Exxon Seeks Buyers for Portion of Assets in North Dakota's Bakken Shale

The planned sale could fetch upwards of $500 million, two sources told Reuters. They said it was part of Exxon's efforts to focus on assets with the highest growth potential after a $60 billion takeover of rival Pioneer Natural Resources in May.

After M&A, Some ‘Stingy’ E&Ps Plan to Hold Operated Shale Inventory

After a whirlwind run of upstream consolidation, experts anticipated a wave of portfolio rationalization and divestitures. But with high-quality drilling locations already scarce, E&Ps may cling to operated inventory.

Lower Prices Spell Lower Oil Growth from Permian, US Shale: EIA

The U.S. Energy Information Administration reduced its forecasts for WTI oil prices and Lower 48 oil production growth in its latest Short-Term Energy Outlook report.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Exclusive: Sheffield Clears the Air, Formentera is Not Just a PDP Buyer

Formentera Founder and Partner Bryan Sheffield delves into the company's drilling operations including the unique history of how Formentera took up assets in Australia's Beetaloo, in this Hart Energy Exclusive interview.

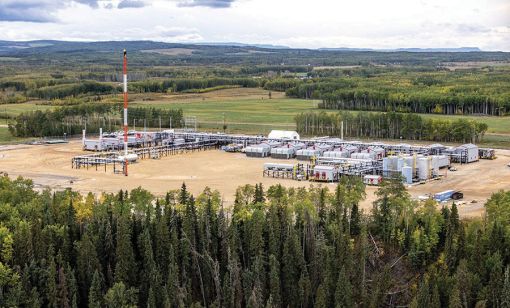

With Montney Production Set to Grow, US E&Ps Seize Opportunities

Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Energy Transfer Leads the Midstream Consolidation Flow

Energy Transfer co-CEOs discuss pipeline pain points, needed M&A, regulatory woes and much more in this Midstream Business exclusive.

Devon Energy Completes Grayson Mill Acquisition

Devon Energy Corp. completed its $5 billion acquisition of Grayson Mill Energy, expanding its Williston Basin operating scale and production.

Trauber: Inventory Drives M&A, But E&Ps Also Vying for Relevancy

Legendary dealmaker Stephen Trauber keeps his eyes open for out of the box ideas: Why not a BP-Shell merger? Or Chevon and ConocoPhillips?

Electricity and LNG Drive Midstream Growth as M&A Looms

The midstream sector sees surging global and domestic demand with fewer players left to offer ‘wellhead to water’ services.