Diamondback Subsidiary Viper Closes $900MM Midland Royalty Deal

Diamondback Energy’s Viper Energy closed the last of three acquisitions from Tumbleweed Royalty, owned by Double Eagle Energy’s founders, that together totaled about $1.1 billion.

SM Energy, NOG Close $2.6 Billion in Uinta Basin Acquisitions

SM Energy and Northern Oil and Gas have closed the acquisitions of XCL Resources and Altamont Energy, adding hundreds of locations and oil cuts of 86% to 87%.

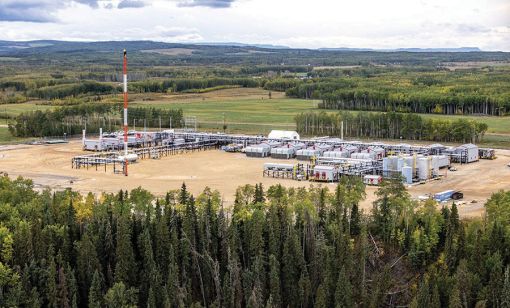

With Montney Production Set to Grow, US E&Ps Seize Opportunities

Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Tailwater Buys Interests Across 5,000 Acres in Permian Core

Tailwater E&P's purchase of non-op working interests from Accelerate Resources includes future inventory held by Diamondback, EOG Resources, Devon and several other E&Ps.

Dorchester Minerals Closes M&A in Midland, Delaware, D-J

Limited partnership Dorchester Minerals closed two transactions in the Permian Basin and in Colorado’s Denver-Julesburg (D-J) Basin.

Energy Transfer Leads the Midstream Consolidation Flow

Energy Transfer co-CEOs discuss pipeline pain points, needed M&A, regulatory woes and much more in this Midstream Business exclusive.

LongPath Adds Vital Energy Assets to Methane Sensing Network

LongPath Technologies is expanding its methane sensing network in the Permian Basin with a significant portion of Vital Energy’s assets.

Trauber: Inventory Drives M&A, But E&Ps Also Vying for Relevancy

Legendary dealmaker Stephen Trauber keeps his eyes open for out of the box ideas: Why not a BP-Shell merger? Or Chevon and ConocoPhillips?

Electricity and LNG Drive Midstream Growth as M&A Looms

The midstream sector sees surging global and domestic demand with fewer players left to offer ‘wellhead to water’ services.

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

Falling oil prices, recession fears and the U.S. election cycle are weighing on an increasingly pessimistic energy industry, according to a new survey of oil and gas executives by the Federal Reserve Bank of Dallas.