Commodity price volatility chilled the market for natural gas M&A this year. But after Tokyo Gas Co. inked a deal to acquire Haynesville Shale E&P Rockcliff Energy II, could more gas deals cross the finish line?

Through its U.S. upstream subsidiary TG Natural Resources, Tokyo Gas Co. Ltd. is acquiring Rockcliff Energy II for $2.7 billion, the companies announced late after markets closed on Dec. 15.

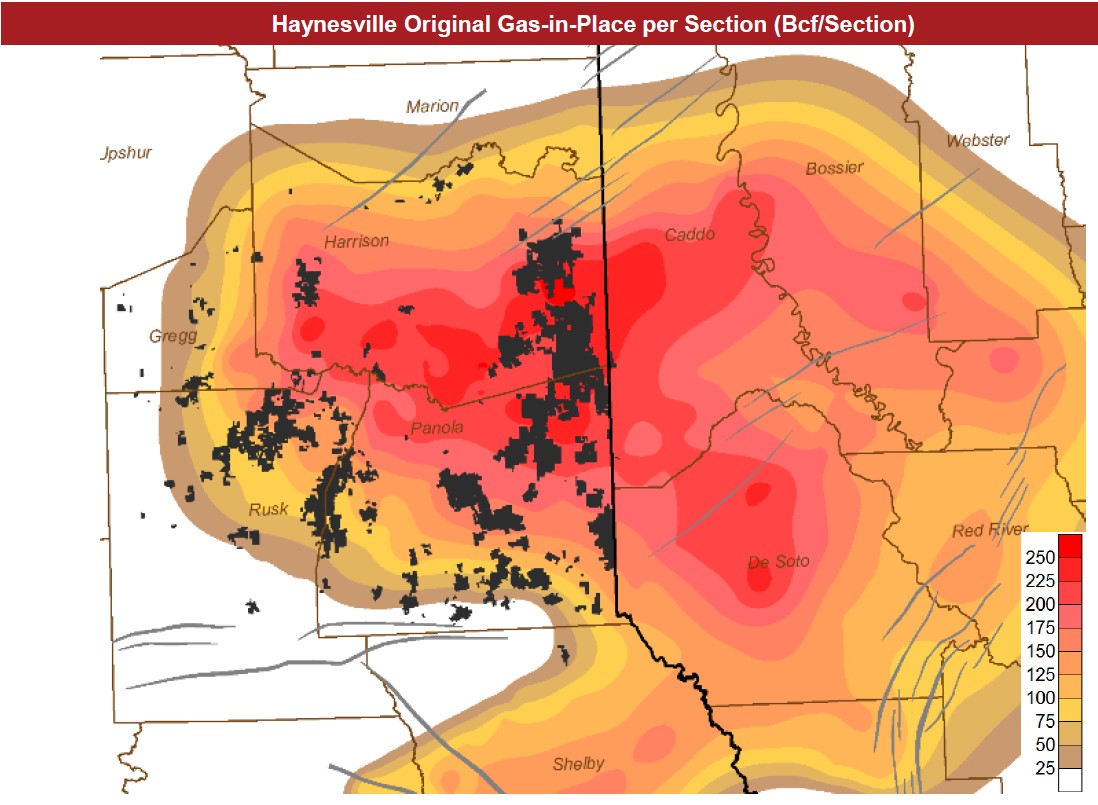

Rockcliff, backed by private equity firm Quantum Energy Partners, developed a sizable position in the East Texas side of the Haynesville Shale play since making its first acquisitions in 2017.

The company operates more than 200,000 net acres and over 1.3 Bcf/d of gross operated natural gas production across five Texas counties.

Tokyo Gas has been seeking to add scale near its existing footprint of natural gas assets in Texas and Louisiana, the company said in an investor disclosure.

With U.S. gas demand expected to rise due to the construction of several new LNG export terminals on the Gulf Coast, Tokyo Gas looked to grow its exposure to U.S. shale.

Rumors swirled earlier this year that Tokyo Gas wanted to acquire Rockcliff for about $4.6 billion; Natural gas prices were about $3/mcf at that time.

But a potential deal at that time fell apart, apparently due to declining natural gas prices.

Analysts at Truist Securities say there’s credibility that lower natural gas prices may loosen up the markets and allow for more M&A.

“We continue to believe the recent move in the gas strip has caused a shakeup in any potential deals as privates feel a capital funding pinch, likely making some companies more attainable for the publics (if they are still willing to ink a deal at these levels),” Truist analysts wrote in a Dec. 17 press note.

The Rockcliff deal’s size is smaller than most public gas-focused E&Ps, but the transaction does shed some light into the current market for natural gas corporate M&A.

TG Natural Resources agreement pays between $3,600 and $3,700 per flowing MMcfe/d of gas output, which screens “a little better than the public group’s average by 11%,” according to Truist’s calculations.

On a valuation basis, the deal gives a positive indirect read-through for several public gas E&Ps, including Antero Resources, Chesapeake Energy and Southwestern Energy.

And it’s a more direct comparison in valuation to Comstock Resources Inc. as the only public pure play E&P in the Haynesville.

“A key for transactions will remain the preference for equity over cash to allow for ride-along upside in a commodity recovery environment,” Truist wrote.

RELATED

Tokyo Gas to Buy Rockcliff Energy’s Haynesville Assets for $2.7B

Season of deals

The M&A market for oil-weighted assets has seen a whirlwind of activity this year, with the biggest transactions taking place in the Permian Basin.

After Occidental Petroleum Corp.’s $12 billion bid to acquire private Midland Basin E&P CrownRock LP, the total transaction value in Permian Basin assets has eclipsed $100 billion this year, according to figures from Wood Mackenzie.

That’s up from the previous peak of $65 billion transacted across the Permian in 2019.

In October, the Permian saw its biggest deal ever get inked—a $60 billion combination between Exxon Mobil Corp. and Pioneer Natural Resources.

Other smaller E&Ps, including Civitas Resources, Permian Resources, Ovintiv Inc. and Vital Energy, have spent billions of dollars to add scale in the Permian this year.

Truist said even more deals could potentially close this year and heading into 2024, based on recent conversations the firm had with several public and private E&Ps.

Several factors are driving E&Ps to hunt for accretive M&A. Numerous companies have a limited runway of Tier 1 drilling inventory with low breakeven costs. Several “suboptimal operators” have higher-than-average breakevens, according to Truist.

Few untapped zones of low-cost oil are left to be explored—and that lack of future new major discoveries places a greater emphasis on external assets.

Truist believes several companies—including Apache Corp., Chord Energy, ConocoPhillips, Coterra Energy, Devon Energy, Diamondback Energy, Marathon Oil, Northern Oil & Gas, Permian Resources and Vital Energy—could potentially be looking to acquire.

Meanwhile, companies including Callon Petroleum Co., Chevron Corp., EQT, SilverBow Resources, Exxon Mobil and several private E&Ps could be sellers of assets.

RELATED

Analysts: Permian Basin Rigs Plummeted on Record Upstream M&A

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.