For over a year, the “A” part of upstream A&D market—acquisitions—has been center stage.

Now, it’s time for the “D” part—divestitures—to claim the spotlight.

After a historic run of U.S. E&P industry consolidation, producers are now pruning their portfolios to consider sales of non-core assets to pay down debt.

But in the days of shale scarcity, producers might not be willing to part with highly coveted operated inventory, especially in the Permian Basin.

Kaes Van’t Hof, President and CFO at Diamondback Energy, told investors just as much.

“I think we’re going to be very, very stingy on keeping operated properties in the Permian because they’re kind of worth their weight in gold right now,” Van’t Hof said during Diamondback’s second-quarter earnings call.

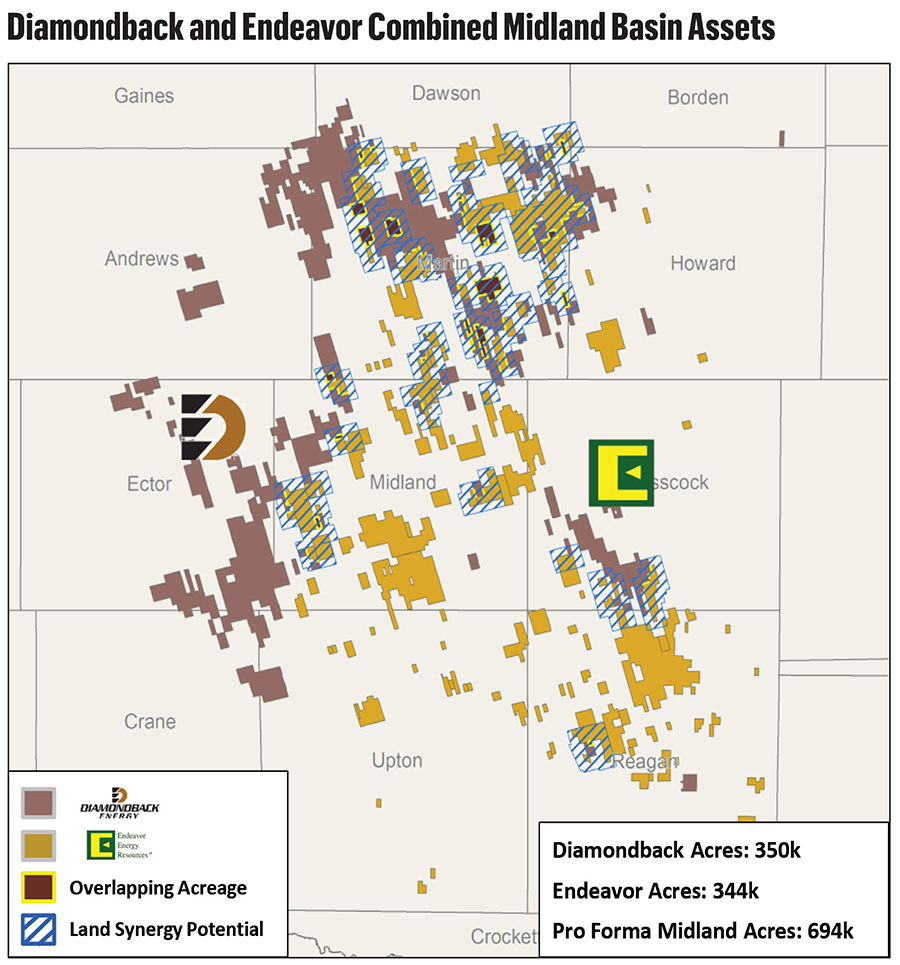

Diamondback plans to tap parts of its portfolio to reduce debt after a $26 billion acquisition of private Midland Basin producer Endeavor Energy Resources; The deal is still pending regulatory approval.

The upstream M&A scramble that Diamondback has jumped into was fueled by a frantic need for drilling inventory. Experts say most operators aren’t going to turn around and give quality inventory away to a competitor.

U.S. producers haven’t always been this parsimonious, said Andrew Dittmar, principal M&A analyst for Enverus Intelligence Research.

“In an earlier cycle of consolidation, it was always a feeling by the bigger public companies that you could sell inventory now—and if you needed it down the road, you could always buy back in,” Dittmar said.

But operators are scared that it could be too challenging and expensive to buy back that lost inventory in the future, he said.

Frankly, most major producers really don’t need to sell operated inventory right now.

Debt levels are extremely low—some suggest the industry may be too conservatively underleveraged—cash flows are robust and balance sheets are near the healthiest they’ve ever been in the sector’s long history.

Public E&Ps Matador Resources and Vital Energy have both been standout buyers in the Permian over the past two years, but neither company is planning to sell off operated inventory packages to reduce debt.

Both plan to de-lever toward their preferred target ratios over the next year using bigger buckets of organic cash flows, Dittmar said.

That bucks a historic trend, where big acquisitions beget portfolio “rightsizing” and eventual sales of non-core operated assets, Dittmar said.

But this isn’t your granddaddy’s A&D market, and the shale revolution of the last decade has evolved.

Tier 2 locations are quickly turning into coveted Tier 1 inventory. Tier 3s are dressing up for the Tier 2 dance. E&Ps are turning over stones in mature shale plays to tout recompletion and refrac projects.

Yesterday’s non-core inventory is suddenly creeping into next year’s multimillion-dollar development program.

M&A experts and investment bankers, who had licked their lips in anticipation of a deluge of post-transaction divestiture activity, have been left scratching their heads.

Instead of marketing operated inventory packages from the big publics, they’re shopping smaller non-operated asset stakes, PDP blowdown plays, minerals and royalties packages, midstream interests and other ancillary items that can generate value for sellers.

Still, many of those experts expect a wave of divestiture activity following a prolonged period of E&P portfolio rationalization.

The wave, it appears, is starting to build momentum.

Starting to play D

Occidental Petroleum might give us the clearest lens into the modern upstream A&D playbook.

Occidental closed a $12 billion acquisition of private producer CrownRock on Aug. 1. The deal gives Oxy an immediate boost in the core of the Permian’s Midland Basin and is immediately accretive to free cash flow.

But Oxy paid up for CrownRock, at 6.3x the company’s 2024 cash flow or $71,000/boe of production, according to analysts at Truist Securities.

While that’s pricey, it’s not uncommon for the highest-quality acreage left in the Permian Basin. In its $60 billion acquisition of Pioneer Natural Resources, Exxon Mobil paid nearly $92,000/flowing boe of production. In its Endeavor acquisition, Diamondback is paying approximately $72,000 per flowing boe.

The CrownRock deal also pushes Oxy further into debt. To reduce its debt to $15 billion, management said it plans to divest $4.5 billion to $6 billion of domestic assets.

Oxy is pulling several different levers to monetize its portfolio.

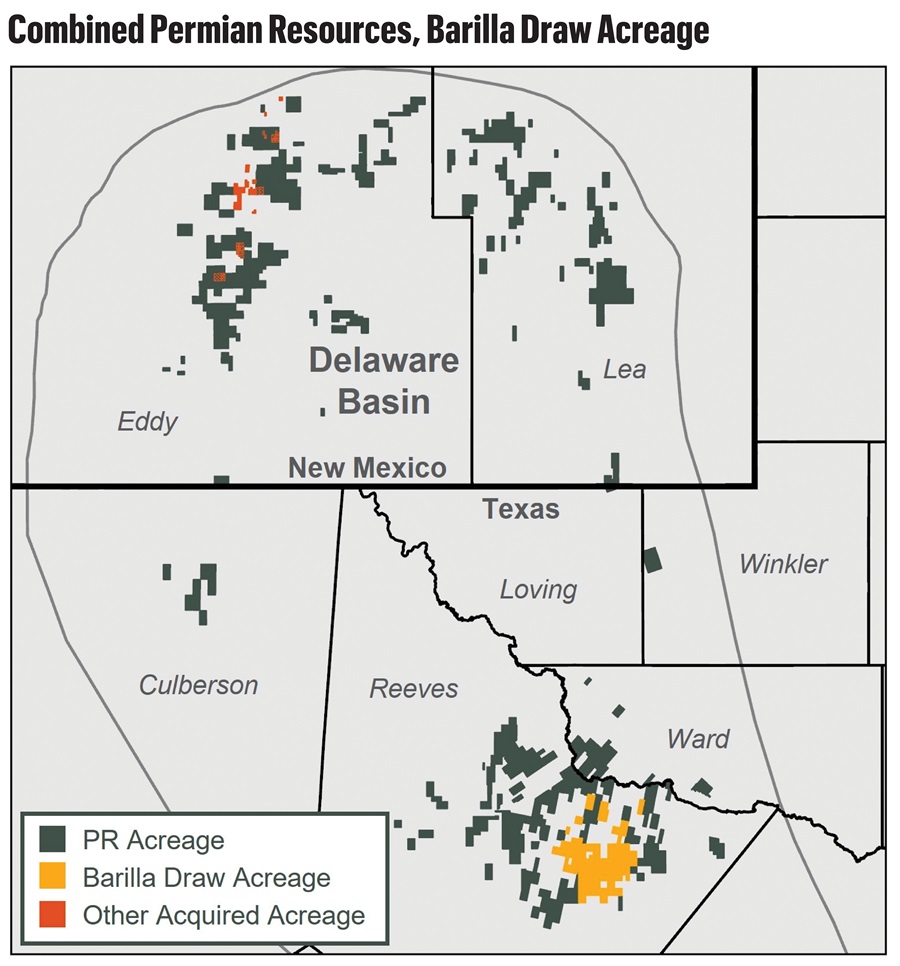

The most notable package to hit Oxy’s chopping block so far has been the Barilla Draw package in the southern Delaware Basin.

Occidental sold the assets to nearby operator Permian Resources for $817.5 million.

The Barilla Draw assets included approximately 29,500 net acres and 9,900 net royalty acres in Reeves County, Texas, in the southern portion of the Permian’s Delaware Basin.

“While these assets have been core to Oxy’s Southern Delaware position for over a decade, the remaining inventory is long outdated in our current development plans,” Occidental CFO Sunil Mathew said during an August earnings call.

Analysts at TD Cowen said the deal had strong industrial sense for Permian Resources, given the company’s acreage overlap in Reeves County, Texas. The companies aim to close the deal by the end of the third quarter.

But a different part of Oxy’s debt-reduction plan recently hit a snare. Analysts and credit ratings agencies had expected Oxy’s Midland Basin joint venture (JV) partner, Colombian energy company Ecopetrol, to acquire a stake in the CrownRock assets from Oxy.

The JV structure between the two companies gives Ecopetrol the right to participate in interests acquired by Oxy in areas of mutual interest.

Oxy had negotiated with Ecopetrol—the company was obligated to do so under the JV structure—to sell a 30% interest in CrownRock for approximately $3.6 billion. That capital would have gone toward further reducing Oxy’s debt.

But negotiations abruptly fell apart, Oxy later disclosed in an SEC filing.

Oxy CEO Vicki Hollub told investors that Colombian President Gustavo Petro nixed the Ecopetrol-CrownRock deal because of his stance against the fossil fuels industry.

Ecopetrol executives cited several reasons for not acquiring the CrownRock stake, including the lack of government sign-off for the deal, emerging domestic gas resources onshore and offshore Colombia and the nation’s objectives of building new wind and solar power generation.

The Colombian company said the CrownRock proposal would have also raised its debt-to-EBITDA ratio above its preferred maximum of 2.5x.

“We have to keep in mind that Ecopetrol is one of the companies that has a very high level of debt,” Ecopetrol Group CEO Ricardo Barragan said during an August earnings call. “By the end of July, $27.7 billion.”

Whatever the reasons, the result set back Oxy’s debt-reduction plan by about $3.6 billion.

But Oxy is still making progress. The company plans to achieve 85% of the $4.5 billion target by the end of the third quarter.

The company has paid down $3 billion in principal debt so far in the third quarter alone, Hollub told investors in August.

Affiliates of Oxy sold 19.5 million common units of Western Midstream Partners, raising $700 million from an underwritten secondary public offering in August.

Even though the Ecopetrol deal fell through, Oxy could also still sell a minority stake in CrownRock’s assets to another interested party. E&Ps are clamoring for pieces of the best acreage left in the Permian.

A minority interest might pique the interests of non-operated specialists like Northern Oil and Gas or other peers—though such a deal would be pricey for most non-op buyers in the market today.

Overall, Occidental has options and other levers to pull after the Ecopetrol deal fell through.

“The upside is you’re retaining a higher stake in this really great inventory that you’re excited about,” Dittmar said. “It does have to make them look harder at other parts of the portfolio that maybe wouldn’t have been up for sale if they’d been able to get that done.”

Classic rock

A blocky, operated, unconventional Permian portfolio like Barilla Draw hitting the market is somewhat of a rarity in these stingy divestiture times, but there have been hints of operated divestiture activity in mature horizontal plays and in legacy conventional reservoirs.

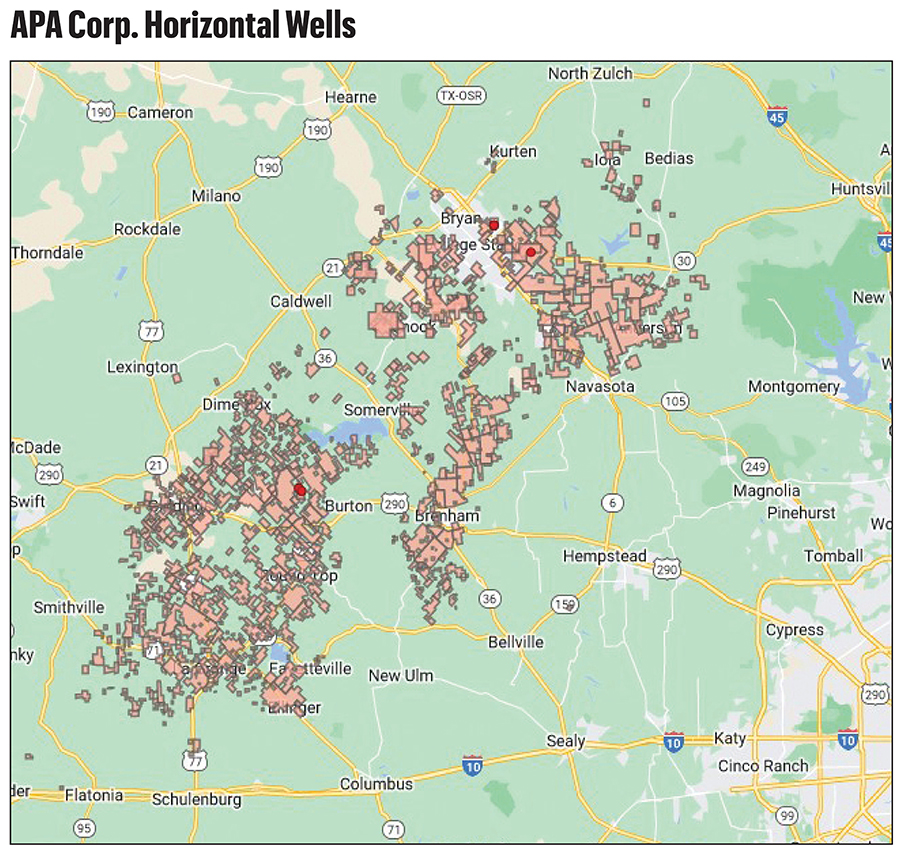

APA Corp., parent company of Apache, got deeper in the Permian through a $4.5 billion acquisition of Callon Petroleum. The Callon acquisition closed in April.

In September, APA said it would divest assets in the Central Basin Platform, Texas and New Mexico Shelf and Northwest Shelf for $950 million.

In the second quarter, APA also sold non-core acreage in the Austin Chalk and Eagle Ford plays for aggregate proceeds of $253 million, the company said in regulatory filings.

The Eagle Ford assets were picked up by private equity-backed E&P WildFire Energy I. The deal included 237,000 net acres and interests in 465 wells.

Eagle Ford operated acreage is selling for much, much less than even mere exposure to premium Permian inventory.

APA’s Eagle Ford package carried a value of $347 million but sold for aggregate cash proceeds of $253 million. APA also assumed asset retirement obligations of $48 million.

APA recorded a net loss of $46 million in the second quarter in association with selling the operated Eagle Ford package.

In conjunction with the Eagle Ford sale, APA also sold Midland Basin mineral and royalty interests—with a carrying value of $71 million—for $392 million after closing adjustments. APA recognized a net gain of $321 million on the Midland minerals sale.

Granted, minerals and royalties trade for higher premiums than do operated or non-op assets. Minerals and royalties are essentially a one-time purchase with a limited risk profile, assuming the purchase area has drilling activity. And there’s some major drilling activity going on in the Midland Basin.

Operators assume a greater financial risk associated with running existing assets and drilling new wells—so operated packages trade at discounts to minerals and royalties’ packages.

However, APA’s portfolio shuffle is still a clear example of how buyers are ascribing less value to highly developed, mature unconventional plays like the Eagle Ford, and seeing greater future upside from the Permian Basin.

In the Midcontinent, MLP Mach Natural Resources sold $38 million of non-producing Western Anadarko assets during the second quarter.

Mach Founder and CEO Tom Ward, who previously co-founded Chesapeake Energy, SandRidge Energy and Tapstone Energy, said the assets were located within the emerging Cherokee horizontal play.

Ward said Mach retains around 40,000 acres within the core of the Cherokee play.

“We only sold a small portion, so we can watch wells that are being drilled and determine if they can then compete with other locations,” Ward said during Mach’s second-quarter earnings call.

E&Ps are so hesitant to part with unconventional inventory that they’re dipping into legacy vertical and conventional assets that have languished away in their portfolios for decades.

Both APA Corp. and Exxon Mobil have gauged buyer interest for legacy PDP-weighted conventional assets in the Permian’s Central Basin Platform.

Rextag data show that both companies operate vertical assets on the Central Basin Platform, wells that first started producing from the 1960s onward—long before the advent of horizontal shale drilling.

Exxon Mobil’s shale subsidiary XTO Energy, “is exploring market interest for select conventional assets in West Texas and Southeast New Mexico,” the Texas-based supermajor said in a statement.

Operations are expected to continue as normal through the marketing process, Exxon said.

XTO is reportedly marketing packages of Central Basin Platform assets that could fetch approximately $1 billion in a sale, depending on oil prices.

Apache has been in the Central Basin Platform since the early 1990s, when co-founder Raymond Plank negotiated a $550 million acquisition of MW Petroleum. The deal doubled Apache’s size and gave the company foundational holdings in West Texas and southeast New Mexico.

There’s certainly a market for PDP-weighted legacy conventional assets churning out free cash flow. It’s a smaller market, and an arguably less exciting one, than the market for premium, untapped shale drilling locations.

But E&Ps might see interesting horizontal upside from these legacy acreage blocks, too. A handful of major operators are delineating curious new horizontal wells up against the flanks of the Central Basin Platform.

On the Midland side of the platform, Occidental, Continental Resources and other producers are testing the gassy Barnett Shale interval.

On the Delaware side of the platform, Marathon Oil and Continental are leading development of the deep Woodford formation.

Non-op shop

Chris Atherton, president and CEO of digital A&D pioneer EnergyNet, thinks divestment activity will probably pick up as more megadeals cross the finish line.

What could eventually come out of Chevron‘s multinational portfolio when it completes a $55 billion acquisition of Hess Corp.? Closing has been delayed until at least mid-2025, when a pivotal arbitration hearing regarding Hess’ ownership of interests in the prolific offshore Guyana development will take place.

Chevron is already marketing sizable packages in the East Texas Haynesville Shale and in Canada’s Duvernay play.

There’s also the natural gas megamerger between Chesapeake Energy and Southwestern Energy, which consolidated huge swathes of gas production in Appalachia and the Louisiana Haynesville Shale. The Chesapeake-SWN deal faced prolonged regulatory scrutiny by the U.S. Federal Trade Commission before closing in early October.

Following the tie-up between Chord Energy and Enerplus Corp. in the Bakken, analysts expect Enerplus’ legacy Marcellus Shale assets to eventually hit the market.

Non-core pieces could also fall out of combined portfolios following the ConocoPhillips- Marathon Oil and Devon Energy- Grayson Mill Energy transactions.

Atherton thinks back to EnergyNet’s days during the shale boom, when the company marketed more non-core operated packages for industry giants like Chevron, Exxon Mobil, ConocoPhillips, EOG, Oxy and large privates like Hilcorp.

“We haven’t seen as much of those types of companies getting rid of the lower value, $50 million to $200 million operated packages,” Atherton said, “and that’s partly because of all the consolidation that’s going on.”

What’s filled that void for EnergyNet has been a proliferation of non-operated upstream interests and minerals portfolios being shopped around the sector.

Appalachia gas giant EQT Corp. is hot on the non-op trail, too, closing a partial sale of non-op Marcellus assets in northeast Pennsylvania with Norwegian energy firm Equinor.

Under terms of the transaction, Equinor sold 100% of its interests in operated Marcellus and Utica assets and paid a cash consideration of $500 million. EQT, in exchange, provided 40% of its non-op interest in the northeast Pennsylvania assets.

EQT is marketing the remaining 60% today, which it reports is fetching a renewed set of interest from several new names, including other international players seeking low-cost shale gas exposure.

Also in Appalachia, BKV Corp. shed non-operated Marcellus interests in a pair of transactions valued at $131.7 million.

RELATED

BKV Prices IPO at $270MM Nearly Two Years After First Filing

Diamondback has raised money with each of the Big Three: non-ops, minerals and royalties, midstream interests.

Still sitting at a red light waiting to close the Endeavor deal, Diamondback sold non-operated properties in the Delaware Basin for $95 million during the second quarter.

Diamondback also “sold a little bit of our Viper ownership to take some risk off the table and get some cash in the door,” Van’t Hof said. Diamondback sold over 13 million shares of Viper Energy, a publicly traded Permian minerals and royalties vehicle, for $451 million in March.

Diamondback also sold interests in West Texas Gas (WTG) Midstream to Energy Transfer Partners for pre-tax consideration of $375 million.

Atherton thinks there’s more operated divestiture activity to come, but it may take a while. There is a lot of debate within E&P C-suites about the wisdom of parting with operated inventory for cash, he said.

“Even if these are assets we aren’t going to get to or aren’t necessarily the highest-returning assets in our portfolio, why would we part with them now?” Atherton asked. “Because we may be trying to buy them back in two or three years.”

Recommended Reading

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

NAPE Panelist: Occidental Shops ~$1B in D-J Basin Minerals Sale

2025-02-05 - Occidental Petroleum is marketing a minerals package in Colorado’s Denver-Julesburg Basin valued at up to $1 billion, according to a panelist at the 2025 NAPE conference.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.