathon Oil, the Midcontinent could very well be considered non-core.

During the second quarter, Marathon’s Oklahoma assets produced the least total resource (42,000 boe/d) and least oil (7,000 bbl/d) across its entire portfolio. Marathon didn’t turn any Oklahoma wells to sales during the quarter, either.

And as ConocoPhillips acquires Marathon in a deal valued at $22.5 billion, including debt, the pro forma company could look at non-core assets sales to pay down debt.

"Companies like Marathon now—you could see them moving out of the SCOOP/STACK,” Hill said, “where multi-basin operators Ovintiv and Devon could either move out altogether or double down on the SCOOP/STACK."

Devon and Ovintiv, for their parts, appear to be focused on different basins. Devon is acquiring Bakken E&P Grayson Mill Energy for $5 billion, and Ovintiv acquired a trio of private Permian E&Ps last year for more than $4.2 billion.

The key to unlocking the Midcontinent’s future will likely be the movement of natural gas prices.

“It’s definitely going to be an interesting year as we see what happens with gas relative to the LNG buildout,” Hill said, “and then, as a result, what happens in the SCOOP/STACK.”

RELATED

Recommended Reading

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

Belcher: Tariff Growing Pains Will Help US Achieve Energy Dominance

2025-04-03 - Tariffs may bring short-term pain, but Trump is aggressively pursuing goals that benefit the U.S., says Cornerstone Government Affairs’ Jack Belcher.

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.