Chevron Corp. is selling a 20% non-operated stake in the Athabasca Oil Sands Project to Canadian Natural Resources. (Source: Shutterstock.com)

Chevron Corp. is selling non-core assets in Canada and Alaska as the U.S. supermajor waits to close a $55 billion acquisition of Hess Corp.

Chevron and its affiliates are raising $6.5 billion in cash through the sales of Athabasca Oil Sands assets and Duvernay Shale assets in Canada, the company said Oct. 7. Calgary-based public Canadian Natural Resources Ltd. is the buyer.

More quietly on Oct. 4, ConocoPhillips announced a purchase agreement to acquire non-operated interests from Chevron on the North Slope of Alaska for $300 million.

Chevron, which is relocating its corporate headquarters from California to Houston, Texas, has previously laid out a divestiture campaign to sell between $10 billion and $15 billion in non-core assets by 2028. After closing the sales in Canada and Alaska, Chevron will have reached about 70% of its divestiture target range.

The sale of a long-cycle oil cash flow assets suggests that Chevron (CVX) is comfortable with its upstream footprint—despite investors thinking the opposite, given Chevron’s pending acquisition of Hess Corp., analysts at TD Cowen said.

“The deal will help extend the ability to pay out current the distribution than [Chevron] otherwise would have, though does not change our view that CVX will have to moderate its buyback in 2026,” TD Cowen analysts Jason Gabelman and Michael Laupheimer wrote in an Oct. 7 report.

The U.S. Federal Trade Commission (FTC) signed off on the $55 billion tie-up between Chevron and Hess in late September. However, the FTC banned Hess CEO John Hess from serving on the Chevron board of directors, alleging in a complaint that he coordinated with OPEC officials to influence global commodities prices.

The blockbuster acquisition remains subject to other closing conditions, including a pivotal arbitration hearing regarding Hess’ ownership interest in the prolific Stabroek Block offshore Guyana. The Stabroek consortium is led by Exxon Mobil Corp. and includes Hess and China National Offshore Oil Corp. (CNOOC) as minority partners.

Hess’ subsidiary Hess Guyana Exploration Ltd. is currently in arbitration regarding the transfer of its Guyana ownership to Chevron. Exxon and CNOOC argue that they have the right of first refusal on Hess’ ownership interest under the existing contract.

An arbitration hearing is scheduled in mid-2025.

In addition to the Guyana asset, Chevron’s acquisition of Hess would give the U.S. supermajor a boost in the Bakken shale of North Dakota and in the Gulf of Mexico.

RELATED

Chevron Sells Canadian Oil Sands, Duvernay Shale Assets for $6.5B

Duvernay play

As Chevron looked across its global footprint, the company’s non-core Canadian portfolio stuck out for a potential sale.

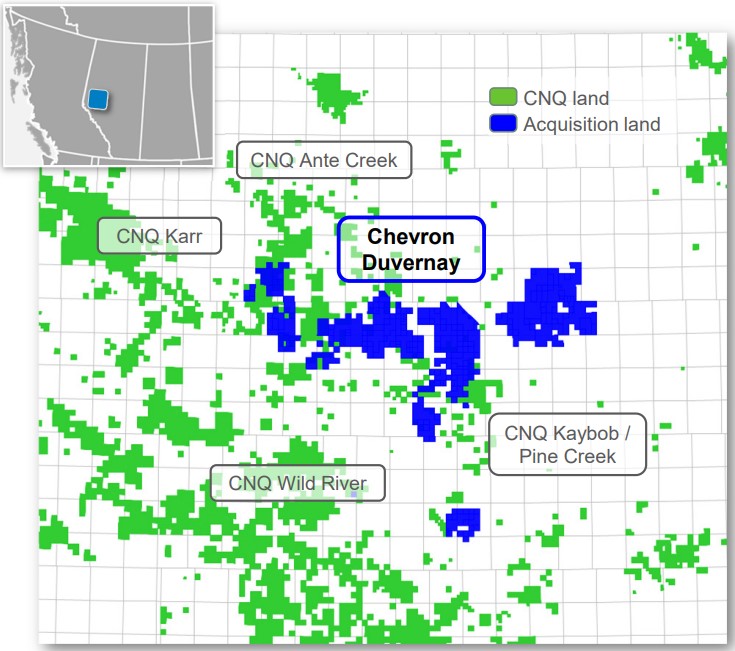

Chevron told investors in January that the company was marketing a 70% working interest in its Duvernay Shale acreage—roughly 238,000 net acres.

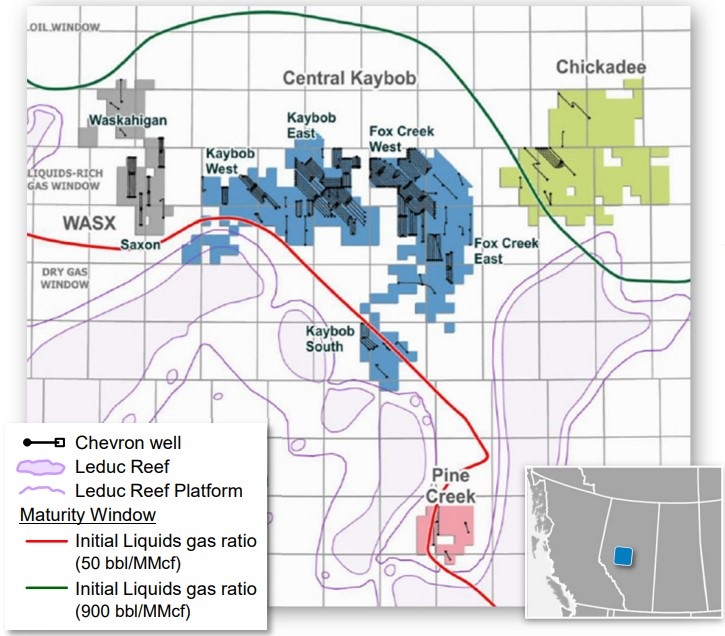

Canadian Natural Resources, the buyer, expects production from the acquired Chevron assets to average approximately 60,000 boe/d in 2025, including 179 MMcf/d of natural gas and 30,000 bbl/d of liquids.

The acquired assets include more than 340 net undeveloped drilling locations, targeting light crude oil- and liquids-rich fairways in the Duvernay play.

The company sees opportunity to grow production from the Chevron Duvernay assets up to around 70,000 boe/d by 2027.

M&A activity and interest in Canada’s Montney and Duvernay shale plays has grown, alongside increased M&A activity in U.S. Lower 48 shale basins like the Permian.

Canadian Natural Resources executives said the assets its acquiring are competitive with its existing portfolio of Montney assets.

“We see strong liquids-rich production across the entire central Kaybob, Waskahigan and Chickadee areas,” said Canadian Natural Resources President Scott Stauth on an Oct. 7 conference call.

Canadian producer Tourmaline Oil this week closed a US$950 million takeover of fellow Calgary-based E&P Crew Energy, deepening a footprint in the Montney shale.

RELATED

Analyst: Chevron Duvernay Shale Assets May Sell in $900MM Range

Athabasca Oil Sands

Chevron joins a long list of E&Ps that have exited from or reduced exposure to the Canadian oil sands, including TotalEnergies, Shell Plc, Equinor, Marathon Oil and Devon Energy.

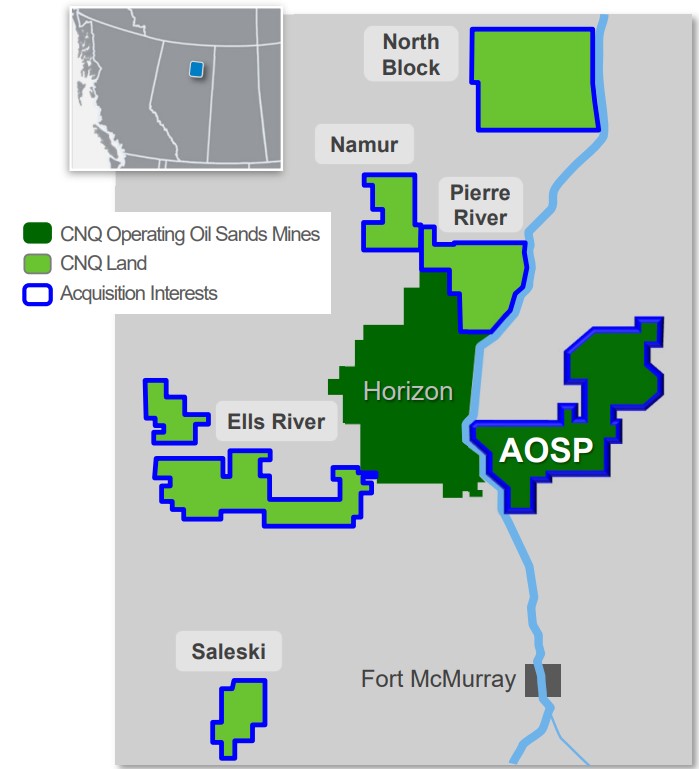

Meanwhile, Canadian Natural Resources continues to get deeper in oil sands mining and processing by picking up Chevron’s 20% non-op stake in the Athabasca Oil Sands Project (AOSP).

Canadian Natural Resources will pick up a 20% additional interest in the Jackpine and Muskeg River oil sands mines, the Scotford Upgrader refinery and the Quest Carbon Capture and Storage facility in Alberta.

Following the deal, Canadian Natural Resources will own a 90% working interest in AOSP. Shell retains a non-op 10% interest in AOSP.

The AOSP acquisition adds approximately 62,500 bbl/d of synthetic crude production. The deal also includes non-producing oil sands leases totaling 100,000 net (267,000 gross) acres.

Canadian Natural Resources made its first AOSP acquisition in 2017, when Shell reduced its interest in the project from 60% down to 10%.

RELATED

With Montney Production Set to Grow, US E&Ps Seize Opportunities

Alaska

Even farther north, in Alaska, Chevron USA Inc. and Union Oil Co. of California are selling non-op interests in the Kuparuk River Unit and a portion of its non-op interest in the Prudhoe Bay Unit to ConocoPhillips for approximately $300 million.

The transaction will boost ConocoPhillips’ working interest in the Kuparuk River Unit to a range of 94-99%, inclusive of satellite fields. The company’s interest in Prudhoe Bay will increase 0.4% to approximately 36.5%.

The acquisition from Chevron will add an estimated 5,000 net boe/d to ConocoPhillips’ Alaska portfolio going forward.

“In the first half of 2024, our investments in Alaska projects have exceeded $1.4 billion, underscoring our sustained commitment to Alaska for more than 50 years,” said ConocoPhillips Alaska President Erec Isaacson Oct. 4.

The Alaska transaction is expected to close by the end of the year.

Chevron had been marketing interests in Alaska oil and gas wells since at least the fall of 2022, according to media reports.

ConocoPhillips operates the Kuparuk field. Private E&P Hilcorp has operated the Prudhoe Bay asset since making a $5.6 billion acquisition from BP Plc in 2020.

RELATED

Recommended Reading

E&P Highlights: April 14, 2025

2025-04-14 - Here’s a roundup of the latest E&P headlines, from CNOOC’s latest production startup to an exploration well in Australia.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Exxon Seeks Permit for its Eighth Oil, Gas Project in Guyana as Output Rises

2025-02-12 - A consortium led by Exxon Mobil has requested environmental permits from Guyana for its eighth project, the first that will generate gas not linked to oil production.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.