International energy companies are pouring investment into new wells and refrac projects in the Eagle Ford. (Pictured): Carrizo Oil & Gas Eagle Ford operations site east of Cotulla near Los Angeles, Texas, in Lasalle County, on Monday, July 27, 2015. (Source: Tom Fox/Hart Energy)

U.S. majors are pouring billions of dollars into the Permian Basin, but international energy companies are all-in on the Eagle Ford Shale.

U.K.-based supermajor BP Plc and its U.S. shale subsidiary BPX Energy continue to pour investment into new drilling projects in the Eagle Ford, according to Texas Railroad Commission (RRC) data.

Spanish energy giant Repsol, which has operated in the Eagle Ford since buying out joint venture (JV) partner Equinor in 2020, has ramped up drilling activity on its South Texas asset.

Other international players, including Canada’s Baytex Energy and U.K. energy and chemical group INEOS, are growing deeper Eagle Ford roots after completing M&A transactions last year.

French energy company TotalEnergies is also getting deeper in shale gas, inking a deal to acquire the 20% interest held by Lewis Energy Group in the Dorado leases operated by EOG Resources.

As upstream companies search for high-quality shale drilling inventory, a bulk of dealmaking has centered on the Permian Basin, the main driver of U.S. crude production growth. But experts anticipate additional activity in South Texas as operators outside the U.S. hunt for drilling runway.

“BP would be a potential candidate to expand in either the Haynesville or the Eagle Ford,” Andrew Dittmar, senior analyst at Enverus Intelligence Research, wrote in a first-quarter M&A report. “The company has maintained a presence in both plays and could look to boost U.S. unconventional exposure to keep pace with U.S. peers Exxon and Chevron.”

RELATED

Mighty Midland Still Beckons Dealmakers

BPX gets oily

BP waded deeper into the U.S. shale space when it acquired the onshore assets of BHP for $10.5 billion in 2018—the British supermajor’s largest transaction this century.

The transaction yielded BPX Energy’s brand and delivered the company a large foothold across the oily and gassy windows of the Eagle Ford.

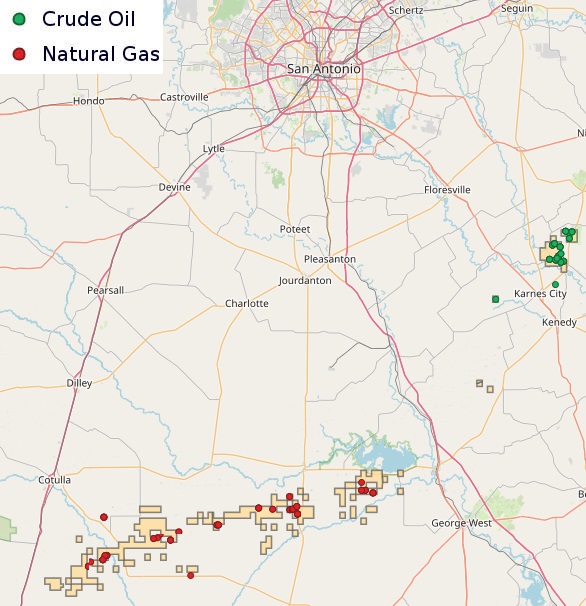

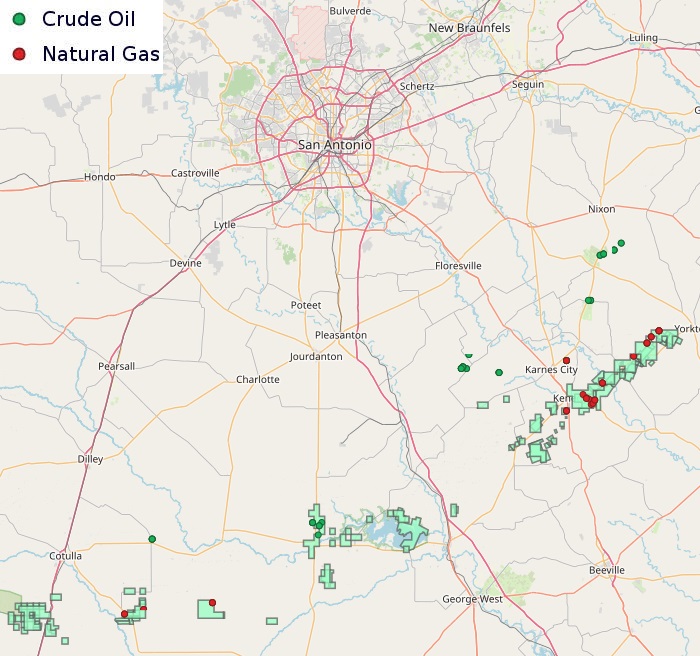

BPX has focused its efforts on the oilier portions of the play in Karnes and DeWitt counties, Texas, and is also ramping up a refrac program with partner Devon Energy to breathe new life into Eagle Ford wells more than a decade old.

Karnes County, Texas is where the bulk of BPX’s operated oil production is sourced. The company produced over 294,800 bbl of crude in Karnes County in April (~9,800 bbl/d), according to RRC data.

BPX also produces significant volumes of liquid condensate from gassier acreage in McMullen County (~12,300 bbl/d in April) and La Salle County (~2,900 bbl/d).

In the Eagle Ford, BPX produced an average of approximately 25,120 bbl/d of crude and condensate during April; the company produced approximately 65,800 bbl/d of crude and condensate across its entire Texas footprint over the same month.

BPX also sources large volumes of natural gas and condensate from its operated position in the Permian’s Delaware Basin.

The Eagle Ford has emerged as a hub of redevelopment activity as operators sift through asset portfolios in search of new drilling opportunities.

ConocoPhillips, Marathon Oil, Devon, SilverBow Resources and BPX are a handful of operators with refrac programs underway in South Texas.

BPX is seeing positive results from a DeWitt County refrac project with its JV partner Devon.

“The Eagle Ford continues to surprise us in the way of its productivity and what these wells are capable of producing,” said Clark Edwards, BPX’s vice president and COO of development, in a recent Hart Energy interview.

“We are bringing on refracs that are, quite frankly, better than the parent wells were, which is just kind of hard to believe,” he said. “We just couldn’t be happier with what we’re seeing in the way of productivity there.”

BPX has more than 450,000 net acres in the Eagle Ford.

RELATED

Enverus: 1Q Upstream Deals Hit $51B, but Consolidation is Slowing

INEOS dives into shale

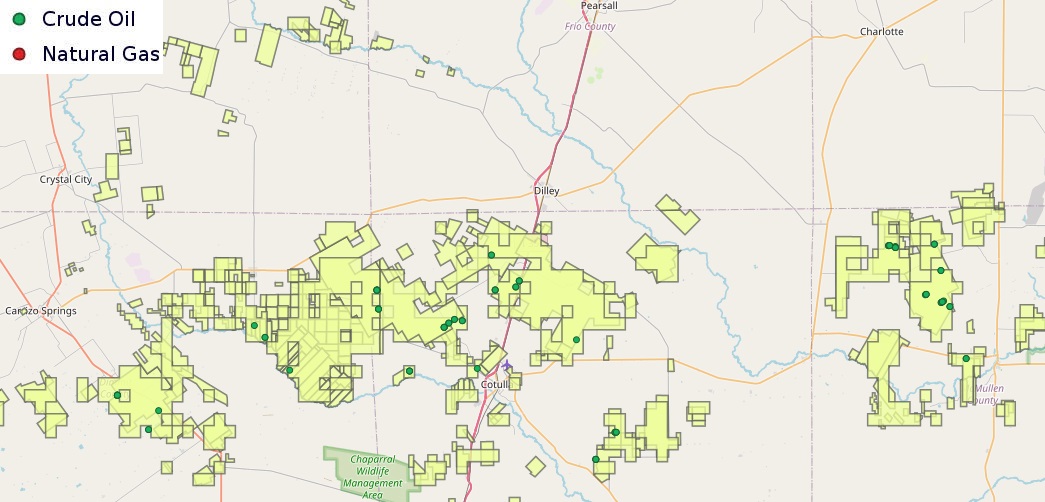

Chesapeake Energy, in its quest to become a pure-play natural gas producer, sold off a portion of its Eagle Ford footprint last year to INEOS Energy, the upstream arm of U.K.-based chemical group INEOS Group.

The $1.4 billion transaction with Chesapeake added approximately 172,000 net acres and 2,300 wells in the Eagle Ford’s black oil window—primarily in Dimmit, La Salle and McMullen counties, Texas.

INEOS said the $1.4 billion transaction marked the company’s entry as an operator in the U.S. onshore oil and gas market.

But RRC data shows INEOS made a quiet entrance into the Giddings Field through an acquisition from Crawford Hughes Operating Co. in 2019.

INEOS submitted data for a handful of new horizontal Giddings wells during 2021 and 2022 and still holds acreage in the area, RRC records show. But the company’s more recent drilling efforts have focused on the South Texas assets picked up from Chesapeake last year.

INEOS USA Oil & Gas produced an average of nearly 42,000 bbl/d of crude and condensate during April, per RRC figures.

RELATED

Chesapeake Finds ‘Much Better Deal’ in Eagle Ford Sale to INEOS

Spanish oil

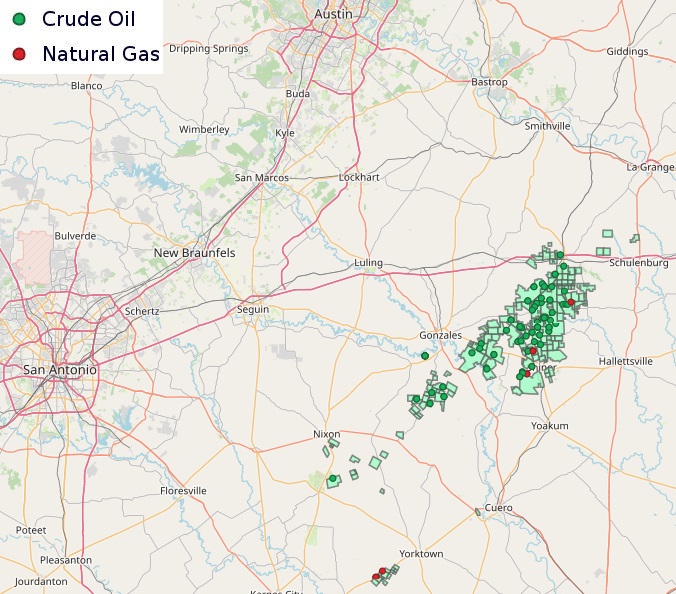

Madrid-based Repsol continues to grow its footprint in liquids-rich fairways of the Eagle Ford.

Repsol Oil & Gas USA acquired the Eagle Ford leases formerly operated by Equinor in 2020, which included assets in Live Oak, La Salle, DeWitt, McMullen, Karnes, Dimmit and Bee counties, Texas.

Last year, Repsol bolted on additional acreage and assets in the Eagle Ford’s tight oil window through the acquisition of Inpex Eagle Ford LLC, a subsidiary of Japanese E&P INPEX Corp.

The bulk of INPEX Eagle Ford’s oil production came from Karnes County; the deal also included assets in Atascosa, Gonzales and La Salle counties, RRC records show.

Repsol is running one rig in the Eagle Ford, the company said in first-quarter earnings. The company was also operating a single rig on its gassy Marcellus acreage, but the rig was slated to be released in June due to “the current gas price environment.”

Earlier this year, Repsol said it planned to invest €$2.2 billion (US$2.38 billion) between 2024 and 2027 into unconventional development in the Eagle Ford and Marcellus.

Repsol produced approximately 10,800 bbl/d of crude oil and condensate from its Eagle Ford asset in April, per RRC figures. Gas volumes averaged approximately 116 MMcf/d.

RELATED

Repsol Eyes Increasing Core US Upstream Business

Canada’s Baytex flies south

To find incremental drilling runway, Calgary-based E&P Baytex Energy looked far south of the Canadian border.

Baytex closed a $2.2 billion acquisition of Houston-based Ranger Oil Corp. last summer, adding 162,000 net acres and 741 undrilled locations across the Eagle Ford’s oil window.

The Ranger acquisition complemented the Canadian company’s existing non-operated position in the Karnes Trough.

The deal also gave Baytex greater exposure outside of Western Canada, where the company has been divesting non-core assets.

After integrating the Ranger Eagle Ford asset last year, Baytex Energy USA Inc. started submitting data on new Eagle Ford horizontal wells with the RRC earlier this year.

During the first quarter, Baytex brought online 19 operated wells (18.5 net) online in the Eagle Ford, including 15 lower Eagle Ford wells, three upper Eagle Ford wells and one refrac.

Ten of the 15 lower Eagle Ford wells were producing long enough to establish an average 30-day initial peak production rate of 1,298 boe/d per well (85% oil and NGL), Baytex reported in first-quarter earnings.

Baytex is also working to optimize its acreage to delineate upper Eagle Ford development areas.

Three upper Eagle Ford wells brought online in the first quarter generated an average 30-day initial peak production rate of 1,214 boe/d per well (72% oil and NGL).

Baytex also completed a refrac project on its operated acreage during the first quarter—at the Medina Unit No. 3H. The refrac is expected to generate an internal rate of return of over 100%, and Baytex has identified additional refrac opportunities in the Eagle Ford to supplement its capital program.

RELATED

Baytex Closes $2.2 Billion Acquisition of Eagle Ford’s Ranger Oil

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

US Oil and Gas Rig Count Rises to Highest Since June, Says Baker Hughes

2025-02-21 - Despite this week's rig increase, Baker Hughes said the total count was still down 34, or 5% below this time last year.

US Oil, Gas Rigs Rise for First Time in Three Weeks

2025-03-21 - Despite this week's rig increase, Baker Hughes said the total count was still down 31 rigs, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.