M&A activity is heating up on the Permian’s Central Basin Platform and Northwest Shelf as majors prune their portfolios for non-core asset sales. (Source: Shutterstock.com)

Classic rock is making a comeback.

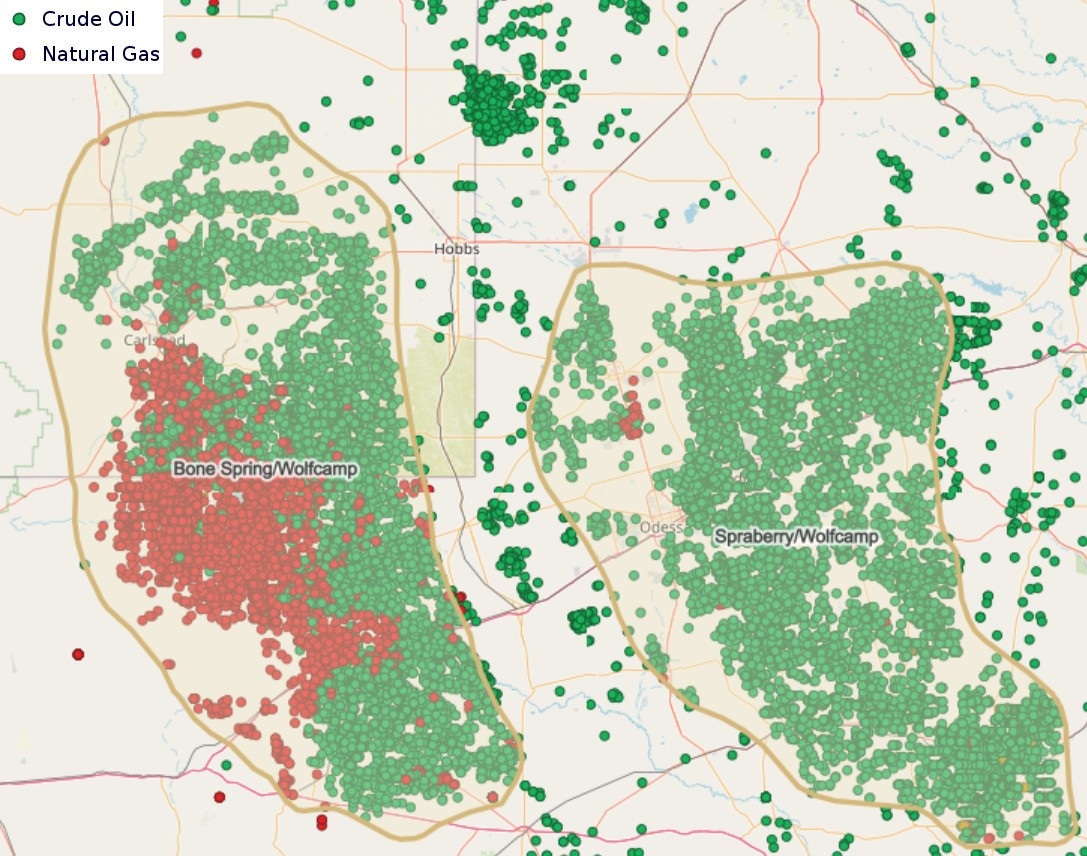

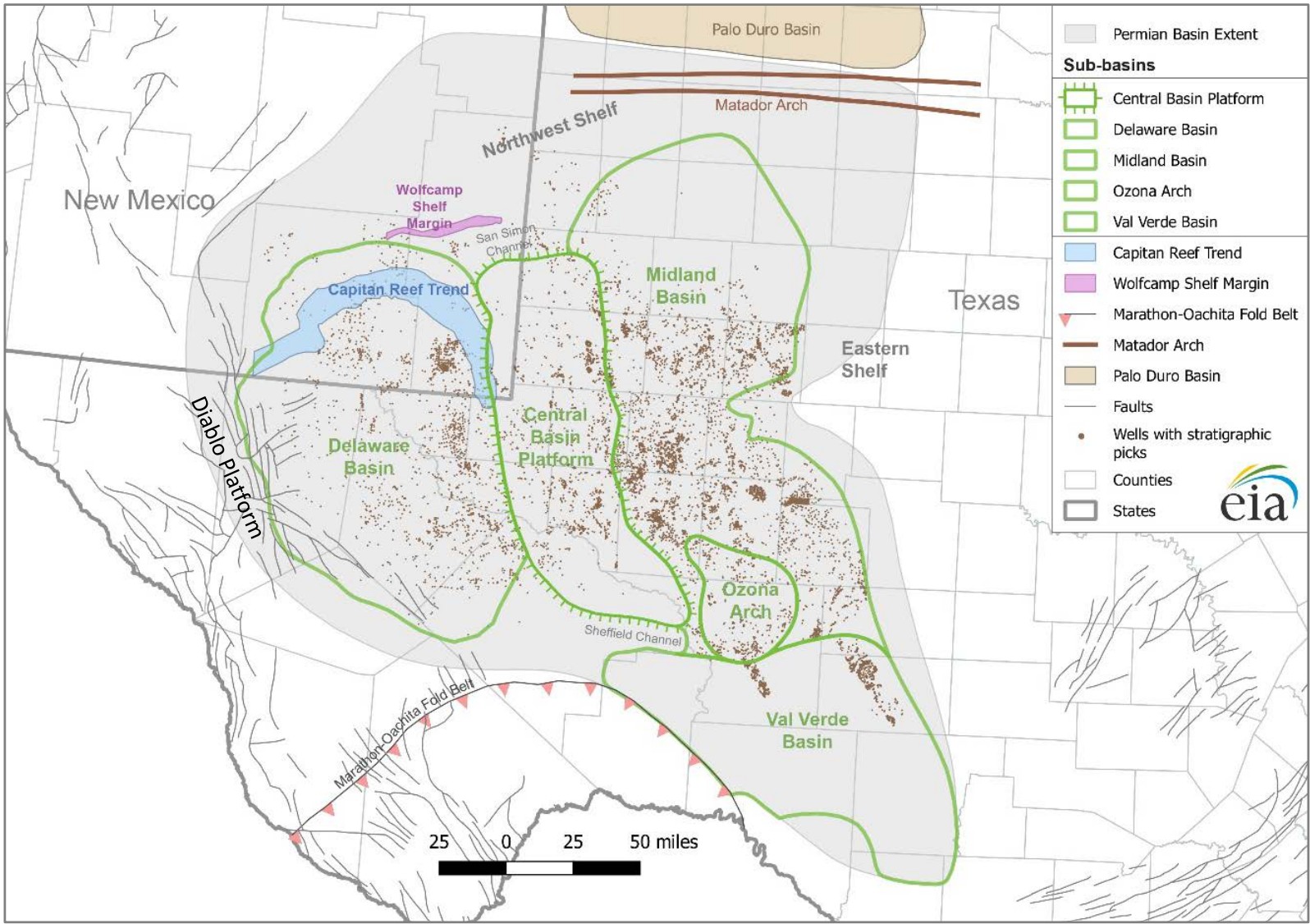

The Permian’s Midland and Delaware basins have attracted hundreds of billions of M&A dollars in the past two years. Now, operators are paying up for legacy conventional assets on the Permian’s Central Basin Platform.

As producers scour the prolific Permian for drilling locations, some say that the Central Basin Platform holds horizontal upside that’s long been overlooked.

Of course, oil isn’t hard to find on the platform. Some of the Permian Basin’s earliest and most legendary oil discoveries were made there.

Vertical production from the platform dates to the 1920s. The massive Wasson field, in Yoakum and Gaines counties, Texas, was discovered in 1937.

Wasson was still the eighth-largest U.S. field by proved reserves when the Energy Information Administration last ranked reserves in 2015, behind giants like Prudhoe Bay, the Wattenberg Field and Briscoe Ranch.

Other major discoveries on the platform included the Goldsmith (1935), Slaughter (1937) and Seminole (1936) fields.

Today, the platform is getting “a renewed look” as producers search for cash flow-boosting production and new drilling locations, said Paul McKinney, chairman and CEO of Ring Energy.

“The best place to find oil oftentimes is where you’ve already found it,” McKinney said at Hart Energy’s A&D Strategies and Opportunities Conference on Oct. 23.

RELATED

It’s All Relative: Family Oil Companies Attract Huge M&A Attention

Dusting off the platform

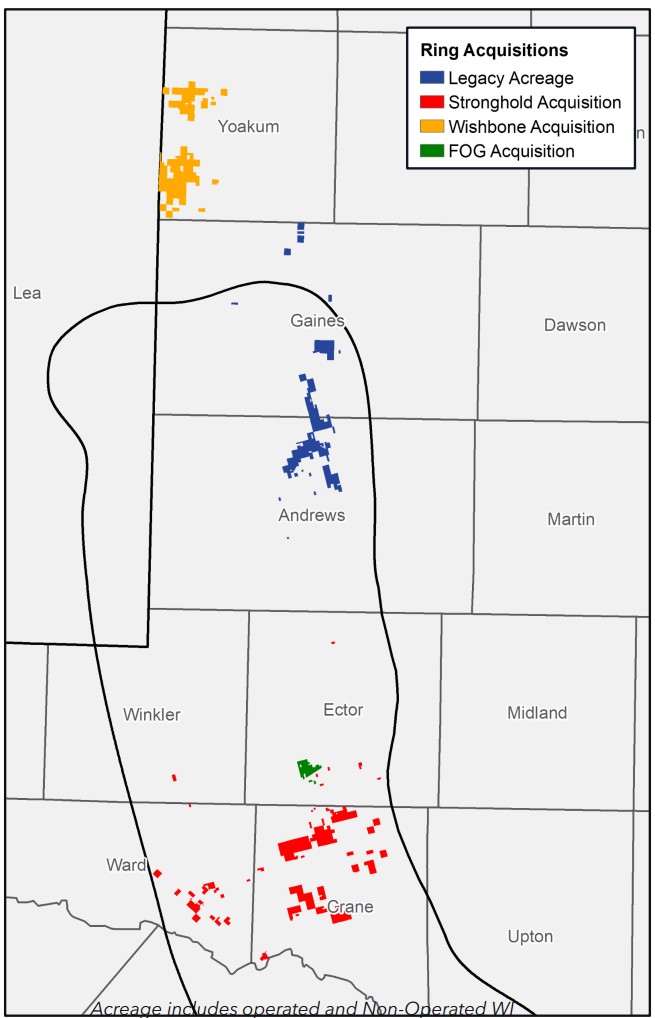

Woodlands, Texas-based Ring has been one of the few publics drilling horizontal San Andres wells on its Central Basin Platform acreage—primarily in Andrews, Gaines, Crane, Ector, Winkler and Ward counties, Texas.

Ring also has a Yoakum County position in the Northwest Shelf, a formation spanning the northern reaches of the Delaware Basin. Riley Exploration Permian (Riley Permian) is the other notable public E&P playing on the Northwest Shelf.

When Paul McKinney became CEO of Ring in October 2020, the Central Basin Platform and Northwest Shelf were “basically dominated by private companies,” he said.

“Up until this summer, the Central Basin Platform and the southern part of the Shelf has been basically left for us to acquire and grow in,” McKinney said.

But dealmaking activity on the platform is starting to heat up once again.

APA Corp., parent company of Apache, in September announced a $950 million sale of conventional assets on the Central Basin Platform and Northwest Shelf to an undisclosed private buyer. The divested assets had estimated net production averaging 21,000 boe/d (57% oil).

The non-core asset sale came after APA closed a $4.5 billion acquisition of Callon Petroleum, deepening Apache’s portfolio in the core of the Midland and Delaware shale plays.

Exxon Mobil is also exploring a sale of select conventional assets in the area, which could reportedly fetch about $1 billion.

Exxon closed its own $60 billion acquisition of Midland Basin giant Pioneer Natural Resources earlier this year.

As public E&Ps prioritize investment in the Midland and Delaware basins, experts think the market will see more non-core asset sales on the platform and the shelf.

“I believe there are more assets on the Central Basin Platform and the southern part of the shelf that are going to hit the market in the future,” McKinney said. “We’re very interested in those assets.”

Major publics with legacy assets in the area include Chevron Corp., Occidental Petroleum and Marathon Oil.

Each of those companies have engaged in large-scale M&A over the past year and are looking at non-core asset sales to reduce debt:

- Chevron is working through a blockbuster $55 billion acquisition of Hess Corp., with most of the deal’s value attributed to Hess’ ownership stake in the Stabroek Block offshore Guyana;

- Occidental closed a $12 billion acquisition of Midland E&P CrownRock in August and is already selling non-core Permian assets;

- Marathon Oil is merging with ConocoPhillips in a $17.1 billion deal, consolidating acreage in the Permian, Eagle Ford, Williston and Midcontinent.

Other than Ring and Riley Permian, the most active developers on the platform and shelf include Steward Energy II, Lime Rock Resources, Blackbeard Operating, BTA Oil Producers and Spur Energy Partners.

Ring estimates that gross production from operators on the Central Basin Platform and Northwest Shelf averages 480,000 boe/d (71% oil), citing Enverus Intelligence Research data.

RELATED

As Permian Targets Grow Scarce, 3Q M&A Drops to $12B—Enverus

Recommended Reading

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Plains All American President Pefanis to Retire

2025-03-27 - Current CEO Willie Chiang will take over as the next president of Plains All American Pipeline following co-founder Harry Pefanis’ retirement.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.