The historic consolidation trend across the U.S. E&P sector during the last 18 months is reshaping the landscape beyond the nameplate megamergers such as Exxon Mobil’s acquisition of Pioneer Natural Resources. Private family companies founded by original wildcatters such as Endeavor Energy Resources and CrownQuest are coming off the market to join the likes of Diamondback Energy and Occidental Petroleum.

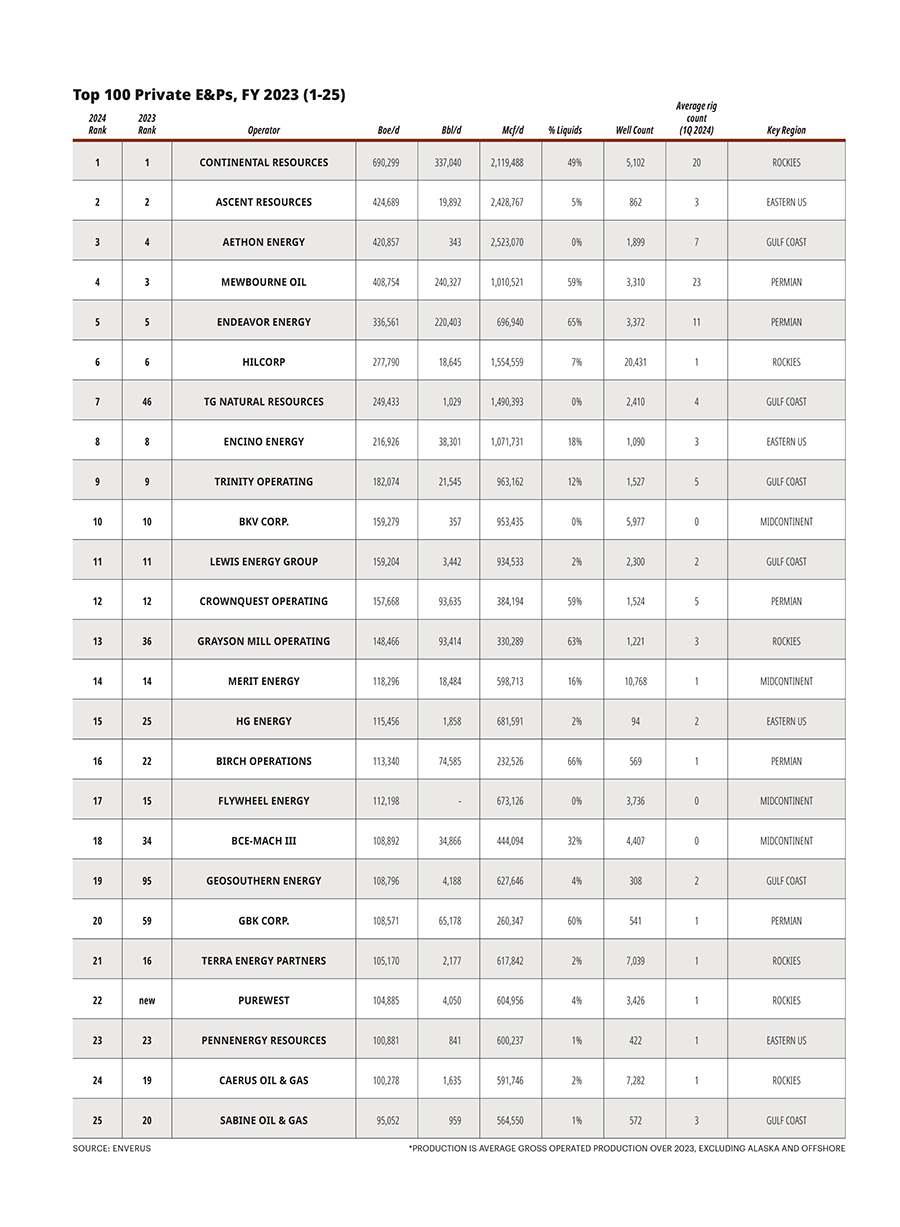

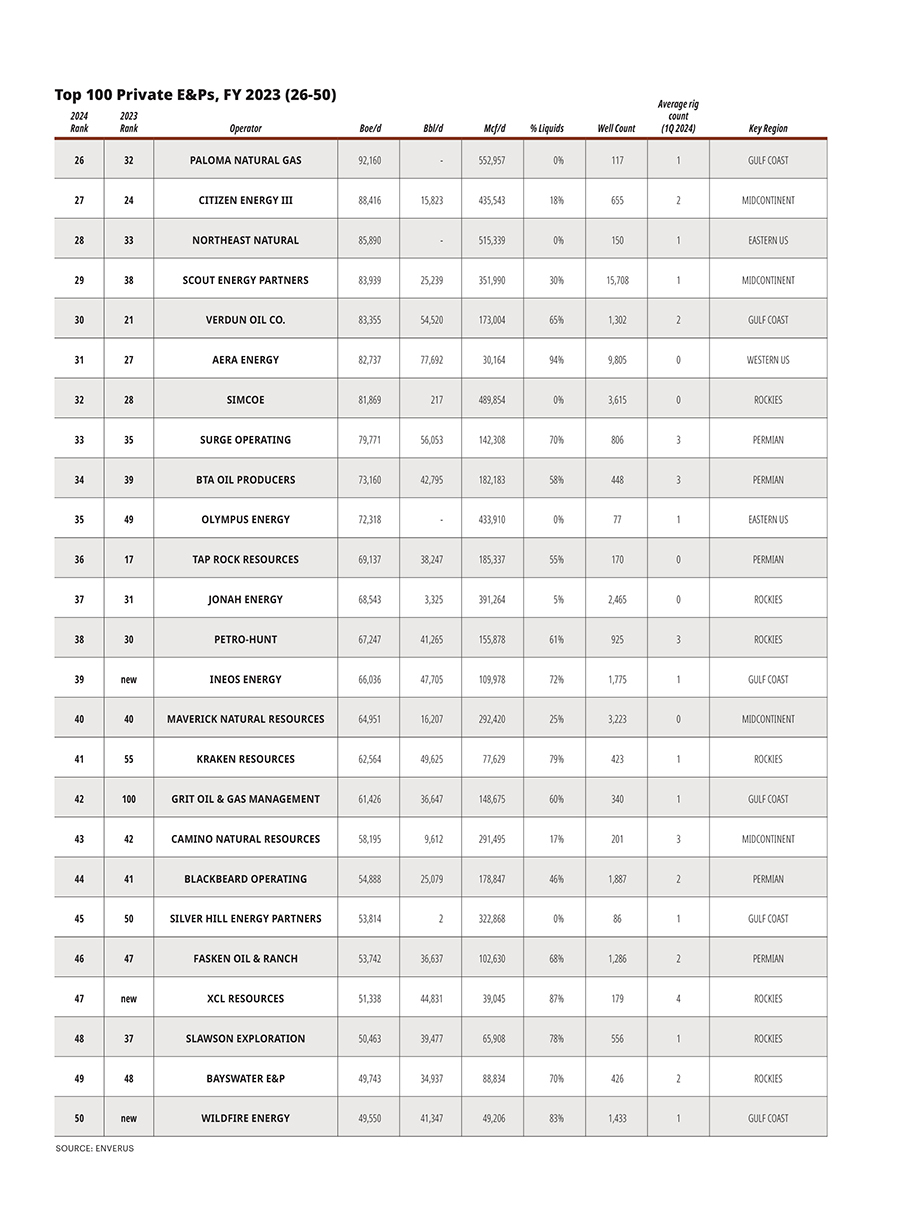

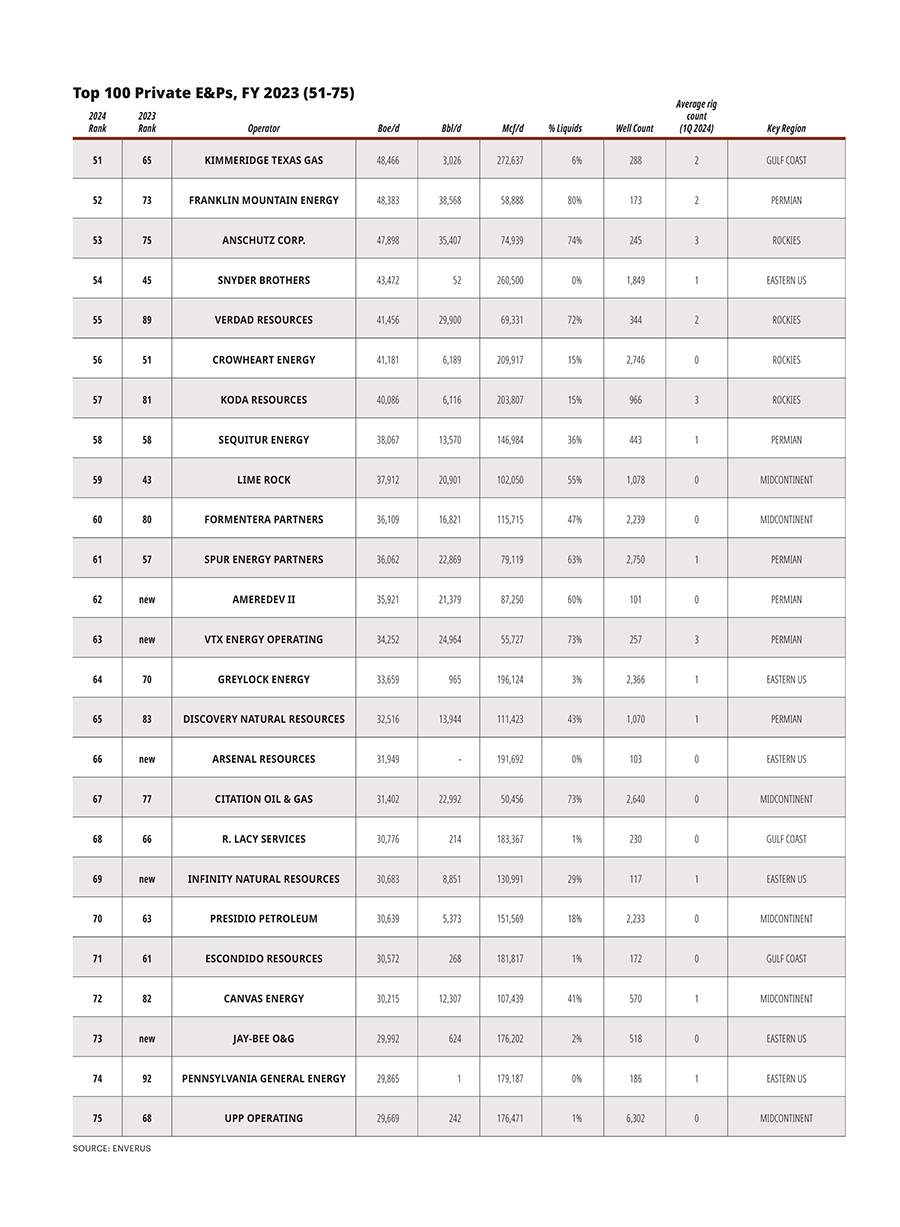

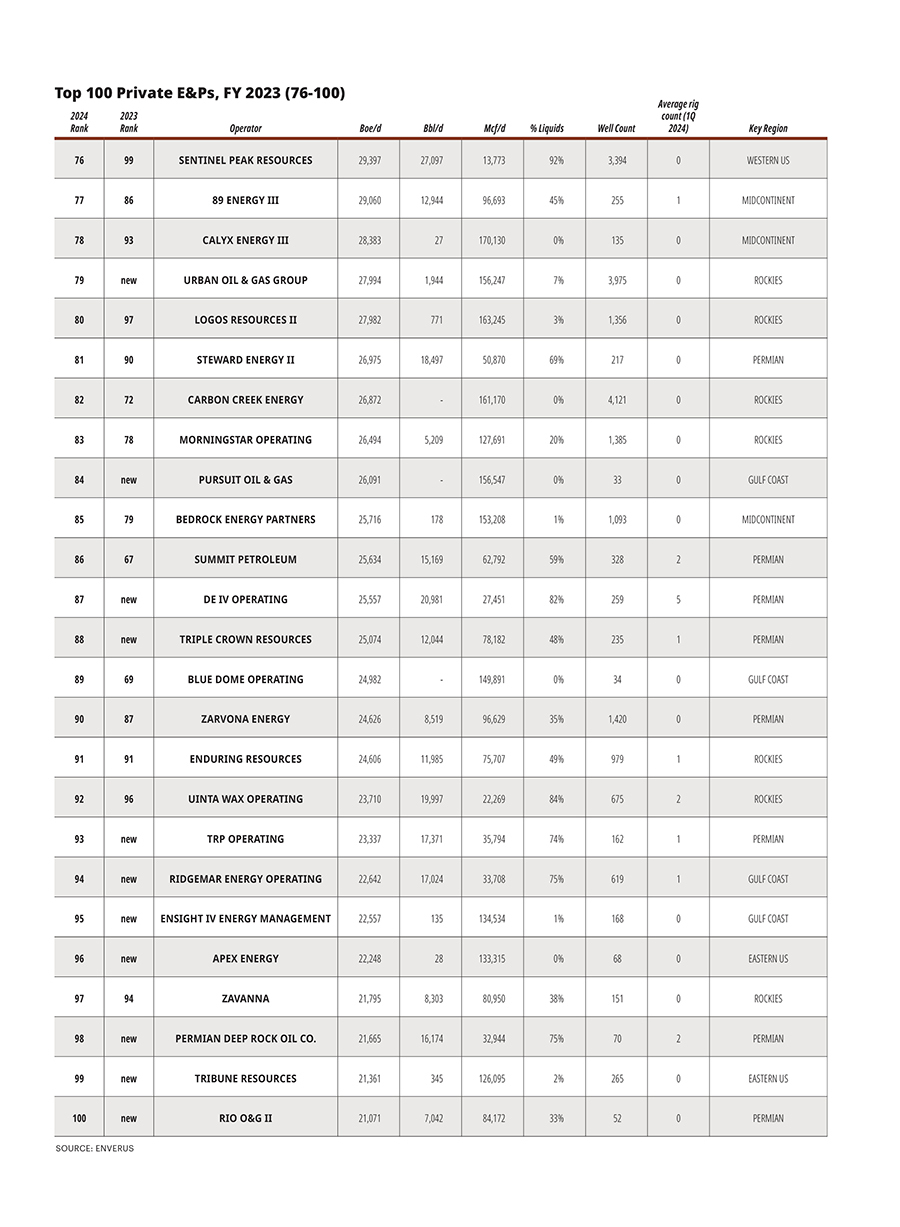

Among the net effects of $200 billion in M&A, a number of private companies have fallen off the list of Top 100 private companies compiled by Enverus in an exclusive partnership with Oil and Gas Investor (OGI). A slew of newcomers to the Top 100 have taken their places.

RELATED

Private Oil Producers Dwindle Amid Consolidation in New Top Operators List

Gas Producers Increasingly Dominating in New Shale Top Operators List

The combination of M&A and the follow-on asset sales in 2023 between public and private operators played a significant role in the shuffling, Justin Lepore, the Enverus analyst who built the list, told OGI.

Among the top examples:

- In Appalachia, TG Natural Resources acquired Rockcliff Energy, reducing the two spots those names held last year into one spot, which opened a position for a new name roll-up into the Top 100;

- In the Gulf Coast, Chesapeake Energy’s asset sales led to both WildFire Energy and U.K.-based INEOS Energy joining the ranking;

- A Permian Basin acquisition elevated VTX Energy (from Delaware Basin Resources) to the list, and the entrance into the Permian of publicly traded Civitas Resources lowered Tap Rock’s ranking and pushed out Hibernia Resources;

- Bakken Shale asset sales from public operators Ovintiv and Crescent Point led to big moves up the list for Grayson Mill Energy and Kraken Resources, respectively; and

- Rockies-weighted operators occupied fewer spots among the top 20 names on the list this year, with their positions taken by Permian- and Midcontinent-weighted operators.

“Private operators have driven much of the growth and been more sensitive to commodity-price changes than their public peers,” Lepore said. “Privates have been more motivated by economic fundamentals and, in many cases, to grow production to become more attractive to takeout targets. Publics have prioritized inventory preservation, capital discipline and steady free cash flow. We expect this trend to continue and lead to moderating growth from U.S. shale, in aggregate.”

During 2023, about 36% of oil production in the Lower 48 came from private operators; some 70% of those volumes came from the top 100 companies on this list, Lepore said. For gas production, the total contribution from private operators to Lower 48 production accounted for 39%, but the concentration of that share coming from the 100 operators on this list is slightly more than 80%.

“As a whole, this production is spread over a list of operators vastly larger than the universe of public operators, leading to a very long tail of smaller operators where incentives can be harder to discern and inventory is not often in basin core hotspots,” he said.

This is the third consecutive year that Lepore has compiled the list with OGI. He sources public production data cleaned through Enverus’ proprietary algorithms, reviews total operated production by producer in the Lower 48 over 2023 and then crunches the data to determine the weighting of production by region. GPS-tracked rig activity rounds out the dataset to provide insight on activity in 2024 through mid-June.

Permian Basin

The technological revolution in directional drilling and hydraulic fracturing has restored the Permian Basin’s standing among the top U.S. energy producing regions, even after more than 100 years of production.

E&Ps pump more than 6 MMbbl/d of oil and 24 Bcf/d from Permian wells, and private companies are among the top producers.

Enverus data shows 29 top privately held companies drilling and producing in the Permian Basin, adding more than 1.1 MMbbl/d of oil and nearly 4.4 MMcf/d of natural gas to U.S. energy production in throughout 2023.

Privately held Mewbourne Oil of Tyler, Texas, produced 408,754 boe/d during 2023, while Endeavor Energy Resources of Midland generated 336,561 boe/d.

Continuous development of hydraulic fracturing and horizontal drilling techniques have helped make the Permian one of the most cost-effective places to drill. Success at producing abundant, affordable energy may shorten the list of both public and private companies drilling in the ancient Permian seabed as strong profits provide the funding for M&A.

If the transaction gains anti-trust approval, publicly traded Diamondback Energy will merge with Endeavor in a $26 billion transaction announced in February.

“The combination will create a premier Permian independent operator,” Diamondback said in a news release when the sale was announced. Diamondback also is a top 10 Permian producer.

The Endeavor-Diamondback merger agreement was announced three months before Exxon closed its $59.5 billion acquisition of publicly traded Pioneer, the largest oil and gas producer in the basin. Exxon, which methodically expanded its presence in the Permian after the full potential of hydraulic fracturing became evident, now dwarfs all other producers in the basin.

Mewbourne has so far managed to stay independent despite the tsunami of acquisitions and mergers engulfing its rivals. Company President and CEO Ken Waits told OGI last year that the family-run company has had great success focusing on organic growth rather than finding a buyer or merger partner.

The company averaged 23 rigs in first-quarter 2024, far more than any other privately held company operating in the Permian, Enverus data shows. Mewbourne has been one of the most active players in the Delaware Basin of the Permian.

Rockies

The Williston, Denver-Julesburg and Powder River basins are generating production at or near all-time highs, boosting the bottom lines of privately held E&P companies operating in the Rocky Mountain region.

Continental Resources, a top player in the Bakken Shale, averaged output of 591,315 boe/d in 2022, reported in 2024. Production totaled 690,299 boe/d across 2023, Enverus data show. That output established Continental, which founder Harold Hamm took private in 2022, as the top privately held E&P last year.

The second-largest private Rockies producer, Houston-based Hilcorp, gets its production in the region from the San Juan Basin of New Mexico and Colorado, and the Green River Basin of Wyoming. Hilcorp produced more than 1.5 MMcf/d of natural gas and 18,645 bbl/d of oil last year, Enverus data show.

Privately owned Grayson Mill Energy sold off its positions in the Powder River Basin in 2021 to focus on acquiring a large stake in the Bakken. The strategy helped make Grayson Mill the third-biggest private E&P production of 148,466 boe/d.

Grayson Mill reportedly is exploring an acquisition in the $5 billion range. Publicly traded Chord Energy announced a $4 billion acquisition of Enerplus in 2024—an expansion it said was aimed at making Chord the largest producer in the Williston Basin.

Privately owned operator Terra Energy Partners became the fourth-largest privately owned producer in the Rockies by concentrating on the Piceance Basin in northwestern Colorado.

Much of Terra’s production comes from the proven Williams Fork Formation in the Piceance. It’s counting on deeper Mancos and Niobrara shales for future production. Terra brought nearly 618 Mcf/d to market, Enverus data show.

PW Consortium, the fifth-biggest privately held E&P, posted strong production from its $1.84 billion merger with PureWest Energy last year. PureWest focused on the Green River Basin of Wyoming. PW produced 604,956 cf/d.

Companies continue to produce profitably in the venerable Denver-Julesburg (D-J) Basin, which has attracted drillers since the 1860s and continues to generate more than 500,000 bbl/d of oil production.

Denver-based Bayswater Exploration and Production produced 34,937 bbl/d of oil and 88,834 cf/d of natural gas. It drills in the D-J and in the Permian.

Anschutz Exploration of Denver is one of the major holders of tracts in the Powder River Basin and is also drilling in the Piceance Basin, and the adjacent Uinta Basin in Utah. Anschutz produced 35,407 bbl/d of oil and 74,939 cf/d of gas.

Eastern U.S.

The focus of oil and gas production in the Eastern United States today is in the the Ohio and western Pennsylvania sections of the Appalachian Basin, which encompasses the Marcellus and Utica shales.

Less than 15 years ago, drillers were cautious about Utica’s prospects because of the expected expense of tapping the estimated reserves of 38 Tcf of natural gas and 940 MMbbl of oil.

Today, Oklahoma City-based Ascent Resources and Encino Energy of Houston are among the top oil and gas producers in Ohio, where production from the Utica began in 2011. Enverus ranked Ascent as the second-largest producer among private E&P companies in 2023.

Ascent produced more than 2.4 MMcf/d of natural gas in 2023 from 862 wells, according to Enverus data. Encino sent more than 1 MMcf/d into the market from 1,090 wells.

Encino, the 10th-largest producer among private E&P companies in 2023, brought up 38,301 bbl/d from all its holdings while Ascent’s output reached 19,892 bbl/d.

Utica gas and oil deposits are at average depths of about 8,000 ft, raising the cost of drilling vertical wells. Rapid advances in lateral drilling and hydraulic fracturing techniques brought production costs down substantially, and output ramped up rapidly after 2010, making the Utica a top natural gas play.

Infinity Natural Resources is a private E&P that’s been buying up oily acreage in Ohio after initially focusing on dry gas production in southwest Pennsylvania. The firm has drilled some of the most prolific producing oil wells in the Ohio Utica.

Production in the Marcellus took off earlier than in the Utica, in part, because wells did not have to be as deep. Privately held companies that have been producing in the Marcellus Shale include PennEnergy Resources, Arsenal Resources and Apex Energy.

The average depth of Marcellus formations is between 6,000 ft and 7,000 ft. However, the location of hydrocarbon deposits in the formation requires drilling wells farther apart than in the Utica, increasing the per-acre costs per boe extracted.

The Energy Information Administration (EIA) estimates that the Marcellus contains about 410 Tcf of recoverable natural gas, and drilling is expected to surge once demand and prices recover sufficiently if regulatory obstacles can be overcome.

Some E&P capital spending is shifting away from the gassy Marcellus toward more oil-rich prospects in the Utica, both because of low gas prices and gas transport concerns.

Proximity to populated areas has slowed both pipeline construction and access.

The majority of the Utica is in New York, Ohio and Pennsylvania, but it extends into Maryland, New Jersey, Tennessee and Virginia, as well. Most of the activity in the Marcellus is in Ohio and Pennsylvania.

M&A activity in the region has focused not just on the size of potential production, but on maximizing access to and increasing the efficiency of pipelines and other infrastructure needed to bring gas to market.

Midcontinent

The Barnett Shale, where one of the richest deposits of natural gas in U.S. history is locked into rock underneath one of the most populated metro areas in the western United States, continues to be major play.

Denver-based BKV Corp. describes itself as one of the top 20 gas-weighted natural gas producers in the U.S. and the largest natural gas producer in the Barnett Shale, with 458,000 net acres and nearly 7,000 producing wells in the play.

Its Barnett holdings are in and near the Dallas-Fort Worth metroplex, primarily in Denton, Johnson, Parker, Tarrant and Wise counties. This proximity to the homes, businesses, and water supplies of 8 million people can make exploiting the Barnett more difficult than regions like the Permian that are in sparsely populated areas.

In addition, the Barnett is less permeable than other shale plays. Drillers must rely on heavy usage of hydraulic fracturing and horizontal drilling. While hundreds of miles of gas-gathering pipelines have been built in the play, Barnett gas must compete with production that is closer to the Gulf Coast industrial center and LNG export facilities.

E&Ps are overcoming the obstacles. Enverus research found BKV produced more gas from the Barnett than any other privately owned E&P company last year.

BKV produced 953,435 cf/d of natural gas from its entire portfolio, which includes gas from the Marcellus Shale in Pennsylvania as well as its core Barnett Shale holdings, Enverus research shows.

Not everyone relies on shale drilling to build its output. Merit Energy has taken a contrarian approach in the Midcontinent by acquiring mature wells. The Dallas-based company has picked up producing wells from companies that often are redirecting assets into shale plays. Merit operates in 12 states including Arkansas, Colorado, Kansas, Louisiana, New Mexico, Oklahoma, Texas and Wyoming.

Merit produced 598,713 cf/d of gas and 18,484 bbl/d of oil, Enverus data show.

Flywheel Energy says on its website that it is the largest producer in Arkansas’ Fayetteville Shale. The Fayette Formation runs through Oklahoma and Arkansas, and is part of the Arkoma Basin.

Flywheel brought up 673,126 sq ft of natural gas a day, according to Enverus data. Drilling in the Fayetteville, which is named after a city in Arkansas, began in 2004. A strictly hydraulic fracturing play, drilling has risen and fallen as E&P companies and investors have looked for the most efficient strategies for exploiting the trapped gas.

Privately held BCE-Mach III, a partnership between Mach Resources and Bayou City Energy Management, owns gas properties in the venerable Anadarko Basin. The BCE-Mach III partnership extracted 444,094 cf/d.

The Anadarko Basin is in portions of Texas, Oklahoma, Kansas and Colorado. Sprawling 50,000 sq miles across the Southern Great Plains, the Anadarko produced the largest amount of natural gas of any area in the United States in the 1990s. Notable fields within the basin include the Hugoton-Panhandle Gas Field discovered in Kansas in 1922; the West Edmond Field; Union City Field; and the Elk City Field. Some of the deepest land wells on record have been drilled in the Anadarko.

Gulf Coast

Low natural gas prices haven’t stopped E&Ps from maintaining prolific production from the deep-well Haynesville Shale in 2024 in the Gulf Coast region.

A massive geological formation in southwestern Arkansas, northwest Louisiana and East Texas, the Haynesville saw gas flows surge beginning in 2008. The play represents one of the most spectacular success stories of the unconventional revolution, and its proximity to Gulf Coast exporters and users gives it added allure for investors compared to the Permian and Midcontinent.

Aethon Energy, which has been drilling profitable and high-producing wells as deep as 15,000 ft in the western Haynesville, is the No. 1 privately held producer in the play. In 2023, the Dallas-based company produced 2,523,070 cubic feet of natural gas a day from its multi-field portfolio, Enverus analysis shows.

Andrea Wescott Passman, Aethon COO, said in March that the company is finding “monsters” deep in the Haynesville and is drilling laterals as long as 1.5 miles to tap the potential. The company has midstream assets that help it get gas to market.

Houston-based TG Natural Resources, a major privately owned E&P operating in the Haynesville and Cotton Valley, produced an average of 1.5 MMcf/d, Enverus data indicates.

The Cotton Valley Formation underlies much of the northern Gulf of Mexico coastal plain from East Texas to Alabama. TG has tapped into Cotton Valley in East Texas and northern Louisiana.

The Lewis Energy Group has drilled into large portions of fields in Webb, La Salle, Dimmitt and McMullen counties in southwestern Texas, one of the most prolific regions for drilling into the Eagle Ford Shale. The Eagle Ford extends over 26 Texas counties from Eagle Pass and Laredo along the Mexican border through Temple and Waco.

Lewis’ total production of 934,533 sq ft a day made it the fourth-largest privately held producer with Gulf Coast holdings.

Trinity Operating Group, which produced 963,162 cf/d in the first quarter, has drilled in both the Haynesville and Eagle Ford plays. Trinity says on its website that it drilled its first well in the Eagle Ford in 2018 and it moved into the Haynesville in 2019.

Privately owned drillers continue to produce gas from the Austin Chalk, a formation that overlays the Eagle Ford. The Chalk runs as shallow as 900 feet and as deep as 16,500 feet.

INEOS Energy has assets in the Giddings Austin Chalk region that include over 100 wells, production and exploration leases across 40,000 acres, its website states. Its assets in the Eagle Ford include 2,300 wells, production and exploration leases across 172,000 acres.

Verdun Oil also is a major player in the Eagle Ford and Austin Chalk.

Company data shows that Verdun owns more than 177,000 net mineral acres in the Eagle Ford trend in Dimmit, La Salle, Frio, McMullen, Live Oak, Atascosa, Karnes, Gonzales, and De Witt counties of Texas. It also owns 30,000 net acres in the Southern Giddings Chalk field centered in Washington County.

Verdun produced 173,004 cf/d and 54,520 bbl/d of oil, Enverus said.

Recommended Reading

NatGas Punches Above $3 Thanks to Summer Heat, Curtailments

2024-06-11 - Natural gas prices, stuck in the doldrums since January, have been slowly rising since May.

US Natgas Prices Ease to 2-week Low on Rising Output

2024-06-21 - The natural gas price decline came even on forecasts for hotter weather next week than previously expected.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-05-10 - Baker Hughes said oil rigs fell three to 496 this week, their lowest since November, while gas rigs rose one to 103.

US NatGas Prices Slide 2% After Mountain Valley Startup Approved

2024-06-12 - Front-month gas futures for July delivery on the New York Mercantile Exchange fell to $3.063/MMBtu in early trading on June 12 as traders reacted to the June 11 approval of the Mountain Valley Pipeline startup.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.