Zacks Equity Research noted Ovintiv has been “strategically repositioning itself to focus on the Permian Basin.” (Source: Shutterstock/ Ovintiv Inc.)

Speculative M&A can be a perilous business, but analysts are sometimes indulgent in these matters, particularly when they involve the Permian Basin and a potential $5 billion to $6.5 billion deal.

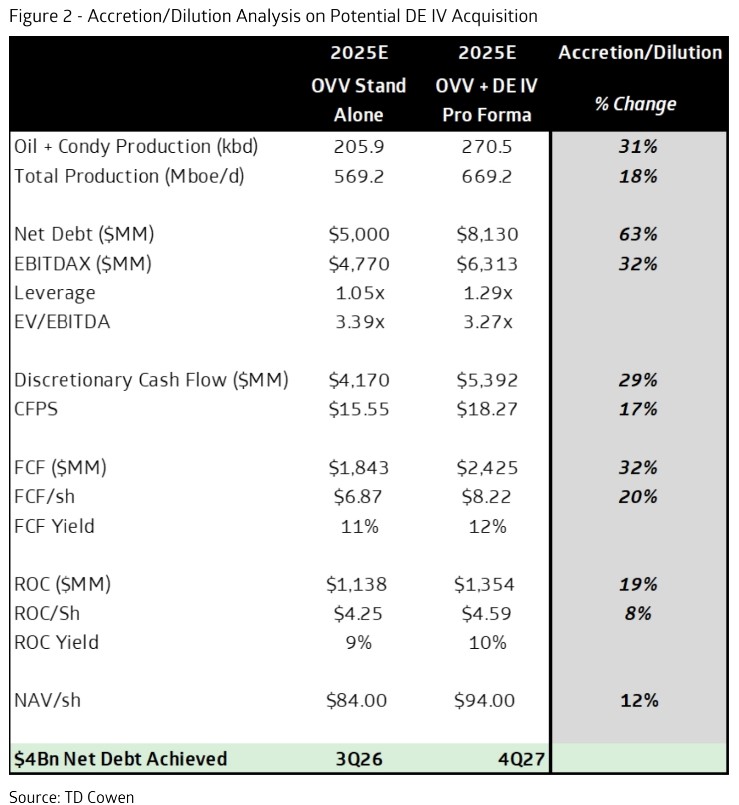

Recent media reports have prompted analysts to weigh in on the potential of Ovintiv (OVV)—which has lately been more Permian-focused—snatching up Double Eagle IV’s Midland Basin holdings. Double Eagle has a history of selling to large public companies, with its last two iterations selling for a combined $9.2 billion.

Fantasy M&A players’ pulses likely quickened on Aug. 21 at Bloomberg’s report of Ovintiv’s consideration of a sale of its Uinta Basin assets, which unnamed sources suggested the company could offload for $2 billion.

A spokesperson for the company told Hart Energy on Aug. 28 that “as a general practice, Ovintiv does not comment on rumored acquisition or divestiture activities.” Double Eagle did not immediately respond to a request for comment.

TD Cowen analyst Gabe Daoud Jr. wrote on Aug. 21 that Bloomberg’s article was an “unsubstantiated report” before greedily picking apart the what ifs a divestiture of the Uinta assets could mean for Ovintiv.

Daoud expressed surprise as “investors likely viewed Anadarko [Basin holdings] as next to go in OVV's portfolio optimization efforts, but certainly makes sense given a relatively active A&D environment in the Uinta and little contribution to corporate FCF (relative to Anadarko),” Daoud wrote.

In his estimation, Uinta sale proceeds could either increase Ovintiv’s return of capital (ROC) or be used to acquire Double Eagle.

On the capital side, a $2 billion sale would hit Ovintiv’s $4 billion net debt target immediately.

“The current ROC framework could theoretically step up to 70% (from 50%) of post-dividend FCF [free cash flow] to bring total '25 payout to ~$5/[share], +18% higher [versus] our published model at ~$4.22/[share] (on cal25 pricing of ~$76 [WTI]/$3.46 [Mcf]),” he said.

The other option: “Make a play—perhaps an aggressive one—for Double Eagle (DE IV),” Daoud said.

Zacks Equity Research noted Ovintiv has been “strategically repositioning itself to focus on the Permian Basin.” In June 2023, Ovintiv closed a deal to buy three EnCap Investments portfolio companies that added 1,050 net 10,000-ft well locations and 65,000 net acres in a cash-and-stock deal valued at $4.275 billion.

“Selling its Uinta Basin assets would allow OVV to concentrate more resources on its Permian operations, aligning with the company’s goal to drive higher returns through focused investments in high-yield areas,” Zacks’ analysts said. “The company has already demonstrated this shift with the sale of its Williston Basin assets in North Dakota for $825 million in 2023.”

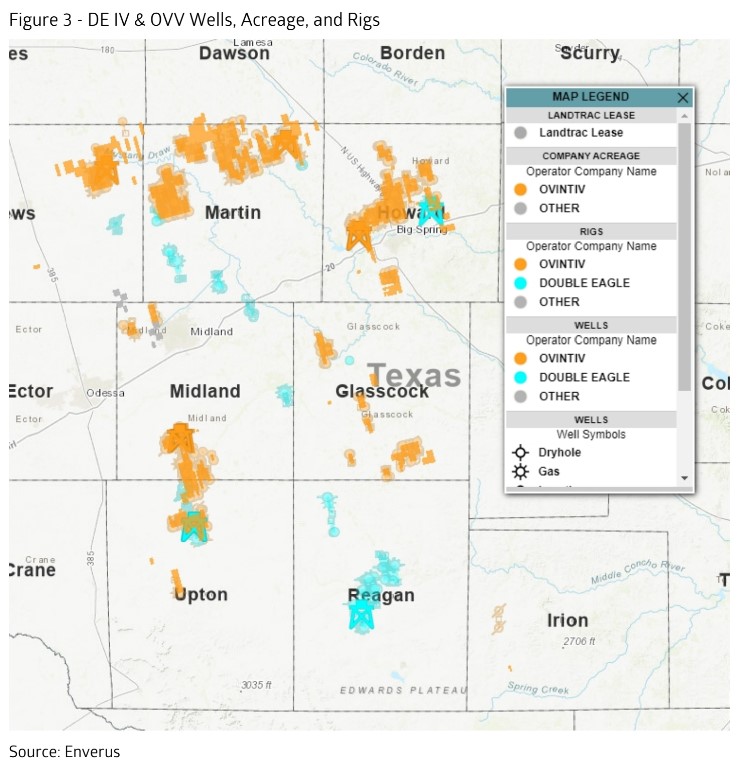

On Aug. 12, Cowen examined what a hypothetical acquisition of Double Eagle would look like for Ovintiv. The Reuters report suggested Double Eagle would fetch a (trial balloon) price of $6.5 billion.

Daoud’s baseline deal recalibrated at a $5 billion purchase price, which assumed a 70-30 debt-to-equity split that would be “accretive on several financial metrics, but in our view, the likelihood of a deal is low as we believe OVV retains adequate inventory & remains focused on achieving $4Bn [billion] in net debt.”

“Succinctly, we'd be surprised to see a DE IV deal at the $6.5Bn headline. Even a $5Bn valuation, though accretive, would push out OVVs $4Bn net debt target to 4Q27 v 3Q26 prior on our numbers, which we believe OVV would prefer not to do,” he said.

The Reuters report suggested that Double Eagle’s asking price was “likely anchored to the goal of ramping to [90,000] boe/d by [year-end 2024],” Daoud said.

Daoud said Cowen’s analysis does not assume synergies or any potential midstream value in the deal.

“We estimate PDP PV-10 of ~$3.6 [billion] at a $75 [WTI]/$3 [Mcf] price deck, which implies ~$40k/flowing boe relative to the [90,000] boe/d,” he said. “As for inventory, Reuters noted ~55k net acres, but we think the report could be undercounting sticks (noted 300 gross) & estimate 574 gross locations remaining (459 net assuming an 80% working interest, implies a ~6 yr inventory life) based on 1,280 acre [drilling spacing units] and 15 wells-per-section.”

That price point would suggest a $3 million per location price, “which still screens slightly rich v an [average] of $2.7MM/location paid in Permian deals since '22…but certainly more reasonable than the $6.5 [billion] figure,” he said.

Based on Cowen and Enverus data, among 2024 deals:

- Diamondback Energy’s pending $26 billion acquisition of Endeavor Energy Resources screened at $3.72 million per location;

- Matador Resources’ $1.9 billion Delaware Basin acquisition of Ameredev II at $4.34 million per location;

- Vital Energy’s proposed $1.1 billion purchase of Point Energy Partners at $1.78 million; and

- Occidental Petroleum’s $817.5 million Barilla Draw agreed sale to Permian Resources at $978,991 per location.

Double Eagle impact

Double Eagle IV has assembled a large Midland Basin footprint since its inception in 2022, with at least $1.7 billion in investor commitments from EnCap Investments, Apollo Natural Resources and Magnetar Capital.

Led by co-CEOs Cody Campbell and John Sellers, Double Eagle has a history of selling at high prices. E&P Double Eagle III—a subsidiary of DoublePoint Energy LLC—exited in 2021 through a sale to Pioneer Natural Resources for $6.4 billion. Double Eagle Holdings II LLC sold to Parsley Energy in 2017 for $2.8 billion.

RELATED

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

In January, Double Eagle IV’s Permian oil averaged about 38,700 bbl/d, according to Texas Railroad Commission data.

In 2025, Double Eagle is expected to run five rigs, suggesting the company can deliver EBITDA of about $1.7 billion, “implying a ~3.0x '25e multiple compared to OVV currently trading at ~3.4x,” Daoud said.

At a five-rig cadence, Double Eagle has the potential to deliver 80 net (100 gross) wells to sales in fiscal year 2025—“perhaps a slight moderation in the '24 pace of 52 wells through May per Enverus,” Daoud said, “from capex of $640MM (assuming ~$800/ft in D&C costs).”

Cowen estimated that would add about 65,000 bbl/d of oil (100,000 boe/d) in 2025—leading to a pro forma production for an Ovintiv-Double Eagle combo of 669,000 boe/d and 270,500 bbl/d.

“Based on our current price deck, this drives EBITDAX +32% higher to $6.3 [billion], but given $3.5 [billion] of added debt, leverage would rise to 1.3x v. 1.1x prior,” he said. “Additionally, we find the deal +18% CFPS [cash flow per share] accretive and +20% FCF/[share] accretive, while ROC/[share] would increase by +8% assuming the current framework.”

Doubts and dissembling

During Ovintiv’s Aug. 1 second-quarter earnings call, President and CEO Brendan McCracken was asked by an analyst about the credibility of the Double Eagle rumors and McCracken’s thoughts on further Permian consolidation.

The open-ended question gave McCracken plenty of room to maneuver, and the CEO observed that there was “lots of consolidation speculation.”

“What we're seeing is that the leading operators really continue to get more technically sophisticated. And the way that's happening, the sort of avenues that are driving that, it's really hard to catch up,” he said. “If you haven't been stacking these innovations across your business all the way along.

“And so that leaves us in a place where prosecuting our strategy means really focused on getting better, not just on getting bigger.”

Earlier this year, Stephen Trauber, chairman and global head of energy and clean technology at Moelis & Co., said Double Eagle was better off being patient.

“Look, they’ve got a data room open,” he said. “Anybody can make a bid anytime. I am sure that Devon will take a look at that, and I'm sure that others will take a look at that, including everybody who has just bought into the Midland.”

But Trauber said that Double Eagle was better off waiting until the recent M&A dust settles in the Permian.

With Exxon Mobil coming off a massive deal to acquire Pioneer Natural Resources, along with ConocoPhillips, Chevron, Occidental Petroleum and Diamondback Energy in various stages of announced deals, “Why would you want to try to do a deal right now?” he said.

Recommended Reading

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

2024-11-29 - With M&A activity all around its Utah asset, private producer Scout Energy Partners aims to grow larger in the emerging Uinta horizontal play.

Shell Completes Deal to Buy Power Plant in Rhode Island

2025-01-24 - Shell has completed its previously announced acquisition to buy a 609-megawatt combined cycle gas turbine power plant in Rhode Island from RISEC Holdings.

Oxy CEO Hollub Sees More Consolidation Coming in Permian, Globally

2024-11-21 - Occidental Petroleum CEO Vicki Hollub names emissions and water management as top challenges for Permian operators and an incentive for growth.

Ecopetrol Buys Repsol Asset Out from Under GeoPark

2024-12-30 - GeoPark Ltd. said Ecopetrol has exercised its preemptive to acquire Repsol Colombia O&G Ltd., which holds a 45% non-operating working interest Block CPO-9.

NOG Commits Up to $160MM to Appalachian Basin Joint Venture

2024-12-12 - Northern Oil and Gas has entered a joint development program with an Appalachian Basin operator, which wasn’t named, in exchange for a 15% working interest, the company said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.