Editor’s note: This is the first in a series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

U.S. shale has consolidated to the point that its upstream players number about half of just a few years ago. The industry is mature—and so are its top basins. Producers run a tight, efficient ship of an industry that exercises capital restraint, returns cash to shareholders and sports yields better than the S&P 500. The incoming president is a big fan and is naming a cabinet that promises to make it easier to do the business of oil and gas. And capital is slowly—very, very slowly—returning to the E&P space.

The timing is impeccable because the new year will carry with it challenges that will likely call upon all of the industry’s resources.

Lingering themes from 2024—managing a disciplined capital structure as inventory life matures; constraints around natural gas infrastructure, water management and Permian Basin electrification; and volatile demand—continue to resonate, said David Deckelbaum, managing director at TD Cowen.

“I think all of these are really just another way of saying that the challenges will be replicating the success that you have with efficiencies in 2024,” he told Oil and Gas Investor (OGI).

“It would be inconceivable that you would be able to achieve the same rate of change in ’25.”

Still, regular capital efficiency gains may now be a necessary part of the industry’s go-forward strategy.

“There’s still very much an existential struggle of how you balance the need for more resource [with] the need to go into more secondary zones while not showing a degradation of capital efficiency,” Deckelbaum said.

‘Doing more with less’

Whether in terms of remaining independent E&Ps, the rig count or capital invested, the industry did more with less in 2024.

U.S. oil production set a new record in August with an average of 13.4 MMbbl/d, topping the previous monthly high of 13.3 MMbbl/d, according to the U.S. Energy Information Administration (EIA). For the full-year 2024, the EIA forecast an average of 13.2 MMbbl/d, which topped the record 2023 annual average of 12.9 MMbbl/d.

And the record gain is expected to continue in 2025, when the EIA predicts U.S. oil production will average 13.5 MMbbl/d.

But the U.S. rig count began trending downward in 2023, when it fell 20% from the previous year, according to Baker Hughes data. The count moved in fits and starts in 2024. For the week ending Dec. 6, the number of oil rigs had increased by five to 482 rigs—the highest figure since mid-October, but still 6% less than the same time in 2023, the services firms said.

Following incremental spending increases in 2022 and 2023, most E&Ps are keeping their 2025 budgets flat compared to 2024.

“We’re getting better at doing more with less,” said James Wicklund, PPHB managing director.

“We are no longer globally in a growth market for oil and gas [unless] growing by 1.5% a year is considered a growth industry. The goal is going to be to maintain production rather than to grow production, at least dramatically.”

Successfully setting production records with fewer rigs and services is a function of efficiency gains, he said.

“If efficiency gains continue to outpace demand growth, then oil prices go down. Now, if an oil company spends less to produce the same amount, they make more money,” Wicklund told OGI.

Indeed, efficiency gains and consolidation left a mark on the industry in 2024, Deckelbaum said. Advanced drilling times, drilling speeds and completion speeds demonstrated that operators are just doing more with less.

“I think that there was a huge field-level thematic that is probably going to carry some pretty nice tailwinds going into 2025,” he said.

“Particularly as you saw quite a bit of consolidation on private packages [and] some of those efficiency gains being laid on top of those acquired assets as a way of generating returns. It’s one of the reasons why I think you could see for some names, capital spending on an absolute basis, just as perhaps the maintenance capital relative to your production is going down on the margin because of efficiency gains.”

Consolidation benefits in 2024 came through with efficiency gains, analysts said, and that will continue in 2025.

In part, UBS analysts said, the valuation arbitrage of 2.2x enterprise value between small- to mid-size E&Ps and large cap E&Ps will force consolidation. The gap reflects the gains that companies made via consolidation, which heightened scale for greater efficiencies.

Production plans, budget base

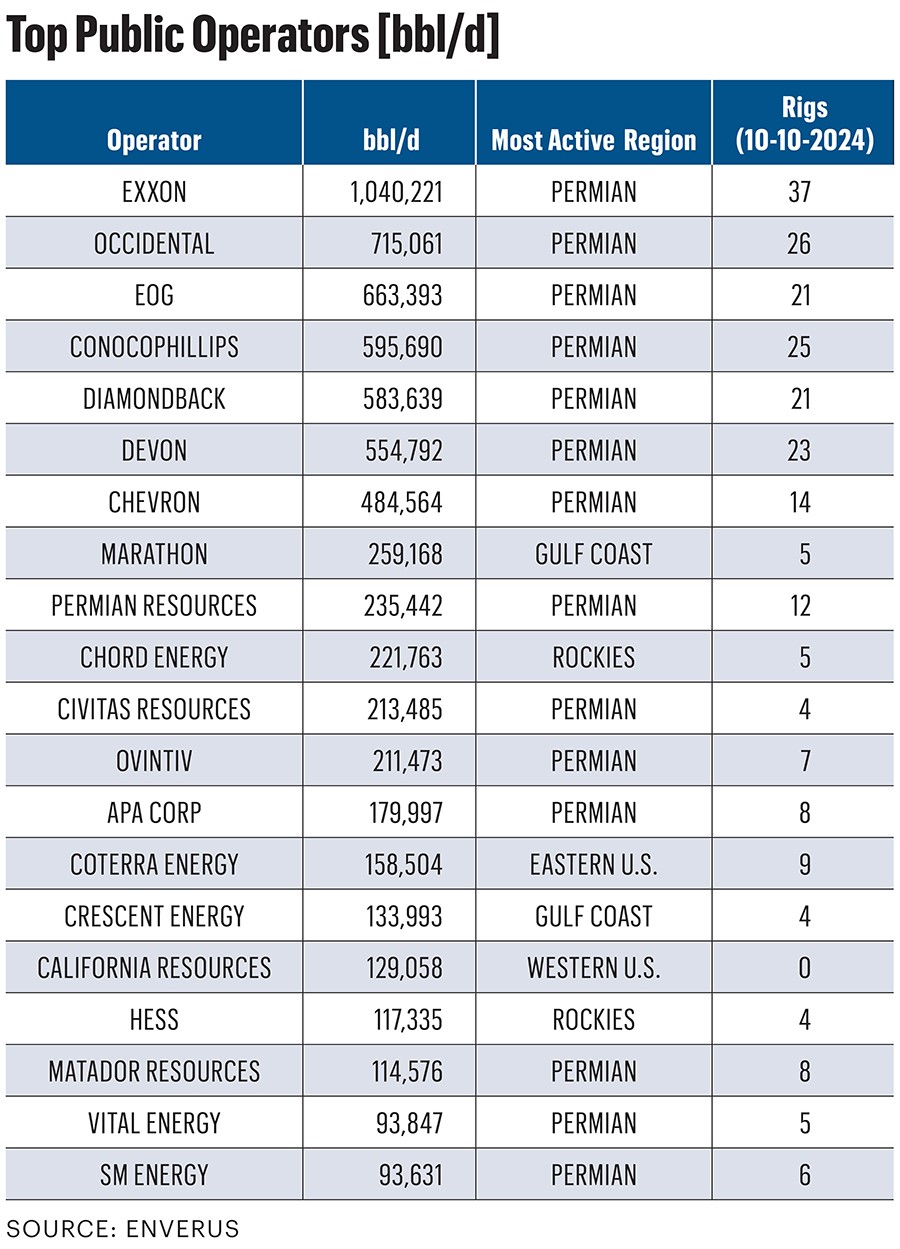

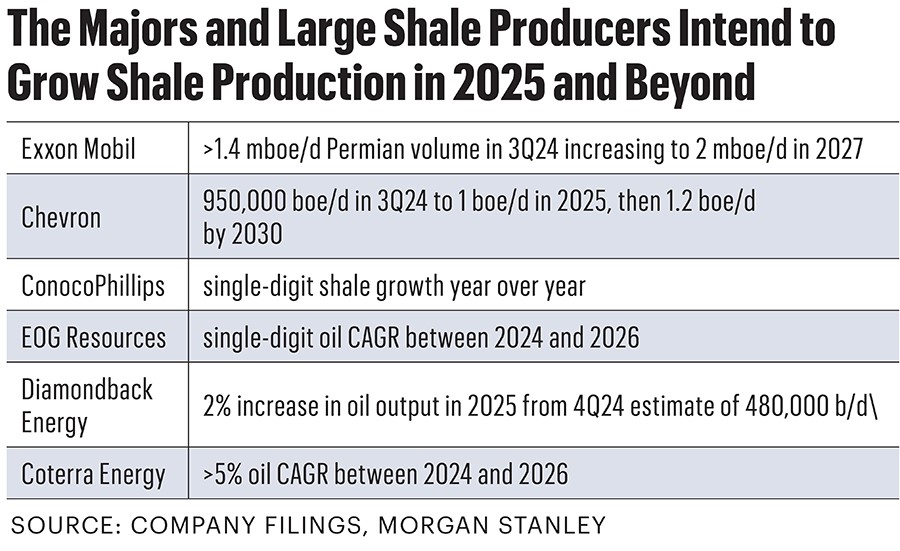

Most E&Ps are budgeting for flat oil production off maintenance programs in 2025, according to third-quarter reporting. Shale growth will happen at the majors and large cap producers, including EOG Resources, ConocoPhillips and Diamondback Energy.

Most shale gas producers are open to deferring activity if the macro view calls for it. Their preference is to use efficiency gains to trim activity, not accelerate growth, said Devin McDermott, Morgan Stanley’s managing director of oil and gas research.

Efficiency gains in drilling and completion activity, coupled with some deflation, will continue to be a tailwind to some E&P budgets. These advances account for a $25/ft reduction in well cost at Diamondback, allowing it to reduce its 2025 capital expenditures plan by up to $400 million. Occidental Petroleum’s well costs in the Denver-Julesberg Basin dropped 20% between the first and third quarters of 2024, and management said that momentum will continue throughout 2025. EQT expects operational efficiency will reduce its capex by $50 million for the new year.

Gas rises to the top

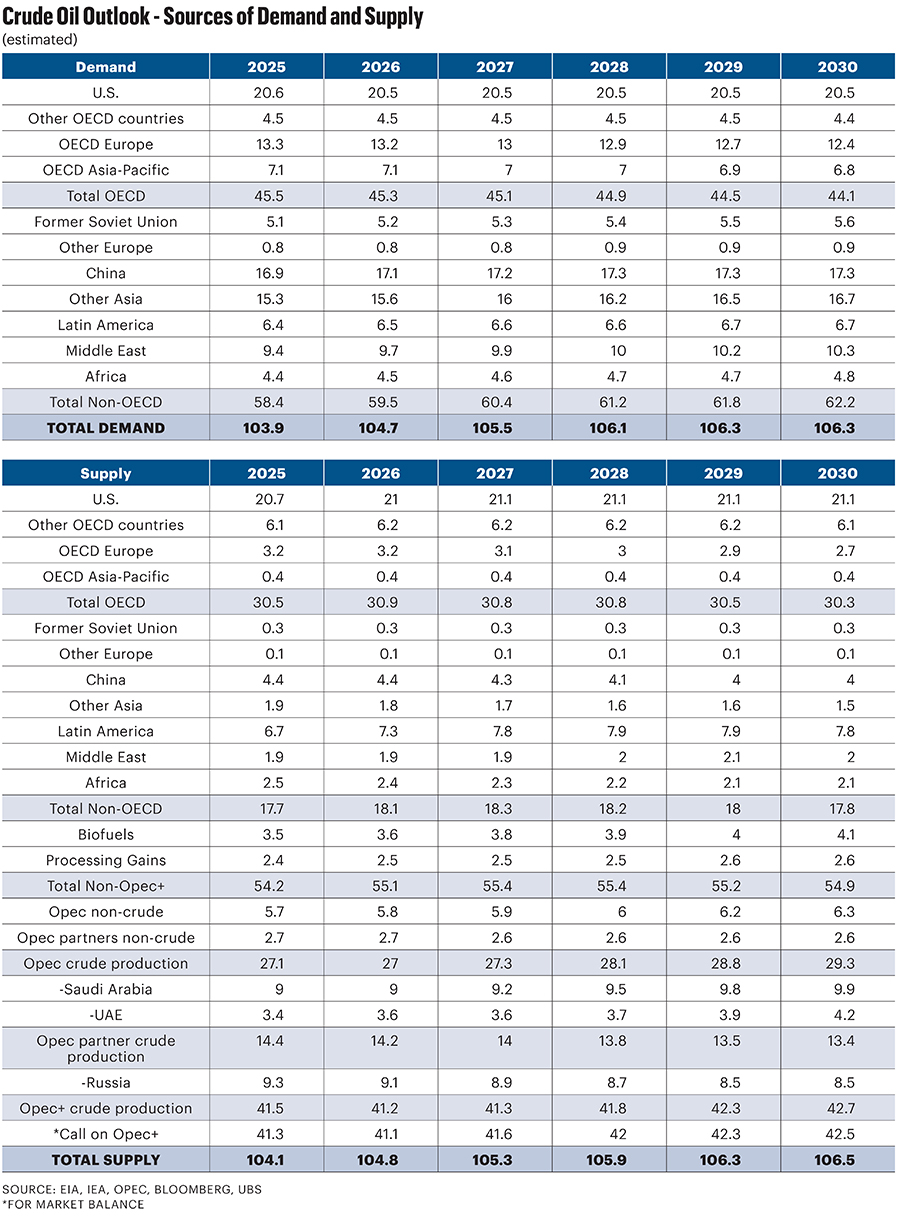

Analysts’ estimates for 2025 oil prices are screening soft with expectations of surplus supply at or slightly above 1 MMbbl/d; Morgan Stanley’s head of European oil and gas research Martijn Rats reckons the surplus could be as much as 1.3 MMbbl/d.

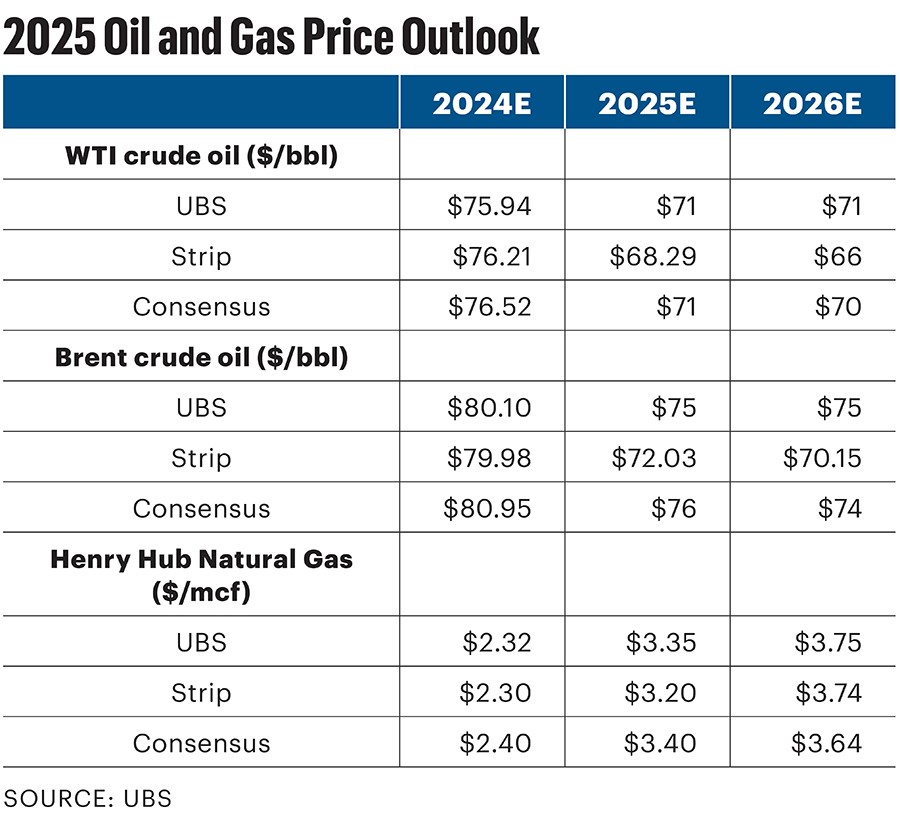

The UBS outlook on oil of $71/bbl WTI in 2025-2026 reflects an offset of the OPEC+ extension of its supply cuts from slower global GDP growth weighing down demand. Still, the bank forecasts that companies within its upstream coverage universe will average an 8% return of capital yield next year, surpassing the S&P 500.

“Upside comes from weaker non-OPEC supply and/or geopolitical impacts reducing supply; downside comes from stronger non-OPEC supply, poor OPEC+ compliance, and/or weaker demand,” Josh Silverstein, UBS managing director and head of energy research, said in December.

UBS has lowered its 2025 demand growth estimate to 1.01 MMbbl/d based mainly on weaker Chinese demand, an impact of the U.S. presidential election and likely trade policy changes aimed at China and other nations.

Beyond 2025, UBS expects oil demand growth to moderate to 800,000 bbl/d in 2026 and 2027 from the weight of the energy transition.

“We expect global oil demand to peak at 106.3 million bbl/d in 2029 before gradually declining,” Silverstein said. A rising rate of electric vehicle uptake will replace 3.3 MMbbl/d of oil for passenger vehicles around the world in 2030.

Stephen Richardson at Evercore ISI might say it best: “Balances in 2025 are ugly, and continued OPEC+ action will be needed to support price.”

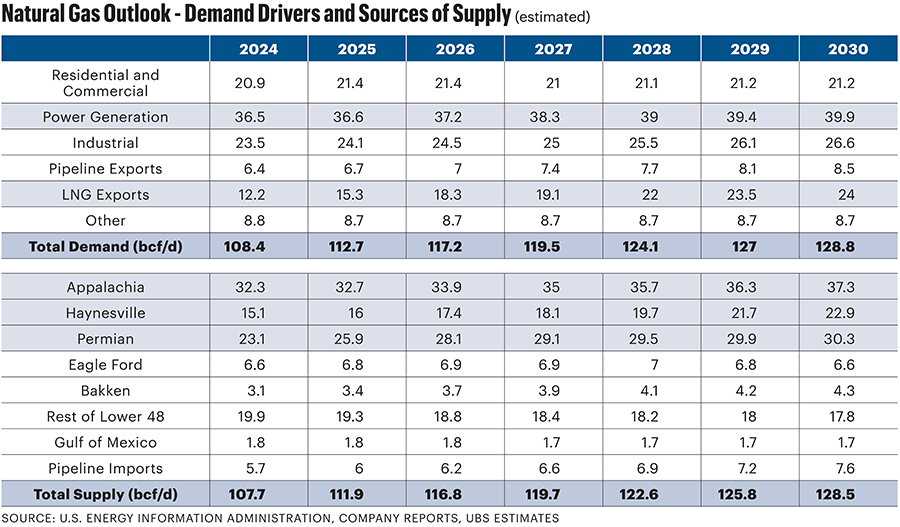

The weaker oil outlook is offset by Wall Street’s forecast of an increase in natural gas prices in 2025-2026. While the Lower 48 is currently oversupplied, the weaker oil outlook may support gas prices.

Silverstein at UBS puts the bank’s Henry Hub outlook price for 2025-2026 at $3.35-$3.75/MMcf, supported by rising demand—especially from LNG exports—and lower activity supporting the supply/demand balance.

UBS is forecasting domestic natural gas balances will decline into an undersupplied position of up to 1 Bcf/d, producing a stronger outlook for 2025 pricing. Both public and private E&Ps will continue to prioritize free cash flow generation over volume growth, Silverstein said.

Long-term UBS projects that Henry Hub prices will stabilize in a $3.50-$4/MMBtu range, an improvement driven by growing LNG exports and higher power generation demand from AI and data center development.

“We see a mixed outlook for energy in 2025,” Silverstein said. “To the positive side, we see natural gas momentum building, the benefits of sector consolidation coming through and shareholder returns ramping as balance sheets have improved. However, crude oil prices face downward pressure, and attractive valuations may not be enough to bring in new investors.”

Consolidation carryover

In 2023, oil and gas E&Ps spent some $234 billion on M&A—the most since 2012, according to the U.S. Energy Information Administration (EIA). And by mid-2024, the year’s upstream M&A activity was already tracking to top the 19 deals in 2023 valued at more than $1 billion, an Enverus report showed.

And that trajectory could have been more dramatic if not for the slow-walk tactics of the U.S. Federal Trade Commission (FTC). The agency has aggressively targeted dealmaking and E&P mergers have been in the crosshairs of FTC Chair Lina Khan and Senate Democrats.

Indeed, closing on most of the largest E&P deals announced since fall 2023 was delayed by the agency’s second notice requests. The flurry of notices was unusual in oil and gas, insiders told OGI.

The Hart-Scott-Rodino Act charges the FTC and the Department of Justice with review of proposed transactions that may affect commerce; either agency can take legal action to block deals that it believes would “substantially lessen competition.” In December 2023, the agencies released updated merger guidelines. Among them: any deal that creates a company with a market share greater than 30% could be problematic.

The mergers caught in the guidelines include:

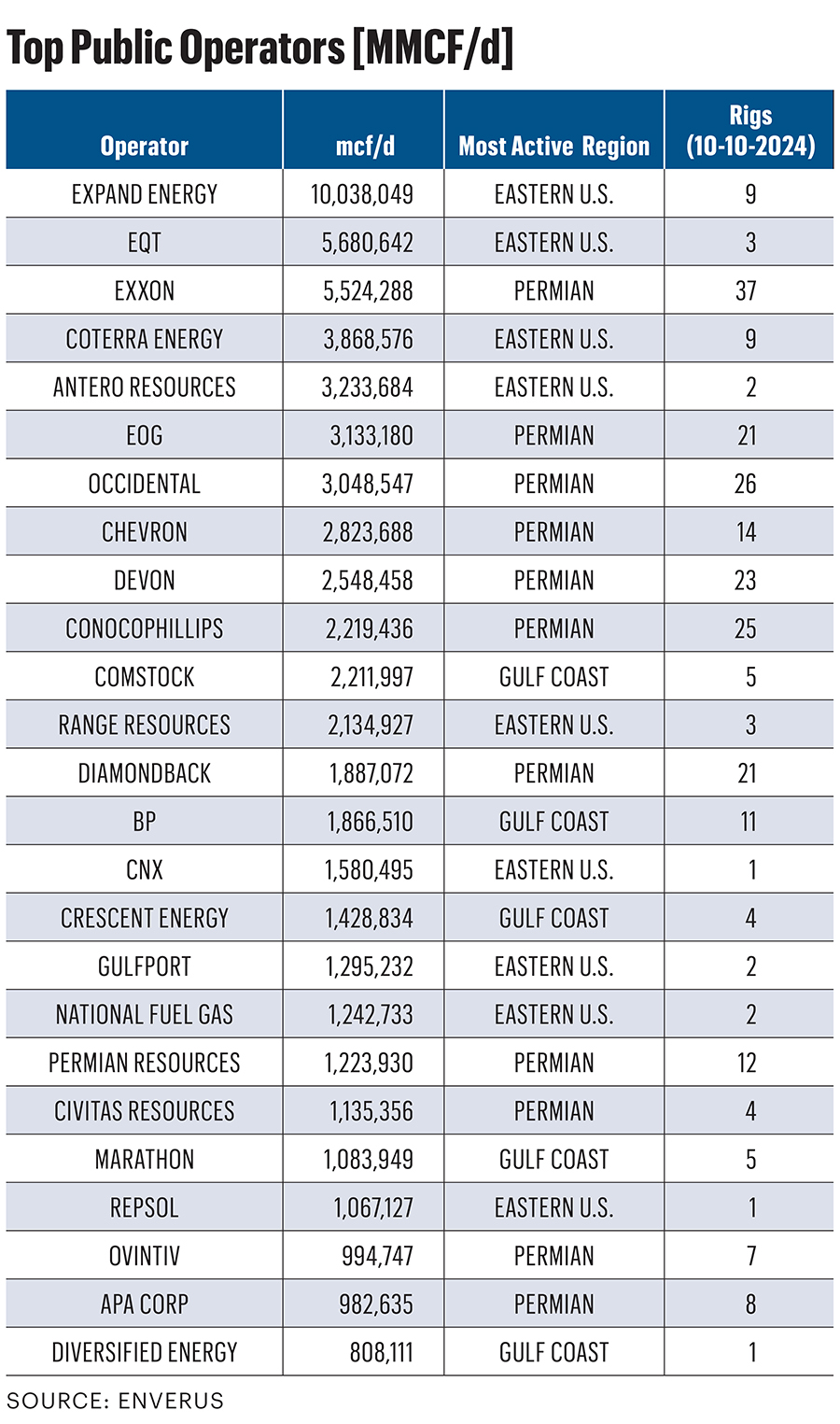

• Chesapeake Energy’s $7.4 billion merger with Southwestern Energy to create Expand Energy;

• ConocoPhillips’ $22.5 billion acquisition of Marathon Oil;

• Exxon Mobil’s $60 billion purchase of Pioneer Natural Resources;

• Diamondback Energy’s $26 billion acquisition of legacy private producer Endeavor Natural Resources; and

• Chevron’s $53 billion purchase of Hess Corp., a deal that Exxon is challenging because it seeks to take over Hess’ assets in Guyana.

But the tide appears to be turning in favor of more consolidation in the space, which many top executives say is greatly needed. And it’s more than simply divesting the noncore assets that recent mergers have added to the portfolio, Occidental Petroleum CEO Vicki Hollub said during Hart Energy’s Executive Oil Conference in November.

“Without a doubt, there’s going to be consolidation, not just in the Permian, not just in the U.S., but around the world,” Hollub said. “Large companies are going to have a very hard time replacing what they produce. That’s created a lot of need for the largest oil companies to do M&A—or they become a declining business.”

The timing appears to be ripe in 2025 for a new administration with a friendlier stance toward oil and gas than shown by President Joe Biden.

President-elect Donald Trump has already produced a litany of names for top agency jobs, including Andrew Ferguson, currently one of the FTC’s five commissioners, to replace Khan.

“One of the aspects of the new administration would be inherently a less scrutinous FTC, which I think did hinder some deals in 2024. And certainly, we saw several large headline deals being slowed by the FTC,” Deckelbaum said. “I would imagine that, in this more benign environment, you’ll likely see continued industry consolidation.”

Gaming 2025 M&A

Consolidation is expected across the upstream space in the Lower 48. After billions of dollars’ worth of significant deals, the Permian Basin remains in play for consolidation, insiders told OGI.

“It has compelling interest for a variety of reasons,” Deckelbaum said.

The Matterhorn Express Pipeline, which came online in October, is flowing an average of 317 MMcf/d of natural gas.

The new takeaway capacity will presumably start alleviating gas pricing locally in the basin, he said.

And the successful testing of some secondary benches in the Permian is gathering interest.

“I would expect that you’re just going to see more focus around additional fences in areas like the Permian that maybe didn’t get as much airtime over the last couple of years. Certainly, areas like Woodford, some areas like the Wolfcamp XY, I think that those are probably where you see the most focus,” Deckelbaum said.

Excitement around LNG expansion and the likelihood that Trump will repeal the Biden administration’s pause on new LNG facilities could heighten activity along the Gulf Coast gas basins, as well as those in Appalachia, he said.

The macro

The next president brings a whole deck of wildcards with him to Washington. While many of the most likely scenarios of a Trump presidency tip in favor of the industry, given Trump’s coziness with oil and gas interests, some of his reported plans have received mixed reactions.

Some of the good in his promises is obvious.

Trump’s choice of Chris Wright, co-founder, chairman and CEO of Denver-based Liberty Energy, for Secretary of Energy was endorsed by none other than shale wildcatter and policy influencer Harold Hamm.

The president-elect also followed the counsel of Hamm, CEO of Continental Resources, on choosing North Dakota Gov. Doug Burgum as Interior Secretary and chairman of the newly formed National Energy Council. The council, Trump said in a statement, is designed to “oversee the path to U.S. ENERGY DOMINANCE by cutting red tape, enhancing private sector investments across all sectors of the Economy, and by focusing on INNOVATION over longstanding, but totally unnecessary, regulation.”

Other items are concerning.

• Trump has repeatedly pledged to levy tariffs on all imports, including Canada and Mexico, and especially China.

• Among his campaign ditties, chants of “drill, baby, drill” were revived at most of his oil-weighted campaign rallies, especially those in so-called blue wall states like Pennsylvania, which fell to the Republicans in November. Trump has promised to reduce the price of gasoline, which would come with more oil supply; oversupply reduces the price of oil, too, and U.S. producers have expressed little interest in watching oil supplies surge and the price of crude plummet.

Most analysts don’t see U.S. shale giving in to the president-elect’s urging. At Wells Fargo, Roger Read said the bank doesn’t expect a greater-than-FCF reinvestment rate among E&Ps, nor does it foresee a return to excessive annual production growth.

“We base this outlook on three key reasons: shale resource maturity, scale and ownership; changed investor demands for returns; and sector consolidation of both public and private E&Ps. The industry’s structure is inconsistent with high growth,” Read said in a December report.

And some of Trump’s ideas are head-scratchers. For example, he promised to fast-track certain permitting for high-dollar investors, posting on his Truth Social site:

“Any person or company investing ONE BILLION DOLLARS, OR MORE, in the United States of America, will receive fully expedited approvals and permits, including, but in no way limited to, all Environmental approvals. GET READY TO ROCK!!!”

But it’s unclear how that would work, given the review process that is built into statute, such as those required by the National Environmental Policy Act.

And then, there’s the bevy of geopolitical variables that could impact U.S. shale.

OPEC+ decided in December to extend its production cuts of 1.65 MMbbl/d though the end of 2026. However, analysts noted some concerns, not the least of which is member compliance, that hover over the announcement.

Mukesh Sahdev, Rystad Energy’s global head of commodity markets/oil, said “a lot depends on how the Trump 2.0 rhetoric on U.S. production growth and sanctions on Iran [and] Venezuela plays out along with tariffs on Canada and Mexico.

“The delayed phase-out also signals that OPEC+ acknowledges the weakness in Chinese demand and is not anticipating a surprise rebound anytime soon, given Trump’s possible tariffs against China.”

Still, OPEC discipline remains a concern, Read said. And even if OPEC shows restraint, Read points to other wildcards at play: Chinese demand trends, tariff/trade risks, OPEC+ discipline, easing/rising global conflicts and winter weather in the Northern Hemisphere.

Recommended Reading

Vitol Boosts Upstream Presence in West Africa with $1.65B Deal

2025-03-19 - Vitol is acquiring oil and gas E&P assets in Cote d’Ivoire and the Republic of Congo from Eni for $1.65 billion.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Constellation Energy Nearing $30B Deal for Calpine, Sources Say

2025-01-08 - Constellation Energy is nearing a roughly $30 billion deal to acquire power producer Calpine that could be announced as early as Jan. 13, sources familiar with the matter said.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.